Nick Shaxson ■ Guest blog: how Switzerland corrupted its courts to nail Rudolf Elmer

Update, Oct 10, 2018 – Swiss top court knocks down bid to extend banking secrecy. Good news for Elmer, following his partial victory in 2016.

Update, Jan 4, 2016: Elmer has won a partial victory, underlining the main point of this blog. In a civil suit brought by Elmer, the Swiss Federal Court has overturned one of the rulings against him because, it ruled, the Zurich judges broke Federal law when they turned down Elmer’s complaint. Elmer told us that two judges in question face investigation and possibly even a court trial. See the Neue Zürcher Zeitung on the case and the court ruling itself here.

Background

Today, Switzerland tightens up its legislation to be able to crack down more effectively on whistleblowers. On this occasion we’re proud to host a guest blog by Rudolf Elmer, a Swiss whistleblower who has been subject to severe harassment by the Swiss courts for around a decade now.

The harassment has extended to his family: it is the sort of treatment one might expect of a totalitarian regime, not of an advanced Western nation.

The harassment is not just from the courts and the financial sector: we should add that, with a fair few honourable exceptions, Swiss media have largely taken the financial centre’s line: that Elmer is a thief and a scoundrel, rather than a whistleblower acting in the public interest.

The truckload of evidence Elmer provides here will, we think, convince you beyond any doubt that the Swiss financial sector has successfully corrupted its courts system.

Guest blog: How Switzerland corrupted its courts to pursue a bank whistleblower.

By Rudolf Elmer

- I blew the whistle on thousands of wealthy individuals including shady arms brokers, Mexican officials linked to drug dealers; Saudi companies linked to the Bin Laden family; and politicians accused of corruption.

- I have been pursued by Swiss courts for a decade, allegedly for breaking Swiss banking secrecy. My family and I have suffered terribly.

- The evidence I provide here shows beyond any doubt that the case against me has no merit in legal terms. Yet the courts continue to pursue me, egged on by a vindictive Swiss banking establishment. A former Swiss judge said elements of my case remind him of “the Mafia.”

- Despite what you may have read in the media, Swiss banking secrecy is far from dead. If it were, they would have abolished their banking secrecy law, and they wouldn’t be pursuing me.

- On July 1, 2015, Swiss whistleblowing laws are set to become even more draconian, with a penalty of up to five years for whistleblowing.[i]

Introduction

I am Rudolf Elmer, a Swiss whistleblower who exposed financial crimes I discovered while working in the Cayman Islands as an employee of Julius Baer Bank and Trust Company Ltd, George Town, Cayman Islands (JBBT – Cayman).

In blowing the whistle, I was acting in the public interest. I have been pursued for breaking draconian Swiss banking secrecy laws. My family has been severely harassed. Under investigation since 2005, I have already served 220 days in prison, and I am still being pursued by judges of the high court in Zurich.

My legal defence hinges on whether or not the Swiss banking secrecy law covers my Cayman-based whistleblowing. In short, it does not.

I blew the whistle on information that I had access to only while I was working in the Cayman Islands before 2003, from a Cayman financial institution that even Swiss authorities admit is outside the scope of Swiss banking secrecy laws[ii].

Yet Swiss prosecutors and judges, who seem bent on prosecuting me at all costs, are simply refusing to take any of this evidence into account, and they have systematically turned down my requests to supply witnesses. Instead, they are relying on a single irrelevant document to try and claim that I was working for Bank Julius Baer in Zurich, which (if it had been true) would have enabled them to convict me under Swiss law. They are also trying to apply Swiss law on an extra-territorial basis.

The Swiss ‘goose that lays the golden eggs has depended heavily for decades (and still depends) on secrecy – so it is particularly important to squash and make an example of whistleblowers. As a result, I have been falsely imprisoned. The Swiss banking establishment has corrupted the Swiss courts in its quest to pursue and persecute me and my family.

The scope of the Swiss Banking Secrecy Law

The Swiss Banking Secrecy Law, in Art. 47, states:

“Imprisonment of up to three years of fine will be awarded to persons who deliberately:

- a) disclose a secret that is entrusted to him in his capacity as employee, appointee, or liquidator of a bank . . ;

- b) attempts to induce such an infraction of professional secrecy.

Persons acting with negligence will be penalised with a fine of up to 250,000 francs.”[iii]

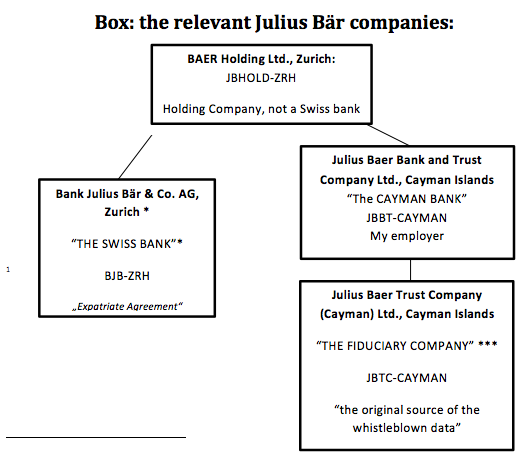

This provision clearly applies only to persons employed by a Swiss bank.[iv] The box below shows each entity and marks which ones are or are not Swiss banks.

In trying to nail me, Swiss prosecutors have been desperate to argue that I was employed by Bank Julius Bär & Co. AG, Zürich (BJB-ZRH, which is a Swiss bank: see the Box).

But my copious evidence provided below proves beyond doubt that this is wrong: I was at all relevant times employed by the Cayman Islands subsidiary, JBBT-Cayman.

What is more, as shown below, even the Swiss prosecutors have accepted that the Julius Baer subsidiaries in the Cayman Islands that are central to my story are not Swiss banks, from the perspective of the Swiss banking secrecy law. In fact, the very reason for creating subsidiaries of the Julius Baer Bank ‘offshore’ in the Cayman Islands was precisely to be outside Swiss law, to enable its clients to avoid tax and other regulatory requirements!

So prosecutors have felt it is essential to persuade the judges that I was not employed by a non-Swiss-bank Cayman subsidiary. They have persuaded the judges to ignore the mountain of evidence showing that I was, and instead focus only on an “Expatriate Agreement” that dealt with the terms of my transfer from Julius Baer Holding Ltd. in Switzerland (where I was previously employed) to the Cayman Islands subsidiary.[v]

What is more, the law only protects bank data held within Switzerland.

It also does not protect the data of fiduciary companies, private and independent asset managers, or even family offices – even in Switzerland – because they are not banks under Swiss Banking Law.

A striking example of this was the case of the Zurich based company Swisspartners, which handed over client names and Swiss bank accounts to US tax authorities. In doing so, Swisspartners did not violate Swiss Bank Secrecy, because it does not have the status of a Swiss Bank in Switzerland. As Reuters explained on May 9 2014:

“Unlike banks such as Credit Suisse, investment advisers and asset managers like Swisspartners are not subject to stringent Swiss bank secrecy laws that forbid disclosure of information about the identity of customers.”

Julius Bär’s Cayman subsidiary that employed me falls into this category too.

The facts of my case

On January 19, 2011 the Zürich lower court convicted me of violating Swiss banking secrecy and I was sent to prison. (This was my second time in prison for this, in a long pattern of persecution.) The judge, Sebastian Aeppli, simply asserted that I was employed by Bank Julius Bär & Co. Zürich, to put my whistleblowing inside the scope of Swiss banking secrecy laws.

His assertion was flat wrong, and multiple evidence shows that I was imprisoned on false grounds.

The evidence is as follows:

- “Assignment as Chief Operating Officer, dated September 1st, 1999 (attachment 2.) This was my employment contract with JBBT-Cayman: it outlines my appointment, salary, benefits, accommodation etc.) and was signed by the CEO of JBBT-Cayman Charles Farrington and the President of the Board of JBBT- Cayman, Walter Knabenhans.[vi]

- A Social Security issue. I filed a complaint against Bank Julius Bär & Co. Zürich on Aug 10, 2007, because social security contributions were not calculated or paid on my fringe benefits from 1995-2002. Yet the prosecutor’s office in Zurich turned this down (Attachment 3) because the bank confirmed in writing to the Prosecutors’ Office that I was not employed by the bank in Zürich but by JBBT-Cayman: so I was not an employee of a Swiss company, so Swiss law could not be applied![vii]

- In the application for renewal of a Cayman Islands work permit for me, made on October 3rd, 2000, JBBT – Cayman’s CEO Charles Farrington confirmed that I was an employee of the Cayman entity. (attachment 4). The document states:

“Name of employer or employing company: Julius Baer Bank and Trust Co. Ltd.”

- An email from Christoph Hiestand, Head Lawyer of Baer Holding AG, Zurich, dated March 31st, 2003, confirming that I was an employee of the Cayman Company and confirming that I was not an employee of Julius Baer Bank & Co. AG, Zürich. (attachment 5) Hiestand stated:

“The Employer’s confirmation must be issued by the former employer [JBBT- Cayman]. Correspondengly, neither the bank [JB-Zürich] nor the holding company in Zürich can confirm the the form given to us. After discussing with the Cantonal authorities it has been confirmed that if we [JB-Zürich] can confirm that you have been employed with JBBT-[Cayman], it would be accepted.[viii]“

Basically, this email explains that only the employer, JBBT – Cayman, can confirm that I was employed from 1994 to 2003 in the Cayman Islands. This is further evidence showing that I was an employee of the Cayman Company, and not of a Swiss company.

- The evidence of Mario Tuor of the Swiss State Secretariat for International Financial Matters. Mr. Tuor said in an email (Attachment 6) that I am not under Swiss Bank Secrecy due to the fact that the clients – settlors, beneficiaries etc. – only had a direct relationship (setting up the trusts, companies, funds etc.) with Julius Baer & Trust Company Ltd., Cayman Islands and not with Julius Baer Bank & Co. AG, Zuerich.

- My termination agreement states:“Mr. Rudolf Elmer joined Julius Baer Bank & Trust Company Limited in Cayman on 1st September 1994. Mr. Elmer’s initial position was that of Chief Accountant and as at 1st January 1999 he was given the title of Chief Operating Officer.

. . . Mr. Elmer’s termination was effective from 10th March 2003.” (Attachment 7)

- In my 1994 contract with Julius Baer Holding company for my work at JBBT-Cayman, it was specified clearly that I was employed under a local contract: (“. . . sie stehen unter lokalem Vertrag.”) (Attachment 1)

- Additional evidence that I was employed by JBBT-Cayman, such as local salary and bonus payments; local pension payments; local health insurance payments; all of which were run through and charged to the Profit and Loss account of the Cayman office and not recovered from Julius Baer Bank & Co. AG, Zürich.

To summarise:

Julius Baer Bank & Co. AG, Zürich, as well as a prosecutor’s office in Zurich, an official of the Swiss State Secretariat for International Financial Matters; the General Counsel of the Julius Baer holding company, and Julius Baer Bank and Trust Company Ltd, Cayman Islands, have all stated that I was an employee of JBBT- Cayman, only.

I was employed by the Cayman unit which is not a Swiss bank – so Swiss Bank Secrecy is not applicable in my case.

The prosecution’s case

The prosecutors and judges are trying to make a case against me by disregarding all the above documents, and are instead fixating on a single document, the “Expatriate Agreement of September 1st, 1999.” (also attachment 9)

This document, in their view, constitutes the overwhelming evidence that I was an employee of Julius Baer Bank & Co. AG, Zurich, Switzerland at the time: they use it to argue that I was covered under the Swiss banking secrecy law.

Yet this letter does not support their case at all, for several reasons:

- In their indictment of June 25th, 2010 (attachment 10) and June 30th, 2014 (attachment 11), Prosecutors Alexandra Bergmann and Dr. Peter C. Giger called this 1999 Expatriate Agreement an “Arbeitsvertrag,” which translates as “Employment Agreement.” This is quite wrong. Materially, the agreement only covers a pension/ insurance matter and cannot be employment contract.

- It lacks clear evidence that this is an employment agreement (for example, there is no mention of salary, or holidays, or health insurance etc;)

- There is no statement that I was employed under Swiss Law;

- The agreement states that “only the terms of this Expatriate Agreement” are based on and subject to Swiss law exclusively”.

- The Swiss Banking Law was not mentioned in the agreement so it is not part of the so-called terms in this Expatriate Agreement of September 1st, 1999 (attachment 9)

- They simply ignored the documents provided here, above.

Why are they pursuing this?

Given that their case is without foundation, what is the basis for their pursuing it? Arbitrariness? Corruption? Political direction? A lack of understanding of English?

Q: Are the prosecutors and judges bending the law and ignoring the truth about Rudolf Elmer`s employment contract?

A: Yes, I believe so. In my opinion, it is a scandal.

More strange facts about the case

First, The Federal Prosecutor’s Office (attachment 12), and the Prosecutor’s Office of the State of Zurich have simply not investigated the data I provided. They have almost comically argued that they can disregard this evidence because

- There is no link to Switzerland in the data

- The data was “stolen”. (This cannot be true, because I was responsible for this data – and thus, legally, I couldn’t have “stolen” it!.)

Second, The Tax Commission of the State of Zurich (attachment 13) went as far as to deny the Federal Tax Authority the right to investigate the data I blew the whistle on. Why not?

Third, The Swiss authorities have not investigated the clients mentioned in the documents (attachment 12) or in newspapers such as The Guardian. Why?

Fourth, my requests to call witnesses in my case have been systematically turned down by judges, to weaken my defense and to prevent the truth from coming to the surface. (Attachment 14.) For example, my lawyer requested that the lawyer Christoph Hiestand, and Dr. Raymond Baer, were called; they also denied my requests to call Julian Assange and Daniel Domscheit-Berg (in respect of WikiLeaks, which published my data.)

On March 7, 2011 the Swiss Federal Court reprimanded the higher prosection office and the Zurich courts for arbitrary behaviour (Attachment 22), in a case I took out against a firm of private detectives who had been harassing me and my family on Julius Baer’s behalf, causing mental injury to me and my daughter who (has been diagnosed as) suffering from post traumatic stress disorder because of the case. The Federal Court reprimanded the courts for interviewing the private detectives as well as multiple Baer top officials, but never questioning us (the victims) for six years. “Arbitrary behaviour” is a damning verdict when applied to a supposedly ‘clean’ court system: it points clearly to the corruption of the rule of law.

An independent judge who reviewed my harassment case said on Swiss TV:

“The answers the Baers and the private detectives gave to the Prosecutor are exactly the same answers you receive from the Mafia: We cannot remember it, there is nothing in writing, yes, we talked about it but not in detail, I did not know what really was going on, etc.”[ix]

That was another clear indication that I was dealing with a legal system that had been morally corrupted in my case.

Fifth, The entire investigation started in September 27th, 2005 and after 10 years there are only two verdicts of the lower Court of Judge Dr. Sebastian Aeppli. The High Court decided to investigate the matter further under its own guidance in 2011 (attachment 15). This case is still underway. It has already created 20 ring-binders full of “evidence”, and has involved many adjustments and re-writes of the original indictment.

Sixth, the “evidence” against me includes a report of an expert witness of the Institute of Comparative Law of Switzerland about Cayman Banking Law (attachment 16.) This report is materially false and even ridiculous: and it hangs on an unsupported assertion made on its second page that the data in question came from a Swiss bank, rather than from where it really came from: a Cayman fiduciary company. To use this as evidence to prove that I was working for a Swiss bank is to engage in circular reasoning. Yet after seven years of investigation, they still do not ‘understand’ where the data came from.

Conclusion

The Lower Court and the High Court of Zurich are trying to apply Swiss Bank Secrecy Law extra-territorially, using a strategy that involves wilful blindness, using false evidence; denying requests to call witnesses, and ignoring mountains of evidence showing that Swiss Banking Law cannot be applied.

The reality is that any banker who speaks the truth about Swiss criminal banking must be legally crucified. Cases such as Hervé Falciani, Lutz Otte, Rudolf Elmer, and Bradley Birkenfeld etc. are other examples.

Swiss bankers who support tax evasion, Libor abuse, currency manipulation etc. simply do not go to court for their crimes. They are a protected species.

There are no serious whistleblower protection remedies in place for financial sector whistleblowers in Switzerland. Even the Baer-linked law firm Baer & Karrer have stated:

“So far, apart from very few exceptions, the Swiss legislator has not enacted laws protecting whistleblowers.”

If there were, many bankers would speak out and tell society the truth, as I did to my enormous personal cost.

ENDNOTES

Endnote 1: Who are the court officials involved in this case?

The officials who have been involved in this case:

- Swiss Prosecutor Alexandra Bergmann;

- Swiss Prosecutor Peter C. Giger;

- Judge Sebastian Aeppli, Judge Dr. R. Schöning; Judge R. Faga from the lower Court;

- Judge Marti, Judge R. Naef and Judge E. Leuenberger, from the Higher Court of Zurich.

In my opinion Judge Dr. Sebastian Aeppli came up with a political verdict, partly because he had already decided in 2011 that I had violated Swiss Bank Secrecy: he had to make the same decision in 2014 as he had in 2011. Was this a political verdict, to fulfil what the incestuously linked political and banking establishment in Switzerland wanted? Was this intended to further his career prospects? (attachment 17).

Endnote 2: Why is this happening?

For decades, it has been Swiss state policy to try and attract criminal and unsavoury funds to Switzerland, and to protect those organizations such as banks (UBS, Credit Suisse, HSBC Switzerland etc.) that harbour and handle those funds. This is the same basic business model found in Cayman, Jersey UK, Luxembourg, British Virgin Islands, Panama, Delaware etc.

A criminal financial industry in a tax haven such as Switzerland needs prosecutors, judges, and even the whole judicial system to protect financial crimes, in order to send this message to international criminals:

“we offer you a safe and secure home in Switzerland!”

Whistleblowers are a grave, foundational risk to this lucrative business model. Crucifying whistleblowers, to serve as an example to others, has become state policy, and prosecutors have become an arm of that policy.

Q: Why are the prosecutors and judges ignoring the facts? Is it simply that Rudolf Elmer must be legally crucified in Switzerland, to make other bankers afraid of speaking the truth about the Dark Arts of Swiss Banking?

Endnote 3: is Switzerland not cleaning up its banking sector?

All tax havens, including Switzerland, claim to have cleaned up, and claim that they are not tax havens: nobody likes a taint. (Google “We are not a tax haven” to understand this better.)

Yet Switzerland’s financial sector, despite having made some (relatively limited) concessions on secrecy and cross-border information exchange to the United States and more recently some concessions to the European Union, is continuing to encourage its banks to pursue predatory secret banking operations in many countries around the world, particularly the most vulnerable developing countries.

Switzerland is still very much a tax haven, or secrecy jurisdiction.

If Switzerland were serious about cleaning up the sector, it would repeal the banking secrecy law. Why has it not done so? Why is it now tightening up its whistleblower laws? And when have there been serious investigations performed against banks and bankers in Switzerland?

Swiss prosecutors can be useful tools in protecting the “Golden Calf of Swiss Bank Secrecy.” By prosecuting whistleblowers like me they are playing a role that is highly useful to the Swiss criminal banking establishment, whose officers are at the pinnacle of Swiss society.

Endnote 4: Human rights violations and psychological terror in Switzerland

The plea of Prosecutor Dr. Peter C. Giger (attachment 18) makes it clear that whistleblowers such as me are enemies of the Swiss state. This kind of behaviour, along with Swiss-style tax haven activity more generally, can involve serious violations of human rights – as a growing community of people, including the International Bar Association Human Rights Institute, now recognise.

People who blow the whistle on financial crimes in Switzerland will see their human rights trampled on, or even ignored, I and my close family have found to our great cost.

I have been exposed to what I call “psychological terror”. The prosecutors demanded that I undergo three psychological evaluations by psychiatrists appointed by the Court of Zurich (attachments 19 and 20).[x] Clearly, the aim was to portray me to the public as mentally ill. I declined to cooperate with the psychiatrists because I felt healthy, and because I was not allowed to have either my lawyer or an independent psychologist attending the psychiatric evaluation.

Human Rights organization such as Human Rights Watch, Amnesty International, and even Transparency International Switzerland, so far all seem to have looked the other way when it comes to supporting the human rights of whistleblowers like me (attachment 21).

The Tax Justice Network, which is a leader in a new and growing global campaign on human rights and tax haven issues, published an article (see also here) in respect of whistleblowers and human rights, after I broke down in Court on December 10th, 2014. (Perhaps fittingly, December 10th was declared Human Rights Day by the U.N. General Assembly.)[xi]

Others, I hope will support me.

ENDNOTES

[i] Also see https://www.news.admin.ch/message/index.html?lang=de&msg-id=57177

[ii] The law covers those supervised by the Swiss Financial Market Supervisory Authority FINMA; the Swiss banking law (https://www.kpmg.com/CH/de/Library/Legislative-Texts/Documents/pub_20090101-BankA.pdf) describes FINMA’s role on 57 occasions; e.g. Art. 1 (4). See a list of authorised institutions is here http://www.finma.ch/e/beaufsichtigte/bewilligungstraeger/Pages/default.aspx Note that “Bank Julius Bär & Co. AG” is the only Julius Bär bank listed here. Julius Baer Bank and Trust Co. Ltd., Cayman (JBBT), my employer, is not a branch but a subsidiary owned by JB Holding, Zürich – and even this entity is not a bank under Swiss Law. JBTC-Cayman, the original source of the data and a subsidiary of JBBT-Cayman, is not a Swiss bank but a Cayman fiduciary company: it is not a Swiss bank even under Cayman laws. Confusingly, the fiduciary company is subject to Cayman’s confidentiality law, but Swiss banks can’t convict under Cayman laws. (Under the “double criminality” test, in fact, they need to be able to show that I broke the law in both countries, which they cannot do.)

[iii] KPMG translation, from https://www.kpmg.com/CH/de/Library/Legislative-Texts/Documents/pub_20090101-BankA.pdf. Also see https://www.admin.ch/opc/de/classified-compilation/19340083/index.html

[iv] Swiss Federal Law on Banks and Saving Banks, Art 49: https://www.kpmg.com/CH/de/Library/Legislative-Texts/Documents/pub_20090101-BankA.pdf

[v] It states clearly that ”BJB-ZRH transfers the Expatriate to Julius Baer Bank and Trust Company Ltd. (JBBT-GCM).” (Also note that the Julius Bär holding company is not a “Swiss bank” under the relevant laws.)

[vi] The letter reads: “We are pleased to confirm the terms of your assignment with JBBT-GCM in Grand Cayman. This offer replaces the assignment between you and JBHOLD-ZRH (Julius Baer Holding, Zurich) concluded on February 15th, 1994.

- Appointment: You will be based at …

- Compensation: a) your salary …

- Employee benefits: you will be…

- Relocation: The Bank …ployee

- Mobility Premium: After succesfull …

- Accomodation: The decision …

- Home Leave: You and your dependent …..

- Working Conditions: Working conitions

Julius Baer Bank and Trust Ltd. Cayman

Signature: Walter Knabenhans and Charles Farrington”

[vii] The wording was as follows in the final decision of the Prosecution Office of Zurich:

First, “Aus dem “Assignment as Chief Operating Officer” ist ersichtlich, dass Rudolf Elmer mit der Julius Baer Bank and Trust Company Ltd, Grand Cayman einen Arbeitsvertrag schloss und dieser einen früheren Arbeitsvertrag mit denselben Parteien vom 15. Februar 1994 ersetzte.“ Translation: “The Assignment as Chief Operating Officer proves that Rudolf Elmer entered into an employment contract with Julius Baer Bank and Trust Company Ltd, Grand Cayman and this employment contract replaces the employment contract between the very same parties of February 15th, 1994.”

Second, “Da nunmehr als erstellt angesehen werden muss, dass Rudolf Elmer in der massgeblichen Zeit von 1. Januar 2002 bis 31. August 2002 nicht für einen Arbeitgeber in der Schweiz tätig war, folgt, dass es für …“ Translation: “It is now proven that Rudolf Elmer was not employed by a Swiss employer during the time frame January 1st, 2002 and August 31st, 2002, it can be concluded, that ….”

[viii] The original letter is in German, and the relevant section reads:

“Die Arbeitgeberbestätigung müsste von Ihrer ehemaligen Arbeitgeberin der Julius Baer Bank and Trust Company Ltd, Cayman ausgestellt warden. Entsprechend können weder die Bank (d.h. Bank Julius Bär & Co. AG, Zürich) noch die Holding in Zürich die Bescheinigung auf dem uns überlassenen Formular als Arbeitgeberin abgegen. . Nach Rücksprache mit der kantonalen Arbeitslosenkasse wurde mir bestätigt, dass eine von uns /d.h. der Bank in Zürich) abgegebene Bestätiung, dass Sie für die Julius Baer Bank and Trust Company tätig waren akzeptiert würde.“

[ix] “Diese Antworten gleichen den genau den Antworten, die wir von der Mafia kennen.” See interview with Dr. iur. Peter Zihlmann, at 57:23 here. https://www.youtube.com/watch?v=9tneOB1PTEU

[x] In the end, I had to undergo three psychological evaluations, because I had to undergo an additional evaluation ahead of my court trial in December 2014. Five medical doctors said I wasn’t fit to stand trial; but the court expert concluded I was fit. The truth became obvious when I broke down on Dec 10th.

[xi] In 2012 the European Court of Human Rights disappointingly turned down my complaint against Swiss banking secrecy, which I had filed in 2008. Details on that are here https://wikileaks.org/wiki/Rudolf_Elmer_files_against_Swiss_banking_secrecy_at_ECHR .

Related articles

The last chance

2 February 2026

The tax justice stories that defined 2025

Let’s make Elon Musk the world’s richest man this Christmas!

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations

Tackling Profit Shifting in the Oil and Gas Sector for a Just Transition

Follow the money: Rethinking geographical risk assessment in money laundering

Harassment of activist of civil rights… Also occurs in Brazil, same if the whistleblower of Judges does not violate the laws of Brazil.

Thank you for fighting for the right cause! The world needs more people like you. I had no idea the Swiss state is so corrupt.

Best wishes to you and your family

Human history will remember your fight. Your tenacity is astounding. As a retired lawyer who if professionally associated with others to seek legal redress against Swiss bankers, I have found that some Swiss ‘bent’ lawyers use the aura of Swiss secrecy to perpetuate criminal wrongdoing. They live a cosy life and work hand in hand with bankers to help transmit illicit funds using Swiss Trust companies. Help and assistance is around should you consider it expedient. All the best.

C