YOU ARE INVITED TO

REPRESENTATION OF PUBLIC INTEREST IN BANKING

A FINANCE WATCH PUBLIC CONFERENCE – WEDNESDAY 7th DECEMBER 2016

A one-day conference

Max. 120 participants

Bibliothèque Royale, Brussels

Why is the public interest such a low priority in banking?

The public interest is not being properly represented in banking and finance: eight years after Lehman Brothers collapsed, the EU’s economy is weak and the banking system remains a threat to financial stability. In response, Finance Watch began a research project in 2015 to investigate why the public interest has been so under-represented in banking and to identify possible improvements. The two-year project invited civil society and academics to participate and contribute to the research.

The conference will present the results of this research – including policy recommendations – while providing an opportunity for its contributors and others to continue the conversation and to strengthen the network of civil society organisations and academics working on the subject.

This one-day event combines plenary sessions with 8 parallel sessions, allowing the participants to explore the multiple dimensions and possible answers to the questions raised.

PROGRAMME (updated 17 November 2016):

MORNING:

9AM | Opening

9:20AM | Introduction on the project and the conference

10AM | Panel discussion on how a simplified, more open and inclusive regulatory process can improve participation and deliver better outcomes in terms of public interest representation?

Panellists:

– Eric Ducoulombier, European Commission, DG FISMA

– Monique Goyens, BEUC

– Daniel Mügge, University of Amsterdam

– Ella Sjödin, Nordic Financial Unions

– Magda Tancau, EAPN and FESSUD

– Myriam Vander Stichele, SOMO

11:30AM | Interview on stakeholder banking:

What are the criteria and recipe for success? How to influence banks actions and foster the participation of the public?

With:

– Christine Berry, New Economics Foundation

– Rym Ayadi, International Research Centre on Cooperative Finance

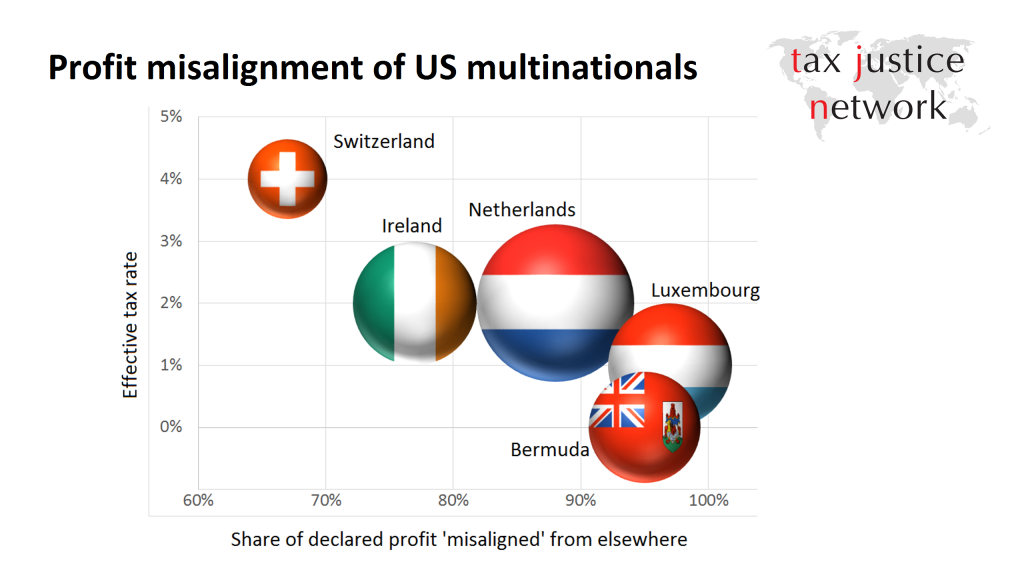

12AM | Keynote speech by John Christensen, Founder and President of the Tax Justice Network:

Building up a movement and influencing policies on a complex and technical issue: learning from the international tax campaigns

AFTERNOON:

2PM | 1st series of parallel sessions: short presentations followed by discussions with participants

> Participation in banking regulation: CSO strategies

S. Pagliari, City University; F. Lemaire, University Paris XIII

> Banks facing societal issues: Investing in the transition

D. Korslund, GABV; S. Hierzig, Share Action

> The future of bailed-out banks: a citizens’ perspective

F. Travers-Smith, Move your Money; L. Deruytter, Fairfin (tbc)

> Citizens’ Dashboard of Finance

G. Porino, Finance Watch; W. Kalinowsky, Veblen Institute

3PM | 2nd series of parallel sessions: short presentations followed by discussions with participants

> Almost all of us are banking clients: consumers’ interest representations

A. Fily, BEUC; Lisa Karstner, Sciences Po Paris

> Learning from German stakeholder bank

C. Scherrer, Kassel University; L. Regneri, Ver.di (tbc)

> Communication, pedagogy: how to talk about money and finance

M. Nichols, Meteos; M. Thiemanns, Goethe University Frankfurt (tbc)

> Building coalitions on finance and tax: lessons from the FTT campaigns and an overview

P. Wahl, Weed; T. Fazi, ISI Growth

4PM | Stakeholders debate: What to do next? Panel discussion on key actions to be taken to improve the representation of the public interest in banking

Panellists:

– Sven Giegold, Member of the European Parliament

– Hakan Lucius, Head of Stakeholder Engagement, Transparency and Civil Society Division at the European Investment Bank

– Andreas Botsch,The German Trade Union Confederation, DGB

– Wim Mijs, European Banking Federation

– Anne Van Schaik, Friends of the Earth Europe

5PM | Closing speech and cocktail reception

Register here