From Global Witness, via email:

From Global Witness, via email:

European Parliament votes to end anonymous shell companies Continue reading “European Parliament votes to end anonymous shell companies”

From Global Witness, via email:

From Global Witness, via email:

European Parliament votes to end anonymous shell companies Continue reading “European Parliament votes to end anonymous shell companies”

In the February 2014 Taxcast: Are European tax havens getting ‘illegal state subsidies’? The European Union’s Competition Commissioner thinks they may be. Are the world’s tax havens really going to become more transparent? We analyse the OECD’s automatic information exchange proposal, warts and all. And the tax haven of the Bahamas is broke – the government’s solution? Tax the poor! Continue reading “The February Taxcast: Bahamas and more”

From Jesse Griffiths, Eurodad, with permission.

From Jesse Griffiths, Eurodad, with permission.

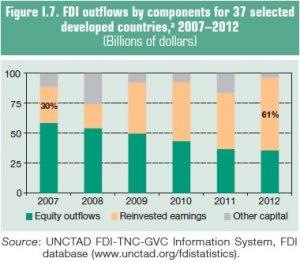

Foreign investment – much smaller than you might believe

You may have seen that foreign direct investment (FDI) was judged last month to have finally regained pre-crisis levels, and that a record percentage of all FDI – 52% – went to developing countries in 2013. The UN’s figures say $759 billion of new investment flowed into developing countries in 2013, right? Well, no actually they say nothing of the sort, but it requires a bit of digging to understand why. Continue reading “Foreign investment – smaller than you might believe”

From the Brisbane Times:

“An $880 million payout to Rupert Murdoch’s News Corporation has reignited the debate over whether global companies pay their fair share of tax in Australia. Continue reading “Australian tax office forced to pay Murdoch $880m over offshore scheme”

A nice article from the UK’s Independent newspaper:

“On Tuesday I had breakfast with a top team from the Swiss Bankers Association, who talked about what had happened since the signing of an agreement with Britain

Continue reading “Swiss “Rubik” secrecy deal – let’s make sure those nails stay in that coffin”

From Brass Moustache productions:

“Where is the gold buried when crisis is looming and society begins to demand its share?

With eloquence and polite mutual support, the British business establishment elegantly winds its way out of society’s demands of accountability and community, and vast amounts of money are diverted away from the state coffers through a net of confusing transactions, Caribbean tax havens and a shelter of bureaucracy. All wrapped up in the “Union Jack”.” Continue reading “The UK Gold film: now available online”

Switzerland, it seems, has rejected the OECD’s new project on automatic information exchange, out of hand.

Continue reading “Swiss reject OECD’s new transparency project”

We have finally completed the full upload to our website of all our past editions of Tax Justice Focus, our inaugural newsletter.

Please take a look.

TJN is pleased to publish a new briefing paper looking at the implications for developing countries of the OECD’s widely referenced Base Erosion and Profit Shifting (BEPS) project, which is designed to find ways to tackle the deficiencies in the international tax system. It is available in English and Spanish. Continue reading “New TJN briefing: OECD’s BEPS project for developing countries”

TJN is pleased to publish a new briefing paper looking at the implications for developing countries of the OECD’s widely referenced Base Erosion and Profit Shifting (BEPS) project, which is designed to find ways to tackle the deficiencies in the international tax system. It is available in English and Spanish. Continue reading “New TJN briefing: OECD’s BEPS project for developing countries”

The U.S.-based Tax Analysts has just published a fascinating article with the bland title Should Donor Countries Push Tax Reform? The answer, we think, is generally ‘yes’ – though it depends, of course, what we mean by ‘reform.’ The article notes: Continue reading “Should donors boost aid to Pakistan if it won’t tax its élites?”

The U.S.-based Tax Analysts has just published a fascinating article with the bland title Should Donor Countries Push Tax Reform? The answer, we think, is generally ‘yes’ – though it depends, of course, what we mean by ‘reform.’ The article notes: Continue reading “Should donors boost aid to Pakistan if it won’t tax its élites?”

From Le Monde:

“The corporations in the CAC 40 [France’s benchmark stock exchange index of the 40 biggest French stocks] have over 1,500 affiliates in tax havens, according to a study published on Thursday by the journal Project . . . cross-checked with authoritative studies data (the work of the Tax Justice Network Association in particular) and the most recent list of tax havens of the [OECD] Global Forum on Transparency.”

. . .

Its authors estimate that, according to their research, ‘their presence in tax havens has not diminished since 2009.”

Read the study, conducted in partnership with the plateforme paradis fiscaux et judiciaries here (in French.) See further coverage in L’expansion, Mediapart, and on France 2 television.

Hat tip: Mathilde Dupré.

From the ICIJ:

From the ICIJ:

“The British Virgin Islands have never been accused of taking financial secrecy lightly. But last week, members of the BVI legislature took a step toward raising the territory’s noted secrecy protections to new heights. Continue reading “BVI tax haven floats 20 years in prison for whistleblowers”

New OECD report on automatic information exchange: will developing countries be left out?

Continue reading “TJN responds to new OECD report on automatic information exchange”

British prime minister David Cameron has announced that money is no object when it comes to tackling the floods now inundating towns to the west of London. Continue reading “Your tax cuts at work”

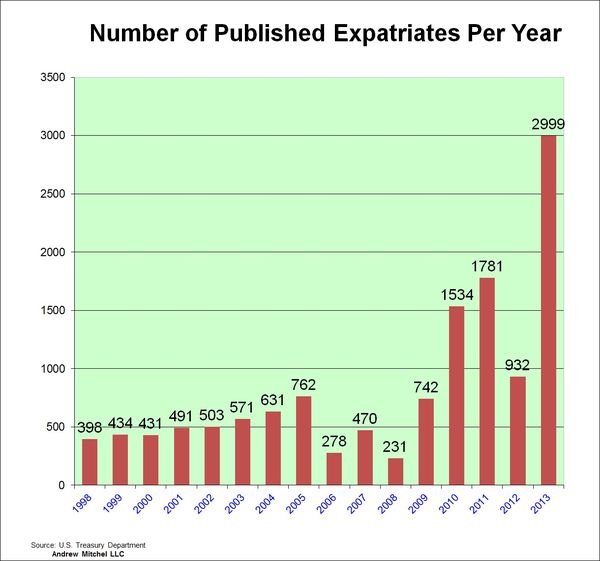

That headline is at least what this contributor would have you take away from his latest column in Forbes. And of course the article speculates that it’s all about tax, tax, and tax Continue reading “Number Renouncing US Citizenship rose 221% in 2013, in tax panic”

That headline is at least what this contributor would have you take away from his latest column in Forbes. And of course the article speculates that it’s all about tax, tax, and tax Continue reading “Number Renouncing US Citizenship rose 221% in 2013, in tax panic”

[vc_row][vc_column][vc_column_text] From Aditya Chakrabortty in the UK’s Guardian newspaper: some statistics that are classics of the “Finance Curse” analysis – where an oversized financial centre begins to weigh on the rest of an economy, rather than to support it. Continue reading “London, the Great Sucking Sound, and the Finance Curse”

From Aditya Chakrabortty in the UK’s Guardian newspaper: some statistics that are classics of the “Finance Curse” analysis – where an oversized financial centre begins to weigh on the rest of an economy, rather than to support it. Continue reading “London, the Great Sucking Sound, and the Finance Curse”

One of the many devious ploys used by the Swiss financial centre to protect its often illicit gains is to insist on ‘reciprocity’ in the exchange of information. Along the lines of: “If we’re going to share information with Nigeria, then they should share the same kind of information with us!” Continue reading “Why should tax havens insist on ‘reciprocity’ from poor countries?”

From the Equality Trust:

How Inequality Became THE Issue – Five Years of The Spirit Level

Continue reading “How Inequality Became THE Issue – Five Years of The Spirit Level”

From Christian Aid:

“Two-thirds (66 per cent) of the CEOs of large UK firms surveyed agreed that ‘multinationals should be required to publish the revenues, profits and taxes paid for each territory where they operate’.

PwC’s research, which involved 1,344 interviews with CEOs in 68 countries, also found that across all the CEOs surveyed, 59 per cent supported the requirement.”

Which has been a core TJN campaign for the last decade or so. We are delighted to have made so much headway. But there’s still a long way to go.

TJN has previously challenged the prevailing discourse on corruption; and we have taken particular issue with Transparency International’s Corruption Perceptions Index (CPI), which looks at corruption through a highly distorted prism. Continue reading “Flipping the corruption myth”

February 4, 2014

Today’s edition of the Jersey Evening Post leads with an article headed ‘Official: Why food costs so much more in Jersey’. Food prices, according to a new study, are one third higher than in the UK. Worse, once taxes and duties are excluded, the difference rises to 50 percent. Continue reading “Why does food cost so much in Jersey?”

Today’s edition of the Jersey Evening Post leads with an article headed ‘Official: Why food costs so much more in Jersey’. Food prices, according to a new study, are one third higher than in the UK. Worse, once taxes and duties are excluded, the difference rises to 50 percent. Continue reading “Why does food cost so much in Jersey?”