Executive Summary

Climate finance is often framed as a search for new money. Our analysis and the climate finance slider released with this report, shows that the real issue is not scarcity but capture. Extreme wealth and undertaxed multinational profits are plentiful; what is missing is countries’ ability and willingness to tax them. This ability, tax sovereignty, has been weakened both by global rules that favour profit shifting and by domestic policies shaped by those who benefit most from the status quo.

We offer a blueprint for a global climate finance pool funded through progressive reforms. This report makes a critical contribution to the fight for fair and sufficient climate finance by:

- Exposing false scarcity: Applying a moderate wealth tax and implementing measures to end cross-border tax abuse across 187 countries could raise sums that dwarf today’s climate finance gap, with money left to spend domestically.

- Laying bare the tax sovereignty gap: Two thirds of countries could become net recipients of this pool while still adding domestic revenue, providing evidence that when governments regain and fairly exercise taxing rights, resources flow in rather than out.

- Showing scale is achievable: The reforms must exceed most existing proposals for climate finance funds.

Two case studies illustrate two very different tales of tax sovereignty, and the devastating linkages to climate justice and public finance. In Tanzania, we showcase how taxing rights are diluted by profit-based mining agreements, long-life stabilisation clauses that lock in tax breaks, and treaty rules that shift taxing rights abroad, all compounded by limited capacity to audit and litigate with multinational corporations. In the United Kingdom, tax sovereignty is self-restricted by successive cuts to top rates and lack of a net wealth tax, a patchwork of incentives (such as the non-dom regime) that invite underpayment, and the City’s influence over policy. The UK also incentivises profit shifting through its overseas territories, weakening its own and other countries’ tax bases.

Together, our findings demonstrate that claims of “no fiscal space” are convenient narratives, not economic facts. The report recommends the following:

Priority actions for civil society coalitions and allies

- Challenge the false narrative of fiscal scarcity by making the scale of untapped domestic revenue visible and politically salient.

- Build cross-movement alliances linking tax justice, climate justice and debt justice movements to challenge elite capture and reclaim public control over global tax and climate finance systems.

- Centre tax sovereignty as a climate justice issue and highlight how tax abuse by elites and multinationals undermines public finance for climate action.

- Expose the role of financial secrecy, tax abuse and corporate lobbying in blocking progress on climate finance.

Technical actions for governments

- Support negotiations for a United Nations Framework Convention on International Tax Cooperation (UNFCTC) and embed standards that guarantee equal rule-setting power for all countries. This includes a fair dispute resolution mechanisms that lowers the threat of existing Investor State Dispute Settlements (ISDS).

- Reclaim taxing rights for source countries by reallocating profit taxation and enforcing minimum effective corporate tax rates, especially in high-emitting sectors, and ensuring the necessary transparency and cooperation to enable effective wealth taxes in each country.

- End the race to the bottom by eliminating harmful tax incentives and introducing progressive wealth and capital taxes targeting elites and carbon-intensive industries.

- Redirect tax revenues into national climate transition plans and contribute fairly to global climate finance through transparent and accountable mechanisms.

Reclaiming tax sovereignty through these steps would not merely fill a funding gap. It would reshape global taxation to serve climate justice and restore democratic control over public finances. Revenue can be raised fairly and reliably from those most able to pay and directed to where they are most urgently needed.

1. The climate finance crisis is a crisis of power, not of resources

Countries have systematically failed to meet even the modest US$100 billion per year climate finance pledge made by developed countries at COP15 in 2009. Yet estimates now suggest that the annual cost of addressing the climate crisis around the world may reach US$9 trillion by 2030[1]. Every moment of inaction drives this figure higher. The chronic failure to mobilise and institutionalise adequate and fair climate finance is not simply a question of broken promises. It reflects political and economic power dynamics within an unjust global system.

To date, climate finance strategies have relied heavily on three pillars: voluntary contributions through public pledges, such as the US$100 billion goal for adaptation and mitigation agreed at COP15; market-based mechanisms, such as carbon trading and green bonds; and blended finance approaches designed to leverage private capital. But all three have fallen short. Voluntary pledges remain unmet, carbon markets have struggled with credibility and equity[2] issues, and private investment continues to prioritise profit over long-term resilience and justice.

By contrast, tax revenue, especially when raised through progressive and redistributive measures, offers a reliable, sovereign and equitable means of financing climate action. Taxes can be designed to reflect responsibility and ability to pay, while also strengthening democratic mandates and public trust. In the face of escalating climate costs, fiscal policy must become a central tool in delivering both national and global climate finance commitments. Financing climate action sooner rather than later is critical. This includes reparative finance for loss and damage to compensate countries harmed by a crisis they did not cause, as well as funding for adaptation and mitigation.

1.1 Why this report, and why now

Governments across the globe continue to claim that resources are scarce or unavailable. However, in reality, trillions in untapped tax revenue exist within the current global financial architecture[3]. What is missing is not money, but political will. Taxation is not merely a budgetary tool—it is a survival mechanism.

This report starts from the recognition that the climate crisis is not fundamentally a crisis of resources. It is a crisis of power, political capture and imagination. As others have noted[4], the real obstacle to change is not an absolute lack of revenue, but a failure to reimagine what progress looks like in a warming, deeply unequal world. Fossil-fuelled development paths are assumed to be inevitable or necessary, even when they are economically inefficient, environmentally devastating and politically unjust. We argue that tax, often seen as too technical or divisive, is central to breaking through this stalemate.

Specifically, we must revisit how tax sovereignty is understood and exercised in the face of the climate emergency. Tax sovereignty, the ability of states to set and enforce their own tax policies in the sovereign interest of their own people and without external interference, is often invoked by governments as a shield to protect their freedom not to tax. But in a world on fire, that freedom is no longer neutral. When the costs of the climate crisis are rising rapidly and falling most heavily on those who did least to cause it, the decision not to mobilise available tax revenues, particularly from extreme wealth or polluting profits, is no longer simply a domestic prerogative. It becomes a crisis of power, not of resources.

Today, many governments still misuse or underuse their tax sovereignty, upholding the right not to tax in ways that prevent urgently needed public finance from being raised. Many other governments are limited in their ability to exercise their tax sovereignty. This, in turn, creates a race to the bottom, making it more difficult for other countries to maximise revenue raising. Additionally, many governments have made choices to be tied down in international tax and investment protection treaties, many of which were signed before the climate emergency escalated. Undoing these choices is difficult and curtails the exercise of full tax sovereignty needed to address present climate challenges.

In this report, we focus on two specific trends:

In the Global North, governments have failed to harness the full potential of progressive taxation. Wealth taxes, which can raise trillions of US dollars annually, remain almost entirely absent, even as extreme wealth concentration and carbon-intensive capital accumulation violate the polluter pays principle. Generous subsidies and incentives[5] to polluting industries, along with sustained tax cuts, further undermine the fiscal base for climate action.

In the Global South, tax sovereignty is actively undermined, either through past decisions to be bound by outdated international treaties or through external political pressure that prevents a country from exercising its sovereignty.

Collectively, countries lose hundreds of billions of US dollars each year through corporate profit shifting and tax abuse. International tax rules, largely shaped by the OECD and wealthy countries, limit the taxing rights of developing nations. Illicit financial flows, often channelled through secrecy jurisdictions that enable opacity in financial systems to facilitate tax abuse and are hosted by the Global North, rob (all) governments of urgently needed revenue to finance their own transitions as well as promoting wasteful corruption. This is compounded by the failure of international climate finance mechanisms to deliver timely and sufficient support.

To address the climate crisis at the scale required, we must abandon the prevailing narrative of scarcity. Climate finance is too often framed as a matter of limited fiscal space, best addressed, it is claimed, through voluntary contributions, carbon markets or private investment flows. This narrative obscures the deeper issue: a refusal to tax existing wealth and profit in ways that would fund a just transition. Taxation must be reframed as a cornerstone of climate justice. So must tax sovereignty, not as a shield for inaction, but as a tool for survival.

1.2 Tax sovereignty, human rights and reparations

This report rests on a set of core principles[6]:

- The polluter pays principle: Climate finance must go beyond national borders to address global responsibilities. Those who have contributed most to the crisis must pay their fair share, not only for local mitigation, but for adaptation and irreversible loss and damage elsewhere.

- Common but differentiated responsibilities (CBDR): All countries must act on climate, but richer, higher emitting nations must contribute more. Climate finance frameworks, and tax reforms to fund them, must reflect historic emissions and unequal capacities.

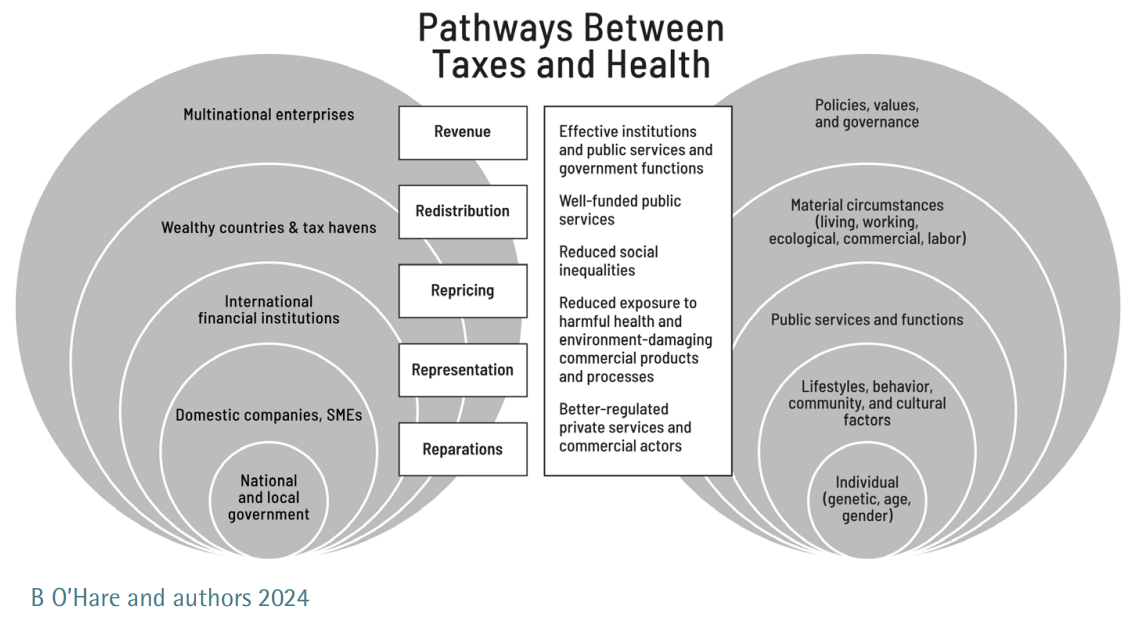

- Tax as a social superpower: Taxes do more than fund public services. They redistribute wealth, disincentivise harmful behaviour, and forge accountability between states and citizens. They are uniquely powerful in delivering just and lasting change.

- International cooperation with equity at the centre: Climate finance decisions must align with human rights, democratic participation, and UN principles. No fair climate finance regime can be built on rules that exclude the voices of those most affected, particularly Global South countries and frontline communities.

Climate finance must be understood not as charity but as a matter of global justice and legal obligation. The Maastricht Principles on the Extraterritorial Obligations of States affirm that governments have responsibilities to avoid harm and to promote equity beyond their borders. This legal framework aligns with the Common but Differentiated Responsibilities and polluter pays principles, which recognise the disproportionate role of wealthy nations and polluters in causing the crisis, and their duty to finance its solutions.

A reparations-based approach to climate finance affirms that countries in the Global South have a right to access adequate, fair and reliable funding, not because of goodwill but because of ecological debt owed. Taxation is central to delivering this finance. Properly designed progressive tax policy, such as wealth taxes and rules to stop cross- border tax abuse, can not only mobilise the required revenue but also reduce inequality and limit the excess consumption of the very wealthy. Tax is both a fiscal and behavioural tool.

To make this argument tangible, this report introduces a new interactive tool: the climate finance slider. Based on original Tax Justice Network country level data, the tool allows users to explore how much revenue could be generated through two key tax justice reforms: introducing wealth taxes and curbing cross-border tax abuse. Crucially, it allows users to allocate this revenue between domestic spending and global climate finance contributions. This illustrates a key argument: it is a false choice to pit national spending priorities against global obligations.

The climate finance slider demonstrates that countries, including those in the Global South, can simultaneously raise public finance at home and contribute to international climate finance, provided tax sovereignty is reclaimed and fairly exercised. Most countries, in fact, are likely to be net recipients under a progressive system. What stands in the way is not technical feasibility. It is entrenched inequality and political resistance.

This report places tax sovereignty at the heart of climate justice. Many countries want to implement tax reforms to raise public revenue and finance domestic transitions but cannot do so because their sovereignty is constrained. Other countries are better able to act but choose not to implement such measures because they are perceived not to be in the national interest. Through case studies, policy recommendations, and data derived from our work on wealth taxation and longstanding research on tax abuse, we show how rethinking taxation, both globally and domestically, can help close the climate finance gap and build fairer societies in the process.

2. Inequality in a warming world: Climate breakdown and fiscal power

This section unpacks the core injustices embedded in the climate finance crisis, including what is needed, who is paying and who is not. It illustrates how entrenched global inequalities, including in taxing rights and fiscal capacity, undermine just responses to a warming world, and how wealthy nations and multinational corporations continue to benefit from existing frameworks.

2.1 The climate finance gap: costs, needs and broken promises

The global community is failing to deliver on even its most modest climate finance pledges. The US$100 billion annual target, first committed to at COP15 in 2009, has repeatedly been missed[7]. Current pledges for the Loss and Damage fund are far below the hundreds of billions of dollars that frontline communities will need. Financial needs are ballooning. By 2030, the combined cost of climate adaptation, mitigation and loss and damage may reach US$9 trillion annually[8].

These costs are not abstract: they translate into lives lost, livelihoods destroyed, and entire regions rendered uninhabitable. Climate-vulnerable countries need at least US$1.3 trillion a year by 2030 just for mitigation and adaptation[9]. Global climate finance remains severely underfunded, especially the loss and damage fund, which to date relies on inadequate, ad hoc and discretionary pledges from some rich countries rather than enforceable, fairly quantified contributions.

Meanwhile, the burden of domestic transitions is rising everywhere. Germany, for example, needs an additional €70 billion annually to reach climate neutrality[10]. Indonesia requires US$8 billion in new investments every year to align its energy sector with net zero targets[11]. South Africa’s Just Energy Transition Investment Plan (JET-IP) outlines a requirement of approximately US$98 billion over the next five years to initiate the shift from coal to renewable energy sources.

And although the scale of climate finance needs remains daunting, there are signs of cautious optimism. The cost of renewable energy technologies continues to fall and early public investment can reduce long term transition costs. This dynamic is reflected in recent modelling by the UK’s Climate Change Committee[12], among others.

But the failure to raise the necessary climate finance is not due to a lack of resources. It stems from political and corporate obstruction to mobilise revenue, particularly through fair taxation. This report argues that the narrative of revenue scarcity must be replaced with a narrative of power, responsibility and justice. Countries are not unable to raise climate finance. They are unwilling and often constrained in their ability to use the tools available to do so.

While this report focuses on international public finance flows between countries, it is important to acknowledge that funding climate policy also happens through domestic level investment by governments, households and the private sector[13].

2.2. Climate inequality: Who pays and who bears the cost

We use the term climate injustice to refer to the disproportionate climate impacts on those communities least responsible for emissions. Climate injustice is deeply intertwined with economic inequality, both between and within countries, historic and current.

As Oxfam and others have shown, the wealthiest nations and the wealthiest individuals within them are responsible for most historical and current carbon emissions. For example, the world’s wealthiest 1 per cent of people are responsible for more carbon emissions than the poorest half of humanity combined[14]. This level of carbon emissions is not incidental. It is structural. It is tied to patterns of luxury consumption, asset ownership and political capture. Rich communities can better insulate themselves against climate shocks like extreme weather events. Yet it is the poorest countries and communities who are most exposed to the worst effects of climate breakdown.

Progressive taxation, including on wealth, is therefore not just a revenue imperative. It is also a tool for reining in overconsumption and excess political and economic influence among those at the top of the economic distribution. Historic marginal tax rates of up to 95 per cent[15] were not only important for raising revenue. They also signalled social disapproval of extremes in the distribution, and imposed an upper limit on individual income and wealth holdings. Globally, former colonial powers have built enormous wealth through fossil-fuelled industrialisation and continue to dominate financial and tax systems that extract wealth from the Global South[16]. Even the diversification and ultimately greening of Europe’s energy systems, by some measures, continues to operate through those same extractivist principles[17]. For example, green colonialism depletes energy reserves and critical minerals in the Global South to power Global North infrastructure[18]. Multinational oil and gas projects degrade local ecosystems and deplete essential resources like groundwater.

Despite this, climate finance remains largely voluntary and disconnected from the polluter pays and CBDR principles[19]. A just approach to climate finance requires not only acknowledging unequal contributions to the crisis but also addressing the mechanisms that allow those responsible to avoid paying their fair share. These mechanisms include preferential tax treatments for polluting sectors[20], ‘greenlaundering’ by financial institutions and fossil fuel corporations to obscure the true scale of fossil fuel finance[21] and mechanisms to facilitate profit shifting, aggressive tax planning and tax abuse more generally.

Fair taxation, especially through the introduction of wealth taxes and reforms to limit tax abuse, offers some of the most just, effective and sustainable ways to operationalise this principle.

2.3 Tax sovereignty and the political economy of climate injustice

At the heart of the climate crisis lies a deep fiscal injustice: many of the countries most exposed to the consequences of rising temperatures are those least equipped to raise revenue for adaptation, mitigation and loss and damage. Their inability to do so is not simply a matter of administrative or economic underdevelopment, but the result of a long history of international rules, corporate strategies, illicit financial flows and political choices that have hollowed out their tax capacity and sovereignty.

A country’s tax capacity refers to its ability to effectively raise revenue through taxation. It is one of the clearest indicators related to the appropriate and effective use of tax sovereignty in light of the climate emergency, and its fiscal power more broadly. It is also a critical precondition for meaningful climate action. While high income countries typically collect 30 to 40 per cent of their GDP in tax revenue, many low and middle income countries collect less than 20 per cent, with some as low as 10 per cent. This gap reflects both domestic challenges and international constraints, as explored in the following sections.

Without sufficient tax capacity, governments cannot fund basic public services, let alone the transition to a low carbon economy. While domestic reform is essential, many of the most powerful barriers to building tax capacity lie outside national borders.

How tax sovereignty is undermined:

Sovereignty, including tax sovereignty, is often celebrated in principle but constrained in practice, especially for countries in the Global South. These constraints include:

- Restrictive and/or outdated tax treaties: Bilateral agreements that limit countries’ rights to tax foreign investors or multinational income, often favour residence-based taxation in wealthier states rather than taxing profits where real economic activity takes place.

- Profit shifting and transfer mispricing: Multinational corporations routinely shift profits out of resource rich countries through internal capital markets, depriving host governments of billions in untaxed earnings.

- Investor-State Dispute Settlement (ISDS) mechanisms: These allow corporations to sue states for changes to tax rules or enforcement, disincentivising reform efforts.

- Tax incentives and stabilisation clauses: To attract investment, many governments have locked themselves into long term, low tax regimes that constrain fiscal space for decades. Stabilisation clauses prevent governments from changing tax rules after investment deals are signed.

- Illicit financial flows and secrecy jurisdictions: Capital flight, trade misinvoicing and tax haven networks more generally siphon off taxable income and wealth, often facilitated by financial and legal enablers and intermediaries based in the Global North.

These dynamics form a system of fiscal neocolonialism, where the ability to govern through taxation is systematically undermined. A stark illustration of the role of power dynamics is provided currently by the second Trump presidency[22], which has committed from day one to curtail the sovereignty of all other countries to tax US multinationals fairly. Countries are left to rely on regressive consumption taxes, volatile natural resource rents, or debt.

Climate justice, however, requires not just ambition, but capacity. Without the fiscal tools to raise revenue equitably, low-income and climate vulnerable countries are forced into impossible trade-offs, such as between education and adaptation, or debt service and disaster response. This is why reclaiming tax sovereignty, through both national reforms and international rule changes, is not only a matter of fiscal justice but a prerequisite for climate justice.

2.4 Realising full and fair sovereignty: Typical wealth tax and anti-tax abuse reforms

Having explored why fiscal space is constrained, we now show how governments can expand it. Two reform families can mobilise resources at scale while reinforcing tax sovereignty and fairness: progressive net wealth taxation and curbing corporate tax abuse. These two sets of reforms naturally complement each other: wealth taxes target stocks of money, whereas anti-tax abuse rules target flows and thus different bases. If tax treaty reform or implementation delays unitary taxation, a domestic wealth tax still delivers revenue and vice-versa. Both sets of reforms also focus on households and firms most responsible for historic emissions, aligning revenue potential with the polluter pays principle.

2.4.1 Progressive net wealth taxation

A net wealth tax complements inheritance, estate, property and capital gains taxes by levying an annual tax on private fortunes, either instead of or in addition to taxes on income. Net wealth taxation matters because it:

- captures generational wealth that may have largely escaped other types of taxation and drives inequality

- targets the top end of the economic distribution with an intense concentration of high-emitting households

- provides a steady revenue stream for long-term investment

Typical design features include:

- Threshold: set high enough to spare middle-class savers (approximately €1 million in Spain; PPP-adjusted equivalents elsewhere).

- Progressive rate schedule: 1 per cent on the entry band, rising to 2 to 3 per cent on ultra high net worth tiers

- Base & exemptions: net of debt, with limited relief for primary residences and pension pots

- Administration: third party data (banks, land and share registries) plus automatic information exchange

In high-income economies, a net wealth tax may yield around 1 to 2 per cent of GDP annually. For example, an enhanced version of Spain’s net wealth tax is projected to raise roughly €10.7 billion a year.[23] In lower income countries, the tax base may be smaller in absolute terms but still significant relative to public budgets.

2.4.2 Curbing corporate tax abuse

Cross-border tax abuse by multinational corporations costs countries hundreds of billions per year. Three core, complementary measures can address this:

| Measure | What it does | Indicative revenue |

|---|

| Unitary taxation with formulary apportionment | Treats a multinational as one firm and allocates its global profit to where real economic activity occurs | +0.5 to 1 per cent GDP[24] |

| Minimum effective tax rate (around 25 per cent) | Top-up rules neutralise low rate jurisdictions and harmful incentives | Included above, prevents erosion |

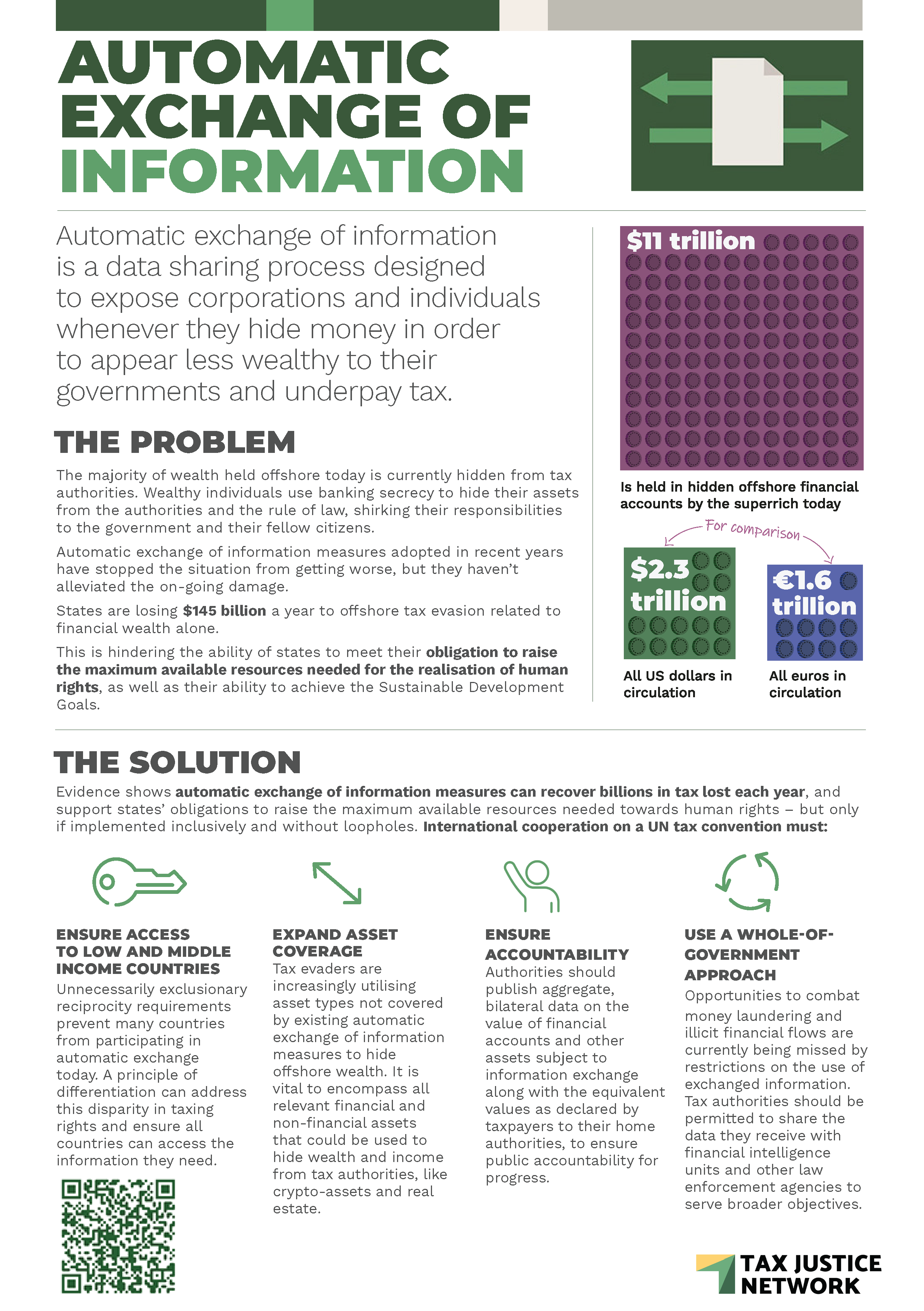

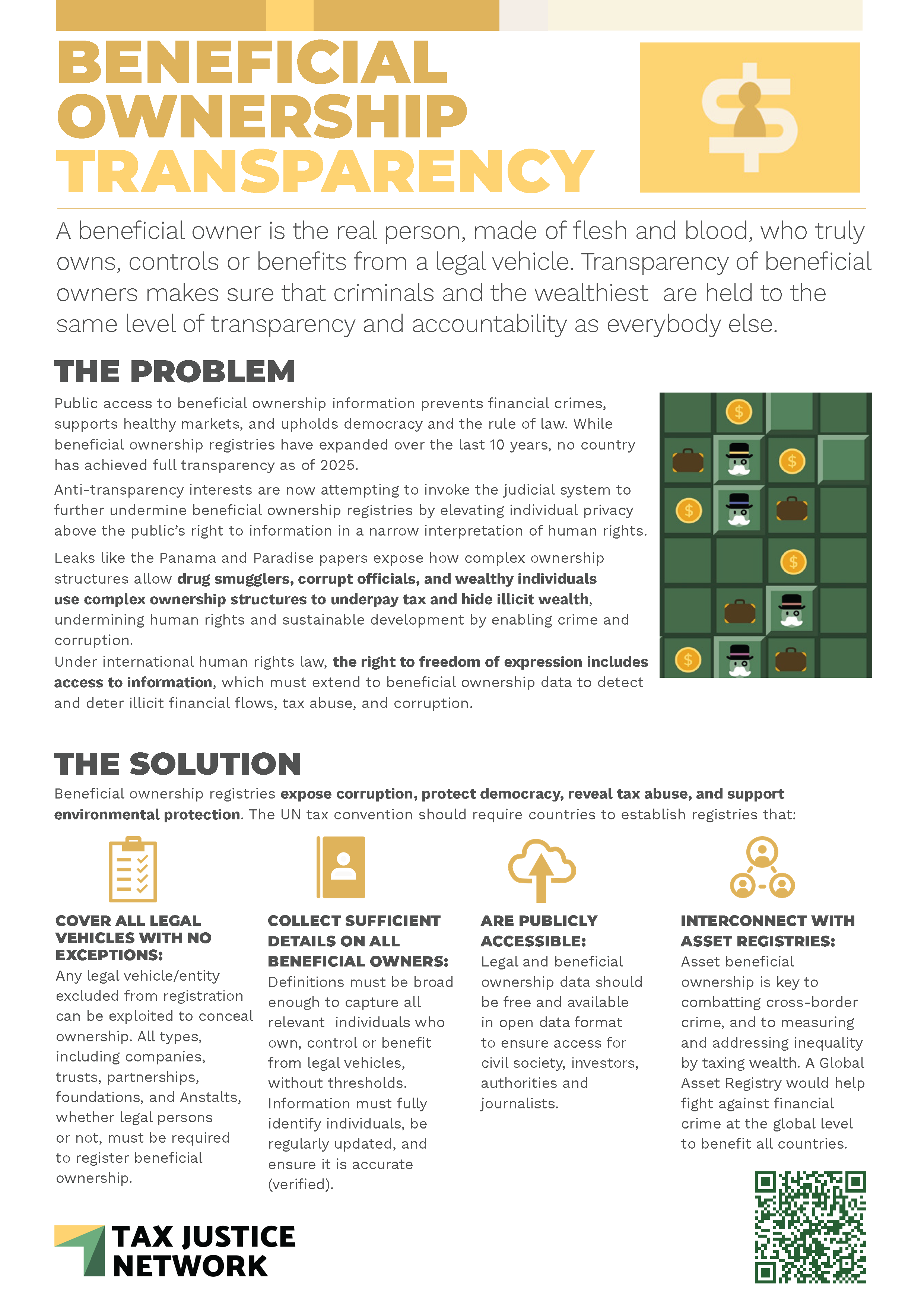

| Transparency tools | Country by country reporting, beneficial ownership registries, automatic information exchange | Enforcement multiplier |

While these figures are indicative, and the size of revenue collected depends on factors such as economic structure and enforcement capacity, a resource rich lower middle-income country like Tanzania, for example, shifting from separate entity accounting to unitary rules could recapture roughly 0.8 per cent of GDP currently lost[25].

3. Enough for both: reclaiming tax sovereignty to overcome climate finance scarcity

This section introduces a new interactive tool: a country-by-country climate finance slider that lets readers explore how revenue raised from two key tax justice reforms could be allocated between domestic investment and contributions to a global climate finance mechanism. The tool is based on the Tax Justice Network’s State of Tax Justice data[26] quantifying losses from cross-border tax abuse, and our modelling of a moderate net wealth tax[27]. All details of the data and associated calculations can be found in the methodology note.

What the tool makes visible is the extent of untapped revenue—and with it, the power of tax sovereignty and fiscal self-determination. Instead of theprevailing scarcity narrative around public finance, countries do not in fact face a binary choice between addressing domestic needs or contributing to global climate finance. Through progressive tax policies, most could easily do both. Revenue could be channelled into domestic decarbonisation policies, adaptation measures and essential public services. Simultaneously, countries could contribute fairly to global climate finance. As previously explained, on top of ongoing improvements in domestic climate finance flows, it is this international climate finance from developed countries to developing countries to support climate action that remains dramatically underfunded.

At the basis of these reforms lies reclaimed and fairly exercised tax sovereignty. It is an essential lever that makes self-determined, inclusive climate action possible, without countries having to choose between domestic and global spending.

3.1 How the slider works

The climate finance slider is an interactive tool that lets users explore what countries could raise and allocate if two major tax justice reforms were enacted: (1) a moderate annual net wealth tax, and (2) effective measures to end cross-border tax abuse by multinational corporations.

For each country, the tool calculates the total potential revenue available from these reforms using estimates from the Tax Justice Network. This revenue can then be split between domestic spendingand global climate finance contributions. Users control this allocation through a sliding bar, visualising how policy choices affect both national budgets and international solidarity.

The slider also uses two global indicators to determine each country’s role. Responsibility is calculated as a country’s share of historical territorial emissions as proxy to calculate its fair contribution to global climate finance. Need is calculated based on each country’s vulnerability to climate change. Details can be found in the methodology note.

For every country, the slider shows:

- the total amount of revenue available annually from these tax reforms

- how much it would contribute to a global climate finance fund, based on the user’s allocation

- how much it would receive from that fund, based on its vulnerability

- whether it ends up a net contributor or net recipient

- how much is left over for additional domestic spending

In short, the slider reveals what countries could achieve if tax justice were made real—and if tax sovereignty were exercised fully and fairly. It does not predict what will happen but shows what is possible under a fair and just system.

The slider is available here.

3.2 Who is missing, and why it matters

While the climate finance slider aims to be global, some countries and jurisdictions are missing due to incomplete data. This reflects gaps in historical emissions and climate vulnerability data. Without both variables, we cannot estimate fair contributions or needs, and therefore, these cases are excluded from the tool. As explained in the methodology note, the choice not to use imputation techniques or proxy data is deliberate to avoid distorting results. Critically, missing data is not random—it reflects patterns of power, invisibility, and contested sovereignty.

What is not measured is often just as important as what is[28]. Countries like Palestine, or jurisdictions such as the British Virgin Islands, Hong Kong or Jersey are excluded not simply because data is incomplete, but because they occupy politically marginal or deliberately obscured positions. Some are territories without full sovereignty, unable to participate in international negotiations. Others are major players in the global offshore tax system. These omissions highlight how those with the most to gain from climate finance—and those with the most to give—can be rendered invisible.

This is especially paradoxical because many missing jurisdictions sit at the extremes of the climate justice spectrum. They are either deeply climate vulnerable and politically constrained (like Palestine), or critical enablers of tax abuse (like the BVI or Hong Kong), or both (like Puerto Rico). Even though their aggregate effect on global revenue or finance distribution is minimal—less than 0.1 per cent of a $1 trillion fund—their absence is symbolically and politically significant. As shown in the methodology, many could still raise substantial tax revenues, even if their emissions are low and their vulnerability is high.

In short, missing from the data does not mean missing from the problem. These gaps reflect some of the same global inequalities this report seeks to address. A just climate finance model must also be a fully inclusive one. Future versions of this work may incorporate missing jurisdictions as more data becomes available. Until then, acknowledging their absence is part of building a transparent and equitable system—one that sees and counts everyone.

3.3 What the data shows

The data reveals a powerful insight: under a progressive tax system, most countries around the world would be net recipients, and still have revenue left over to spend domestically. This undercuts the dominant narrative of scarcity and dependence, showing that fiscal capacity already exists, but it is unequally distributed and politically constrained. Countries in the Global South could reduce dependence on foreign aid or volatile loss and damage funding if they were able to effectively mobilise their own resources. Countries with greater historical responsibility can contribute more, aligning with the principle of common but differentiated responsibilities, while having revenue leftover for domestic spending.

The slider challenges the false trade-off between local priorities and global responsibilities. It visualises a path toward sovereignty, justice and shared climate action.

Key findings include:

- The US would be able to contribute $70 billion from additional tax revenue towards a global climate finance fund of $300 billion and be left with $707 billion for domestic spending. For a fund of $1.5 trillion, the US would be able to contribute $365 billion with $412 billion to spare. Even using the largest fund size and including global emissions since 1850, which stand at 24.54 per cent, the United States would still have more additional tax revenue available from ending cross- border tax abuse and introducing a progressive wealth tax than what they would be expected to contribute to the fund (US$777.5 billion vs US$638 billion).

- The UK would be able to contribute $13 billion from additional tax revenue towards a global climate finance fund of $300 billion and be left with $64 billion for domestic spending. For a fund of $1.5 trillion, the UK would be able to contribute $65 billion with $12 billion to spare.

- France would be able to contribute $6 billion from additional tax revenue towards a global climate finance fund of $300 billion and be left with $58 billion for domestic spending. For a fund of $1.5 trillion, France would be able to contribute $33 billion with $31 billion to spare.

- China would be able to contribute $47 billion from additional tax revenue towards a global climate finance fund of $300 billion and be left with $627 billion for domestic spending. For a fund of $1.5 trillion, China would be able to contribute $236 billion with $438 billion to spare.

- India would be able to contribute $11 billion from additional tax revenue towards a global climate finance fund of $300 billion and be left with $99 billion for domestic spending. For a fund of $1.5 trillion, India would be able to contribute $53 billion with $57 billion to spare.

- Brazil would be able to contribute $3 billion from additional tax revenue towards a global climate finance fund of $300 billion and be left with $53 billion for domestic spending. For a fund of $1.5 trillion, Brazil would be able to contribute $15 billion with $41 billion to spare.

- The Maldives are a prime example of the conundrum of small islands states: they are a net recipient of climate finance, but under a big fund size might struggle to meet their contribution.Assuming a fund size of US$1.5 trillion, the Maldives would be a net recipient at US$109 million. The potential additional tax revenues of US$30 million from tax reforms would cover the Maldives’ global climate finance contribution and still provide an extra US$3.5 million to spend domestically. Under a bigger fund scenario (US$2.6 trillion), the Maldives would receive US$234 million and would have to contribute US$46 million in global climate finance, meaning that even if they committed all the extra revenues to the fund, it would only cover 66 per cent of its fair contribution. If the fund were recurrent, the Maldives could spread their contribution over time and meet their part in two years while still having funds to spend domestically.

- No matter the size of the selected fund, almost two thirds of the included countries (63 per cent) would be net recipients of climate finance under the proposed tax reforms.

Based on the underlying data and findings, countries are also classified along a tax sovereignty scale, which compares their potential additional tax revenue to current tax collection levels[29].

The scale aims to illustrate how widespread constraints imposed by lacking or partially exercised tax sovereignty are on public budgets.

| Tax sovereignty level | Range | Share of Countries | Example |

|---|

| Challenged | 0-5% | 36% | Belgium (2.7%) |

| Endangered | 5-15% | 42% | Tanzania (13.6%) |

| Negated | +15% | 19% | Timor-Leste (29.4%) |

3.4 What this means for climate justice

Exercising tax sovereignty fairly would allow countries to fill public budgets at home and participate in a fair multilateral climate finance system. The question is no longer whether countries can afford to act, but whether they are willing to act, and whether they are allowed to. The data shows clearly that climate finance constraints are political, not fiscal. The slider is therefore more than just a numbers game. It is a visual intervention into a dominant narrative of scarcity. Too often, governments claim they cannot fund climate action at scale because public resources are limited. But if countries reclaimed their tax sovereignty and implemented fair tax reforms, most would have more than enough revenue to meet both domestic needs and contribute to global goals.

Importantly, the slider’s global finance pool functions as a partial, proxy form of climate reparations in the absence of any formal colonial or climate reparations regime. It acknowledges that wealthier, high emitting countries owe historical climate debt to those who are least responsible for emissions but most vulnerable to rising temperatures.

The tool also challenges the artificial divide between domestic priorities and global obligations. Climate-vulnerable countries, especially in the Global South, are often asked to choose between servicing external debt, financing basic public services and decarbonisation. But when endowed with mobilising their own fiscal resources, these countries can clearly do both, fund their own transitions, and reduce dependency on donor dependent, volatile climate finance.

The slider also helps operationalise principles like the polluter pays principle and common but differentiated responsibilities (CBDR). Those with higher historical emissions have greater responsibility to contribute to a global fund. Those most vulnerable receive more. Contributions are not based on charity, but on fairness and justice.

Crucially, in the absence of any formal reparative framework between former colonial powers and those most harmed by climate breakdown, this global climate finance pool also functions as a partial, proxy form of climate reparations. It acknowledges that the current climate crisis is the product of unequal histories, and that those who benefitted most from carbon intensive development must now help shoulder the costs.

Finally, the slider makes visible something often ignored in climate negotiations: the power of taxation to drive justice. Just as tax injustice has helped entrench the climate crisis, through subsidies, secrecy, and the under taxation of polluters, so too can just taxation become a cornerstone of reparative climate finance. Reclaiming tax sovereignty is not only a way to raise money. It is a way to reclaim democratic control over the transition ahead.

4. Sovereignty in action and denial

Despite formal claims, the actual autonomy countries have over their tax systems is frequently limited. To fully understand why tax sovereignty is a contested terrain, and why many countries struggle to exercise it effectively, this section explores concrete examples, demonstrating both certain countries’ failure to actively use tax sovereignty for climate finance purposes, as well as the restrictions faced by other countries attempting to exercise their tax sovereignty in that way. It highlights how historical legacies of colonialism, contemporary global economic structures, and political economy considerations continue to shape and constrain fiscal choices, with profound implications for climate finance.

4.1 Why tax sovereignty is critical

Tax sovereignty is often seen as an abstract legal principle, and is, at least in terms of an overarching goal, largely absent from climate justice advocacy.

However, it is a deeply political expression of autonomy and collective self-determination. The ability to levy and collect taxes is at the heart of state power: it is how societies determine who contributes what, and to which collective ends. Tax sovereignty and the way countries use it is what shapes countries’ achievement of tax fairness, or the 5Rs of tax justice, that is, using taxation to raise revenue, reprice goods considered to be incorrectly priced by the market, redistribute income and wealth, improve representation and channel reparations for past injustices[30].

Historically, struggles over taxation were foundational to anti-colonial movements, from the rejection of the British imperial “taxation without representation” in 18th-century north America, to uprisings against colonial taxes across Africa and Asia[31]. Following independence, newly sovereign states saw control over tax policy as a cornerstone of national development strategies[32]. Conversely, the denial of self-determination through the forced forgoing of tax revenue continues to be a key feature of illegal occupation[33].

In many post-colonial states, the sacrifice of the new states’ power to tax foreign companies in favour of the former colonial powers has consistently been pushed as a necessary concession to attract foreign investment. This view has led to many legacy investment and tax treaties that are fundamentally imbalanced when it comes to those new countries’ ability to raise tax revenue. Additionally, the promise of fiscal sovereignty was also undermined in domestic tax policy making. At the same time that countries were gaining independence from the UK’s colonial empire, new developments were kicking off on what would eventually come to be called the UK’s “second empire”: a network of British tax havens consisting of crown dependencies like Jersey and Guernsey and overseas territories like the Cayman Islands and the British Virgin Islands, and at the centre of which sits the City of London. The UK’s “second empire” is today responsible for a quarter of all the tax losses countries suffer to multinational corporations and wealthy individuals using tax havens to underpay tax[34]. It continues the colonial undermining of other nations’ tax sovereignty and self-determination.

The global turn to neoliberalism in the 1980s and 1990s brought about a powerful reorientation of tax policy, pushed via structural adjustment programmes led by international financial institutions, in particular the IMF and the World Bank, and backed by the Washington Consensus and their donor governments. Under the banner of investment reforms, many countries were urged to lower corporate tax rates, introduce tax privileges for foreign investors and limit the taxation of extractive sectors, such as mining in Peru or the extractive sector in Ghana. These reforms coincided with the expansion of global financial liberalisation and the rise of offshore finance[35], which created a structural mismatch between where economic activity took place and where profits were declared and taxed.

Today, the idea that countries retain full sovereignty over their tax systems is more of an illusion than a fact. In practice, countries’ ability to set and enforce tax rules is shaped and constrained by an international system designed around the interests of capital. For many developing countries, sovereignty is confined to taxing consumption and wages at home, while multinational corporate profits escape through a labyrinth of tax abuse and profit shifting structures. For high income countries, sovereignty is often willingly not exercised, most notably by failing to tax wealth and by refusing to challenge financial secrecy within their own economies or spheres of influence.

Even in international negotiations, appeals to respect tax sovereignty are increasingly contradictory. They are made both to protect a state’s right not to tax, often by wealthier countries; and by Global South countries seeking to reclaim rights denied to them by existing tax norms promoted by the North[36]. This contradiction sits at the heart of the current push for a UN Framework Convention on International Tax Cooperation, an attempt to rebalance the asymmetries of global tax governance through inclusive deliberations and restore meaningful sovereignty to all countries.

In the context of climate breakdown and widening global inequalities, tax sovereignty and the way countries use it, or are prevented from using it, is no longer just a technical concept. It is a political faultline in the struggle over who pays, who decides and who benefits from the transition to a low carbon economy, or from the lack of one.

4.2 Who gains from undermining tax sovereignty?

If the erosion of tax sovereignty undermines public revenue and fiscal capacity, the next logical question is: who benefits? This section provides a short overview of key actors and mechanisms that have shaped and profited from this erosion.

At the centre of the web are multinational corporations, including those in highly polluting sectors like fossil fuels, agribusiness and shipping, as well as ultra-wealthy individuals and the financial secrecy jurisdictions that shelter their wealth. These actors profit from a global tax system that is designed to allow capital and corporate profits to move freely and with limited oversight (in stark contrast to the policing of the cross-border movement of people), while placing structural limits on certain governments’ ability to tax and allowing capital and profits to be accumulated in countries with governments that are not interested in taxing at all.[37]

Consider Shell, which in 2021 reported US$20 billion in profits yet paid no UK corporate tax[38]. Or Glencore, the mining giant repeatedly linked to aggressive tax planning and political influence operations across the Global South. Or ExxonMobil, whose use of subsidiaries in Bermuda, the Bahamas and the Cayman Islands has helped shield profits from higher tax jurisdictions[39].

These practices are legal, in part, because global tax governance has long been dominated by high-income countries and corporate interests. The OECD’s Base Erosion and Profit Shifting (BEPS) initiative and the Global Anti-Base Erosion (GLoBE) rules under Pillar Two, promised to curb corporate tax abuse. But the headline minimum corporate tax rate of 15 per cent, with a litany of exemptions[40], is far below what most countries require to reinvest revenue into public finance, and the deal contains many carveouts and loopholes that significantly undermine its redistributive potential. Many low and middle-income countries were not included in negotiations, and those who opt out of the deal risk exclusion from benefit-sharing or retaliatory measures.

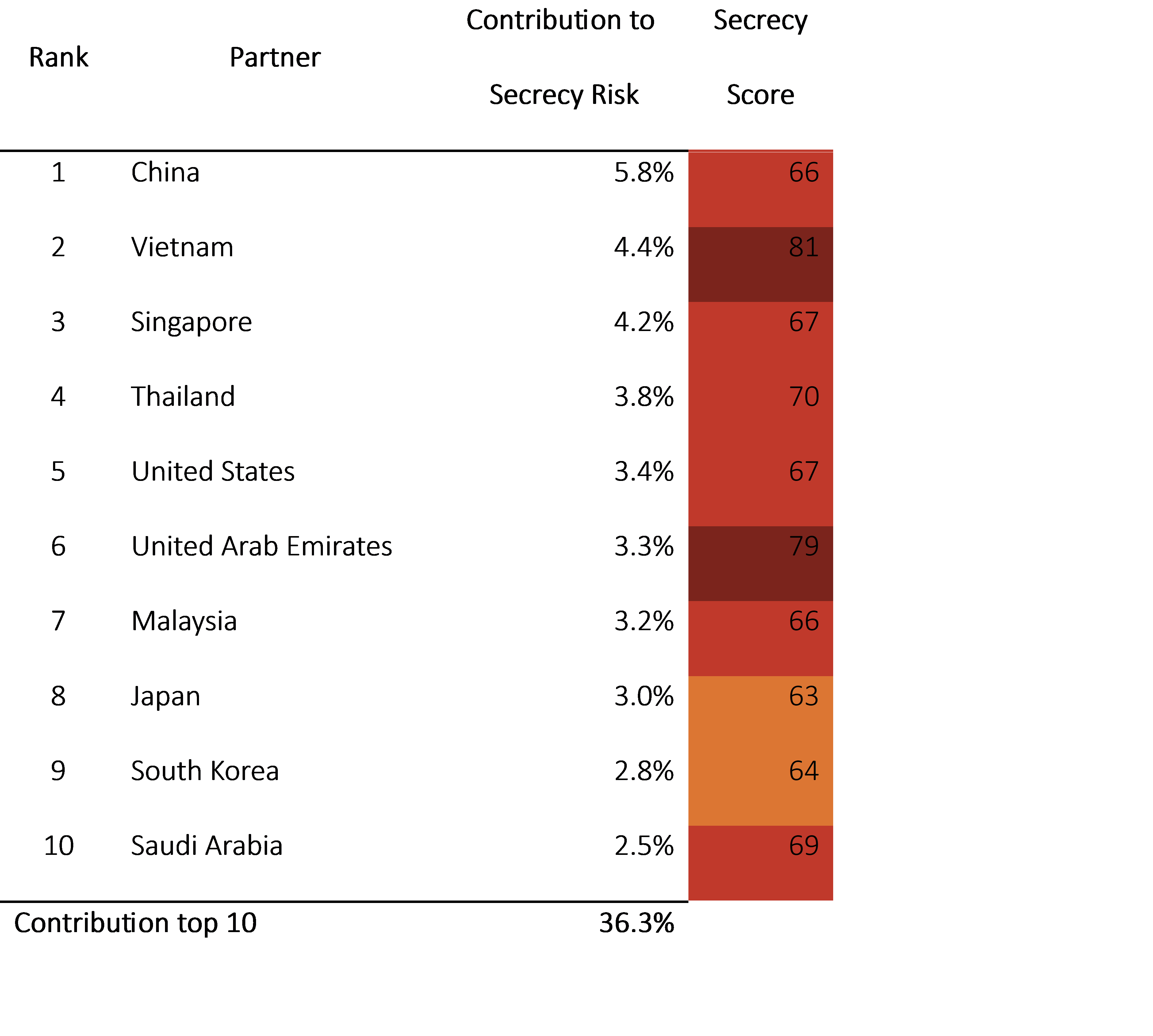

Meanwhile, financial secrecy jurisdictions, from Switzerland and Singapore to Guernsey, continue to act as safe havens for hidden wealth and illicit financial flows. These jurisdictions allow firms and wealthy individuals to obscure their activities and ownership structures, and to benefit from weak international enforcement around automatic exchange of tax information and beneficial ownership transparency[41].

Investor state dispute settlement (ISDS) mechanisms also play a role in weakening tax sovereignty. Polluting companies and companies with aggressive tax planning strategies have used ISDS to challenge environmental policies and tax hikes. For example, British energy firm Rockhopper sued Italy for banning offshore oil drilling[42], and ExxonMobil has previously threatened to sue countries under investment treaties in response to proposed tax reforms. The mere threat of arbitration often has a chilling effect, deterring governments, particularly those already facing fiscal pressures, from pursuing needed reforms[43].

Constricted tax sovereignty is not an accident of history. It is the result of deliberate strategies backed by corporate lobbying, investor arbitration and political pressure. These strategies protect the wealth and emissions of a powerful minority, while shifting the cost of climate finance onto those least responsible for the crisis.

4.3 The politics of lost revenue: how tax sovereignty is captured and denied

Across the world, countries are failing to realise the full potential of their sovereign power to levy tax, but not for the same reasons. As previous sections have shown, many countries do not lack financial resources, but lack the political and structural capacity to claim them. The resulting scarcity narrative is not inevitable but manufactured. It is sustained by a global economic architecture that enables tax abuse and prioritises capital mobility.

Our climate finance slider tool illustrates that most countries, across income levels, have sufficient tax potential to raise meaningful revenue through the introducing of wealth taxes and the elimination of cross-border tax abuse. Yet, whether due to external constraints or internal political inertia, these options remain underused or blocked entirely.

In the Global South in particular, constraints include:

- Restrictive tax treaties

Many developing countries are bound by bilateral tax treaties that prioritise residence-based taxation, limiting their ability to tax income generated within their borders. Often, these treaties have been signed without much public scrutiny, at a time when those countries had little capacity to assess their impacts. The treaties are also ill-equipped to consider a country’s changing circumstances, such as growing climate financing needs. For instance, Uganda’s treaty with the Netherlands prevents Uganda from taxing certain income streams, resulting in lost revenues for Uganda, regardless of whether such income is taxed in the Netherlands[44]. Tax treaties can be renegotiated or terminated. However, countries that benefit from the current arrangements often resist renegotiation, and termination is a significant political and diplomatic step. Even if Global South countries decide to terminate a treaty, multinationals sometimes use stabilisation clauses (see below) to claim tax treaty benefits even after termination.[45]

- Profit shifting and transfer mispricing

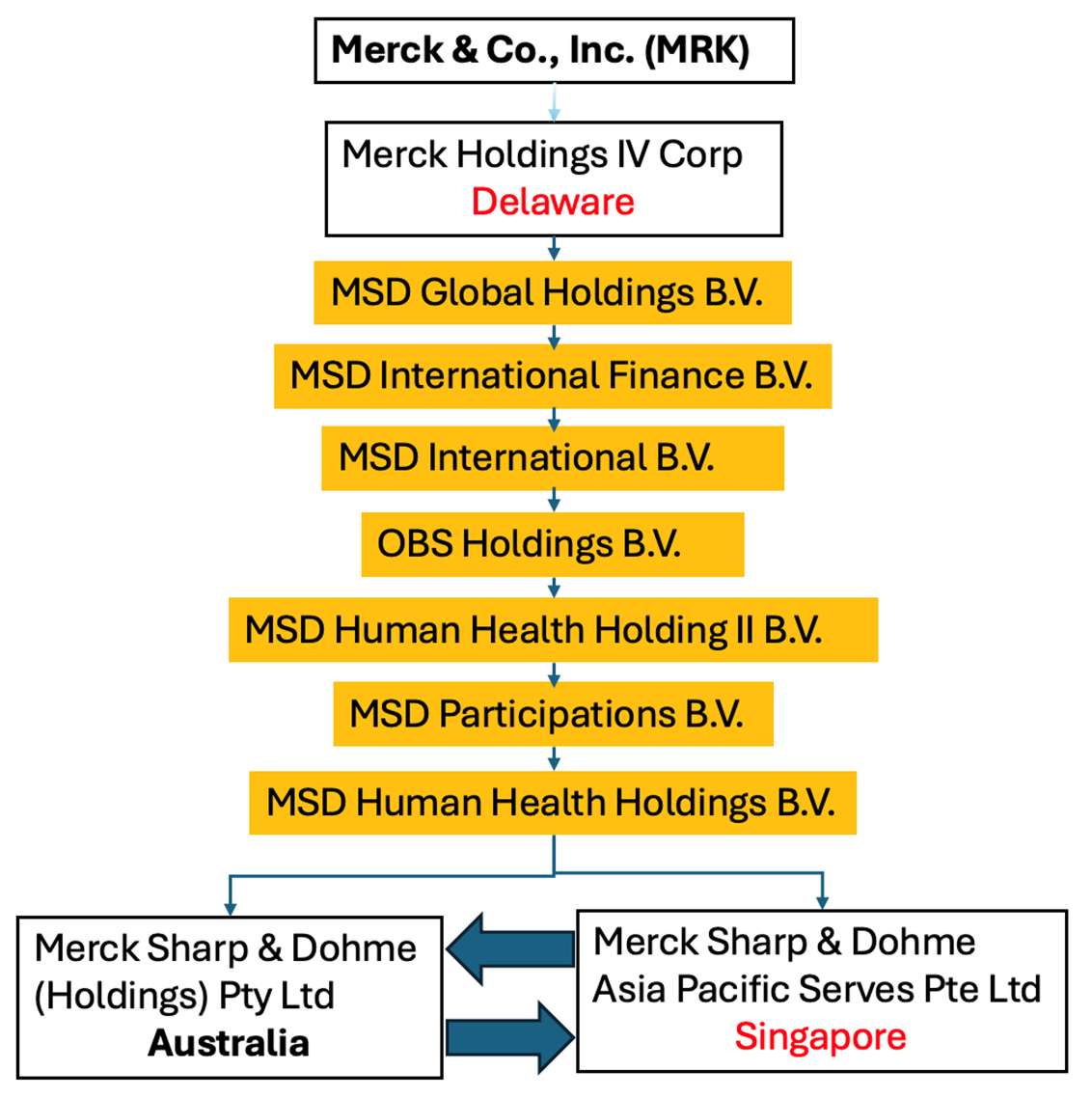

Multinational corporations often shift profits out of resource-rich countries through mechanisms like inflated intra-group payments. These payments are deducted against the local tax base and can take the form of intra-group royalty payments, fees for management services or interest payments for intra-group financing, strategically provided by group companies abroad. In Zambia, for example, mining companies have engaged in such aggressive transfer pricing practices that reduce local taxable income on a massive scale, leading to significant revenue losses[46].

- Investor state dispute settlement mechanisms

As mentioned, ISDS provisions in international investment agreements allow corporations to challenge legitimate policy reforms in international tribunals. Investors in the fossil fuel sector have been frequent ISDS claimants. In Eco Oro v. Colombia, for example, the tribunal held that Colombia’s environmental mining ban decision violated the minimum standard of treatment in the investment section of the Colombia–Canada free trade agreement[47]. These disputes often involve tax matters, meaning ISDS’ regulatory chill can also stifle countries’ ability to shape tax policy. ISDS also affects Global North countries. For example, UK based oil refiner Klesch initiated arbitration against Germany, among other countries, after the EU passed a temporary windfall tax on excess profits from oil and gas activities known as the ‘solidarity contribution’[48].

- Tax incentives and stabilisation clauses

To attract foreign investment, some governments offer tax holidays and stabilisation clauses that lock in favourable tax terms for multinationals and their investors, limiting future legitimate tax policy changes such as the re-evaluation of tax incentives, the termination of tax treaties or the adoption of international policy reforms like the global minimum tax. Such clauses are common in long-term contracts within the extractive industries[49].

- Illicit financial flows and secrecy jurisdictions

Illicit financial flows, including trade misinvoicing and capital flight, drain public revenues. Nigeria, for example, loses billions annually due to under-invoiced oil exports and other illicit activities, with funds often ending up in offshore accounts facilitated by global financial intermediaries and enablers[50].

In the Global North, the problem is most often not constraint but the failure to exercise tax sovereignty fairly:

- Failure to tax extreme wealth

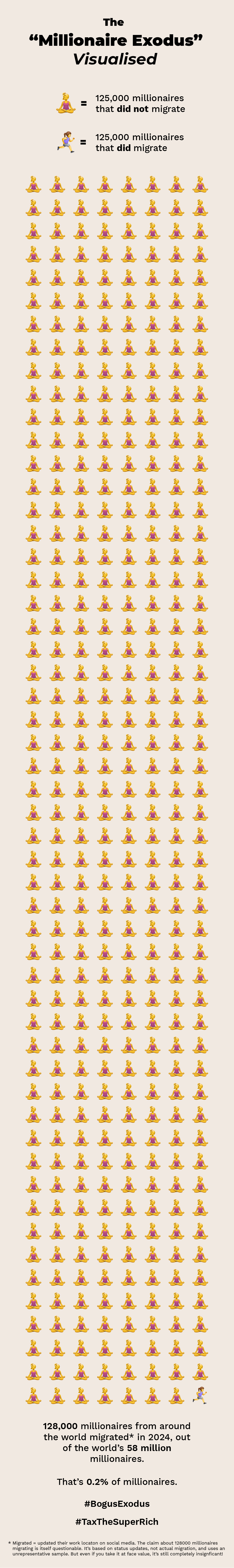

Despite growing calls for redistribution, most high-income countries continue to resist implementing wealth taxes[51]. By forgoing taxes on extreme wealth, rich country governments miss a critical opportunity to reduce inequality, raise public revenue and create the fiscal and political support needed to strengthen progressive tax systems. This refusal comes at a particularly high cost, as the richest households are also responsible for a vastly disproportionate share of emissions, in both consumption and investments[52]. The refusal is at least in part due to pervasive myths and misconceptions about the role and impact of tax and of how wealth is created. One recent example is extensive media reporting on a supposedly tax-driven “millionaire exodus” which did not actually occur[53].

- Deliberate weakening of corporate tax rules

Corporate lobbying has significantly shaped tax legislation, leading to lower rates and complex loopholes. In the United Kingdom and European Union, polluting sectors like aviation, shipping and fossil fuels have successfully lobbied to retain preferential tax treatment, including tax incentives, undermining both revenue collection and emissions reduction goals[54]. In the United States, the 50 largest companies spent US$2.5 billion on lobbying and received US$423 billion in tax breaks between 2008 and 2014[55].

- Continued tolerance of secrecy jurisdictions

Financial secrecy jurisdictions, including Switzerland, the United States and the United Kingdom’s network of Crown Dependencies, enable tax abuse on a massive scale. These centres remain largely untouched. They help obscure the wealth of elites, as well as the business activities and ownership structures of multinationals, including the strategic channelling of fossil fuel finance through opacity and offshoring[56].

- A hollow global minimum tax

The OECD’s global minimum corporate tax rate (15 per cent) under the Pillar Two framework has been widely criticised for being too low, riddled with loopholes and for failing to meaningfully redistribute taxing rights[57]. Carve-outs for tangible assets and payroll allow corporations to maintain effective tax rates below the agreed minimum[58]. Refundable tax credits can be used to incentivise the development of intellectual property under the GloBE, but these are cash-flow intensive and often too costly for Global South countries. Carve-outs and tax credits furthermore apply on the basis of ‘neutrality’: the rules allow countries to also incentivise environmentally harmful activities in as much as they allow incentivising environmentally sustainable activities.

The consequences of constrained or neglected tax sovereignty are not just theoretical. They play out in very concrete ways across both high and low-income countries. Whether it is a Global South government prevented from taxing extractive profits or a Global North government choosing not to tax excess wealth, the result is the same: foregone public revenue. As we have shown, these are not isolated policy failures. They are systemic outcomes of a global system of tax governance that privileges capital mobility over justice and entrenches inequalities.

This matters profoundly for climate finance. When governments allow trillions in tax revenue to go uncollected, they limit their ability to fund domestic transition plans. This locks the Global South into further dependency, whether through external debt, the commodification of natural resources through carbon markets, or overreliance on donor finance.

The false narrative of scarcity persists not because the revenue does not exist, but because governments are either unable or unwilling to collect it.

5. Case studies

The following case studies illustrate the global dynamics of tax sovereignty. One highlights how Global South countries are routinely blocked from claiming their taxing rights on polluting multinationals, even as they try to do so. The other shows how, in the Global North, countries exercise their sovereignty by actively deciding against taxing wealth. Together, they offer a window into the real political and capital barriers standing in the way of a just climate finance system.

5.1 Tanzania vs. Acacia Mining: Tax sovereignty in chains

Tanzania is Africa’s fourth-largest gold producer, with mining long seen as a key driver of development. Yet for years, the country collected little revenue from its gold mines. Generous mining contracts in the 1990s and 2000s granted foreign firms like Barrick Gold (operating in Tanzania via its subsidiary Acacia Mining) extensive tax incentives and stabilisation agreements. These deals, often negotiated behind closed doors, overrode general tax laws. This is a common practice in the African extractive sector that can undermine the sovereign use of taxing power.[59] Under such agreements, companies have enjoyed low royalty rates, tax holidays and other exemptions, leaving Tanzania with limited revenue from mining profits. Meanwhile, local communities have borne the brunt of environmental harm from mining waste and pollution. This underscores how multinationals frequently violate the polluter pays principle, operating profitably while underpaying tax and avoiding responsibility for environmental and social harms.

The dispute

President John Magufuli took office in 2015 on a promise to secure a larger share of resource wealth. In March 2017, Tanzania abruptly banned the export of unprocessed gold and copper concentrates, directly impacting Acacia, which derived about 30 per cent of its revenue from those exports[60]. A presidential committee report accused Acacia of under-reporting the gold and copper content of its shipments. On this basis, authorities issued Acacia with a US$190 billion tax bill, nearly four times Tanzania’s GDP, for years of allegedly unpaid taxes and penalties[61]. The government passed new laws to void some mining contracts, raised royalty rates and demanded state ownership stakes. Acacia denied the accusations of underpaying tax and misreporting the amount and value of gold and copper contained in its exports.

Unable to independently resolve the standoff, the company’s parent, Barrick Gold, intervened. At the same time, Acacia initiated international arbitration proceedings to contest Tanzania’s actions, invoking investor protection mechanisms. By 2019, Barrick moved to buy out Acacia’s remaining shareholders and strike a deal with the government. Barrick and Tanzania soon announced a framework to settle all claims. Key terms included:

- the formation of a new operating company jointly owned by Barrick and the Tanzanian state

- a US$300 million one-time payment to settle the tax claims

- a 16 per cent free equity stake in Acacia’s three major gold mines granted to Tanzania (a small fraction of the original US$190 billion claim)

- a 50/50 split of future economic profits from the mines between Barrick and the Tanzanian government

The outcome highlighted both Tanzania’s determination to assert its taxing rights and the significant barriers it faced in doing so.

Constraints to tax sovereignty

Tanzania’s clash with Acacia Mining became an example of the constraints facing Global South countries attempting to tax polluting industries on their own terms. Several structural barriers were exposed:

Tanzania’s tax treaties have historically favoured foreign investors. Many treaties follow OECD standards that emphasise taxation in the investor’s home country (residence) over the source country (Tanzania). In prior tax treaty negotiations, Tanzania has often been made to accept these OECD clauses. This means Tanzania often loses rights to tax mining profits or must accept lower withholding rates on dividends, interest and royalties. Such treaty limitations have curbed Tanzania’s ability to tax mining income at the source, even though the gold was extracted from its soil. The treaties also do not consider the changed circumstances and revenue needs caused by the climate crisis. However, renegotiating these unfair tax treatiesis difficult and slow.

- Investor state dispute settlement

The dispute demonstrates the leverage that ISDS mechanisms give to companies. Acacia initiated arbitration under international investment agreements, and some shareholders believed the company had a strong chance of winning against Tanzania[62]. An adverse ruling could have forced Tanzania to pay enormous damages or reverse its policies. Tanzania’s government had already been rattled by a prior ICSID arbitration case. Fearing costly litigation and large payouts enforced abroad, Tanzania’s lawmakers moved in 2017 to outlaw international arbitration for natural resource contracts, insisting that disputes be settled in domestic courts[63]. While this reasserted a form of sovereignty, it also sparked concern among investors and did not negate ongoing cases.

- Profit shifting and commodity mispricing

The US$190 billion claim shed light on potential profit shifting and tax abuse. Audits alleged that Acacia understated the mineral content of exports for years[64]. By under-reporting gold and copper yields, a company can shift profits out of the country, for instance by selling the minerals to an affiliated trader at an artificially low value, thereby reducing taxable income in Tanzania. Multinationals often exploit such practices, including creative transfer pricing and use of offshore subsidiaries in low tax jurisdictions. Tanzania’s experience fits a broader pattern: African countries lose many billions annually in illicit financial outflows, much of it through corporate practices that underpay tax or involve outright evasion[65].

- Tax incentives and investor stability clauses

The roots of the dispute trace back to the very contracts and incentives that originally attracted foreign investment. In a phase of rapid development, Tanzania granted extensive tax concessions to mining companies. Some mining agreements included stabilisation clauses that locked in low royalty and tax rates, insulating companies from any future unfavourable law changes. These incentives severely limited Tanzania’s tax take once mines became productive. Mining contracts are notorious for being negotiated without public oversight, and such deals can override parliament’s taxing power, limiting the reach of local tax authorities. The Tanzanian government grew frustrated that, despite high gold prices and sizable production, companies paid only minimal royalties and had not paid income tax for many years. In effect, Tanzania’s own contracts, crafted under donor and investor influence, had constrained its tax sovereignty. Renegotiating these contracts proved challenging.

- Administrative and capacity limitations

The case also revealed gaps in technical and administrative capacity. Auditing a multinational miner’s true output and profits is a complex task. Weaknesses in routine monitoring allowed underreporting to go undetected for years. Moreover, handling high-stakes negotiations and legal battles required special expertise. Tanzania found itself outsourcing negotiations to the parent company because direct talks with Acacia had broken down. In preparing for arbitration, it would likely have had to hire expensive international law firms. All of this underscores the administrative constraint: even when political will exists to claim more revenue, capacity shortfalls remain, from skilled tax auditors and geologists to experienced negotiators and legal counsel.

Resolution

By early 2020, the dispute was resolved in principle with the formation of a new joint venture to manage Barrick’s Tanzanian mines. Under the finalised agreement, Tanzania would hold a 16 per cent equity stake in each mine, which may be of lower fiscal value because dividends can be deferred and debt loaded, while Barrick retained 84 per cent ownership but agreed to split profits and economic benefits evenly with the government[66]. The one time US$300 million settlement payment was made to clear all outstanding tax claims, and Tanzania lifted the concentrate export ban, allowing operations to gradually resume. In exchange, Barrick gained assurances of stability and an end to further litigation related to the dispute.

However, it is notable that the final terms required major Tanzanian concessions compared to the country’s initial demands. The US$190 billion figure was pared down to US$300 million. The new 50/50 split of net profits, which can delay and reduce revenue compared with a sales-based royalty[67], can be seen as a revenue-sharing mechanism that allowed Tanzania to only recover a fraction of the tax it might have collected through standard channels. The resolution came only after Tanzania asserted its sovereign powers by changing laws and issuing large tax claims, but it ultimately had to compromise. This outcome illustrates how difficult it is for a Global South country to fundamentally renegotiate the terms of extraction once contracts have been signed and operations are underway.

Implications for tax sovereignty and climate finance

Tanzania’s experience with Acacia Mining encapsulates the complex challenges of preserving tax sovereignty to undertake legitimate tax policy reform, particularly over polluting multinationals, within an international tax governance system skewed in favour of corporations. The case highlights how legal structures, corporate practices and capacity constraints can come together to limit a nation’s ability to hold extractors and polluters accountable. These tax sovereignty struggles have direct implications for climate justice and finance:

- Erosion of the polluter pays principle

Effective climate action demands that those who cause environmental damage bear the costs. Yet, as seen in Tanzania, mining companies can operate profitably while contributing minimally to offset the damage they cause. This not only undermines accountability and public trust but also deprives governments of resources needed for climate change mitigation and adaptation.

- Draining climate finance at the source

Developing countries like Tanzania are often seen as reliant on international climate finance. However, a fair global tax system could significantly boost their domestic public budgets, making them less dependent on climate finance from donor countries or aid. Tax revenue lost to profit shifting and unfair treaties directly translates into less money for investments in renewable energy, climate resilient infrastructure and adaptation and mitigation. This loss is especially consequential in the Global South, where governments rely more on corporate tax income and are most vulnerable to the effects of climate breakdown.

The cost of sovereignty

Tanzania’s bold stance carries lessons for other countries.

On the one hand, it demonstrates that countries can try pushing back against unfair corporate tax deals and can overcome the policy freeze caused by ‘legacy’ treaties. On the other, it reveals the risks of retaliation and capital flight. Some investors may have reassessed Tanzania’s investment climate during the dispute. This underscores the need for international frameworks and stronger global rules that reconcile long-term, stable investment pathways with tax justice. There is a clear and longstanding asymmetry at play, as evidenced by dispute settlements: Global South states like Tanzania are defendants far more often than claimants, and many tax disputes are settled in opaque tribunals with little accountability. Reform can help but must be far reaching — including rules to change tax treaties, multilateral agreements that set minimum tax floors for extractive industries, and avoid ISDS in tax dispute resolution in order to protect states’ rights to tax. Climate finance advocates are increasingly recognising that stable domestic revenue-raising is essential to a sustainable transition[68]. Climate justice requires tax justice.

5.2 The United Kingdom: Captured not to tax wealth

The UK provides a stark counterpoint to Tanzania’s experience. It is a Global North nation with a very different relation to tax sovereignty. In particular, the UK’s persistent refusal to implement a wealth tax highlights how political and economic capture, not just technical capacity, shape tax outcomes.

Colonial legacy and the rise of tax havens

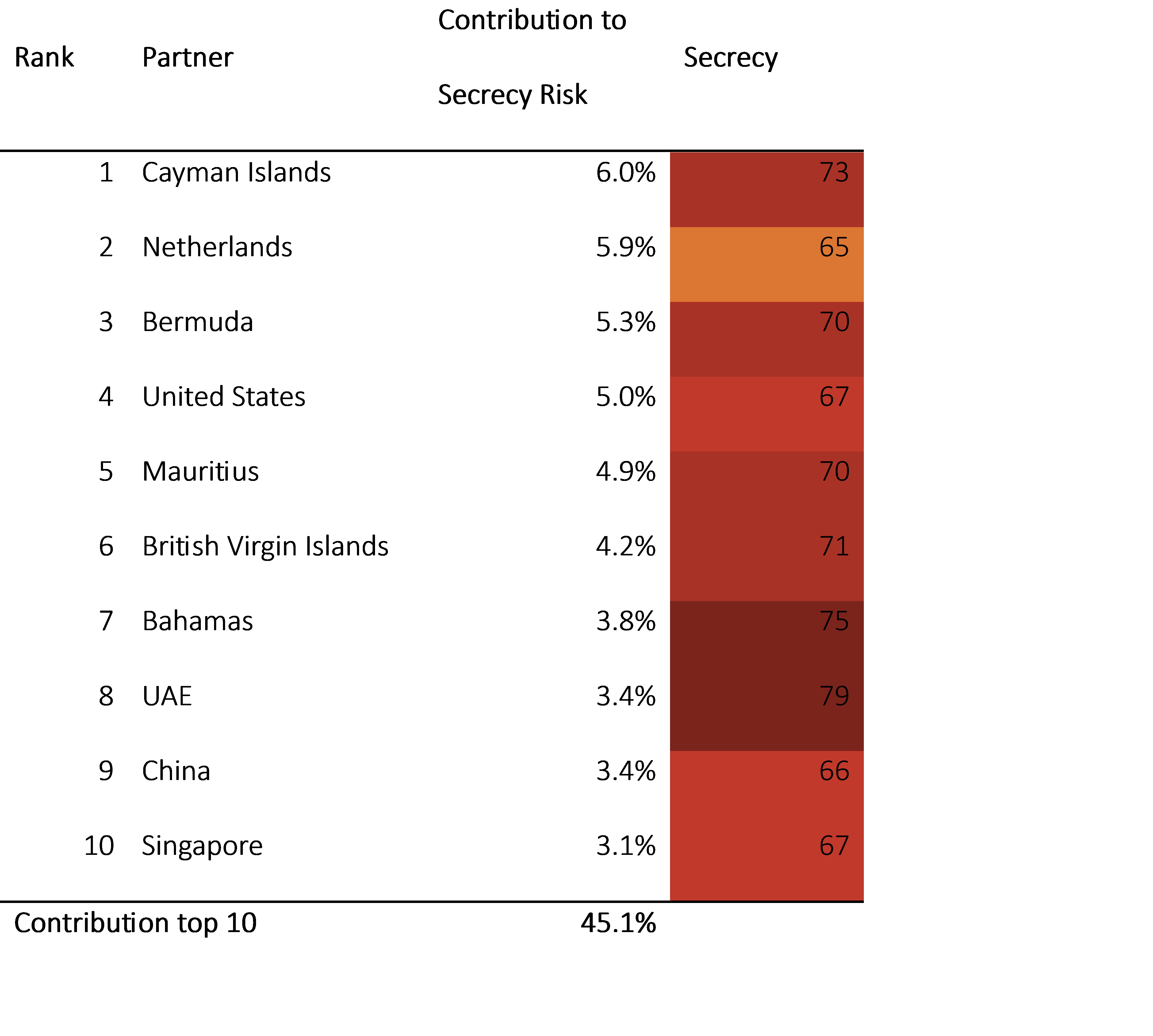

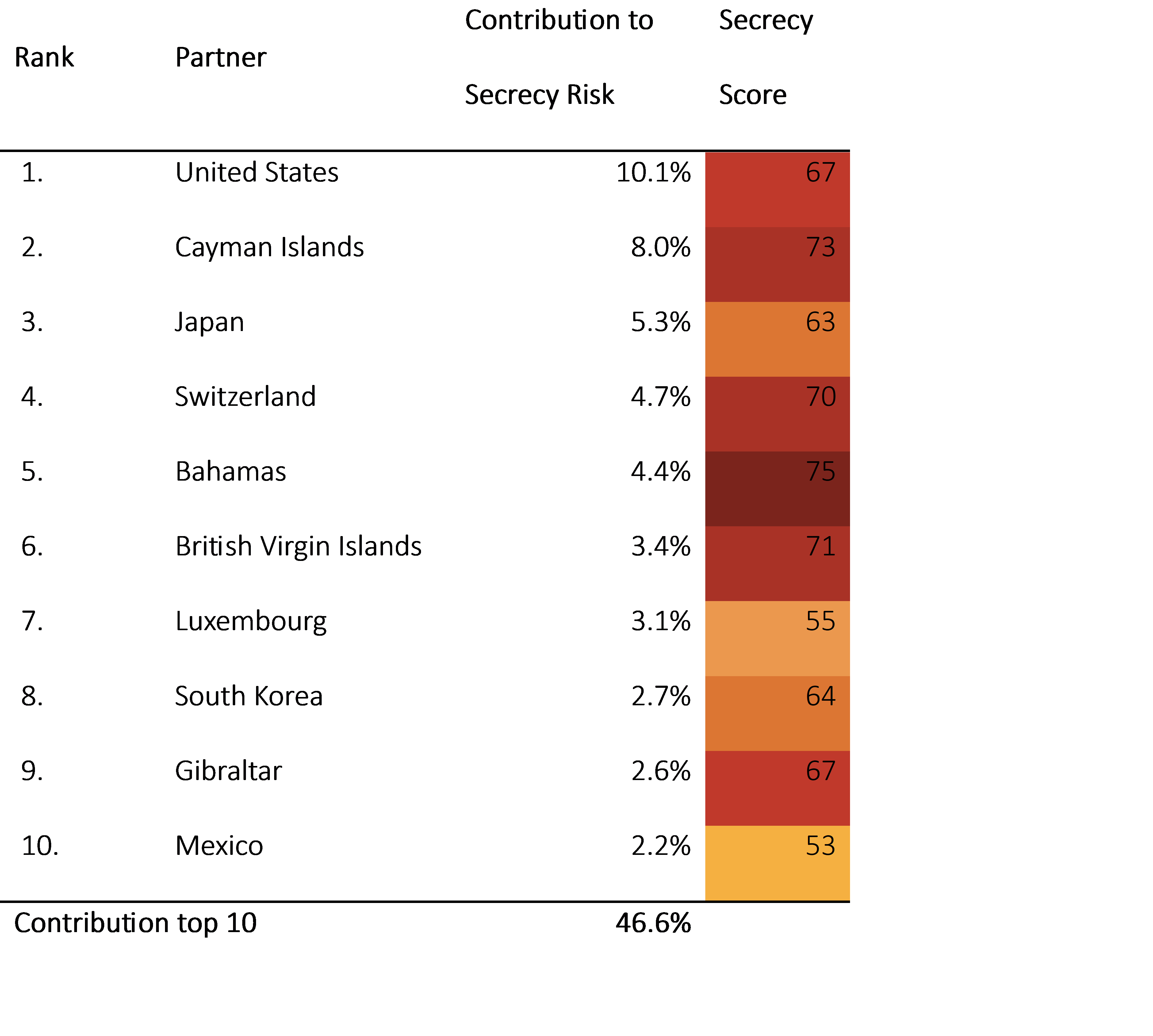

Britain’s colonial history set the stage for many of today’s tax policy choices. During decolonisation in the mid-20th century, British elites and institutions cultivated a “second empire” of tax havens in Crown Dependencies and Overseas Territories[69]. As formal colonies gained independence, London and the City of London encouraged jurisdictions such as the Channel Islands (Jersey and Guernsey) and Caribbean territories (Bermuda, Cayman Islands, British Virgin Islands, etc.) to take on new roles as secretive offshore financial centres[70]. This “archipelago capitalism” was explicitly rooted in the British imperial decline. For example, in the 1950s, the UK encouraged its remaining dependencies to provide offshore services as a form of “development” after centuries of extracting wealth[71]. Today, many of the world’s tax havens are former British colonies or dependencies[72] and the UK’s network of havens is responsible for facilitating nearly 26 per cent of global tax revenue losses each year. In essence, the UK helped create a global system that enables wealth to escape taxation – a legacy of colonial wealth protection that continues to benefit elites.

This legacy places Britain at the centre of a vast financial secrecy network or spider’s web. It enables multinational companies and wealthy individuals, including British elites, to shift profits and assets offshore while paying minimal tax. The UK and its so-called “second empire,” which includes tax havens such as Jersey, the British Virgin Islands and the Cayman Islands, together constitute the world’s greatest enabler of corporate tax abuse, responsible for round 23 per cent of global corporate tax underpayment[73]. This historical context is critical. It illustrates how the UK’s economic elite have long benefitted from asset protection structures, reducing political pressure on governments to introduce or expand wealth taxation.

Inequality up, wealth tax off the table

Despite this history, or perhaps because of it, the UK has never implemented a wealth tax. The closest attempt came in the 1970s, when a Labour government pledged to tax the net wealth of the rich. The effort quickly faltered under intense pushback from wealthy individuals and the establishment. The proposal was abandoned amid claims that the rich would find ways to avoid it and that it would not raise much revenue. Since then, no British government has introduced an annual tax on overall net wealth. The UK therefore stands out among major economies, particularly in Europe, for its refusal to directly tax large fortunes. While some wealth taxes in Europe have been repealed under pressure, many countries previously had them in place. Some, such as Spain, have reintroduced wealth taxes in recent years.

Britain, however, has never enacted one at all. As pointed out by the UK Wealth Tax Commission, while the UK has several ways of taxing wealthy people on a recurring basis, these existing taxes are seriously defective, making them inefficient, inequitable and too easy to avoid. Since long, the Commission suggests to reform existing taxes on wealth and introduce a net wealth tax for the specific purpose of reducing inequality, which has steadily grown[74]. Over the past few decades, the richest have moved significantly ahead of the rest of society. Billionaires and multi-millionaires have multiplied in both number and net worth, while ordinary workers have faced stagnant wages and prolonged austerity. The Sunday Times Rich List recorded just 15 UK billionaires in 1990. By 2023, that number had risen to 171, each holding an average of £4 billion[75]. This explosion of private wealth has not been matched by corresponding increases in public revenue or redistribution efforts. Even as public finances have come under greater strain than ever before, for example after the 2008 financial crisis, the COVID-19 pandemic, and more recently due to rising defence spending, successive governments have ruled out a wealth tax. During the pandemic, when the fiscal cost of emergency measures exploded, the UK Wealth Tax Commission explicitly recommended a one-time wealth tax on millionaire households as “the fairest and most efficient” way to repair public finances[76]. The Conservative government ignored these calls and instead introduced further spending cuts and increased regressive indirect taxes. In effect, the UK has chosen not to draw on the vast concentration of private wealth for the public good, even when the need was clear and the policy tools were available.

Political and structural barriers to taxing wealth

The UK’s political establishment has deep ties to wealthy elites. The City of London has long exerted an outsized influence on policy, famously becoming “the dominant political force in Britain” since the 19th century[77]. This influence has shaped a dominant policy paradigm that favours low taxation on capital and high net worth individuals in the name of competitiveness. Policymakers frequently invoke fears that a wealth tax would drive wealthy individuals and investors out of the UK. These narratives, while not evidence-based, are heavily promoted by the financial sector and elite lobbyists and echo the very dynamics that created the offshore system.

The UK’s (former) non-dom tax regime is a striking example of how the country has courted global wealth. It allowed resident wealthy foreigners and some UK nationals to avoid tax on overseas income, reinforcing London’s appeal as a tax haven for elites. Such policies entrench a powerful lobby opposed to progressive tax measures.

Importantly, many political decision-makers themselves are drawn from the upper echelons of wealth, making them more sympathetic to anti-wealth tax arguments. The finance industry and wealthy individuals fund research and campaigns to dissuade new taxes on wealth, framing them as “unworkable” or harmful to Britain’s economy. This lobbying was evident as far back as the 1970s, when the original wealth tax proposal was deemed untenable, and continues today behind the scenes. The result is a policy stalemate. Even as public opinion polls consistently show support for higher taxes on the rich, the idea is repeatedly dismissed in Westminster.

The UK’s structural role in global finance also plays a part. London is a hub for managing the assets of the global rich, including oligarchs and billionaires whose fortunes are often held in trust funds, luxury real estate and shell companies. Taxing extreme wealth would mean confronting this lucrative status quo, including the financial interests of banks, law firms and accountancy firms, which serve as key enablers of tax abuse and secrecy. The UK government has consistently shown reluctance to impose reforms that might jeopardise the City’s competitiveness. For example, it has long resisted implementing transparent registers of beneficial ownership[78]. This combination of elite influence, a competitiveness-based ideology and deep entanglement with offshore finance has kept a wealth tax off the UK policy agenda.

Missing billions: wealth tax potential vs tax abuse losses