The International Consortium of Investigative Journalists have released their latest leak of data from the offshore world. The ‘Paradise Papers’ are a leak of over 14m documents from the offshore law firm Appleby.

So far leading politicians and even Queen Elizabeth have been revealed to be involved in the offshore world with more revelations scheduled to be published over the following days.

Our press release responding to the leak can be found below. If you need to contact the TJN, contacts are at the bottom of this post or here.

You can also see our CEO Alex Cobham’s video response here: [MEDIA PLEASE NOTE: this video is freely available for your use, no need to ask permission]

A transcript of the video can be found here.

To download a copy of this Press Release in PDF click here.

Tax Justice Network calls on UN to convene a global summit to end tax abuse and financial crime

The ‘Paradise Papers’ have once again highlighted the failure of governments around the world to deal with the scourge of tax dodging and financial crime facilitated by offshore financial centres, and we commend the ICIJ on their fearless investigative journalism.

The Tax Justice Network is calling on world leaders to commit finally to ending tax abuse and financial secrecy. The United Nations should convene a summit of world leaders with the goal of agreeing a UN convention to end tax abuse and financial secrecy. World leaders need to agree binding targets to reduce all forms of illicit financial flows, with accountability mechanisms to ensure progress.

Research from the Tax Justice Network shows that the level of profit shifting by multinational companies has exploded over the last decade. The latest estimates show that world governments are losing $500bn a year in taxes due to tax avoidance by large companies. A further $200bn a year is estimated to be lost due to the undeclared offshore wealth of tax evading individuals.

The Paradise Papers is the largest leak of data to date from the world of financial secrecy. And once again, the leaks confirm that this is not a marginal activity, but a systemic, global issue. Major corporations and wealthy elites are dodging taxes – and their obligations to society – with impunity, supported by the biggest banks, accountants and lawyers.

Nor are these victimless crimes – far from it. These truly anti-social actions undermine public health and education systems, and drive inequality and corruption – leaving the poorest families and the poorest countries of the world to suffer. Tax Justice Network research confirms that lower-income countries bear a disproportionate share of the burden from global tax abuse – and this has direct costs in terms of everything from foregone economic growth to excess child mortality.

In response to the leaks Alex Cobham, chief executive of the Tax Justice Network said:

“These leaks confirm the systemic nature of tax abuse and corrupt practices, with global financial secrecy being marketed by major law firms, banks and accounting firms. Government efforts to combat this problem have been piecemeal at best. And that is why the Tax Justice Network is today calling for a genuinely global response.

“World leaders need to seize the moment and convene at the UN to agree a path to ending financial secrecy and tax abuse for good. And we, as citizens of the world, must demand this from our elected representatives. Otherwise we may as well just sit and wait for the next leak – because those profiting from these anti-social practices will never stop on their own.”

Liz Nelson Director of TJN’s work on tax justice and human rights said:

“Financial secrecy jurisdictions, by damaging public services and driving inequality infringe on fundamental rights including right to life, freedom from poverty, and basic sanitation

“By eating away at government revenue they deny women and other historically discriminated against groups fundamental rights to health, education, to political participation, economic empowerment and access to justice”.

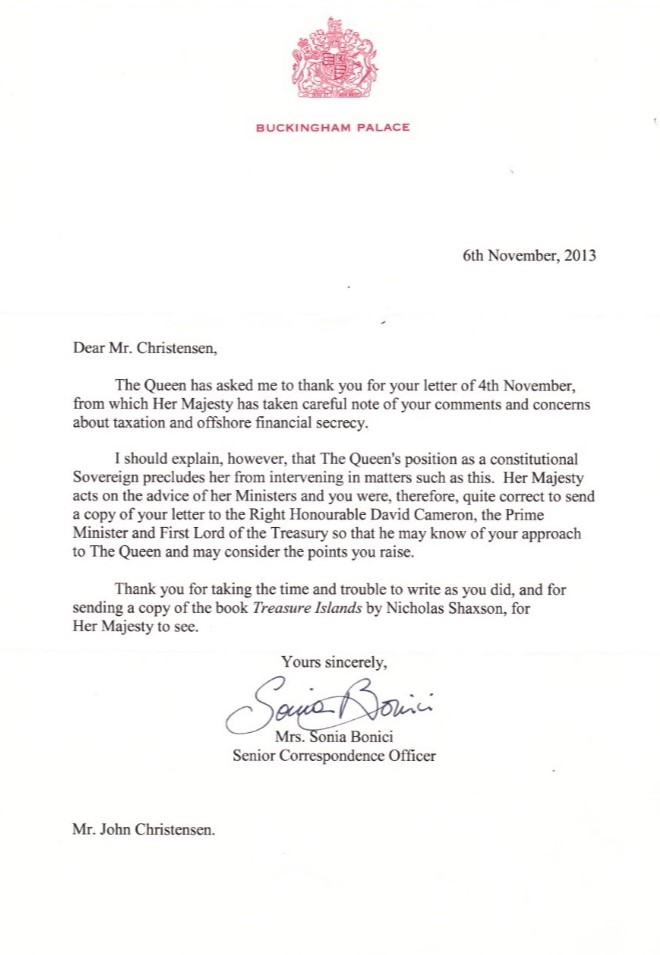

John Christensen, Chair of the Tax Justice Network said:

“Law firms like Appleby specialise in providing offshore structures to their global clientele. Appleby needs to be thoroughly investigated to ensure that their partners and staff have not been knowingly facilitating criminal and corrupt practices.

“For too long lawyers have hidden behind client privilege to protect clients from investigation: the Paradise Paper revelations, and the Panama Papers stories that preceded them, show that lawyers cannot be trusted to respect the laws of sovereign states.

“Any lawyer who fails to report suspicious client activities should face strict penalties, involving custodial sentences and loss of professional status. Strong measures are needed to rebuild public confidence in the law professions.”

ENDS

Contacts

Tax Justice Network spokespeople are available to respond to for media comment.Please contact [email protected] or contact the following people directly:

George Turner UK, george [@] taxjustice.net +44 (0) 7540 252 850

Alex Cobham, UK, alex [@] taxjustice.net +44 (0) 7982 236863

Markus Meinzer, Germany, markus [@] taxjustice.net +49 (0) 178 340 5673

Andres Knobel, Argentina – Spanish language, Andres [@] taxjustice.net

Julien Tingain, Francophone Africa, julien [@] taxjustice.net

Henrique Alencar, Portuguese language, henriquedomenici [@] msn.com

Notes

- The Tax Justice Network is an independent international network launched in 2003. We are dedicated to high-level research, analysis and advocacy in the area of international tax and the international aspects of financial regulation. We map, analyse and explain the role of tax and the harmful impacts of tax evasion, tax avoidance, tax competition and tax havens. The world of offshore tax havens is a particular focus of our work.

- Our full briefing looking at fixing the international tax system can be found here: https://www.taxjustice.net/wp-content/uploads/2017/11/Fixing-the-International-Tax-System-TJN-Briefing.pdf

- The amount of losses to government revenue to profit shifting by multinational companies has been estimated by the Tax Justice Network to be upwards of $500bn. This is slightly more conservative than a paper published by the IMF which puts the figure at $600bn. A full briefing on the estimates of the tax losses to avoidance and evasion can be found here: https://www.taxjustice.net/wp-content/uploads/2017/11/Tax-dodging-the-scale-of-the-problem-TJN-Briefing.pdf