Andres Knobel ■ How to assess the effectiveness of automatic exchange of banking information?

In December 2018 the OECD’s Global Forum published the new terms of reference to assess compliance with the OECD’s Common Reporting Standard (CRS) for automatic exchange of information. Two weeks later, the EU Commission published a report about automatic exchange of information within the EU. Both reports are show the urgent need for effective statistics. Why are civil society organisations the only ones explicitly asking for this? More importantly, when will we get heard?

The OECD, like any good monopoly, makes countries get the whole package they offer. (There’s no other show in town). First the legal framework: the Common Reporting Standard (CRS) for automatic exchange of information. Then the explanatory manual (the CRS Commentaries). Then the installation instructions (the CRS Implementation Handbook), and finally, the OECD sends its own inspectors (the Global Forum) to review countries’ use of the OECD product (the CRS) and to tell them what else they need to get.

At the Tax Justice Network we don’t think the OECD way is necessarily the only or best way, so we have been sending our comments and recommendations about the loopholes we found in the CRS, in the CRS Commentaries, in the implementation Handbook, and we responded to a consultation on passports for sale, but most of it to no avail. In 2017 we found out that the Global Forum was working on developing the new terms of reference to assess countries on their effective implementation of automatic exchange of information. We tried to get involved to send our feedback before the terms of reference were finalised, but we got no response. In March of 2017 we decided to go solo and publish our own report with all our recommendations for the new terms of reference. The title left no doubt about its content: “What the new OECD/Global Forum peer reviews on automatic information exchange must not miss”. Fast forward a year and a half later. In December 2018 the Global Forum finally published the new terms of reference to assess automatic exchange of information (due to start in 2019). We are confident in saying that they didn’t consider any of our main recommendations.

We’re hoping, at least, that the new Global Forum peer reviews that will assess countries’ compliance with automatic exchange of information will be as detailed as the peer reviews are on compliance with “exchanges upon request” (which are a great source of information for the Tax Justice Network’s Financial Secrecy Index and the related Bilateral Financial Secrecy Index). Even though these peer reviews on exchanges “upon request” are a great source of valuable detail for us doesn’t mean that we agree with the Global Forum’s conclusions or overall ratings, especially regarding powerful countries like the US. Most of the “worst offender” countries at the top of the Financial Secrecy Index are considered “compliant” or “largely compliant” by the Global Forum.

What’s missing from the terms of reference?

The Global Forum’s new terms of reference for assessing automatic exchange of information missed a great opportunity to assess effective compliance. In about seven pages, the terms of references say that they will basically assess whether countries comply with general requirements. This may end up being a great source of information, but we were hoping the Global Forum would push countries on a few very important issues:

- Passports and residencies for sale (aka “golden visas”): are countries offering them? What enhanced due diligence is applied by financial institutions if an account holder claims to be a resident in a country offering golden visas, since this could be part of a scheme to avoid being reported under automatic exchange of information?

- The use of information beyond tax purposes: will countries join the Punta del Este Declaration about the use of information received to tackle corruption and money laundering?

- Prevention of schemes to circumvent automatic exchange of information related to account holders which are not required to be reported: will countries apply the “wider approach” so that banks collect information about all non-residents (for example in Andorra)? Will banks have to file “nil returns” when they consider that they have no information to report (instead of simply not reporting anything at all)?

- Will the US be considered a “non-participating” country, so that anti-avoidance measures are applied against investment entities located in the US? [As we explained, the US should not only be considered a “non-participating” country, but it should also be blacklisted by the OECD because it isn’t implementing the CRS despite its 2014 commitment to do so].

- Are countries implementing the OECD Model mandatory disclosure rules on schemes to circumvent the CRS or to hide the beneficial owner of an entity?

What would have made the terms of reference genuinely effective?

The Global Forum should have included the points above in the terms of reference. But the worst flaw yet is that there are no references to public statistics, which are the only way to prove that banks and countries are actually implementing and complying with automatic exchange of information. In other words, the Global Forum will assess: “do you have laws that transpose the CRS into your domestic legislation? Do you have laws that require you to audit/supervise whether banks are doing their job?”. We would have liked the Global Forum to also ask: “Show me the money… publish statistics about how much information you have actually collected and exchanged”.

Our 2017 paper explained what public statistics could look like, why these statistics breach no confidentiality and best of all, why they involve no extra cost (the information is already held by countries’ tax authorities). In addition we have explained how statistics could be used to prevent abuses of golden visas, how some countries (the US, Switzerland, Japan, Australia, Argentina) are already publishing similar information and how statistics could be used to identify avoidance schemes.

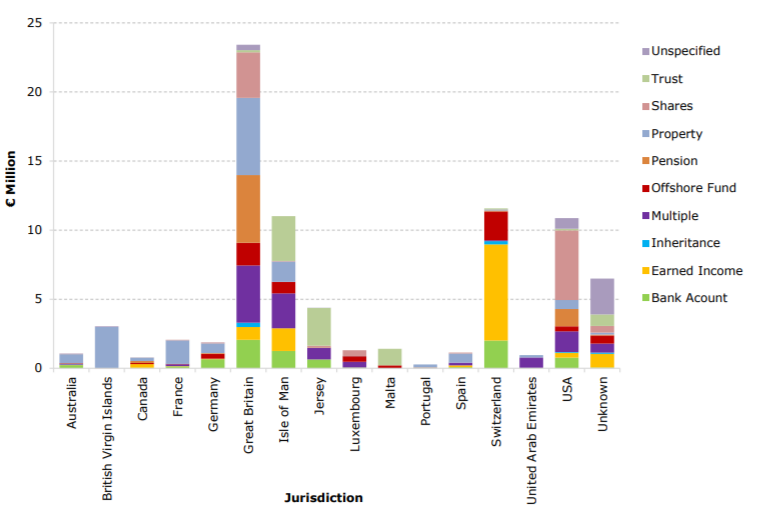

Ireland, for instance, published statistics about its offshore disclosure programme, describing where Irish residents hid their money and the type of offshore investments used:

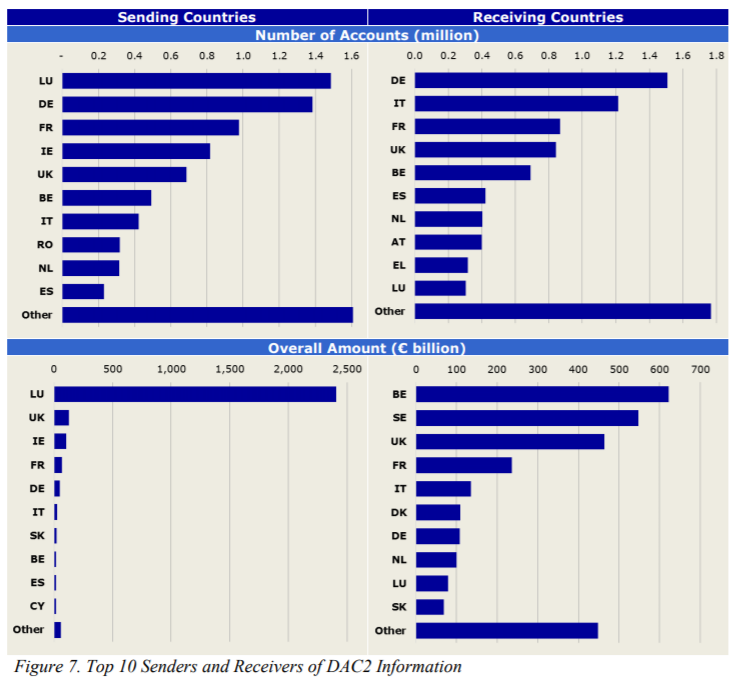

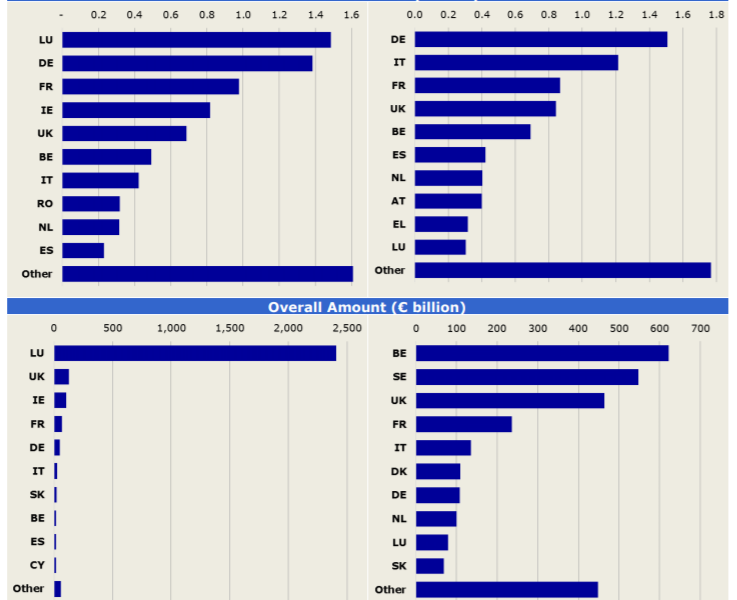

In support of the usefulness of public aggregate data on automatic exchange of information, this week the EU Commission published some interesting statistics, though not detailed enough. In relation to automatic exchange of banking information within the EU (in this case the legal framework is the first revision to the Directive on Administrative Cooperation, or DAC 2, which is almost the same as the CRS, but applies within the EU), the EU Commission writes:

Member States exchanged information concerning a total of some 8.7 million accounts (…) [with] account balances amounting to EUR 2,919 billion in total (…), gross proceeds which account for EUR 3,466 billion (…) [and] dividends are valued at EUR 21.2 billion, interest at EUR 19.0 billion, and other payments at EUR 61.8 billion.

Going deeper concerning bilateral information, this is what the EU Commission reported:

In case the chart wasn’t obvious enough, the EU Commission says:

Outgoing flows of financial information are dominated by Luxembourg, with 17% of the accounts and nearly 80% of the amounts reported.”

If EU countries haven’t realised it yet, they should look into why so many EU residents stash so much money in Luxembourg compared to all other EU countries.

Lastly, public statistics are proven useful for another purpose not related to finding tax evaders: holding tax authorities to account for not using automatic exchange of information at all. The EU Commission reports on countries not doing their job:

During the first year of DAC2 exchanges, (…) Bulgaria, Slovakia and Malta, reported not having opened the files received. (…) Nine states reported not using the information received via DAC2.”

And so, the facts speak for themselves. It’s not enough to know whether countries have laws. It’s not enough either if countries have laws that require banks to comply with the law. The only way to confirm that effective implementation is taking place is to publish statistics about what’s actually going on. And looking at outliers (eg Luxembourg) would be a great way to start.

Related articles

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

The millionaire exodus myth

10 June 2025

The Financial Secrecy Index, a cherished tool for policy research across the globe

When AI runs a company, who is the beneficial owner?

Insights from the United Kingdom’s People with Significant Control register

13 May 2025

Uncovering hidden power in the UK’s PSC Register

Vulnerabilities to illicit financial flows: complementing national risk assessments

New article explores why the fight for beneficial ownership transparency isn’t over

Do it like a tax haven: deny 24,000 children an education to send 2 to school

Asset beneficial ownership – Enforcing wealth tax & other positive spillover effects

4 March 2025