Nick Shaxson ■ Justice, interrupted: will bankers get off the hook ever more lightly?

Two Economist blogs in a row: this time we’ve a fine excuse because their image comes from our TJN Senior Adviser, Jim Henry, who presented this data at the TJN-supported Illicit Financial Journalism Programme in London last week, and gave a preview last February in our Taxcast (see below): “just what does a bank have to do to lose its licence?”.

Two Economist blogs in a row: this time we’ve a fine excuse because their image comes from our TJN Senior Adviser, Jim Henry, who presented this data at the TJN-supported Illicit Financial Journalism Programme in London last week, and gave a preview last February in our Taxcast (see below): “just what does a bank have to do to lose its licence?”.

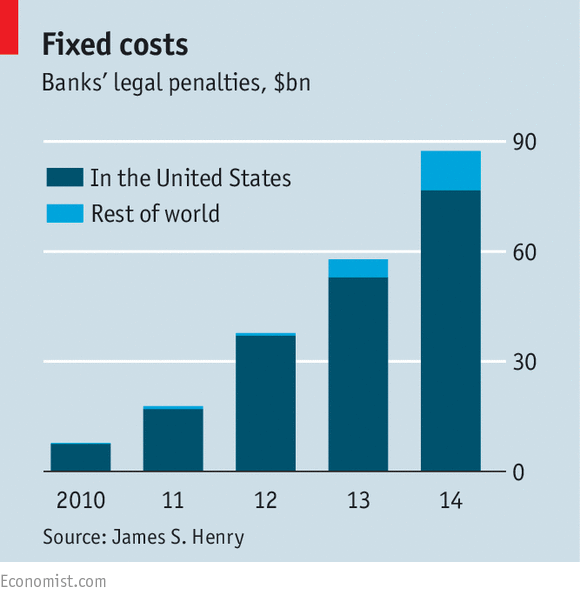

The graph on the right comes from a story in The Economist entitled and subtitled Justice, interrupted: more wrongdoing at banks, more swingeing fines, no prosecutions.

The short article is well worth reading. Note a couple of things in particular: nearly all of those fines were paid in the United States where, for all the problems with financial ‘capture’ and so on, at least they are doing something about the problem. We and many others would argue that the financial centre in the City of London, whose international financial centre is of a similar size to the U.S.’ financial sector, is significantly more corrupted and dangerous even than its counterpart in the U.S., and the ‘capture’ is more complete. This is quite a good demonstration of that.

Second, note this, as The Economist put it:

“Admitting to criminal behaviour in America was once a guarantee of bankruptcy. . . . the Department of Justice and other regulators seem to have magicked this consequence away.”

And let’s not forget that this is a process. The “capture” is not going away – if anything, it may well now start to penetrate ever more deeply now that the global financial crisis is a few years behind us.

See Henry talking about this on the Real News Network:

Listen to our Taxcast from February. Henry starts at 13:40ish.

Related articles

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025

The millionaire exodus myth

10 June 2025

The Financial Secrecy Index, a cherished tool for policy research across the globe

Inequality Inc.: How the war on tax fuels inequality and what we can do about it

New Tax Justice Network podcast website launched!

The People vs Microsoft: the Tax Justice Network podcast, the Taxcast

Como impostos podem promover reparação: the Tax Justice Network Portuguese podcast #54

Convenção na ONU pode conter $480 bi de abusos fiscais #52: the Tax Justice Network Portuguese podcast