Nick Shaxson ■ New official warning: too much finance is bad for your economy

This is devastating. The Economist has just picked up on an issue that is at the core of TJN’s Finance Curse analysis, with a new article entitled Warning: too much finance is bad for the economy. It notes:

This is devastating. The Economist has just picked up on an issue that is at the core of TJN’s Finance Curse analysis, with a new article entitled Warning: too much finance is bad for the economy. It notes:

“One of the biggest political issues in recent years has been that Wall Street has done better than Main Street. That is not just a populist slogan. A new study from the Bank for International Settlements (the central bankers’ central bank, as it is dubbed) shows exactly why rapid finance sector growth is bad for the rest of the economy.”

The article is based on a study from the Bank for International Settlements, updating an earlier one that we referenced in our Finance Curse analysis.

The BIS abstract’s wonkish way of putting it goes like this:

“In this paper we examine the negative relationship between the rate of growth of the financial sector and the rate of growth of total factor productivity. We begin by showing that by disproportionately benefiting high collateral/low productivity projects, an exogenous increase in finance reduces total factor productivity growth. Then, in a model with skilled workers and endogenous financial sector growth, we establish the possibility of multiple equilibria. In the equilibrium where skilled labour works in finance, the financial sector grows more quickly at the expense of the real economy. We go on to show that consistent with this theory, financial growth disproportionately harms financially dependent and R&D-intensive industries.”

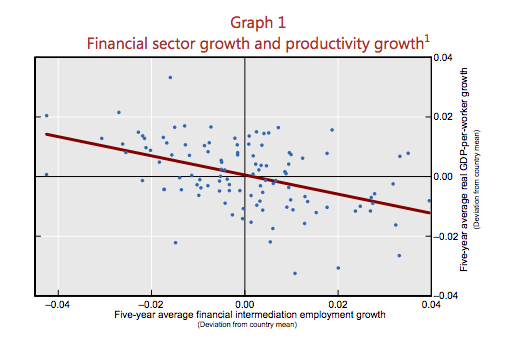

There’s a pretty clear graph:

And the conclusion notes:

“The growth of a country’s financial system is a drag on productivity growth. That is, higher growth in the financial sector reduces real growth. In other words, financial booms are not, in general, growth-enhancing, likely because the financial sector competes with the rest of the economy for resources. [TJN: another central component of the Finance Curse analysis] There is a pressing need to reassess the relationship of finance and real growth in modern economic systems.”

The Economist does a decent job in locating this in established economic theory too.

As we put it earlier, an oversized large financial sector is not the Golden Goose providing benefits for all, but a cuckoo in the nest, crowding out and harming other sectors and society. Winston Churchill summarised:

“I would rather see finance less proud and industry more content.”

Quite so. All this is exactly, precisely what we’ve been arguing in our Finance Curse analysis. The only difference, we’d argue, is that we penetrate more deeply and extensively into the political-economic reasons why this should be the case.

Do we have a new grand narrative at work here? Some people seem to think so.

Related articles

The Financial Secrecy Index, a cherished tool for policy research across the globe

New Tax Justice Network podcast website launched!

Como impostos podem promover reparação: the Tax Justice Network Portuguese podcast #54

Convenção na ONU pode conter $480 bi de abusos fiscais #52: the Tax Justice Network Portuguese podcast

As armadilhas das criptomoedas #50: the Tax Justice Network Portuguese podcast

The finance curse and the ‘Panama’ Papers

Monopolies and market power: the Tax Justice Network podcast, the Taxcast

Tax Justice Network Arabic podcast #65: كيف إستحوذ الصندوق السيادي السعودي على مجموعة مستشفيات كليوباترا

Remunicipalización: el poder municipal: January 2023 Spanish language tax justice podcast, Justicia ImPositiva