Naomi Fowler ■ New research on key role major economies play in global tax avoidance

An important new study on Offshore Financial Centres (OFCs) from the University of Amsterdam has made some fascinating discoveries, challenging, as the Financial Secrecy Index has, the popular misconception that tax havens are only palm fringed little islands and exposing that in fact major economies play a key role in global tax avoidance. Specifically they’ve mined data that highlights the central role of ‘conduit’ and ‘sink’ havens. Enter stage right the United Kingdom and the Netherlands…

In ‘Uncovering Offshore Financial Centers: Conduits and Sinks in the Global Corporate Ownership Network’ economists and computer scientists in the CORPNET research group have used:

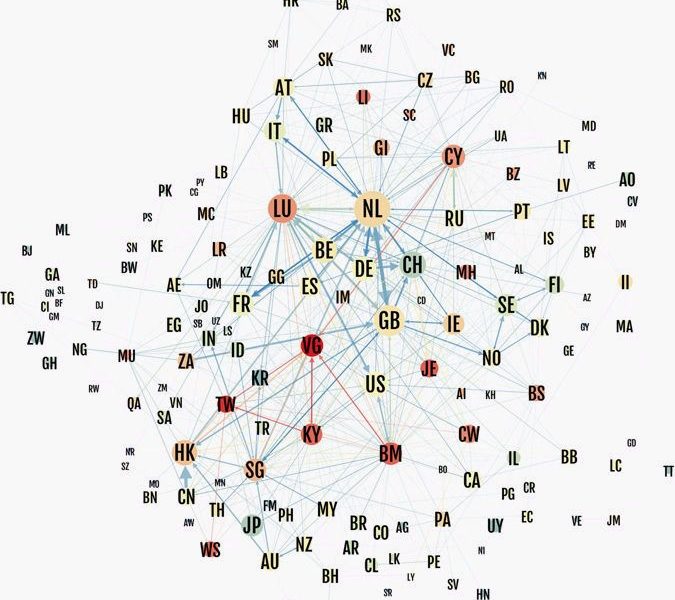

“a data-driven method based on network analysis to identify OFCs. Our data covers over 77 million ownership relations, which together form a large network in which value flows from subsidiaries to shareholders. From it we extract millions of global corporate ownership chains (see Figure 2). The resulting fine-grained insight allows us to not only see where value originates and ends up, but also exactly where it originated. This allows us to identify two types of OFCs:

- Sink-OFC: a jurisdiction in which a disproportional amount of value disappears from the economic system.

- Conduit-OFC: a jurisdiction through which a disproportional amount of value moves toward sink-OFCs.”

As they describe here:

“We looked not at country-level statistics but at detailed company data. By asking which countries and jurisdictions play a role in corporate ownership chains that is incommensurate with the size of their domestic economies, we were able to identify, for the first time, a complex global web of offshore financial centres.

We analysed the entire massive global network of ownership relations, with information of over 98 million firms and 71 million ownership relations. This granular firm-level network data helped us to distinguish two kinds of tax havens: sinks and conduits.”

They’ve identified 24 ‘sink’ Offshore Financial Centres, including Taiwan. We wrote about the dangers of Taiwan’s rise as an un-noticed tax haven, ‘the new Switzerland for Asia’ here. And here, where we explain that given the lack of external assessments of Taiwan’s legal framework, Taiwan couldn’t be ranked in our most recent Financial Secrecy Index, although its range of potential “secrecy score” (how secretive its legal framework is) is among the worst secrecy jurisdictions (or “tax havens”). Taiwan hasn’t even committed to implementing the OECD’s CRS for automatic exchange of banking information, let alone signed the multilateral competent authority agreement to implement it. On top of everything else, Taiwan is exploiting this voluntary self-exclusion to promote itself as a tax haven.

The University of Amsterdam researchers also found that only “a handful of big countries – the Netherlands, the UK, Switzerland, Singapore and Ireland – serve as the world’s conduit OFCs.”

They draw attention to the fact that “Of 24 sink OFCs, 18 have a current or past dependence to the UK…”

And very importantly they also point out:

“Our findings debunk the myth of tax shelters as exotic far-flung islands that are difficult, if not impossible, to regulate. Many offshore financial centres are highly developed countries with strong regulatory environments.”

We absolutely agree. This is matter of political will. And abuse of power.

Now read further about this fascinating research, here and here.

Related articles

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations

Democracy, Natural Resources, and the use of Tax Havens by Firms in Emerging Markets

The Financial Secrecy Index, a cherished tool for policy research across the globe

Do it like a tax haven: deny 24,000 children an education to send 2 to school

Tax Justice transformational moments of 2024

The State of Tax Justice 2024

Indicator deep dive: ‘Royalties’ and ‘Services’

Indicator deep dive: Public country by country reporting

Profit shifting by multinational corporations: Evidence from transaction-level data in Nigeria

5 June 2024