Nick Shaxson ■ Top tax expert: Big 4 “accountants of fortune” must be broken up

In March The Economist magazine rang alarm bells (again) about a rise in concentrated market power: a problem where the biggest firms get ever bigger and more like monopolies, making it easy to extract wealth from the rest of us (as opposed to creating wealth.) This, in turn fosters steeper inequality and poverty and reduces economic growth. As they put it:

“High profits across a whole economy can be a sign of sickness. They can signal the existence of firms more adept at siphoning wealth off than creating it afresh, such as those that exploit monopolies. If companies capture more profits than they can spend, it can lead to a shortfall of demand.”

It is a scary article: though mostly focused on the United States, it touches on a phenomenon that is affecting most countries, where the problem seems to be getting worse, fast.

The accountancy firms, of course, take this problem and inject steroids. It’s not just market power in their own industry that’s a problem: through the tax (and other) shenanigans that they design and market for their multinational clients, they transmit this problem to all other sectors: far beyond their own areas of audit and accountancy. The fact that they have unusually concentrated power in their own market – see below – makes this worse still.

Now Michael West, one of Australia’s best-known tax journalists, is quoting a rare voice of reason and authority: George Rozvany, a former head of tax for Australian multinationals and a former insider at Ernst & Young, PwC and Arthur Andersen. Though he’s Australian, his words are intended to have global relevance:

“Although presenting as “the guardians of commerce” they are unregulated and unaccountable; they have infiltrated governments at every level and should be broken up.

. . .

“The Big Four have, under a Rasputin-like cloak of illusion strayed from their original and critical role of verifying the accuracy of financial accounts for all stakeholders, to be “accountants of fortune” merely representing the accounting position for multinationals and developing aggressive international tax avoidance practices,” he told michaelwest.com.au.”

These four global behemoths, which employ 800,000 people and are expected to enjoy revenues of $130 billion this year, are arguably the greatest vectors for tax injustice the world has ever seen.

So how big is the problem, in terms of market power?

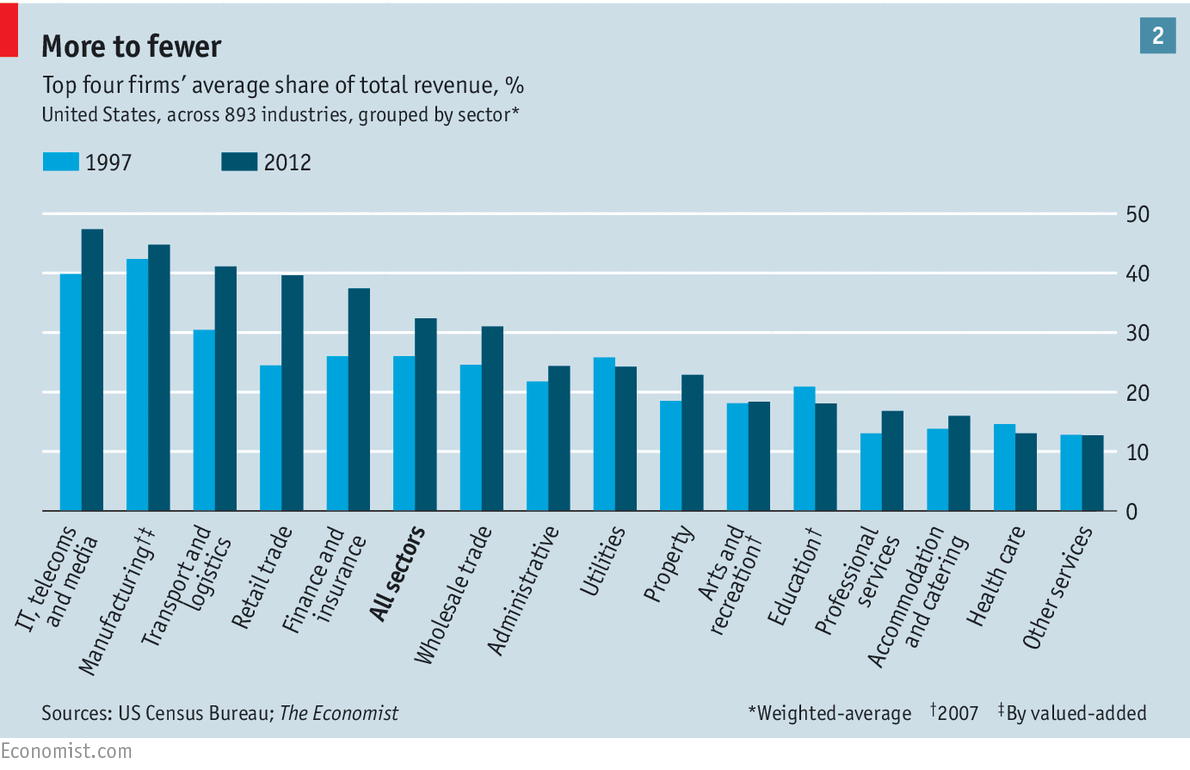

Well, The Economist has a graph showing that the top four firms’ average share of total revenue, with market share rising to shocking levels, nearly 50 percent for technology firms.

It doesn’t break this down for accountancy and audit. But we do know that in the market for auditing corporations with over $1 billion in annual revenue, the Big Four market share is 98 percent (see also here.)

Ponder that statistic for a moment. Does anyone think this state of affairs is remotely healthy?

Now back to Michael West’s article: Oligarchs of the Treasure Islands. There is a lot more in there to get your teeth into. Such as this, from Rozvany:

“From a regulatory viewpoint, it makes perfect sense to split the accounting and tax functions of each of the Big Four to improve financial integrity and to split each of these firms again into two firms to create competition. International commerce will then have eight international audit firms and eight international tax firms from which to choose.”

Break ’em up. Could this turn into a major global campaign?

And now a call to the Big 4: each and every one of them – can they produce any good arguments why they shouldn’t be broken up?

Related articles

Taxing Ethiopian women for bleeding

Tax justice and the women who hold broken systems together

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

The tax justice stories that defined 2025

Let’s make Elon Musk the world’s richest man this Christmas!

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025