John Christensen ■ Oxfam: the International Finance Corporation and tax havens – new report

Monday 11th April

Oxfam has launched a new briefing on the IFC and tax havens.

This briefing will also be presented and discussed at our event at the World Bank CSO forum on Friday 15th of April at 11 am-12.30 in Washington DC.

The key findings of the report include:

The key findings of the report include:

- 68 companies were lent money by the World Bank’s private lending arm (IFC) in 2015, to finance investments in sub-Saharan Africa. 51 of these 68 companies use tax havens with no apparent link to their core business;

- Together, these companies received 84% of the IFC’s investments in sub-Saharan Africa last year;

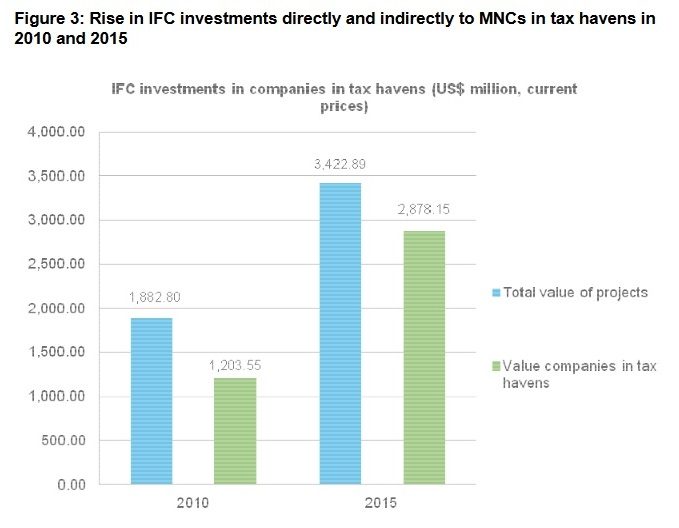

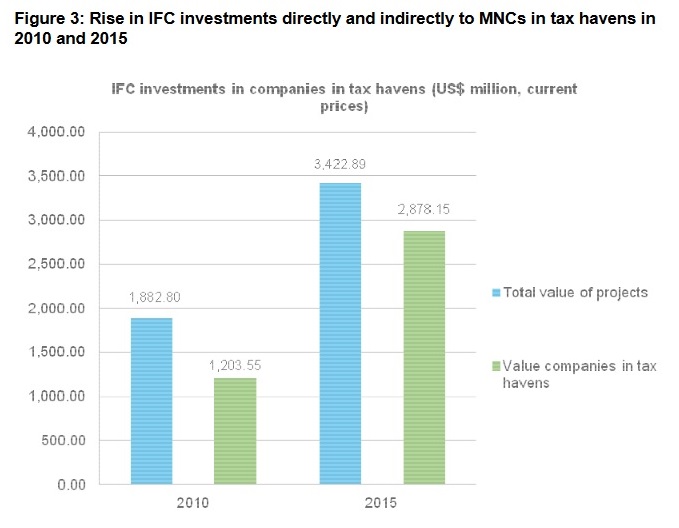

- In 2015, the IFC portfolio for SSA was 68 projects of a total value of US$3422 million of which US$2878 million were associated with tax havens through IFC clients – a significant increase in the use of tax havens since 2010 (see chart);

- Oxfam calls on the World Bank Group to put in place safeguards to ensure that its clients can prove they are paying their fair share of tax.

Inequality is rising around the world. Fighting inequality must be an integrated priority for everyone in development, to promote and achieve sustainable development.

As the World Bank and IMF prepare for their Spring Meeting in Washington 13–15 April, and in the wake of the Panama Papers scandal which reveals how powerful individuals and companies are using tax havens to hide wealth and dodge taxes, Oxfam is calling on the World Bank Group to put safeguards in place to ensure that its clients can prove they are paying their fair share of tax.

Read Oxfam’s report here

Related articles

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

Tax justice pays dividends – fair corporate taxation grows jobs, shrinks inequality

The Financial Secrecy Index, a cherished tool for policy research across the globe

UN Submission: A Roadmap for Eradicating Poverty Beyond Growth

A human rights economy: what it is and why we need it

Do it like a tax haven: deny 24,000 children an education to send 2 to school

Incorporate Gender-Transformative Provisions into the UN Tax Convention

Just Transition and Human Rights: Response to the call for input by the Office of the UN High Commissioner for Human Rights

13 January 2025

Tax Justice transformational moments of 2024