Nick Shaxson ■ How the ‘competitiveness’ dogma made banks corrupt

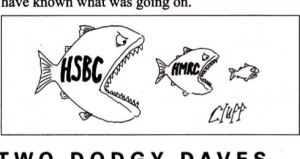

We’ve come across an interview in The Atlantic with Stephen Platt, an expert on financial crime prevention, contained in an article entitled How Dirty Money Gets Into Banks. As much as anything, we’ve taken it as an excuse to reproduce this fabulous cartoon in Britain’s Private Eye magazine, which rather speaks for itself in the wake of the HSBC scandal (see TJN’s “high grade tosh” comment in the New York Times yesterday on one element of this multi-headed hydra of a scandal.)

Although the Atlantic article doesn’t deliver on a technical level (see our “mechanics of secrecy” section for that), Platt does make some interesting observations, including reminding us of UN estimates — for 2009, a subdued part of the economic cycle — that money laundering of criminal proceeds, excluding tax evasion, would amount to 2.3-5.5 percent of GDP, or US$ 2.1 trillion as a mid-range. That’s enough dollar bills to go many, many times to go to the moon and back.

Now Platt comments about how to tackle the problems:

“I think of this is as a series of concentric circles. In the centre, we have a bank employee and we need to influence his or her behavior. The next circle is senior management, then the board, then the legal construct of the institution, then the regulator, then the government, then political parties, then society and finally “capital.”

This is certainly a useful way of framing things. And he continues:

“The government needs to provide the tools to the regulators and set the policy agenda. The difficulty is the influence the banks have on the outermost circles, in particular political parties and crucially the control that they exercise over large pools of development capital. We have to recognize how difficult it is for governments to begin to take effective action because of corporate capture. No government wants to cause perceived economic harm by scaring off capital to friendlier climes.

That’s the full section giving us the excuse for the cartoon. (The same page, by the way, shows another fine cartoon where a tax inspector with a big smile on his face is holding a small fishing net and a tiny glass jar containing two minnows.)

And our final comment relates to the last sentence: “No government wants to cause perceived economic harm by scaring off capital to friendlier climes.”

Translation: no government wants to crack down on financial crime for fear of becoming ‘uncompetitive.’

Competitiveness again. Once you start looking for it, you will find it everywhere. This race to the bottom between jurisdictions is arguably the biggest reason why our economies are in the mess that they are.

More – much more – on the enormous subject of national ‘competitiveness’ in the coming year.

Related articles

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

Tax justice pays dividends – fair corporate taxation grows jobs, shrinks inequality

The millionaire exodus myth

10 June 2025

The Financial Secrecy Index, a cherished tool for policy research across the globe

Vulnerabilities to illicit financial flows: complementing national risk assessments

UN Submission: A Roadmap for Eradicating Poverty Beyond Growth

A human rights economy: what it is and why we need it

Do it like a tax haven: deny 24,000 children an education to send 2 to school

Incorporate Gender-Transformative Provisions into the UN Tax Convention

Just Transition and Human Rights: Response to the call for input by the Office of the UN High Commissioner for Human Rights

13 January 2025