Nick Shaxson ■ How Glencore made its money

From an excellent new article in Foreign Affairs, by Ken Silverstein. It concerns the commodity trading giant Glencore, which Reuters once called “the biggest company you never heard of,” and which went public in May 2011.

“What the IPO filing did not make clear was just how Glencore, founded four decades ago by Marc Rich, a defiant friend of dictators and spies who later became one of the world’s richest fugitives, achieved this kind of global dominance.”

The answer is, the article reveals, “at once simpler and far more complicated than it appears.”

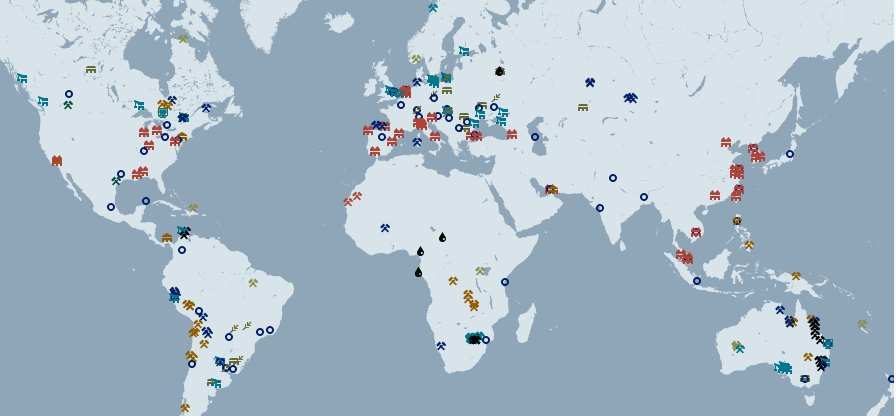

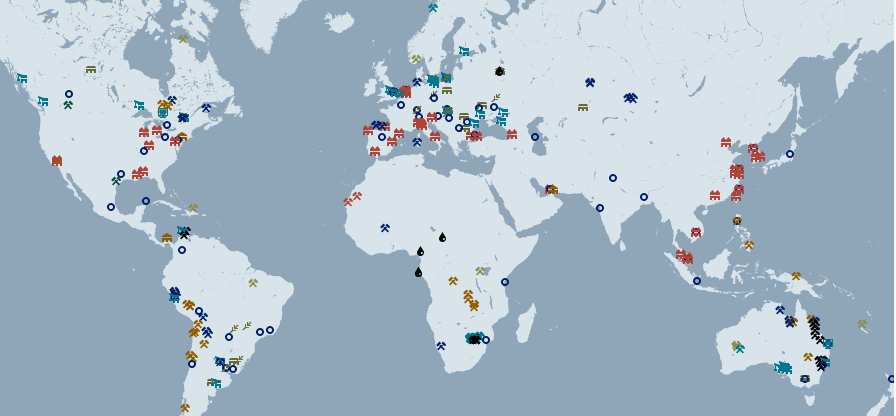

“Like all traders, Glencore makes its money at the margins, but Glencore, even more so than its competitors, profits by working in the globe’s most marginal business regions and often, investigators have found, at the margins of what is legal.

This means operating in countries where many multinationals fear to tread; building walls made of shell corporations, complex partnerships, and offshore accounts to obscure transactions; and working with shady intermediaries who help the company gain access to resources and curry favor with the corrupt, resource-rich regimes that have made Glencore so fabulously wealthy.”

Just our kind of subject, really. And how about this for a quote of the day?

“We’re all bandits here,” one of the men told me when I asked what made Switzerland such an attractive base for traders. “You can be accepted as long as you bring a lot of money.”

Now read on.

Related articles

A Call for Climate and Social Justice: Why Europe Needs a Wealth Tax

Another EU court case is weaponising human rights against transparency and tax justice

Submission to Special Rapporteur on the independence of judges and lawyers on undue influence of economic actors on judicial systems

Litany of failure: new briefing sets out OECD’s manifold shortcomings in international tax talks

Financing Africa’s Climate Action

Tax injustices are eroding women’s rights in Brazil, and we need to talk about it

Submission to the Committee on the Elimination of All Forms of Discrimination against Women

20 May 2024

The fiscal social contract and the human rights economy

29 April 2024

Ireland (again) in crosshairs of UN rights body

Source: http://www.theherald.com.au/story/2383926/ian-kirkwood-glencore-tax-bill/

Glencore tax avoidance strategies – 2015-05-14

Introduction of Glencore about worldwide strategies you can see in this BBC-documentary:

BBC – 2012 – Why poverty – 3 of 8 – Stealing Africa.avi or Youtube: http://www.youtube.com/watch?v=WNYemu...

(for some reason Glencore is not mentioned on the title and it’s about Zambia copper mine abusive businesses).

=======================================================================

Source: http://www.bbc.co.uk/programmes/p010jx25

Stealing Africa

Why Poverty? Episode 3 of 8

Ruschlikon is a village in Switzerland with a very low tax rate and very wealthy residents. There is so much money in the public coffers that mayor can’t spend it all, largely thanks to the contribution from one resident – Ivan Glasenberg, CEO of commodities giant Glencore. However, Glencore’s copper mines in Zambia don’t generate similar tax windfalls for Zambians. The country has the third largest copper reserves in the world, but 60 per cent of the population live on less than $1 a day and 80 per cent are unemployed. Christoffer Guldbrandsen investigates the dark heart of the tax system employed by multi-nationals and asks how much profit is fair.

A BBC Storyville film, produced in partnership with the Open University, Stealing Africa screens as part of Why Poverty? – when the BBC, in conjunction with more than 70 broadcasters around the world, hosts a debate about contemporary poverty. The global cross-media event sees the same eight films screened in 180 countries to explore why, in the 21st Century, a billion people still live in poverty.

=======================================================================

Glencore (a Swiss company) tax avoidance strategies (=fully unsustainable and unethical conduct).

Hope that someone will find data of the company activities in recently leaked banking data.

This “low profile” (=highly secretive) company is a master using “large scale highly sofisticate” tax avoidance and “transfer price schemes).

Ivan Glasenberg a former CEO of Glencore has also “partnered with a well know already past “tax fugitive” Marc Rich to contribute on those “avoidance schemes”.

Sources:

http://en.wikipedia.org/wiki/Marc_Rich

http://globaljournalist.org/2013/11/profile-glencore-in-zambia/

http://www.newstatesman.com/blogs/business/2012/10/ns-business-profile-marc-rich-glencores-fugitive-founder

https://www.taxjustice.net/2014/05/06/glencore-made-money/

http://www.theherald.com.au/story/2383926/ian-kirkwood-glencore-tax-bill/

http://www.theage.com.au/business/bhp-and-rio-tinto-under-audit-for-singapore-hubs-used-to-lower-tax-bills-20150411-1mikkr.touch.html

The tax evasion schemes are estimated on billions on US$ … not millions!

Unfortunately I don’t have information about how many Swiss banks and “tax heaven are involved on Glencore “avoidance schemes”. In my personal opinion the Glencore business ethic belong to “reckless financial abuse of poor countries” where they are doing business! Does Australia will be the next “tax victim”?

And my question is: Why this “corporate” has still a business license?

And not to forget that they are plenty of global corporate playing these tax avoidance schemes!

It’s also worldwide the time for all tax authorities to have a close and deep look about these schemes.

This issue will be also a BIG HEADACHE to the Swiss legislators and banking regulators.

Mario Hakulinen

Wordl citizen

Fuzhou, Fujian, South-China

https://disqus.com/by/mariohakulinen/

Source: http://www.oecd.org/tax/transparency/contactus.htm

Global Forum on Transparency and Exchange of Information for Tax Purposes