Liz Nelson ■ Right to education must be backed by tax policy

Education provides the “foundations for individual autonomy, liberty and human dignity”. (1)

Yesterday marked the start of the Global Partnership for Education’s (GPE) two-day Summit, which is hosted by the Nigerian and UK governments. The Global Education Summit: Financing GPE 2021-2025, which you can join live (2:00pm BST), aims to explore “with key partners the role of education in the face of today’s key challenges”.

We’ll be listening carefully to the debates and most importantly the political commitments. Meaningful action is especially needed on two of the challenges to be explored in the Summit: financing education and advancing gender equality.

The Abidjan Principles underline states’ obligations to establish free, quality, public education systems for all. Public services, therefore, should be the central way in which governments support the realisation of the right to education, and thus open up lifelong opportunities in further education, training and access to paid employment. Access to education needs to be delivered consistently and sustainably. Schools and other centres of education along with the educators and support teams of carers, specialists, and technicians needed to operate them are critical to deliver the right to education. So too is the public transport and digital infrastructure to ensure all children have access to education.

Where resources are scarce, girls fare less well than boys in terms of opportunities and accessing education. This is because girls and women adult learners are disproportionately burdened by structural and systemic discrimination. Girls will be depended upon to undertake the burden of caring for others within the family and wider communities. Girls will also be expected to provide income to the household in many different ways including tending crops, small scale manufacturing, domestic labour and can become victims of trafficking.

Social and economic policies need to be dismantled and re-designed so that assumptions about the role of girls and the regressive impacts from the failure to fulfil the right to education are addressed in progressive public service policies. Policies, therefore, need to be effective instruments to ensure women and girls, in particular, enjoy the right to education. Social and economic policies need to ensure that women and girls have access to affordable digital services, to accessible public education services and to available social protections.

At the Tax Justice Network we approach the notion of sustainable financing for human rights, including the right to education, through our 4 R’s of tax:

Raising revenue progressively by broadening and deepening the tax base; redistributing income and wealth using taxation policy and so that those who have more contribute proportionately to their wealth and income; repricing market goods and services such as harmful tobacco good or carbon emissions, and strengthening the accountability of governments through the payment of taxes, which ultimately underpins the social contract and effective political representation.

The country profiles of our annual State of Tax Justice report, jointly published with the Global Alliance for Tax Justice and with Public Services International, report on the scale of revenue losses to cross-border tax abuse.

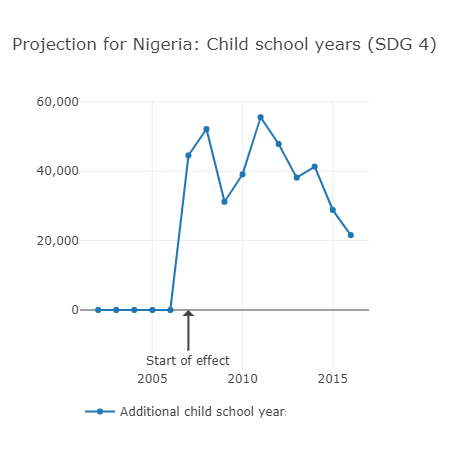

Consider the hosts of the GPE summit. Nigeria is estimated to lose US$10.8 billion a year, or 2.4% of the country’s GDP. For education, over a ten year period an increase in government revenue of 19.67% would be associated with 400,000 children receiving an extra year of education, or roughly 40,000 every year (2). With similarly dramatic losses projected in each other area of public services, it is unsurprising – but most welcome – that Nigeria has been at the forefront of demanding international progress against tax abuse. Nigeria is championing the important UN FACTI Panel recommendations for a new and fairer global architecture to fight illicit financial flows, for example, and standing against OECD proposals on corporate tax that would give the great bulk of new revenues to the richest countries.

The UK loses even more tax from corporate and individual tax abuse – an estimated US$10 billion lost to global tax abuse committed by multinational corporations, and nearly three times that to offshore tax abuse by individuals – roughly US$600 per person. As a high income country, however, the public financial constraint on access to affordable education in the UK is less binding when compared to lower income countries. And indeed, the UK’s losses are in no small part the result of the country’s deliberate strategy of positioning itself at the heart of a network of financial secrecy jurisdictions and corporate tax havens, the legacy of the British Empire. But that strategy means that the UK is responsible for imposing major revenue losses on other countries, with harsh impacts on the available resources for public services in lower-income countries – not least, public education.

The GPE Summit, continuing today, presents a real opportunity for governments, policy makers and a cross section of civil society groups to look hard at and address the financing of global education. As MaryJacob Okwuosa, National Coordinator at Activista Nigeria and Founder at Whisper To Humanity, said this week, “It is time for GPE to take tax seriously” and by implication the governments of the world. That seriousness must be reflected in an intersectional approach to substantive equality in education for girls and women learners.

The technical nature of tax issues may be seen or projected as problematic, but the decisions needed are political, and simple. The GPE should recognise explicitly that tax is the sustainable source of finance for public education, and lend its weight to international efforts to redress the global inequalities that face lower-income countries in exercising their taxing rights.

Sources: (1) Yoram Rabin, The Many Faces of the Right to Education, in D. Barak-Erez and A. Gross (eds), Exploring Social Rights Between Theory and Practice, 2007; (2) GRADE https://med.st-andrews.ac.uk/grade/research/

Resources:

Tax Justice & Human Rights: The 4 Rs and the realisation of rights

Domestic Financing: Tax and Education

Related articles

The last chance

2 February 2026

The tax justice stories that defined 2025

Let’s make Elon Musk the world’s richest man this Christmas!

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025

The myth-buster’s guide to the “millionaire exodus” scare story

Money can’t buy health, but taxes can improve healthcare

The elephant in the room of business & human rights

UN submission: Tax justice and the financing of children’s right to education

14 July 2025