Nick Shaxson ■ Oxfam report: Ending the Era of Tax Havens

Back in June 2000, three years before TJN’s birth and at a time when nobody was talking about the issues, the charity Oxfam published a seminal document entitled Tax Havens: Releasing the hidden billions for poverty eradication. It was an important part of global tax justice history. We’re delighted that Oxfam has again been extremely active in the area, and now has produced an important, in-depth new report entitled Ending the Era of Tax Havens: Why the UK Government Must Lead the Way, written with the help of TJN’s research Director Alex Cobham.

Back in June 2000, three years before TJN’s birth and at a time when nobody was talking about the issues, the charity Oxfam published a seminal document entitled Tax Havens: Releasing the hidden billions for poverty eradication. It was an important part of global tax justice history. We’re delighted that Oxfam has again been extremely active in the area, and now has produced an important, in-depth new report entitled Ending the Era of Tax Havens: Why the UK Government Must Lead the Way, written with the help of TJN’s research Director Alex Cobham.

It begins:

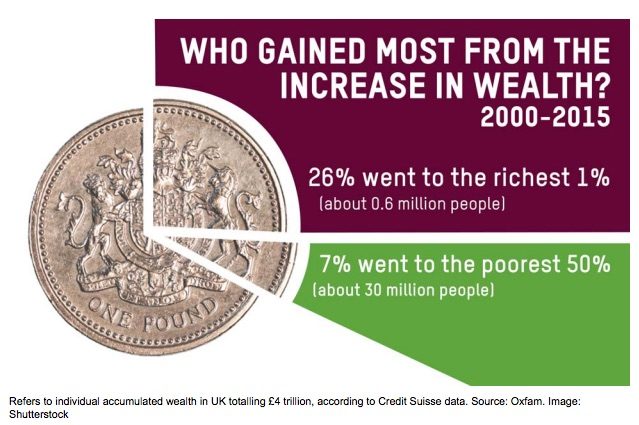

“The gap between the rich and the rest is growing. Tax havens are at the heart of the inequality crisis, enabling corporations and wealthy individuals to dodge paying their fair share of tax. This prevents states from funding vital public services and combating poverty and inequality, with especially damaging effects for developing countries. The UK heads the world’s biggest financial secrecy network, spanning its Crown Dependencies and Overseas Territories and centred on the City of London – but this in fact provides an unparalleled opportunity to help end the era of tax havens. As the UK Prime Minister prepares to host the anti-corruption summit in May, this briefing paper outlines how tax havens fuel the inequality crisis which leaves poor countries without the funds they need, the UK’s role in the global tax haven system, and what the government can do about it.”

Saying it like it is: read more about the British Connection here. We’ll highlight and summarise a few choice sections:

- “The City of London Corporation is officially a lobbyist for the UK financial services sector and for financial deregulation, both at home and abroad. A City of London ‘Remembrancer’ liaises with the UK Parliament, bringing intelligence from the political sphere back to, and lobbying on behalf of, the City. The Corporation, which predates Parliament, has various other special privileges and ‘freedoms’, putting it in some ways outside of normal UK civic governance. (Read more about this in the report — but also in Treasure Islands and in our report of how the UK became an offshore financial centre.)

- The Big Four Audit firms: Deloitte, Ernst & Young, KPMG and PricewaterhouseCoopers (PwC). The report outlines a range of abusive and illegal practices, noting their global dominance, their central role in the tax haven world, and cites Prem Sikka: No accountancy firm has ever been fined or disciplined by its professional body for selling unlawful tax avoidance schemes. In fact, there are no negative consequences for the designers of such schemes.’ Oxfam continues: “This idea, of a business model that relies in part on the deliberate frustration of the intentions of regulators and policy makers, raises a larger question about whether these firms should ever be seen as objective providers of technical expertise. The Big Four have the potential to exert enormous influence, positive or negative, over tax policies and the administration of tax, with concomitant potential to affect inequality and poverty.

- Highlighting just one of many HSBC scandals, Oxfam notes: “This case raises a number of questions about the UK government’s appetite to tackle tax abuse. Is the UK simply more tolerant of tax evasion than other countries that had less at stake but pursued the criminals and the revenues more vigorously?57 Did the bank’s economic importance affect its treatment? Do political relationships play a role? Is there a specific HSBC issue at play, or is this merely symptomatic of a wider ‘Finance Curse’?”

The policy recommendations of the report are crucial (see the Oxfam report for the full recommendations):

Corporate tax

• Require all large MNCs to make country-by-country reports publicly available for each country in which they operate. In this respect, note this UK parliamentary bill, due tomorrow, which TJN strongly supports:

That leave be given to bring in a Bill to require certain multinational enterprises to include, within their annual financial reporting, specified information prepared in accordance with the Organisation for Economic Cooperation and Development’s requirements for Country-by-Country reporting; and for connected purposes.

• Conduct a rigorous and independent ‘spillover analysis’ of UK corporate tax rules to assess whether they have harmful knock-on effects on the ability of developing countries to collect their own taxes.

Transparency of beneficial ownership

• Extend the UK’s public registry of beneficial ownership to trusts and other legal entities, so that the ultimate owner of all corporate vehicles in the UK is known.

• Require the UK’s Crown Dependencies and Overseas Territories also to introduce public registries of beneficial ownership for companies, trusts and other legal entities.

Information exchange

• Exchange tax information automatically on a comprehensive, multilateral basis, and without requiring reciprocity from lower-income countries.

• Publish aggregate statistics showing the size and origin of the assets in UK financial institutions, to help monitor the impact of automatic exchange of information and to generate political will for other countries to join.

• Make it clear that information provided can be used in anti-corruption efforts as well as to address tax evasion, to ensure the maximum utility of information shared under the automatic exchange of information. [TJN adds: the UK hosts a global anti-corruption summit in May, and we will be working hard to ensure that tax havens are brought squarely into the corruption debate: not least through our forthcoming ‘tax havens and corruption’ workshop.]

• Require the Crown Dependencies and Overseas Territories to carry out each of these measures.

• Ensure that UK government departments and contractors do not use tax havens, by introducing requirements into procurement contracts that set minimum financial transparency criteria for the jurisdiction of incorporation.

City of London Corporation

• The government should mandate an independent, fully public review of the functioning and operations of the City of London Corporation, looking at its internal democratic processes, transparency and accountability; its impact on the same for the UK; the wider impact of its lobbying overseas; and any spillovers to other countries, especially developing countries.

At a global level, the UK government should support international efforts to end the era of tax havens. These should include the following:

• Begin a second generation of inclusive global tax reform to fix the broken international tax system, including a commitment to end the race to the bottom, to work towards an effective minimum global tax rate and appropriate consideration of unitary taxation, and involving all countries on an equal footing and all relevant international institutions through an intergovernmental tax body.

• Set up integrated, binding, exhaustive and objective monitoring exercises of tax havens at a global level, in order to assess the risks posed by these jurisdictions. These exercises should be held regularly and their outcomes should be made public.

• Specifically agree definitive financial secrecy criteria for a blacklist of secrecy jurisdictions, and countermeasures against them and the individuals and companies using them.

• Increase transparency around tax rulings and the granting of tax incentives.

The big 4 audit firms, both in their City of London operations and globally, have the potential to exert enormous influence over tax policies and the administration of tax. They should:

• Publish an OECD BEPS country-by-country reporting template in its entirety, and encourage their clients to do the same.

• Only assist with tax returns which fulfil both the spirit as well as the letter of the law. • Refrain from any lobbying on tax issues which might be reasonably construed as being against the public interest.

• Publish comprehensive data on an annual or more frequent basis of the full set of political activity in each jurisdiction, defined to include any direct and indirect lobbying, any paid and pro bono support provided to political parties and governments, and any public advocacy.

And don’t forget TJN’s upcoming workshop on corruption and tax havens, touching on all these issues, and plenty more.

As a reminder, the Oxfam report is here.

Related articles

Just Transition and Human Rights: Response to the call for input by the Office of the UN High Commissioner for Human Rights

13 January 2025

Tax Justice transformational moments of 2024

The Tax Justice Network’s most read pieces of 2024

Did we really end offshore tax evasion?

The State of Tax Justice 2024

Stolen Futures: Our new report on tax justice and the Right to Education

Stolen futures: the impacts of tax injustice on the Right to Education

31 October 2024

How ‘greenlaundering’ conceals the full scale of fossil fuel financing

11 September 2024