Naomi Fowler ■ The European Union, tax evasion and closing loopholes: new report

Today, a new report commissioned by the Greens/EFA group in the European Parliament and written by the Tax Justice Network’s Andres Knobel demonstrates that despite progress in recent years on closing down opportunities for tax evasion, there are still significant loopholes for citizens and multinationals to evade paying taxes where they are based.

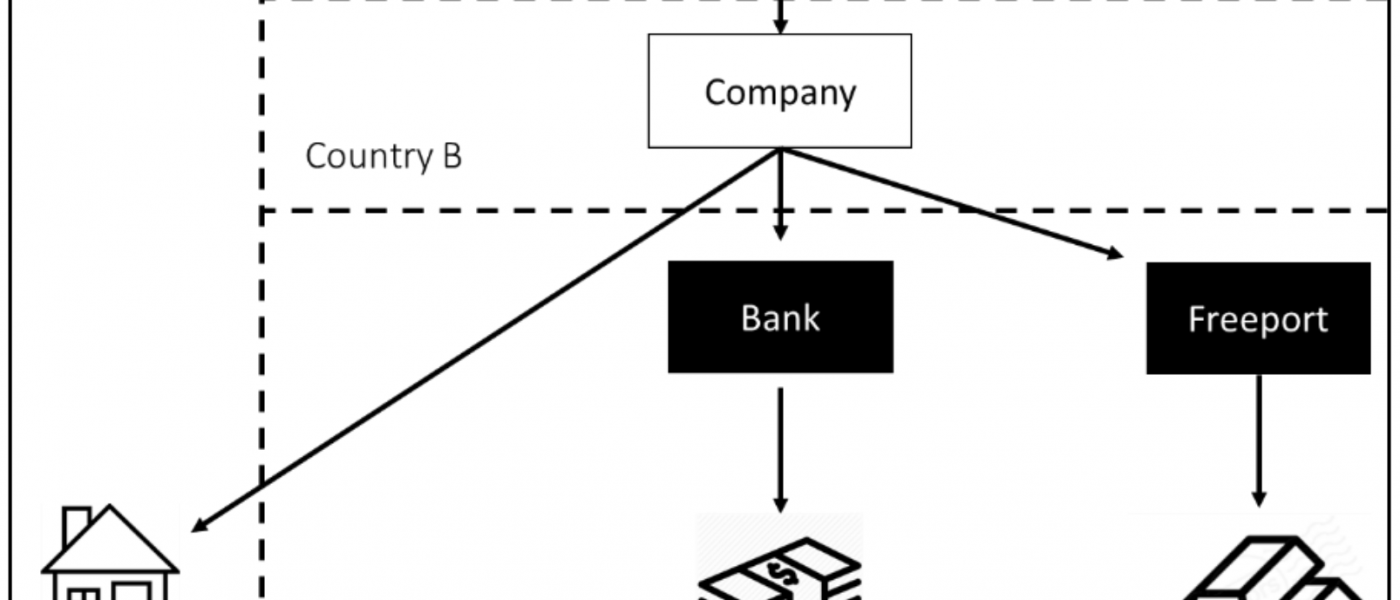

The study, “Reporting taxation: Analysing loopholes in the EU’s automatic exchange of information and how to close them”, shows that in order to close down loopholes for tax avoidance and evasion the EU urgently needs to revise the DAC2 and DAC3 directives, which provide for the automatic exchange of financial information and of tax rulings respectively. The EU must be ready to sanction financial centres that fail to exchange complete information with the EU and should include non-cooperative jurisdictions on its tax blacklist, including Tax Haven USA. The report also calls for much greater due diligence and monitoring of Golden Visa schemes to be sure that individuals aren’t just buying their way out of their tax obligations.

As the Greens/EFA spokesperson on tax Sven Giegold says:

Europe must speak with one voice and say to those currently cheating on their obligations to either play by the rules or quit the game.”

Absolutely. And as the report says of the context:

The current global financial system is characterised not only by little or outdated regulation (e.g. on crypto-currencies), but especially by little or no transparency.”

The lack of transparency has made it fairly easy for wrongdoers (including multinationals engaging in unfair tax agreements) to benefit from corruption, money laundering, tax evasion or avoidance, by hiding and mixing themselves, their assets and their transactions within legitimate uses of the global financial and tax system.

In order to address this problem, national authorities have started to cooperate more with each other at the international and European level to update or establish financial regulations and to increase transparency requirements. However, solving the problem depends on all countries, starting with major players (e.g. major financial centres and tax havens) agreeing to change (rather than blocking) and actually implementing the necessary changes. Without this, improvements and solutions will only get so far.”

The full report is here.

Related articles

The tax justice stories that defined 2025

2025: The year tax justice became part of the world’s problem-solving infrastructure

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations

Tackling Profit Shifting in the Oil and Gas Sector for a Just Transition

Follow the money: Rethinking geographical risk assessment in money laundering

Democracy, Natural Resources, and the use of Tax Havens by Firms in Emerging Markets

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

The Financial Secrecy Index, a cherished tool for policy research across the globe

Vulnerabilities to illicit financial flows: complementing national risk assessments