John Christensen ■ Sweden’s recipe for success: high taxes, strong unions, and equal distribution of wealth

While recent elections in France, U.K. and the U.S.A. have shown the results of globalisation gone bad, Sweden has successfully adapted its development model to make globalisation work for the majority of its people. And the secret to this success? Well, according to Finance Minister Magdelena Andersson (an economist), the key ingredients are high taxes, strong labour unions, and equal wealth distribution.

This weekend, as disgruntled French voters held their noses and voted against the anti-globalisation agenda of the Front National, Bloomberg published a heartening article about how Sweden has bucked the global trend by adopting an activist state model to mitigate the worst effects of globalisation. Using taxes to redistribute wealth and income, and investing in training to increase productivity and improve labour mobility between jobs, are among the key differences between Sweden and (say) the United States. As Bloomberg says:

“In a world still flinching from the financial crisis that hit a decade ago and the populist wave that followed, Sweden’s economic stewardship holds lessons that challenge the conventional wisdom in the U.S. on how taxes work, according to the Harvard-educated minister. Speaking in an interview in Stockholm, Andersson says success comes down to “three things: It’s the jobs, it’s our welfare and it’s our redistribution.”

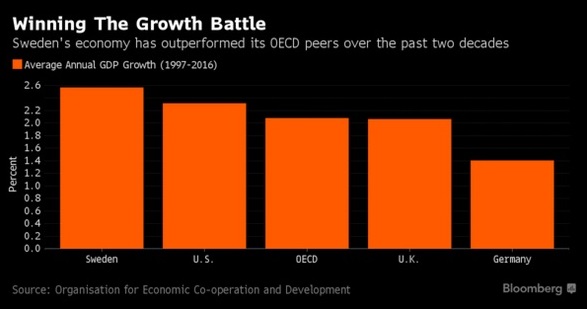

The results of this entirely different approach to adapting the Swedish economy to globalised markets can be seen in the long term growth trends over the past two decades. Sweden stands well ahead of the OECD country average and, notwithstanding US dominance of the digital economy, performs better than that country:

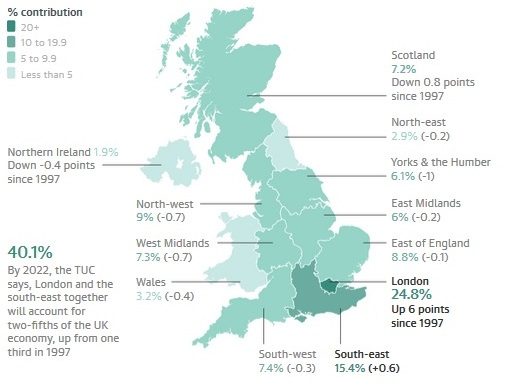

More importantly, while the USA struggles with rising inequality, falling earnings for the majority, and mounting social division, Sweden has taken an entirely different route, as the following chart vividly illustrates:

We can draw many lessons from Sweden’s success, but we’d like to focus on two key matters.

First, bucking the ‘no-choice’ logic of Thatcherism’s There Is No Alternative defeatism, Sweden – and some other Nordic countries – have largely persevered with their commitment to social democracy, and have emerged as winners.

Second, for those who think it impossible to resist the race-to-the-bottom dynamic of tax competition, Sweden shows that high taxes do not harm growth. As Andersson says:

“They (taxes) of course have negative effects,” she said. “All taxes do, but what you use the money for can have positive effects and that’s exactly what the Swedish model shows. You can have high taxes and high employment and growth.”

While President Trump and Prime Minister May seem hell-bent on pursuing their agenda of tax cuts for the rich, French President-elect Emmanuel Macron seems to have noticed the Swedish success story and is looking northwards for inspiration.

Read the fill Bloomberg article here.

Related articles

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

The tax justice stories that defined 2025

Let’s make Elon Musk the world’s richest man this Christmas!

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025

The myth-buster’s guide to the “millionaire exodus” scare story