Nick Shaxson ■ New analysis: why Google is paying just 2% tax rate in the UK

The Daily Mirror newspaper in the UK is running a story entitled Google is paying even LESS tax than thought as UK deal is just 2%.

This is based on a new TJN analysis, based not on current tax rules but on what Google might pay if the UK were to adopt a fairer tax system that we’ve advocated. We analysed Google’s tax settlement in the UK for 2014, and we find that – even after a deal with the UK tax authorities to pay a little extra tax – just one tenth of the Google’s real profits are actually declared for tax purposes in the UK. This results in a real, effective tax rate of around two per cent.

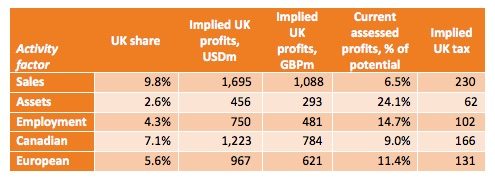

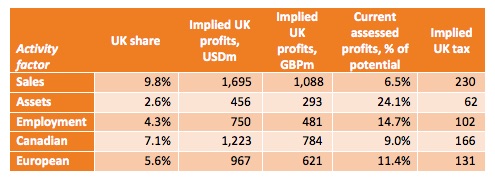

Our approach looks at the profits made by Google globally, and attribute those profits to the UK on the basis of the proportion of Google’s http://premier-pharmacy.com/product-category/mans-health/ real economic activity in the UK (not only sales, but also assets and employment). This achieves the stated aim of the OECD, the international organisation of leading industrial economies, which in 2013 embarked on a process to develop new tax rules that would better align profits with the location of real economic activity.

More specifically:

“The Canadian and European multiple-factor formulae provide a broader base of economic activity against which to consider profit misalignment, and provide a closer range. The implied tax bill for 2014 is £131-£166 million; while current declared profits are 9-11% of the implied tax base. Were the OECD BEPS process to achieve its aim, or were a unitary tax approach with formulary apportionment adopted, Google could expect to pay in UK tax each year an amount equivalent to or greater than the settlement reached for the entire period back to 2005.

. . .

Google UK’s taxable profits for 2014, after the deal with HMRC, are about 10% of what would be expected if their profits were aligned with the UK share of Google’s real economic activity – which is the stated aim of policymakers, and the clear demand of the public. With statutory corporate tax rates set to fall below 20%, the real effective rate may end up lower than 2% of the actual profits attributable to UK economic activity. By any reasonable benchmark, the Google deal highlights the comprehensive failure of international tax rules.”

It reaches two main conclusions:

- Multinationals must be required to publish their country-by-country reporting data, under the new OECD standard, to reveal where their economic activity takes place, where profits are declared and where tax is paid. At a minimum, this will allow the public to hold multinationals and tax authorities accountable for their performance. We welcome the recent support for this original Tax Justice Network policy proposal from European Commissioner Pierre Moscovici, and UK Chancellor George Osborne – but that support must now be turned into legislation.

- Recognising that the OECD BEPS process has failed to meet the scale of the challenge of profit shifting, policymakers should urgently convene an independent, international expert-led process to explore alternatives – starting with the taxation of multinational groups as a unit, rather than maintaining the current pretence of individual entities within a group maximising profit individually. This will allow full consideration of formulary apportionment approaches, including as recommended by the Independent Commission for the Reform of International Corporate Taxation (ICRICT); and detailed analysis of possible practical steps to move towards a functioning system.

The full analysis is here.

The world awaits policymakers (perhaps in the UK or European Commission) actually delivering public country-by-country reporting data. In the meantime, this type of analysis is the closest it’s possible to get to assessing whether companies’ profits are aligned with their economic activity. We’ll be looking at other companies soon, so would welcome any comments on this analysis.

Also see our document Towards Unitary Taxation.

Related articles

Indicator deep dive: ‘Royalties’ and ‘Services’

Proposal for ‘Business in Europe: Framework for Income Taxation’ (BEFIT): A wrong turn in the right direction

2 February 2024

Formulary apportionment in BEFIT: A path to fair corporate taxation

31 January 2024

New Tax Justice Network podcast website launched!

Monopolies and market power: the Tax Justice Network podcast, the Taxcast

A year the tide turned in the fight for tax justice

Taxing Wall Street: the Tax Justice Network December 2020 podcast

$427bn lost to tax havens every year: landmark study reveals countries’ losses and worst offenders

The State of Tax Justice 2020

20 November 2020

Why is Google paying any tax in the UK?