Nick Shaxson ■ UNCTAD: multinational tax avoidance costs developing countries $100 billion+

The UN Conference on Trade and Development (UNCTAD) has just published a major new study on corporate tax in developing countries, which contains a wealth of new information analysis as well as some important headline numbers: notably that developing countries lost around $100 billion per year in revenues due to tax avoidance by multinational enterprises (MNEs), and as much as $300 billion in total lost development finance.

In more detail:

- MNE foreign affiliates contribute an estimated $730 billion annually to government budgets in developing countries, of which corporate income taxes account for some $220 billion. These contributions represent on average, around 10% of total government revenues, compared to around 5 percent on average in developed countries. In Africa, the share is 14 percent.

- An estimated $100 billion of annual tax revenue losses for developing countries is related to inward investment stocks directly linked to offshore hubs. The estimated tax losses represent around a third of the potential total – or towards half of current MNE corporate income taxes. Adding up both lost tax revenues and with the reinvested earnings that are lost as profits are shifted away from the developing country yields a total ‘development finance loss’ in the range of $250 – $300 billion (see the note below for more details).

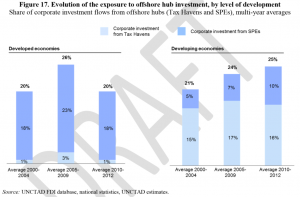

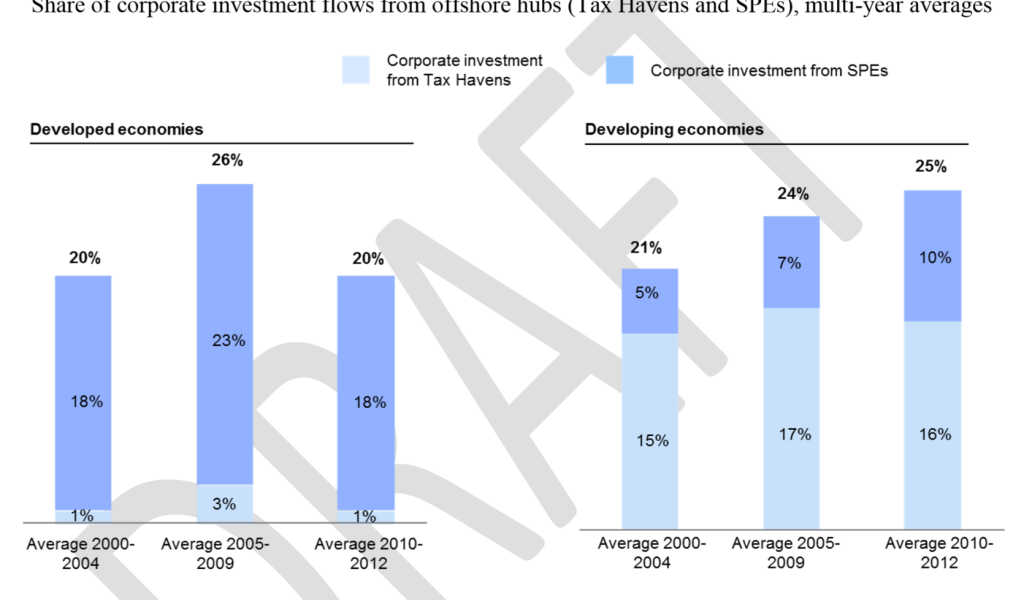

- Some 30% of cross-border corporate investment stocks – FDI, plus investments through Special Purpose Entities (SPEs) – have been routed through offshore hubs.

- A 10 percent increase in the use of ‘offshore hubs’ for inward investment is associated, on average, with a fall of over one percent in reported taxable returns.

- Increasing international efforts to tackle tax avoidance practices have managed to reduce the share of offshore investments in developed countries, but exposure of developing economies is still on the rise.

As mentioned, the leakage of development resources is not limited to the loss of domestic tax revenues. Profit-shifting out of developing countries also affects their overall GDP (as it reduces the profit component of value-added, which is what GDP measures). And, as companies shift profits away from the country that is the recipient of the inward investment, they may further undermine development opportunities by reducing the reinvestment of those profits for productive purposes. Applying an average reinvestment rate of 50% to UNCTAD’s estimate of $330 – $450 billion in (after-tax) profit shifting, would suggest a loss in reinvested earnings in the range of $165- $225 billion.

Adding up the tax revenue losses and these lost ‘reinvested earnings’, the total leakage of development financing resources would then be in the order of $250 – $300 billion annually.

Alex Cobham has published a more detailed summary of the report.

UNCTAD has also used a relatively new tax database called the Government Revenue Dataset from the International Centre for Tax and Development (ICTD), which TJN’s Cobham and others have been working with, to provide an approximate baseline for the corporate and other tax contribution of MNEs in developing countries.

The new UNCTAD report is called “a working paper for review and feedback,” so be sure of more such reports and data to come.

One for our permanent reports page.

Related articles

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

The tax justice stories that defined 2025

Let’s make Elon Musk the world’s richest man this Christmas!

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025

The myth-buster’s guide to the “millionaire exodus” scare story