Niko Lusiani ■ Reframing tax policy to reset the rules of the monopoly game

The following article is from the “Tax and Monopoly” October 2022 issue of the Tax Justice Focus, an online magazine that explores boundary-pushing ideas in tax justice and revolutionary solutions to the most pressing challenges of our time. Each edition features articles from prominent experts and academics from around the world. The “Tax and monopoly” issue is co-published with the Balanced Economy Project and Roosevelt Institute.

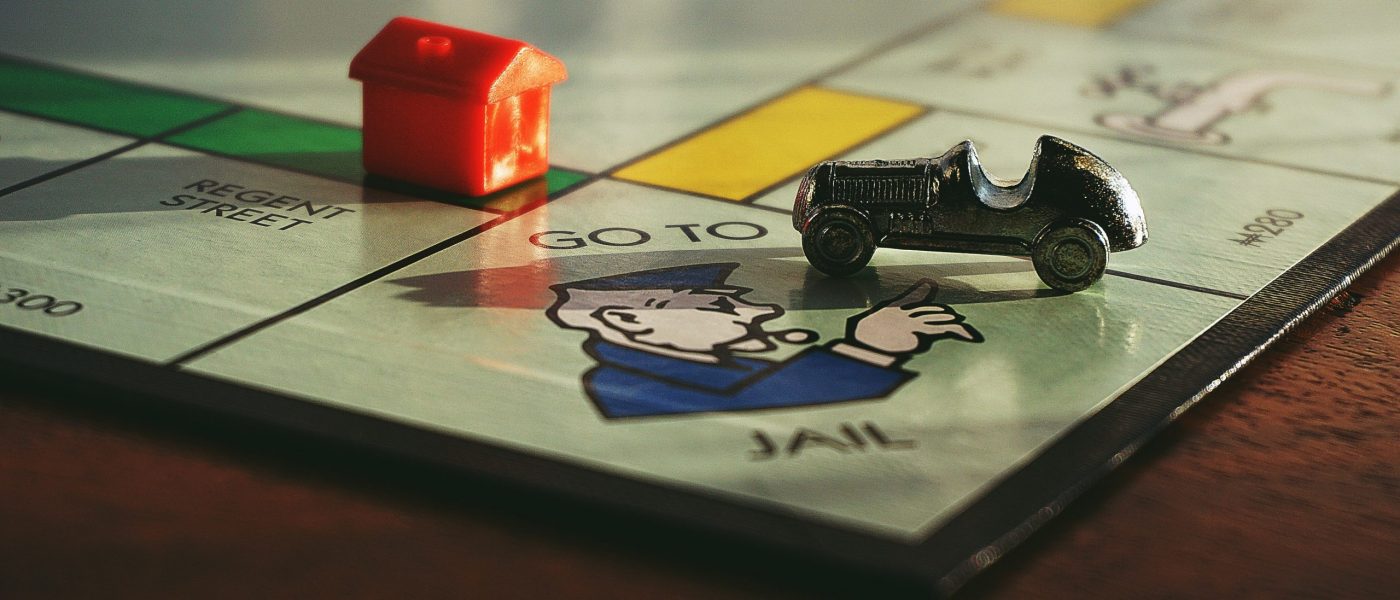

Monopolists and rentseekers have been running rings round the democratic fiscal state for decades. It is obvious to everyone that the game is rigged. But we still have a few more rolls of the dice. Let’s use them wisely.

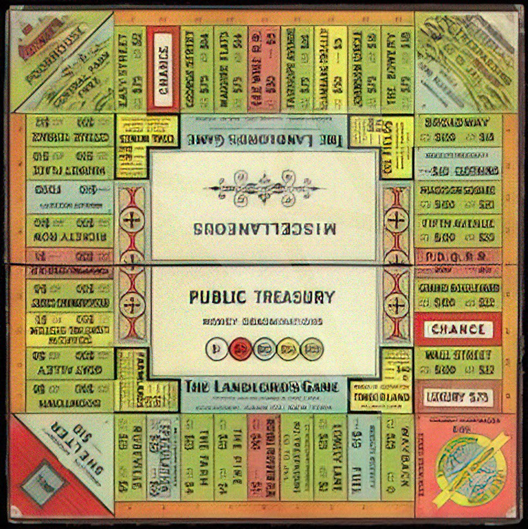

The earliest known version of Monopoly, called The Landlord’s Game, was designed by an American women’s rights and anti- monopoly advocate, Elizabeth Magie, in 1902. She invented the game to illustrate the economic consequences of rent-seeking and the value of wealth taxation to discourage large agglomerations of economic power.

The instructions included a graduated tax table, with increasing marginal rates depending on property/wealth, and the funds went back to pay for basic necessities of all the players. In this first version of the Monopoly game, everyone won when the poorest player doubled their original stake. Compare that to today’s rules of the Monopoly game, where the goal of the game is financial domination. Paying income taxes is purely bad luck, and when you are forced to contribute, the proceeds just go back to the bank – helping no one.

Different eras, different rules of the game, very different conceptions of the role and the value of taxing entities with excessive market power.We begin this issue of Tax and Monopoly Focus with this bit of folk wisdom to show not just how far back the relationship between tax policy and anti- monopoly goes in the public conscience, but also to illustrate that the current tax rules – which exacerbate corporate consolidation – are not natural or necessary. They are in fact long due for a rethink and a re-write.

Before jumping into this rethinking, we might well start with some of the ways in which current tax rules incentivise and otherwise actively subsidise the growth of corporate oligopolies.

First, current international tax rules and the presence of tax havens work to boost after- tax profits for globally-integrated large firms. Smaller domestic competitors who cannot engage in the same sort of regulatory arbitrage are at a structural disadvantage.

The mere size and complexity of large, global corporate structures with many subsidiaries worldwide allow these entities to befuddle tax auditors and essentially prevent equal enforcement of tax laws. This is frustrating enough for richer countries: just think how much harder it is for revenue authorities in lower-income countries. Simply put, the more complicated the corporate structure, the less enforceable the tax code is. The bigger you get, the less likely you’ll have to pay tax.

Second, and relatedly, the tax code and its enforcement are particularly vulnerable to lobbying by concentrated special interests, such as incumbent corporate oligopolies. Again, this is troubling enough in wealthy nations; lower-income countries are even more susceptible. Indeed, the more profitable and more incumbent a corporation becomes, the more is at stake in the formation and enforcement of tax policy. Lobbying for lower taxes may indeed be inefficient economically, as Professor Philippon has argued,2 but changing tax laws and how they are enforced becomes a premium when a corporation becomes a highly-profitable incumbent.

Third, the flat corporate income tax rate – as it exists today in the US – is facially neutral between small and large firms. But given the exorbitant tax privileges large, incumbent firms have in practice, a statutorily flat rate in reality means a much lower effective rate for larger, global firms compared to smaller, domestic ones. Given all the other tax advantages of bigness, this de jure equal treatment creates de facto advantages for large, incumbent firms. Further, by taxing the first dollar of firm profit the same as excessive profits gained from rent-seeking, a flat rate effectively incentivises super-normal rent-seeking by dominant firms.

Fourth, unlimited corporate interest deductions (until recently in the US, and this is still being battled in the EU) allow for highly-leveraged buyouts that wouldn’t be done without such tax deductions.

Finally, the US Federal tax code for over a century has subsidised many merger and acquisition (M&A) deals via what’s called a tax-free reorganisation, which allows sellers to defer (sometimes indefinitely) the gain from their sale to avoid tax liabilities.3 This implicit subsidy incentivises corporate consolidation, with little if any redeeming economic or societal value.

Just as today’s tax system contributes to corporate consolidation, so then too can our tax policies help restructure the economy to disrupt concentrated economic power and drive a more dynamic, multi- player economy. This special edition collects five timely contributions which help to diagnose the role our tax code can have to deconstruct and deter excessive market power as a complement to a more assertive anti-monopoly agenda.

Susan Holmberg and Stacy Mitchell brilliantly chronicle Amazon’s tax break-financed rise to retail dominance, a vivid illustration of how a broken tax system has helped spawn a 21st century monopoly.

Reuven Avi- Yonah’s proposal of a steeply progressive corporate income tax rate to tax away excessive profits, as well as George Dibb’s critical eye toward taxing rents, would both help ameliorate the functionally unequal tax treatment between large and small firms while simultaneously helping curb harmful consolidation.

Allison Christians’ contribution digs into the conceptual, philosophical and ultimately political waters of how to distinguish normal from excess, windfall or otherwise abnormal profits. And my piece with Emily DiVito explores how an individual wealth tax on America’s top Billionaire ‘blockholders’ could curb their drive to use their companies to capture excess market power.

The standard approach of competition policy – a public interest-minded interpretation and robust enforcement of antitrust laws alongside the deployment of public options to outcompete private incumbents – remains extremely valuable.

But competition policy in isolation shouldn’t have to do everything. This collection aims to help re-envision tax policy as a complementary anti-monopoly tool to curb corporate consolidation and re-balance our economies. Just like the rules of the original Monopoly game once did.

As Director of Corporate Power at the Roosevelt Institute, Niko Lusiani leads the think tank’s program to dissect and dismantle the ways in which extractive corporate behaviour jeopardises workers, consumers, our natural environment, and our shared economic system.

Related articles

Tax justice and the women who hold broken systems together

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

The tax justice stories that defined 2025

Let’s make Elon Musk the world’s richest man this Christmas!

Admin Data for Tax Justice: A New Global Initiative Advancing the Use of Administrative Data for Tax Research

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025