Andres Knobel ■ The abuse of Limited Partnerships in the UK: predicting the future with the Financial Secrecy Index

The Tax Justice Network’s Financial Secrecy Index assesses jurisdictions on their transparency levels in their legal framework by looking into 20 different indicators including banking secrecy, beneficial ownership registration, anti-money laundering, etc.

One of the key principles of the index is the weakest link principle (or “lowest common transparency denominator”), meaning that a jurisdiction will be rated under each indicator based on the worst transparency case available. For example, if the United Arab Emirates has, in general, appropriate accounting regulations for companies but one of its 39 free zones allows companies not to keep proper accounting information, the whole country will be rated based on that worst case.

Some may argue that this is unfair. After all, the general rule may be fine, and this is just a small exception. But that’s the whole point. Just as a hacker would break into a computer system not by trying against the security component that actually works, but by finding a weakness, the index follows the same approach. We look for weaknesses (legal loopholes) in countries’ transparency laws that could be exploited, not by hackers but by individuals and entities involved in illicit financial flows. If a UAE company is engaging in tax avoidance or evasion, it will likely choose to incorporate in the free zone offering accounting secrecy, not transparency.

The index follows this “potentiality” approach of the worst available case not because it knows that this weakness will always be exploited, but because it could be, and that’s bad enough for us. But now, the UK proves that this does happen.

The UK is portrayed as the champion of beneficial ownership registration. That is partially true. Although Ukraine came very close and was the first to commit to integrating their register with a global one, the UK was the first country to set up a fully online free register of beneficial ownership available in open data format. This not only allows individuals and authorities all over the world to access beneficial ownership data, but it also allowed NGOs such as Global Witness to run checks and alert UK authorities about potentially false information that had been registered.

However, as our paper on “the state of play of beneficial ownership registration” shows, the UK is doing a good job with regard to companies (though still not ideal, e.g. because the thresholds for identifying a beneficial owner are still too high, allowing many people to escape being registered). But when it comes to other legal vehicles, the situation is different. And we’re not referring just to trusts.

The UK also fails when it comes to partnerships, again because of the weakest case principle we apply in the index. While limited liability partnerships (LLPs) have to register their beneficial owners, limited partnerships (LPs) don’t – they only need to register their legal owners.

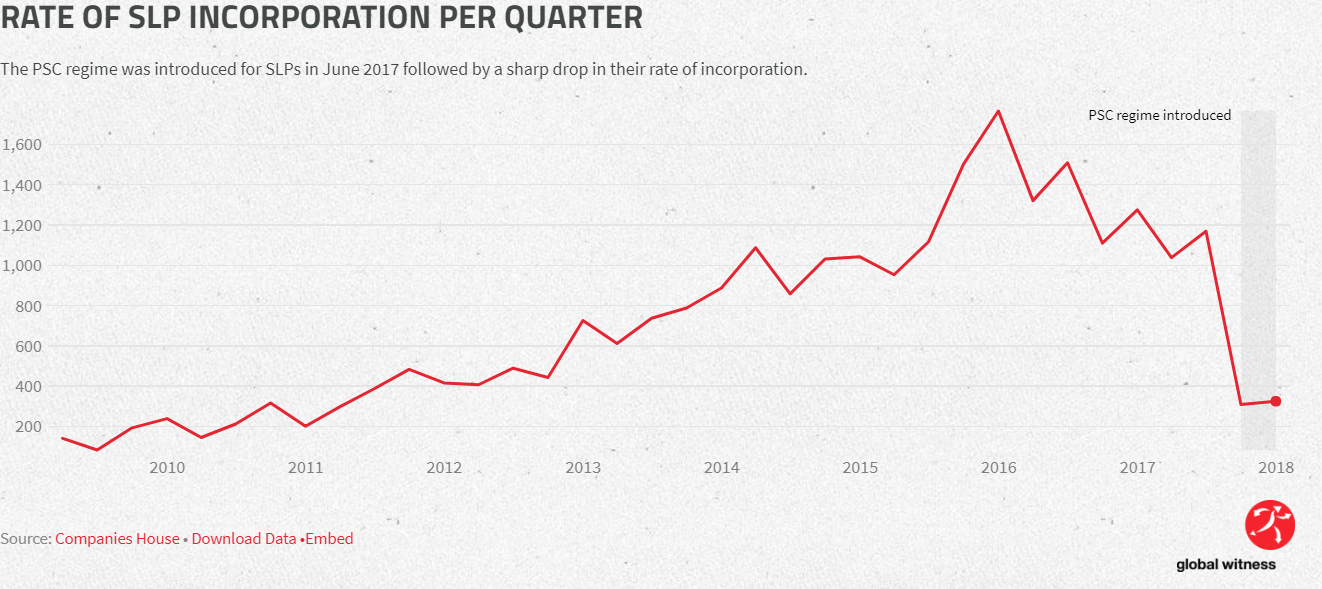

Interestingly, after reports on abuses using Scottish limited partnerships (SLPs), the UK decided to subject them to beneficial ownership registration. In an example that shows us why transparency is the best disinfectant, we saw the same result as when – as a result of the Panama Papers scandal – New Zealand added more transparency requirements to existing and newly registering New Zealand foreign trusts: many decided to de-register their foreign trusts from New Zealand. In the case of Scottish limited partnerships, their incorporation numbers also went down drastically when beneficial ownership registration was added, as shown by Global Witness:

But here’s how our Financial Secrecy Index principle on the weakest link/worst case scenario applies in reality. Apparently, the UK “forgot” that Scotland is not the only country in the UK. While beneficial ownership registration started to apply to Scottish limited partnerships, this wasn’t extended to those from Northern Ireland and England. And now we see the consequence, as reported by the Herald in Scotland:

“The result was a 79 per cent reduction in registrations of Scottish limited partnerships but respective 142 per cent and 22 per cent rises in English and Northern Irish ones” (emphasis added)

While we hope the UK will extend beneficial ownership registration requirements to all legal vehicles (including limited partnerships, foundations and trusts), we’re also sad to see that the index is right: that transparency weaknesses are exploited, and that’s exactly why governments must only pass and implement regulations that are free from loopholes or exemptions, not only in the UK but in all countries and territories.

Tax Justice Network’s team of “regulatory hackers” will keep monitoring this, raising awareness and hoping we’ll get heard.

Related articles

Malta: the EU’s secret tax sieve

The tax justice stories that defined 2025

2025: The year tax justice became part of the world’s problem-solving infrastructure

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations

Tackling Profit Shifting in the Oil and Gas Sector for a Just Transition

Follow the money: Rethinking geographical risk assessment in money laundering

Democracy, Natural Resources, and the use of Tax Havens by Firms in Emerging Markets

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

The Financial Secrecy Index, a cherished tool for policy research across the globe