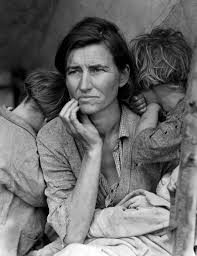

Naomi Fowler ■ Women, tax and equality: yet again, the burden is disproportionately borne by women

The impacts on gender of tax and spending decisions made by governments although important are often little understood by decision makers. As the UK government sets out its autumn statement the Women’s Budget Group is seeking to promote understanding of this issue.

Earlier this year, the Women’s Budget Group has released a report laying out concerns about the direction of travel around the UK government policy on tax and spend. The fundamental message in their analysis – that there is little recognition and understanding of the impact of specific tax cuts and austerity measures on women – is mirrored the world over where the orthodox thinking on fiscal policy heaps tax burdens on women, diminishes public services most accessed by women and/or replaced by them, and undermines their economic independence.

Since then, the Women’s Budget Group has also set up what they’re calling the May Monitor, which seeks to hold Prime Minister May to account over her promises to implement economic policies that serve everyone.

Some tentative steps in the right direction are being made. The May Government has announced an ‘inequality audit’ meant to use data to assess inequality of all kinds in relation to performance on the delivery of a range of services. But the Women and Equalities Select Committee thinks they should go much further. They’ve called for an independent inquiry into why the government hasn’t published a proper analysis of how its spending plans will affect women, minorities and disabled people. We feel that’s imperative, and not only in the UK.

The issue is a serious one. When the Women’s Budget Group crunched the data they found that women will be far more negatively affected by today’s political choices on tax and benefits than men. According to their research women will have bourne 85% of the burden of the changes to the tax and benefits system by 2020. By that time, the tax and benefit changes will have hit women’s incomes twice as hard as men and they’ll be an estimated £1,003 a year worse off by 2020 on average; for men, this figure is £555.

This report is a timely reminder of the importance of this issue and is well worth reading. You can find it here. Governments have been very slow to recognise and try to avoid these impacts on women. We’ll be watching and covering the under-reported effects of tax on women and equality a lot in the coming months and years.

Related articles

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

The tax justice stories that defined 2025

Let’s make Elon Musk the world’s richest man this Christmas!

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025

The myth-buster’s guide to the “millionaire exodus” scare story