Nick Shaxson ■ Mossack Fonseca: why so few American clients? (Hold the conspiracy theories)

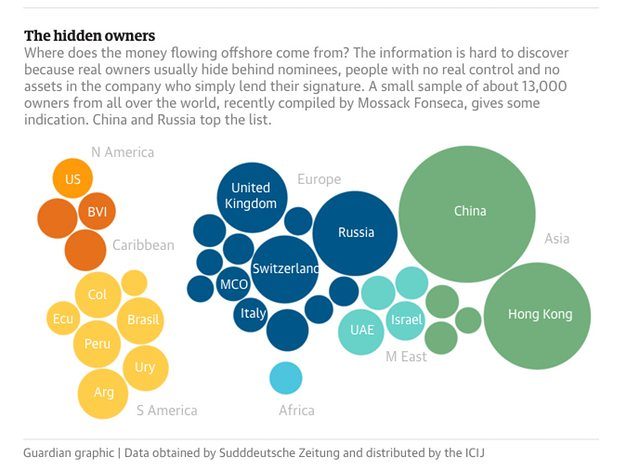

There has been a lot of buzz about one aspect of the Panama Papers: why have so few U.S. citizens been exposed in these leaks? Panama was set up originally as a country – and as a tax haven — with the help of U.S. financial interests, and it has been substantially within the U.S. orbit (mainly with the purpose of keeping influence over the Panama Canal.)

There are all kinds of theories doing the rounds (of course) about CIA plots and other skulduggery to explain this anomaly, but we think other factors are more likely to explain it.

First, with 11.5 million documents, the biggest public data leak in world history, this show isn’t over. There will surely be plenty more to come, and it’s too early to say definitively how many U.S. people have been exposed.

Second, most U.S. citizens have a wealth of tax havens to choose from in their own back yard: from the reassuringly British BVI (British Virgin Islands) to Bermuda to the Bahamas — to the United States’ own secrecy states such as Delaware and Nevada. These places are not known for widespread, out of control vice and corruption: but Panama is. Why would a U.S. person stash their money in Spanish-speaking, unstable, outlandinsh and frankly scary Panama, when they could put it in places with a much better reputation — and where they speak not only English, but in many cases the Queen’s own English?

Third, even if you were to come to Panama, a non-Hispanic U.S. person would be likely to choose some of the law firms with more reassuringly English-sounding names, such as those you can find if you scroll down this list.

Fourth, from the words of Ramon Fonseca himself, via the Associated Press:

“Few American names have cropped up in the “Panama Papers,” a trove of 11.5 million confidential records detailing such accounts. That’s because the Panama-based Mossack Fonseca law firm at the center of the scandal doesn’t like taking on American clients, one of its founders says.

Ramon Fonseca, who started the firm with Jurgen Mossack, told The Associated Press in an interview Thursday that their law firm has only a handful of American clients, most of them members of Panama’s burgeoning expat retirement community. It’s not out of any anti-Americanism or fear of the Internal Revenue Service.

“My partner is German, and I lived in Europe, and our focus has always been the European and Latin American market,” Fonseca said at his law office. “As a policy we prefer not to have American clients.”

We would hesitate to believe much that this crime facilitator says, but this is a perfectly plausible explanation. If you are a law firm you can either take U.S. clients wholesale or you take few or none of them, because you’ll need to put considerable organisational resources into understanding that country and its complex tax system and laws. So it may well make sense to have a policy of not catering to certain countries, purely from this standpoint.

Fifth, in a related point, there are plenty of offshore players now who are scared of taking on U.S. clients. They’ve seen what the U.S. justice department has done to Swiss banks – and they don’t want to risk that kind of heat.

Sixth, there have been some U.S. names turning up: see here.

We don’t think the conspiracy theories are necessary at this point.

Related articles

Malta: the EU’s secret tax sieve

The tax justice stories that defined 2025

2025: The year tax justice became part of the world’s problem-solving infrastructure

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations

Tackling Profit Shifting in the Oil and Gas Sector for a Just Transition

Follow the money: Rethinking geographical risk assessment in money laundering

Democracy, Natural Resources, and the use of Tax Havens by Firms in Emerging Markets

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

The Financial Secrecy Index, a cherished tool for policy research across the globe

This is weak. I haven’t visited the Tax Justice Network in some time. Just the fact that you’re passing on the sketchy ICIJ’s articles without hesitation or comment (I haven’t spend a whole lot of time on the site, but that fact I’ve established) is enough to sour me on an org I thought could do little wrong. How did it happen? Are you guys really okay with George Soros and USAID? Really?

I felt there was a pro-USA bias to the reporting, when the ICIJ made some of the information public on the 4th April. Especially as they showed Putin predominately on some of their images. Also the Süddeutsche Zeitung and Guardian ran stories concentrating on Putin, even though it is not actually mentioned in the leaks?

Then there is the issue, that they will not release all the information into the public realm. What is it, they do not want the public to know?

Let me guess. You have members who belong to the crooked ICIJ?

Let me guess. you work for . . .

Creating offshore entities to escape high U.S. income taxes at least seem to involve legal business activities and a relatively simple tax avoidance strategy. What should be troubling American citizens is the creation of a more sophisticated international tax exempt “charitable” foundation, “the Hillary, Bill & Chelsea Foundation”, designed to provide cover for political influence peddling and to actually finance the Clinton lifestyle and support the mass of Clinton political operatives (http://nypost.com/2015/04/26/charity-watchdog-clinton-foundation-a-slush-fund/ ) The Marc Rich scandal is a one of the prime examples of how to make politics pay and avoid investigation and prosecution for bribery.