Nick Shaxson ■ Tax Justice Research Bulletin 1(6)

June 2015. Surprising everyone by actually arriving within the stated month, here’s the sixth Tax Justice Research Bulletin – a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international tax, available in full over at TJN.

This issue looks at a new paper in The Lancet on the potential links between direct taxation and health outcomes including child mortality; and at research on the suitability or otherwise of accounting data for tax purposes. The Spotlight falls on tobacco taxes, the shameful manipulation of economic arguments by Big Tobacco, and a paper entitled The Single Best Health Policy in the World: Tobacco Taxes.

If this issue were any more health-y, you could put a vest on it and send it out to do a half-Iron Man with Owen Barder.

June’s tune, via Sarah Knott, is Jawad Ahmad’s ‘Bhola kya karey – Wo jiay ya marey’.

Finance For Development: are direct taxes best?

One of the striking differences between the Millennium Development Goals set in 2000, and the post-2015 Sustainable Development Goals, is the latter’s emphasis on domestic resource mobilisation – set against the aid-centricity of the former. While this is welcome (primarily because of the enhanced potential for domestic “ownership” of priorities, and the ensuing political benefits), it does raise a question.

A new paper published in leading health journal, The Lancet, tackles this question. Reeves, Gourtsoyannis, Basu, McCoy, McKee and Stuckler construct a panel of revenue, expenditure and health data for 89 low- and middle-income countries, from 1995-2011, and use it to explore the relevance of different sources of financing.

A new paper published in leading health journal, The Lancet, tackles this question. Reeves, Gourtsoyannis, Basu, McCoy, McKee and Stuckler construct a panel of revenue, expenditure and health data for 89 low- and middle-income countries, from 1995-2011, and use it to explore the relevance of different sources of financing.

They reach two main findings.

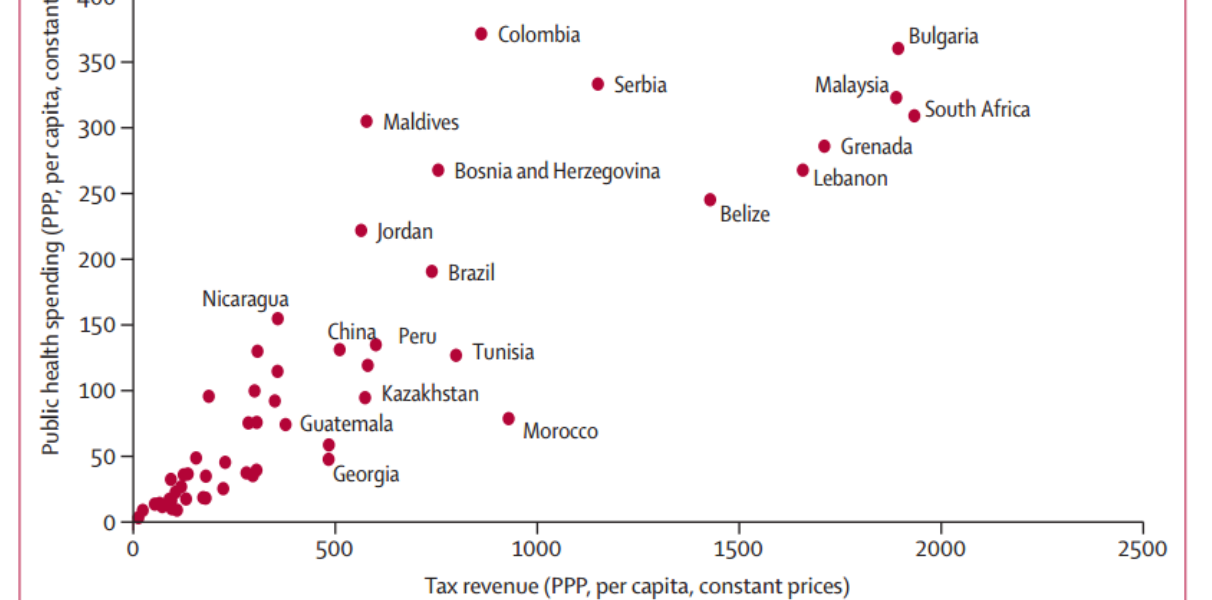

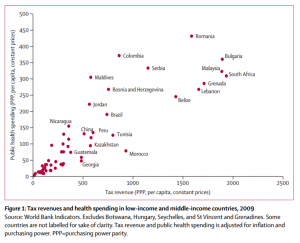

First, as you’d expect, they uncover a fairly strong association between tax revenues and health spending (Figure 1 – click to enlarge): more tax revenue per capita… more public health spending per capita.

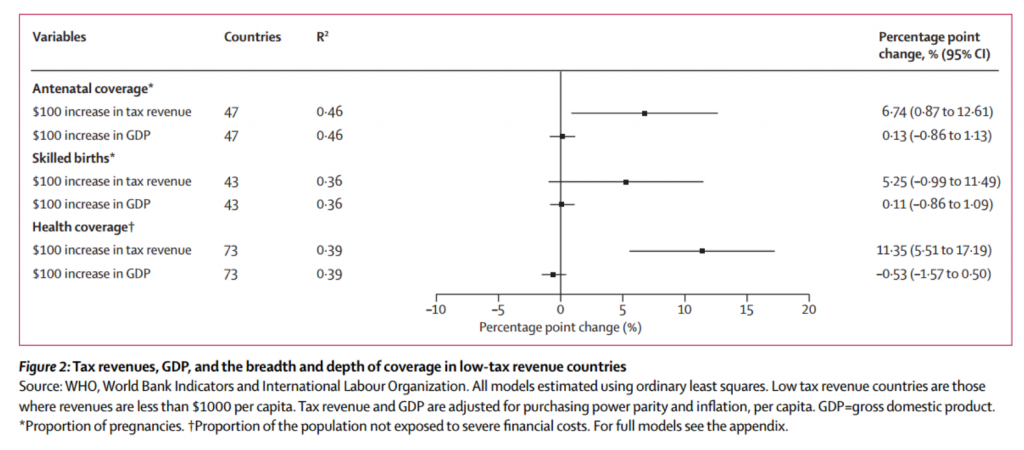

In a simple model, an additional $100 of GDP per capita is associated with $1.86 of extra health spending; while an additional $100 of tax revenue per capita is associated with $9.86 of health spending. There is also (Figure 2) support for impact on health outcomes.

In a simple model, an additional $100 of GDP per capita is associated with $1.86 of extra health spending; while an additional $100 of tax revenue per capita is associated with $9.86 of health spending. There is also (Figure 2) support for impact on health outcomes.

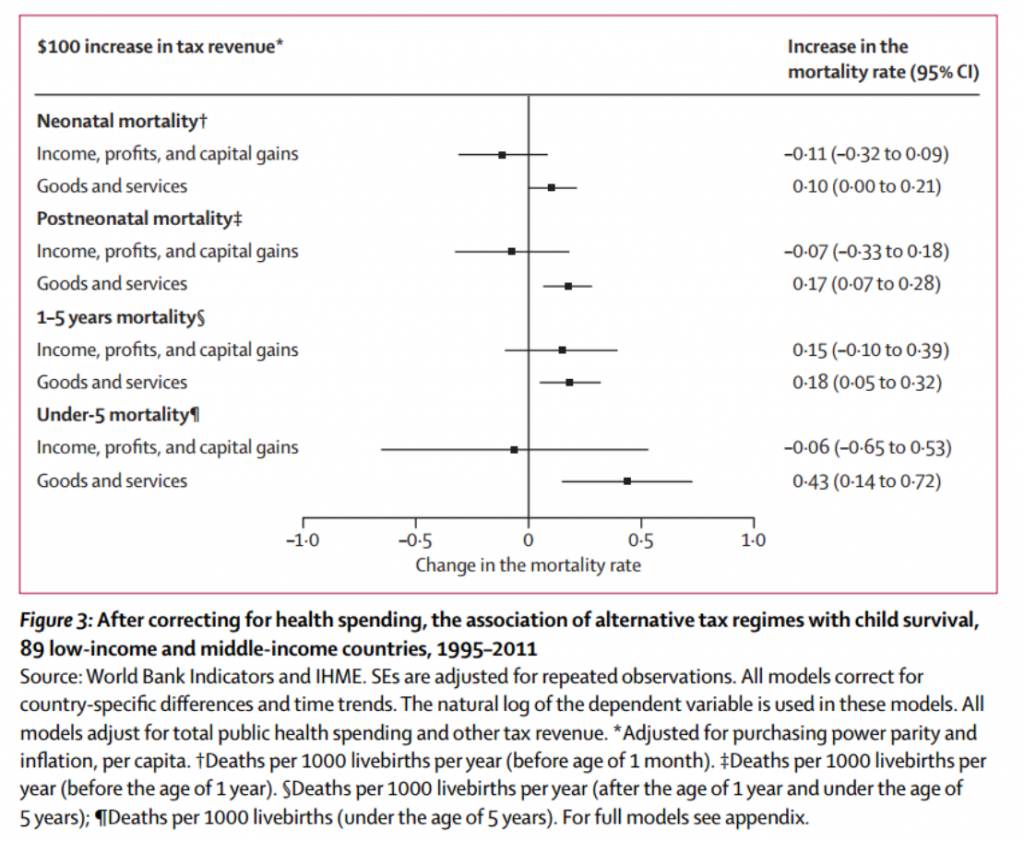

Second, the authors find that the association hinges on direct tax in particular. They find that $100 of direct tax revenue per capita is associated with $16 of public health spending; whereas consumption and other taxes appear to have a small negative association. Most strikingly (Figure 3) there is an association between consumption taxes (but not direct taxes) and mortality outcomes.

What should we make of these results? (Does VAT kill children?) The authors are cautious about the limitations of World Bank tax data, and about direct causal interpretations of the results. But perhaps still more caution is needed.

Broadly speaking, we expect direct taxes (on income, profits and capital gains) to be more progressive than taxes on consumption – since households with lower incomes inevitably consume more of their income. In addition, there is some evidence to suggest that direct taxes are the most powerful in driving governance improvements associated with greater reliance on tax revenues rather than say natural resources or aid – on which, see Mick Moore’s really useful, critical survey in this ebook. So if direct taxes are a progressive tool associated with better governance, should we expect also to see better public spending outcomes?

Perhaps, and maybe even probably; but let’s be careful. Correlation and causation again. If governments are more or less interested in progressive taxation, and more or less interested in universal service provision, we’d expect those to line up so that governments favouring progressive tax will generally also deliver more broad-based improvements in (e.g.) health. But that’s not the same as saying that if all governments increased direct taxes (by diktat, or from changes in international norms, or – say – improvements in the transparency of multinationals), that they would also all focus more on health improvements.

We know that there are strong correlations between GDP per capita and tax/GDP. We know, too, that this holds most strongly for direct taxes. In addition, the sample period covers what is probably the peak of the “tax consensus” which inter alia encouraged consumption taxes above all others, and the relative neglect of direct taxes. In general, such advice was most powerfully passed into policy in those countries with least capacity and least political space to resist.

By and large, then, we’d expect to see that countries with the lowest per capita incomes and the weakest states exhibit not only low public health spending and poor outcomes, but also low tax revenues and relatively high reliance on consumption tax rather than direct tax — without there necessarily being any link from tax choices to spending outcomes…

This paper is a thought-provoking contribution, but due both to data weaknesses and to the difficulties of establishing causality, it can’t be more than suggestive. The challenge for further research is to address, as far as possible, these two issues. We can’t show that specific tax policies necessarily deliver different spending policies or outcomes (these are separate policy choices); but we may be able to demonstrate the associations more strongly, not least by allowing more effectively for the causal roles of per capita GDP and state capacity, and/or by focusing on specific moments of policy change to understand the effects.

Big Tobacco and the world’s single best health policy

Tobacco tax has been largely overlooked in tax justice discussions – perhaps because it’s a relatively niche issue compared to income tax, for example. But there are important reasons why we should see tobacco tax as a significant justice issue, and there may be important political lessons to learn about how leading opponents of effective taxation operate.

My erstwhile CGD colleague Bill Savedoff and Albert Alwang have just published a powerful paper whose title says it all: “The Single Best Health Policy in the World: Tobacco Taxes.”

The authors survey the substantial literature and set out the key findings. Very briefly:

- tobacco taxes are ‘the single most cost effective way to save lives in developing countries’;

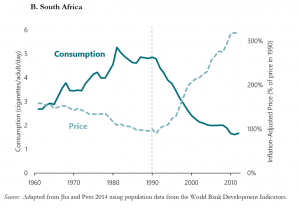

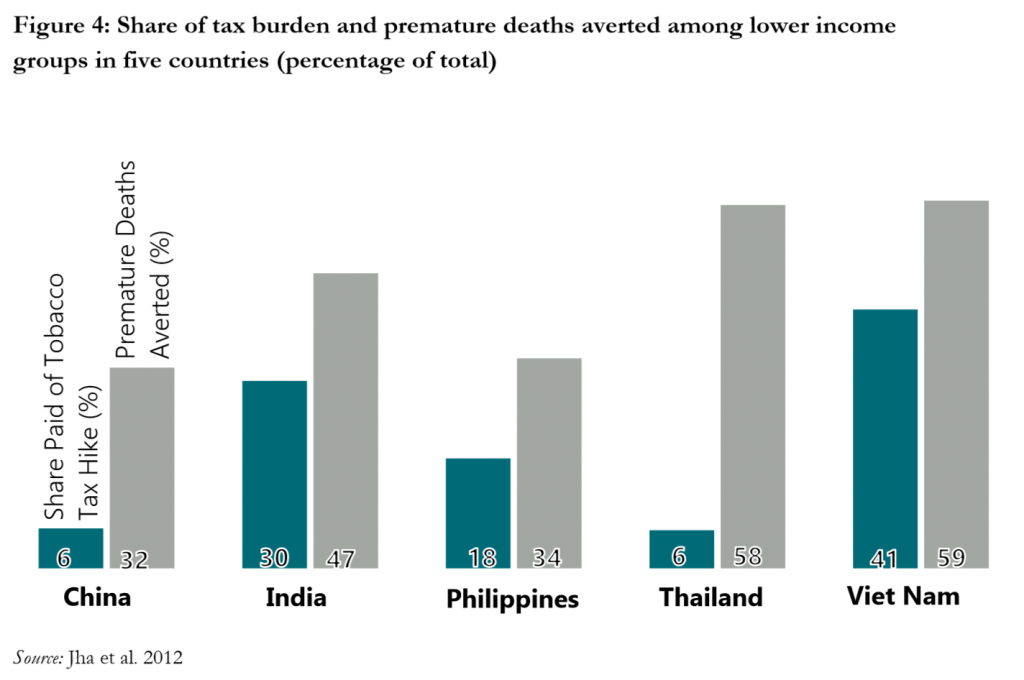

- the benefits in terms of premature deaths avoided accrue disproportionately to the poorest people (Figure 4);

- substantial revenues can also be raised; and

- we know what effective (and ineffective) tobacco taxes look like.

Why then are the appropriate policies not being pursued in more countries? Savedoff and Alwang address this question too (p.13):

Why then are the appropriate policies not being pursued in more countries? Savedoff and Alwang address this question too (p.13):

“Tobacco companies have undermined public health efforts to save hundreds of millions of lives by delaying the introduction of tobacco taxes, reducing tax rates, or advising countries to adopt tax policies that are less effective at reducing tobacco consumption. They do so by promoting false or exaggerated concerns related to the effect of tobacco taxes on employment, government revenues, poor people and smuggling.”

Those ‘concerns’ include:

- The claim that other (less effective) approaches are better than tax;

- The claim that other (less effective) tax approaches may be better for revenue;

- The claim that tobacco taxes are regressive, and ultimately borne most by households that policymakers (should) care about; and

- The claim that tobacco tax will increase illicit tobacco (a phenomenon for which only tobacco companies have been found guilty, repeatedly over time and across the world).

No prizes, I’m afraid, for identifying parallels with some of the more extreme lobbying against multinational corporation tax/transparency measures.

Where these tactics have been successful despite the evidence, it is in large part because the tobacco lobby’s power is unmatched – and it is difficult to create an equivalently focused counter-lobby in defence of those unknown people who will lose their lives unnecessarily in the future.

The need for more effective coordination of advocacy for effective tobacco taxes is clear; where it will come from is not, despite important efforts from Bloomberg Philanthropy and the Gates Foundation. Does it fall to a handful of foundations to take on big tobacco around the world? Where are the World Bank and IMF? Where are leading development donor countries which have done much to reduce their own tobacco consumption?

And where is TJN? Well, watch this space. And let me know if you might want to be involved in something. (See also this post on big tobacco’s influence on World No Tobacco Day, a version of which has just been published in the Philippines daily, BusinessWorld.)

Accounting data: a tool for obscuring and manipulating tax data?

One of many happy things about the Tax Justice Network is the range of experts involved, by discipline and by professional background. And one of the great things this gives rise to is analysis that is often so far ahead of the immediate public policy discussion that you might not even be able to see it from over there. For example…

Two TJN stalwarts from the accounting side – one an academic, Prof. Prem Sikka, and the other practitioner-turned-campaigner, Richard Murphy – have come together to address the prickly question of whether accounting data can actually be part of the solution to the corporate tax base erosion and profit shifting of multinationals.

Their working paper is published by the International Centre for Tax and Development, in its important series addressing unitary taxation. [Full disclosure, just in case it’s not completely clear already that I’m biased: I have an unrelated paper in that project, and am working with the ICTD on other stuff too.]

A little background: TJN started up in 2003 with a project to promote country-by-country reporting by multinationals (notably, Richard’s draft standard), as a major transparency tool to limit tax abuse. Since then this esoteric proposal has moved steadily from the extremist fringes to centre stage, with the 2013 meetings of the G8 and G20 directing the OECD to produce such a standard for global use.

One effect of this is that accounting data has probably become more central to high-level political proposals (and scrutiny) than – well, perhaps ever. (I still remember a meeting of the International Accounting Standards Board in the mid-late 2000s, marked by the then-revolutionary presence of NGOs which pointed the way forward to that greater public interest. Happy days…)

The tendency, conscious or otherwise, has been to assume that accounting data is accurate (though not necessarily addressing the right things), and at least broadly consistent across jurisdictions. As such, it can provide the basis for powerful measure such as country-by-country reporting (for both red-flagging by tax authorities, and holding to account by civil society).

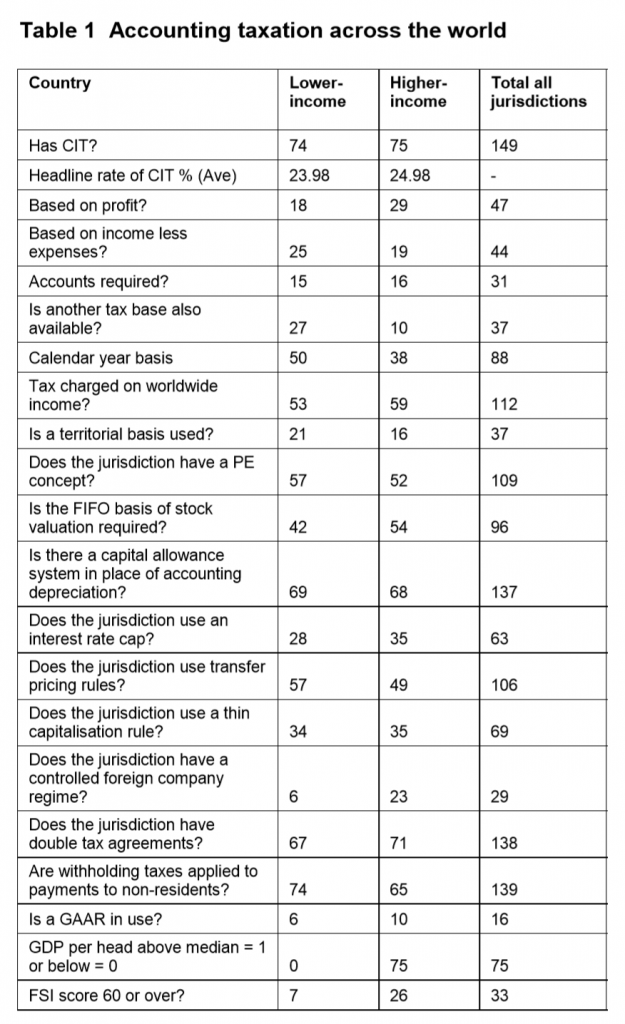

But if there’s one, top line message from the new Sikka & Murphy (2015), it’s this: accounting data does not at present provide a good basis for this greater understanding of tax. Rather, accounting data not only provides a means by which tax positions can be obscured from view; it also provides an additional vector by which tax positions can be manipulated.

But if there’s one, top line message from the new Sikka & Murphy (2015), it’s this: accounting data does not at present provide a good basis for this greater understanding of tax. Rather, accounting data not only provides a means by which tax positions can be obscured from view; it also provides an additional vector by which tax positions can be manipulated.

How so? The abridged Table 1 gives a sense of it (scroll down or click for larger version). The differences around the world in accounting treatment for tax purposes are manifold and fundamental. The opportunities are legion for multinationals to exploit differences in national treatment, in order to achieve preferred global tax outcomes.

Now since “no jurisdiction which we can identify relies upon unadjusted traditional accounting profit as a basis for the taxation of corporate income”, and reliance on International Financial Reporting Standards would exacerbate not ameliorate the problem, the authors argue that “tax-specific measures of income and expenses for taxation purposes need to be defined” – not least, for any proposal for a full shift towards unitary taxation of MNEs. Their specific suggestion is this:

“[W]e think it possible that a taxation base for unitary taxation that is broadly, but not precisely, equivalent to the accounting concept of EBITDA (Earnings Before Interest, Taxation, Depreciation and Amortisation) could be developed. This resulting tax base before offset of locally-determined allowances could then be apportioned in accordance with a formula that is likely to exclude assets, because relief for expenditure on capital will be given locally and capital costs do not therefore need to be considered for formula purposes.”

Even more than usual, this summary is nowhere close to doing justice to the deep and rich set of questions that the paper raises. It’s a difficult paper, technically challenging in more than one way and requiring the reader to think well ahead. And it’s an important paper. We may not hear much about it for a while, but it wouldn’t be at all surprising to see it being referred back to as a foundational piece of problematisation in years to come.

Endpiece

The main research event of the month, nay the year, is the TJN annual research workshop at City University, which you’ve either just attended (great to see you!) or just missed (boo).

This year’s thematic focus was on the flawed notion of “competition” between nation states, and there’s a cracking set of papers from a whole range of disciplines (from philosophy to accounting) and backgrounds (including practitioners, civil society researchers and academics from universities from Hong Kong to Barcelona); and touching on all sorts of tax and non-tax aspects of ‘competition’, with insights into everything from Guernsey’s dominant investment position in annexed Crimea, to the ‘voluntariness’ of migration; and from regulatory responses of commodity traders to the role of KPMG in systemic regulatory arbitrage.

The workshop ended with a really engaged discussion about the relative merits of taking on the entire logic of state competition, versus the practical value of keeping focus on tax.

There’s certainly an important challenge in reclaiming the word ‘competition’ in this context, which has been used almost as a synonym for ‘no government intervention’ – when ensuring competition may well require greater intervention, in order to prevent power abuses leading to further concentration. The creators of the ‘Global Competitiveness Index’, for example, probably don’t see themselves as advocates for a world regulatory body, preventing unfair competition between states…

Submissions for the Bulletin, including tax-related melodic suggestions, are most welcome.

Related articles

Do it like a tax haven: deny 24,000 children an education to send 2 to school

Incorporate Gender-Transformative Provisions into the UN Tax Convention

Just Transition and Human Rights: Response to the call for input by the Office of the UN High Commissioner for Human Rights

13 January 2025

Tax Justice transformational moments of 2024

The Tax Justice Network’s most read pieces of 2024

Stolen Futures: Our new report on tax justice and the Right to Education

Stolen futures: the impacts of tax injustice on the Right to Education

31 October 2024

CERD submission: Racialised impacts of UK’s ‘second empire’

UN submission sets out racist impacts of UK’s ‘second empire’