Nick Shaxson ■ Are European Union finance ministers about to deliver another stitch-up on corporate tax?

Update 3, June 21. The EU Press Release is here. Scornful comments continue to circulate.

Update 2: This blog is turning into a series of updates in *italics*, with the original background discussion in plain text underneath. Currently, the situation is uncertain – two hours ago, Jeroen Dijsselbloem, the president of Ecofin, tweeted:

Jeroen Dijsselbloem ?@J_Dijsselbloem 2h

#ECOFIN hope for a deal on the #ATAD-discussions on Monday #EU2016NL

So things are not decided yet. Meanwhile, one of our commenters, watching this situation unfold, has added:

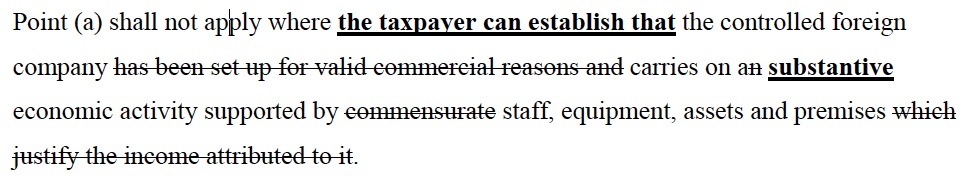

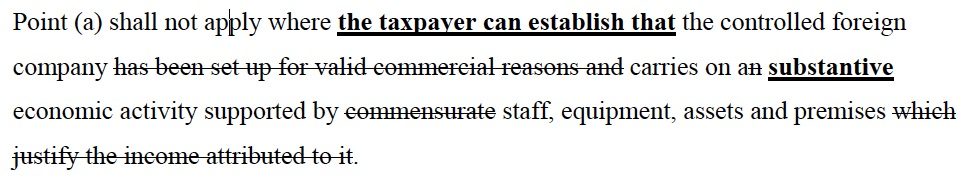

Note that the text of CFC rules has slightly changed compared to the text in the blog, the text “the taxpayer can establish that” have been deleted again. That only further weakens the already useless compromise text.

While the CFC rules against parking profits in tax havens have been watered down, the other BEPS elements have been sabotaged too.

The limitation of interest deductions was weak to start with, but member states can now delay implementation for five year, and existing loans used for profit shifting are exempt until they mature. Like Tove, Lotta and Sol already noted, some member states said they first want an OECD agreement that all OECD members have to implement this, but there is no initiative whatsoever to upgrade the argeed OECD BEPS “common approach” on limiting interest deductions to a “minimum standard”.

The rules against hybrid mismatches, which are situations where profits end up in between two countries and remain untaxed, were incomplete to start with. Although the OECD has clearly spelled out a common approach that can be applied unilaterally as well as bilaterally between any two countries, the proposed compromise only addresses mismatches between two EU countries. The EC will come with a proposal to address mismatches between an EU country and a third country later this year.

In short, EU ministers of finance have completely sabotaged three key OECD BEPS actions – however, it is still possible that after the weekend, it will turn out there is no deal yet.

For those interested, here is the link to all public statements by ministers of finance in the morning:

http://video.consilium.europa.eu/en/webcast/6ab6c51a-afdc-4a41-8192-0415600f1b7e

And here is the link to the press conference this afternoon:

http://video.consilium.europa.eu/en/webcast/2519ce6f-446f-4325-84d5-0c5e1b6a71c1

Update 1: June 17th. Another commentator on this continuing email thread:

“The public debate on ATAD [the EU Anti Tax Avoidance Directive] is over for now, and ministers will try to reach final agreement on some of the outstanding issues. We expect them to reach an agreement later this afternoon. The press conference is scheduled for 16:30 CET and can be watched live here.”

Sol Picciotto, said, based on what is known so far:

“The whole package is now so weak that it is clear that governments want to continue their tax competition games, and are not serious about corporate taxation.”

Another email commentator:

“I hope everyone’s filling up their buckets of scorn, ready to be poured all over the outcome when it’s finally announced! It is pathetic, isn’t it.”

Original blog:

We’ve just received this, via email:

“Tomorrow, the EU Ministers of Finance will meet in the Ecofin Council in Luxembourg. Probably they will reach political agreement on the EU Anti-Tax Avoidance Directive. Confirming . . . fears, the so-called CFC rules against parking profits in tax havens have been watered down to something completely useless. And I mean COMPLETELY useless.”

All this, on the eve of a possible “Brexit” referendum, fired ultimately by anger at an establishment consensus that is viewed as out of touch with ordinary people (read this brilliant short analysis on that). What a spectacular folly this tax move would turn out to be, if things unfold here as feared.

The full text of the presidency compromise for the directive is available here (For other languages, change the /en/ in the link into /de/, /fr/ etc.) This is a summary, from the same commentator, of how ghastly it all is:

“To escape the new rules, multinationals only have to show that their tax haven subsidiaries (the CFCs) conduct some real economic activity, never mind if that’s just washing the windows of each other’s offices, and then the tax haven subsidiaries will completely get off the hook, even if they also happen to be destinations for billions of profits that are artificially shifted there.”

And here is what that particular stitch-up looks like, from the text itself.

There are discussions about two articles in the text, — 8(2)(a) and 8(2)(b), if you’re into that level of detail — which member states can choose between. The weakest of the two, as the same commentator continued:

“requires a tax authority to prove that profits of a tax haven subsidiary result from completely artificial arrangements, and it only applies to profits shifted out of the parent country. Thus, both types are completely useless against profit shifting out of developing countries.”

But there is at least some hope: Diarmid OSullivan, a different commentator on this email trail said:

“We’re getting mixed reports about whether the Council will actually agree this proposal tomorrow, though. The CFC rules seem to have been very contentious.”

And a third commentator, Sol Picciotto, adds:

“Maybe at some point MNE [multinational] CEOs will decide this whole mess has got out of hand and they will sack their tax advisers and start supporting CCCTB and unitary taxation!”

See Prof. Sol Picciotto’s new post on unitary tax; see also this Fools’ Gold post, looking at the UK government’s role in all this, pointing to a post by Diarmid O’Sullivan of Actionaid, exposing Britain’s role in all this, with plenty of background.

Related articles

Vulnerabilities to illicit financial flows: complementing national risk assessments

A tax justice lens on Palestine

New article explores why the fight for beneficial ownership transparency isn’t over

UN Submission: A Roadmap for Eradicating Poverty Beyond Growth

A human rights economy: what it is and why we need it

Strengthening Africa’s tax governance: reflections on the Lusaka country by country reporting workshop

Do it like a tax haven: deny 24,000 children an education to send 2 to school

Urgent call to action: UN Member States must step up with financial contributions to advance the UN Framework Convention on International Tax Cooperation

Incorporate Gender-Transformative Provisions into the UN Tax Convention

Asset beneficial ownership – Enforcing wealth tax & other positive spillover effects

4 March 2025