Nick Shaxson ■ Taxing tax havens – Foreign Affairs article

TJN Senior Adviser James S. Henry has an article in the latest edition of Foreign Affairs entitled Taxing Tax Havens: How to Respond to the Panama Papers. It makes the point, as we have, that the tax havens are about so much more than tax, and then adds that much of the wealth supposedly stashed in these places is actually not there.

“Most of this wealth is not actually invested in the treasure islands themselves. The reason is simple: the very things that make the islands good places to stash money also make them dangerous places to do so. They generally have tiny capital markets and loose financial regulations; they are home to regulators, police, and judges who are not quite as impervious to back-door influences as First World enforcers. So offshore investors are generally unwilling to trust such places with large amounts of their financial wealth.”

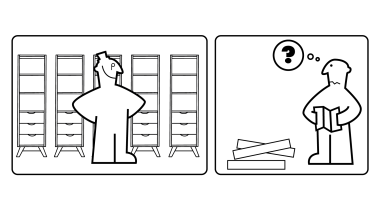

The smaller havens are way stations.

“That helps explain why most offshore wealth winds up being routed by way of treasure islands to the ultimate havens—First World financial centers such as New York, London, Zurich, Geneva, Frankfurt, and, to a lesser extent, Singapore, Hong Kong, and Dubai. It is these ultimate havens, and not the archipelago of offshore conduits or treasure islands, that is the final resting place for the vast bulk of so-called offshore private wealth.”

And for similar reasons, he argues that the clients prefer larger, more solid banking institutions and private enablers to help them hide their wealth.

“Many wealthy offshore investors are surprisingly risk averse when it comes to managing their offshore wealth, which they tend to regard as a nest egg, to be relied on if their base businesses go bust. To be cautious, therefore, they tend to favor larger, more established financial institutions that can usually—not always—be counted on to safeguard their wealth even at long distances. In other words, they look for the banks that are too big to fail.”

The silver lining here is that their size and clout means they can be regulated, if the political will can be found. Which is a big ‘if’ – but a somewhat smaller ‘if’ than before the Panama Papers exploded into the world’s consciousness.

For Henry’s key proposals for reform, read on here.

Related articles

The Tax Justice Network’s most read pieces of 2024

Stolen Futures: Our new report on tax justice and the Right to Education

Stolen futures: the impacts of tax injustice on the Right to Education

31 October 2024

CERD submission: Racialised impacts of UK’s ‘second empire’

UN submission sets out racist impacts of UK’s ‘second empire’

Infographic: The extreme wealth of the superrich is making our economies insecure

Wiki: How to tax the superrich (with pictures)

Taxing extreme wealth: what countries around the world could gain from progressive wealth taxes

19 August 2024

A Call for Climate and Social Justice: Why Europe Needs a Wealth Tax

Taxhaven Rothschild Trust North America LLC 100 W Liberty St, 10th floor. Reno, NV 89501 USA Telephone: +1 775 398 7403. for excellent service above €5 million