Nick Shaxson ■ Goodbye UK Patent Box – don’t let the door hit you on your way out

Updated with substantial and important analysis at the bottom, which raises a new and crucial question about whether the world’s media has swallowed a load of spin:

Last month two TJN-related authors, David Quentin and Nicholas Shaxson, had a piece on the Naked Capitalism site entitled The “Patent Box” – Proof That the UK is a Rogue State in Corporate Tax. The article was based on an original post by David Quentin entitled The UK’s “Patent Box” – a really nasty, disingenuous and hypocritical piece of tax law.

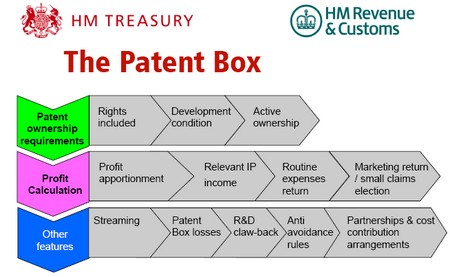

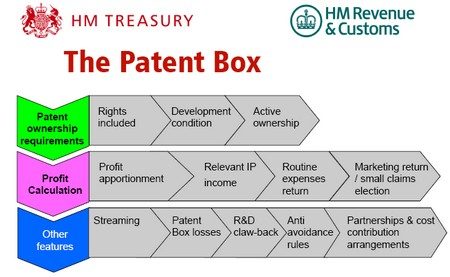

The Patent Box is a tax incentive that reduces the effective UK corporation tax rate to 10 percent (as compared to 21 percent for the headline corporate tax rate) on income attributable to patents, subject to certain conditions. It was introduced last year with this eye-watering claim by David Gauke, Financial Secretary to the Treasury:

“I reject any suggestion that the UK’s Patent Box facilitates profit shifting.”

Of course not Mr. Gauke. It’s shuffling, not shifting.

Now we’ve had news that the UK has decided to “water down” its patent box regime under pressure from Germany, which like many civilised countries views such wheezes as nasty, disingenuous and hypocritical pieces of tax law. These scams supposedly made the UK more “competitive”, but as we’ve shown on several occasions, such claims are nonsense.

Now Quentin has a new blog whose headline we’ve borrowed here: Goodbye Patent Box – don’t let the door hit you on your way out. It makes some interesting points, noting that the fine print of the agreement is that the UK will abolish its patent box regime.

The relevant paragraph says:

“Closure and Abolition of IP Regimes – to allow time for the legislative process, all existing regimes will be closed to new entrants (products and patents) in June 2016. These schemes will be abolished by June 2021.”

That’s pretty clear, and the world’s media seems to have accepted this package overall as a watering down of the UK’s patent box regime.

But – and it’s a big one – the joint UK-German is nastily cryptic on what’s actually going on here – will the patent box be brought back in through the back door, in the guise of something else? Informed sources have now alerted us to the possibility that there is something nasty afoot.

That will be the subject of our next blog (update: now available).

In the meantime, the rest of Quentin’s latest blog is worth pointing to:

“The ostensible idea behind patent box regimes (which is the name given to a reduced rate of tax for profits derived from intellectual property) is to be “competitive” but of course if everyone has a patent box then there is no particular competitive advantage in having one and the end result is simply that corporate profits derived from intellectual property don’t get taxed anywhere – very nice for the asset-owning classes of the “developed” world but not much fun for everyone else.

On the face of it these kinds of “competitive” tax practices are a classic prisoner’s dilemma but there is one major difference; in the prisoner’s dilemma the prisoners can’t talk to each other, but jurisdictions can discuss tax policy. And they can even agree not to undermine each other’s tax bases. And that is what Germany has managed to persuade the UK to do.

The business sector could legitimately complain that this is complete chaos. Last week the Patent Box was the jewel in the crown of the UK’s “competitive” corporate tax regime, a few months ago it was seen to be a factor in a 100 billion dollar takeover bid, and now it is no more (or, at least, it won’t be any more in due course). Business sector voices are constantly talking about how, above all, they value “certainty” in tax regimes. Perhaps the UK could mitigate the damage caused by this sudden wild fluctuation in approach to tax policy by announcing that it represents a new ethos rather than realpolitik; that the days of “competitiveness” in this area are conclusively over.

If the current UK government doesn’t want to signal that kind of shift in emphasis away from spurious notions of “competitiveness” and towards genuine engagement in the evolution of an international system of corporate taxation that actually works, then maybe the Labour party could use the idea as a general election pledge for next year. Although they need to be careful how they position themselves, of course, because the Patent Box was their idea.”

Related articles

🔴Live: UN tax negotiations

Joint statement: It’s time for the OECD to walk the talk on human rights

Did we really end offshore tax evasion?

The State of Tax Justice 2024

EU public consultation on the Anti-Avoidance Directive

Indicator deep dive: ‘Royalties’ and ‘Services’

Submission to EU consultation on Anti-Tax Avoidance Directive (ATAD)

6 November 2024

Stolen Futures: Our new report on tax justice and the Right to Education

Stolen futures: the impacts of tax injustice on the Right to Education

31 October 2024

Hide-seek-hide? On the effects of financial secrecy

1 October 2024