John Christensen ■ Unequal Britain: tax system is much less progressive than people believe

More evidence, if this was needed, that people can be fooled most of the time by the repetitive drip, drip feed of tax nonsense coming from much of the media, some parts of academia and think-tanks, and from far too many politicians.

Britain’s Equality Trust has published a report on its survey into public attitudes towards tax and inequality. The good news is that the vast, vast majority of those surveyed felt that the tax system should be more progressive than it is in practice. A whopping 96 percent of those polled were in agreement on this, which serves to emphasise the broad consensus on this matter.

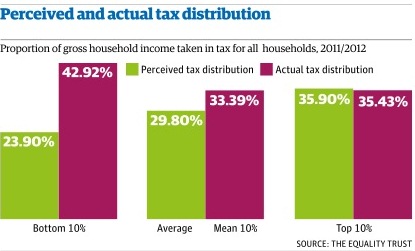

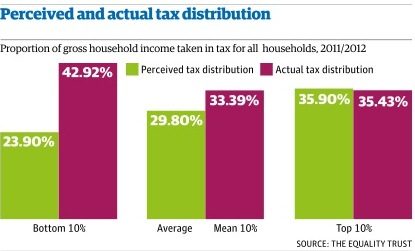

The bad news, however, is that the survey reveals a strongly-rooted public misunderstanding about how heavily taxed poorer households are in practice. As the chart above shows, there is a massive under-estimation in people’s perception of how much tax poorer households pay as a proportion of their gross household income. The public perception is that poorer households pay relatively less than richer households. In truth, the poorer households pay 43 percent of total income in tax, while the richest households pay 35 percent. And bear in mind that the latter also have a huge wealth base to fall back on, so they’re both income and asset rich.

What explains this massive gulf between public perception and the harsh reality? We’d argue that political failure is the real reason; the media might share some of the blame, but politicians should be setting the agenda here and (for the greater part) they simply shy away from discussing progressive tax systems. Its time to change this situation. As The Equality Trust’s director, Duncan Exley said:

“The public are misled about this country’s tax system. They think households with the highest incomes pay more than those with the lowest, whereas the opposite is the case. Even more concerning is how little our current system matches people’s preferences on tax. We’re calling on all parties seeking to form the government from 2015 to commit to the principle that any changes in tax policy are progressive.”

On average the public underestimates the amount of tax paid by the poorest ten percent of households by 19 percentage points, according to the Ipso Mori survey conducted for The Equality Trust.

Read the report here.

Related articles

The myth-buster’s guide to the “millionaire exodus” scare story

Money can’t buy health, but taxes can improve healthcare

The elephant in the room of business & human rights

UN submission: Tax justice and the financing of children’s right to education

14 July 2025

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

Tax justice pays dividends – fair corporate taxation grows jobs, shrinks inequality

UN Submission: A Roadmap for Eradicating Poverty Beyond Growth

A human rights economy: what it is and why we need it

Do it like a tax haven: deny 24,000 children an education to send 2 to school