Global labour group joins call for policymakers to require public country by country reporting from multinational companies

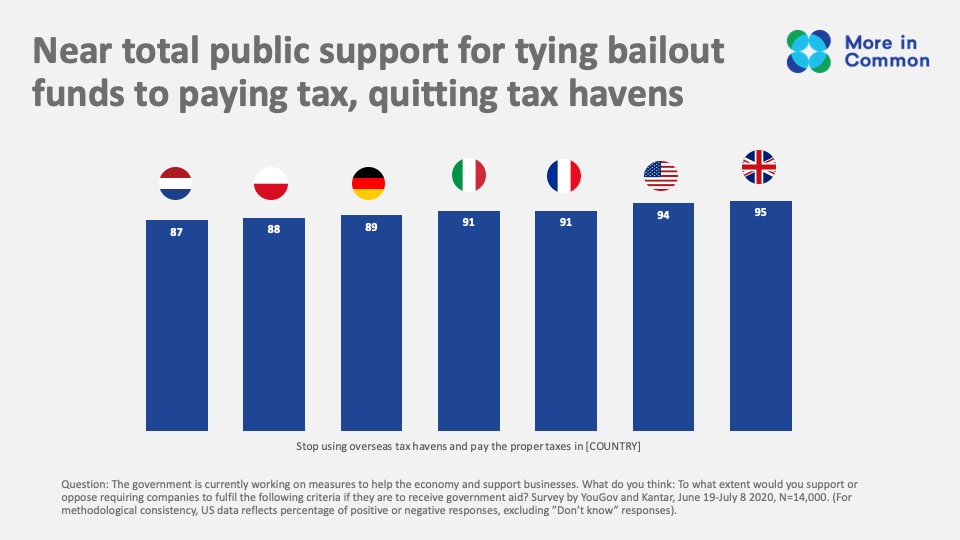

Striking new polling data from seven leading countries shows overwhelming public support for policymakers to crack down on companies using tax havens. The polling, conducted in the USA, France, Germany, Italy, Poland, the Netherlands and the UK, shows unmatched levels of support ranging from 87 per cent to 95 per cent. Participants were asked their views on measures to tie public funds used to bail out companies during the coronavirus pandemic to their record on paying tax, and ending the use of tax havens.

The polling, courtesy of More in Common who commissioned this research as part of a report published today on public attitudes on COVID-19 recovery priorities, was undertaken by YouGov and Kantar (N=14,000, polling took place between June 19 and July 8).1

Now leading labour unions have joined the call to ensure that the first, and critical step taken by policymakers around the world is to require tax transparency from multinational companies. The global union federation Public Services International, with more than 700 affiliates representing 30 million workers in 154 countries has joined with the international Tax Justice Network to call on governments to introduce a requirement for public country by country reporting.

First proposed by the Tax Justice Network in 2003, the method is designed to detect and deter the profit shifting practices multinational firms use, by revealing the misalignments between where multinationals’ sales and employees are located and where their profits are declared for tax purposes. The OECD’s private reporting standard was introduced in 2015, at the request of the G20 group of countries. Earlier this year, the OECD published the first aggregated data from the process, allowing researchers to estimate for the first time that multinationals globally shift approximately $1.3 trillion in profit each year away from the countries where real economic activity takes place and into tax havens.2

Publishing this data at the company level would provide a major breakthrough in the ability of the public to hold governments and multinationals accountable, and reveal the detailed pattern of profit shifting in full – allowing immediate policy action. The OECD standard is under review this year, with investors, labour and activists calling3 for it to converge to the much stronger tax standard of the Global Reporting Initiative (the biggest global setter of sustainability standards).4 That would make the requirement for public reporting even more powerful. Even the ‘big four’ accounting companies, which have long opposed public country by country reporting, have now reversed position. In a rare collaboration at the World Economic Forum, they now propose the GRI standard as a core metric to be adopted into companies’ required financial reporting.5

Analysis of aggregated country by country data recently published by the US’s Internal Revenue Service revealed the EU to be losing $27 billion in corporate tax every year from US firms due to profit shifting enabled by Luxembourg, the Netherlands, Switzerland and the UK – often referred to collectively as the “axis of tax avoidance”.6 Requiring multinational corporations to publicly disclose their country by country reports can raise billions in corporate taxes for countries around the world by exposing and deterring profit shifting.7

Campaigners have repeatedly drawn attention to the multiple costs to society imposed by corporate tax abuse. First, the lower effective tax rate for multinationals distorts the market and undermines competition, tilting the playing field against the smaller and domestic businesses which account for the majority of employment. Second, the lost revenues reduce the funds available for governments to invest in public services – including, crucially, public health. Third, the evidence shows that investors also lose out. When companies aggressively lower their effective tax rate, the returns for shareholders do not rise – but the risks that they bear do increase. Fourth, profit shifting artificially drives down wages as workers are denied access to the share of corporate profits they helped create, through wage bargaining, when profits are hidden in tax havens. Lastly, corporate tax abuse exacerbates the race to the bottom on statutory tax rates, which worsens inequality. Because corporate income tax acts as a backstop for progressive tax more broadly, the lowering of corporate tax rates leads to the erosion of personal income and capital gains tax rates, making the overall tax system more reliant on regressive consumption taxes, and raising inequality.

Rosa Pavanelli, secretary-general at PSI, said:

“These polling figures, from country after country, confirm the public’s great anger at the scale of corporate tax abuse by multinational companies, and the cost to public revenues. This is a direct contributing factor to the shocking underfunding of our public services, which the COVID-19 pandemic has fully exposed. Policymakers must act urgently to stem these losses and support public services – and that starts with simply requiring tax transparency from these companies, many of which are now seeking access to public funds.”

Alex Cobham, chief executive at the Tax Justice Network, said:

“The coronavirus pandemic has exposed the grave costs of an international tax system programmed to prioritise the interests of corporate giants over the needs of people. Now more than ever, governments must reprogramme their tax systems to prioritise people’s wellbeing. They can start today, right now, by making it a requirement for multinational firms to publish their country by country reporting. Many countries already require multinational firms to submit country by country reports privately to their tax authorities and the evidence shows that simply making that data public can curb corporate tax abuses and raise substantial public revenues. As this new polling confims, there is overwhelming public demand to end corporate tax abuse – public country by country reporting is the necessary first step, and policymakers can deliver it today.”

-ENDS-

Contact the press team: [email protected] or +44 (0)7562 403078

Notes to Editor:

- More in Common’s report, The New Normal, is available here: www.moreincommon.com/newnormal/

- Multinationals shift $1.3tn into tax havens every year, groundbreaking analysis reveals

- Investors demand OECD tax transparency

- Businesses, campaigners back GRI tax standard to tackle $500bn corporate tax abuse epidemic

- Deloitte, EY, KPMG and PwC: “Toward Common Metrics and Consistent Reporting of Sustainable Value Creation”

- EU loses over $27 billion in corporate tax a year to UK, Switzerland, Luxembourg and Netherlands

- UK u-turns on commitment to country by country reporting, giving up £10 billion in corporate tax