Tax Justice Network ■ New book provides practical solutions to make tax work to reduce poverty

We’re delighted to announce a new book: Tax Justice and Global Inequality: Practical Solutions to Protect Developing Country Tax Revenues, edited by Krishen Mehta, Erika Dayle Siu and Esther Shubert, published by Zed Books and featuring contributions from many leading thinkers in the field. The following post, by Erika Dayle Siu and Krishen Mehta (who is also a board member of the Tax Justice Network), introduces the key issues and contributors.

In Myanmar, 50 out of every 1,000 children that are born die before the age of 5; in Norway the equivalent number is 2. In Equatorial Guinea 342 women die in childbirth for every 100,000 births; in France, the equivalent number is 8. In Japan, 100% of the primary school age children are enrolled in school; in West and Central Africa, more than 25% of the children are not enrolled in any school at all.

There are many reasons for the current situation, and there is no doubt that poor management, lack of transparency in governance, and the role of local elites contribute to the problem. But the existence of limited resources to meet their needs is foundational. Corruption, and the resultant competition for limited resources, is a natural outcome of the lack of resources.

What are some of the future consequences of such extreme poverty?

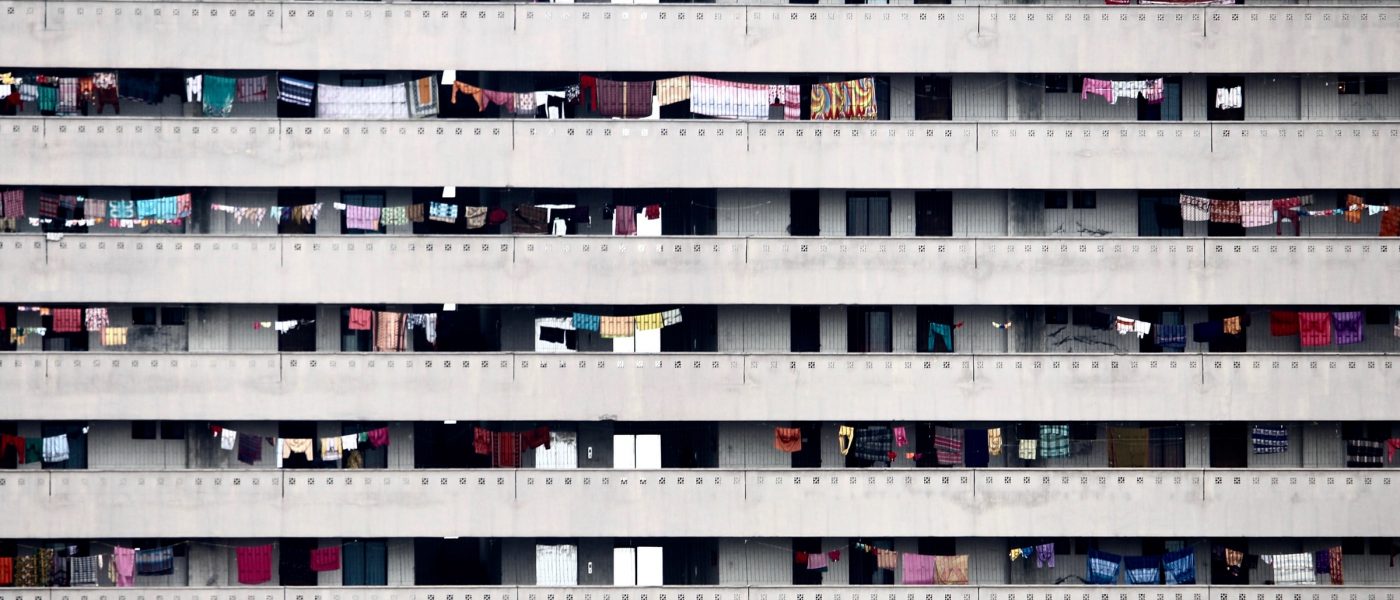

There is the risk that a large number of the lower income countries in the Global South, particularly in Africa, Latin America, and parts of Asia could face greater instability in the years to come as a result of these tax losses. This has implications not only for these countries and regions, but also for countries beyond, including in the Global North.

If the refugee migration from some of these countries thus far has already had negative implications for the Global North, then what will happen if the situation becomes much worse economically in the Global South in the years to come? Clearly, the shortfall of tax revenues will make it very difficult for these countries to invest for the future and provide hope for their citizens, especially the younger generations. If this situation is left unchecked, it could have major spillover effects on the Global North that could make the current refugee and migration crisis seem modest in comparison.

What then is the answer to the current situation?

Based on various estimates, it is believed that the resources needed to address the scourge of extreme poverty globally have risen since the pandemic, to around US$ 100 billion a year; although recent estimates by the Tax Justice Network indicate that as much as US$ 427 billion a year is lost due to aggressive corporate tax avoidance and evasion by wealthy individuals. That means that if the current faults in the global tax rules did not exist, the challenge of extreme poverty could very well be remedied several times over.

Estimates of the number of people living in extreme poverty since the beginning of the Covid-19 pandemic have surged upward by an additional 120 million people. This means that there are now likely to be over 766 million people, or close to 10 percent of the global population living on less than $1.90 per day. Alleviating such extreme poverty would require about US$ 100 billion – but recent estimates by the Tax Justice Network indicate that as much as US$ 427 billion a year is lost due to aggressive corporate tax avoidance and evasion by wealthy individuals. That means that if the current faults in the global tax rules did not exist, the challenge of extreme poverty could very well be remedied four times over in one year.

The need for resources also extends to emerging economies seeking to promote public health and a healthy and productive workforce, especially as they grapple with fiscal imbalances caused by the pandemic. An analysis in 2019 estimated that over 50 million premature deaths could be prevented if countries increased excise taxes to raise prices of tobacco, alcohol, and sugary beverages by 50 percent over the next 50 years. These reforms would yield over US$ 20 trillion in revenue.

Contributions of this new book

These are just a few of the many opportunities to mobilize a considerable amount of resources for sustainable development and poverty reduction. The essays in a new book, titled: Tax Justice and Global Inequality: Practical Solutions to Protect Developing Country Tax Revenues, edited by Krishen Mehta, Esther Shubert, and Erika Dayle Siu offer practical tax policy solutions at the domestic and international levels and provide alternatives to current taxation rules that are not working to support developing country priorities.

This book brings together a group of authors who present solutions from varied perspectives, concerned not only about revenue raising, but also the environment, public health, fair trade agreements, and human rights.

- Alexandra Readhead presents what resource-rich countries can do to make the extraction of their natural resources a win for both sides.

- Tovony Randriamanalina then deals with the current transfer pricing system, and how it can be made to work more effectively for developing countries.

- Annet Ogutto explores how international tax competition can lead to harmful tax practices and what can be done about it.

- Mustapha Ndajiwo then delves into the challenges faced by developing countries in the expanding area of taxing the digitalised economy, and more equitable approaches to taxation in this space.

- Victoria Lee examines the use of bilateral investment treaties and free trade agreements, and how the interests of developing countries can be better protected.

- Kerrie Sadiq takes us into an application of formulary apportionment as a possible solution to address multinational entity debt financing schemes.

- Jorg Alt and Charles Chilufa present an idea whose time has come – that of joint tax audits in the current environment of information exchange and country-by-country reporting to ensure that multinational corporations are paying their fair share of taxes in each jurisdiction.

- Lauri Finer presents an example of tax avoidance in development finance, and how both countries involved can ensure development objectives in such an environment.

- Erika Siu, Estelle Dauchy, Evan Blecher and Frank Chaloupka explore how taxation can address the production and consumption of harmful goods, such as tobacco, alcohol and sugary drinks to achieve better outcomes for health.

- Tatiana Falcao discusses environmental taxation and a multilateral carbon treaty as a pathway for the protection of our common future.

- Nikki Reisch examines the close linkage between fiscal policy, inequality, and human rights, under the challenging paradigm of ‘taxing for justice’.

- Monica Iyer describes a more just international tax order that gives content to Article 28 of the Universal Declaration of Human Rights through the lens of the global tax system.

In many countries, discussions about tax reform are often dominated by the views of economists and financial experts, and the reform process is often not subject to full democratic debate. As a result, technical considerations of efficiency and ease of administration often overshadow discussions of economic, social, and environmental equity. It is this trend that we seek to counter in creating a system that is just as well as efficient. The essays in this volume represent an effort toward that goal.

Related articles

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

The tax justice stories that defined 2025

The best of times, the worst of times (please give generously!)

Let’s make Elon Musk the world’s richest man this Christmas!

Admin Data for Tax Justice: A New Global Initiative Advancing the Use of Administrative Data for Tax Research

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025