Nick Shaxson ■ The chaser’s guide to tax havens: a simple 1,413-step guide

Some offshore humour for a Monday morning: The Chaser’s Guide to Tax Havens, from Australia. The magazine has an interesting history:

Some offshore humour for a Monday morning: The Chaser’s Guide to Tax Havens, from Australia. The magazine has an interesting history:

“Ever since The Chaser started, back in 1999, we have strived to build our company on a solid foundation of inexplicable and highly technical tax losses.”

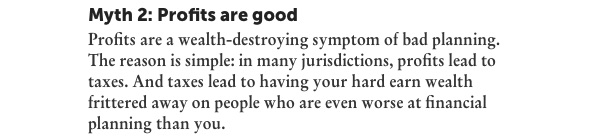

Back to the guide to tax havens: perhaps our favourite section is this one – because it’s so appallingly true, from a tax cheater’s perspective:

But Myth 1 is pretty good too. Another excerpt, among many:

“Next, we looked at Malta. The main advantage of this little group of islands is that it is a member of the EU, which means that if we ever http://healthsavy.com/product/cialis/ went into manufacturing automobiles, we could just cheat our way through the process. “We could make satirical emissions targets,” exclaimed Amy before we explained to her that Volkswagen had already thought of that idea. The advertised benefit of Malta is that it provides “simplified accounting”, which Amy explained meant not having to provide a “true and accurate” record of what has gone on inside your business. Now we were talking!”

Now read on . . . this article, while funny, is in fact a well-researched guide to some the monkey business that has taken over the world of corporate multinational tax.

Related articles

The tax justice stories that defined 2025

The best of times, the worst of times (please give generously!)

Let’s make Elon Musk the world’s richest man this Christmas!

Admin Data for Tax Justice: A New Global Initiative Advancing the Use of Administrative Data for Tax Research

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025

Indicator deep dive: ‘patent box regimes’

Two negotiations, one crisis: COP30 and the UN tax convention must finally speak to each other