Sergio Chaparro-Hernandez ■ New Tax Justice Policy Tracker makes it easy to monitor progress towards a UN Tax Convention and beyond

This year marks 20 years of research and investigation by the Tax Justice Network into all things tax havens and financial secrecy. Providing reliable, consistent research on these issues has always been a core part of our mission and that research has empowered us, as well as others, to uncover and tell powerful stories that drive social change.

As explained in our new strategic framework launched this year, we believe there are 9 key policies that can be used to reprogramme our tax systems to work for everyone, not just the superrich. These policies include automatic exchange of information between countries; transparency of beneficial ownership information; public country by country reporting; disclosure of sufficient public data; enforcement by well-resourced and operationally independent tax authorities; good taxes encompassing a progressive and effective overall tax system; a global asset register; unitary tax – and a global tax convention under auspices of the UN.

Our new Policy Tracker is a long-term project that makes it possible to explore which countries are leading the way, and which are blocking change for the 9 policies mentioned above. It is a tool whose power lies in collaboration, as it aims to become a mechanism for gathering information that would otherwise remain dispersed among many actors. We are kicking off the beta-version of the tracker with one live-tracked policy, a UN tax convention, because this is the critical question facing policymakers internationally today. The next modules will be incorporated gradually in the coming years.

Data as a strategic asset for change

We believe that data is a strategic asset. But for it to be optimally useful, it needs to be available in a format that makes it easy to digest and understand.

It is against this background that the Policy Tracker has been developed, making data and insights more accessible to researchers and campaigners across the globe.

The tracker includes tools such as insight cards, country maps and global progress calendars, which offer user-friendly ways to keep up to date with developments in these key policies.

It can be easy to feel overwhelmed when we are faced with topics that are important, complex and fast-moving – and all of this at a global scale. The Tax Justice Policy Tracker aims to change that.

What the Policy Tracker does

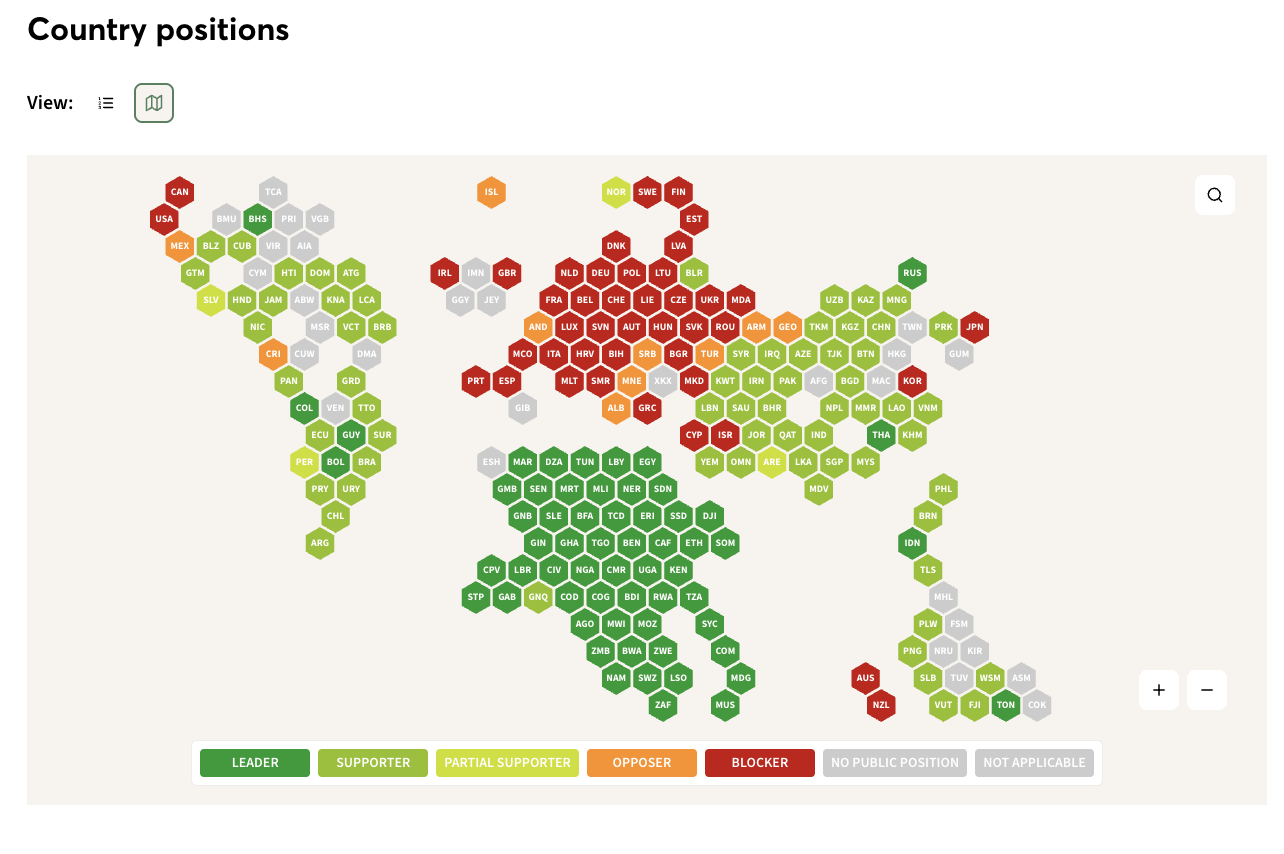

http://policytracker.taxjustice.net/The Tax Justice Policy Tracker monitors and promotes progress on nine key policies that can reprogramme our tax systems to treat the needs of all members of society as equally important. The tracker will grade each country’s laws on how well the country is implementing each of the nine policies, helping governments spot where they can improve. Just like in school, grades go from A to F, where A+ means a country is fully and effectively implementing the policy and F means it’s failed it. The tracker also reports each country’s public position on each policy. Positions go from Leader, Supporter, Partial Supporter, Opposer to Blocker.

We know that scoring methodologies to track these policies involve complex decisions. Some of them will require dynamic assessments that change over time as they move towards universal acceptance and progressive implementation. That is why we want to co-design these methodologies together with the tax justice movement and other interested partners. As the tracker develops, ex ante and ex post mechanisms to provide feedback on these methodologies will be made available on the Policy Tracker’s website.

Over time, the Policy Tracker will include updates on developments in respect of public country by country reporting (potentially in the first quarter of 2024); the automatic exchange of information by the fourth quarter of 2024; beneficial ownership transparency in 2025; and for the other policies covered by our strategic framework some time thereafter.

Where the data comes from

The Tax Justice Policy Tracker will use a set of questions to evaluate over 200 countries and territories on the tracked policies. Answers to the questions determine countries’ grades and positions. Answers are based on data that is regularly collected and verified by researchers and experts from the wider global tax justice movement, including the Tax Justice Network’s Financial Secrecy Index and Corporate Tax Haven Index.

Crowdsourcing support from the public helps us respond faster to regulatory changes. If you think an answer to a question on the tracker should be updated with new data, please contact us.

Using the Policy Tracker for status updates on the UN tax convention

Importantly, this first iteration of the Policy Tracker allows you to easily track the status of the proposed UN tax convention: it tracks which countries are blocking the proposal, and who supports it; how this differs across regions; and what you need to know about the most recent and upcoming events. And perhaps most importantly: it is tracked and updated live.

This is important: One of the major policies the Tax Justice Network has long advocated for, is moving global tax policy development and oversight to the United Nations. It’s advocacy work that has paid off: there was full consensus at last year’s United Nations General Assembly to begin intergovernmental discussions on a new framework for international tax cooperation. The resolution also mandated the UN Secretary-General to produce a report identifying the main options for member states. The report was the subject of a high-level debate at the General Assembly last month, where strong support for progress was expressed, and emerging consensus points towards a legally-binding framework convention on tax.

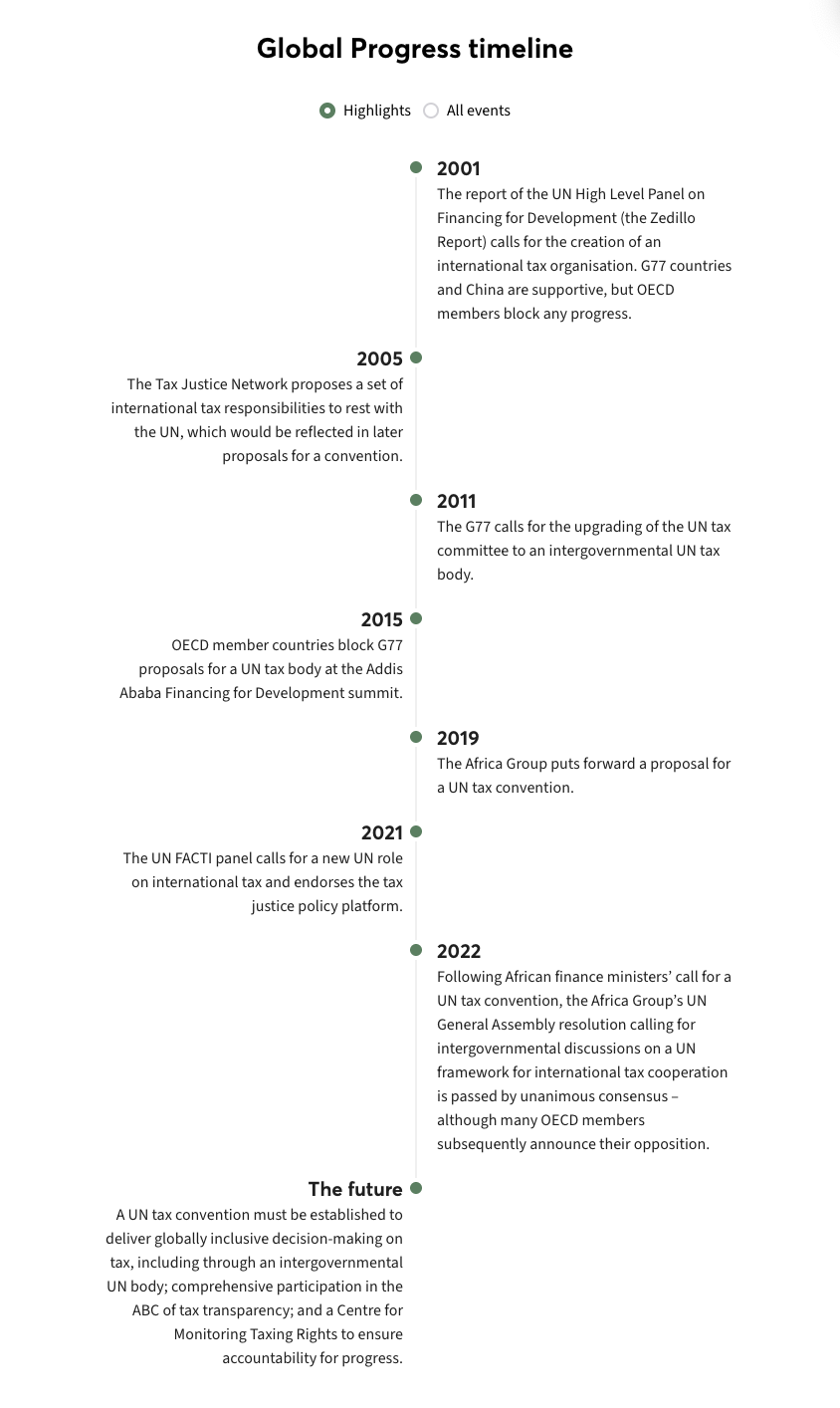

While the Tax Justice Network has been engaged with the need for a UN-driven tax convention for many years, we know that the topic may be new to many. For this reason, the Policy Tracker also includes a high-level timeline, that explains how the conversation has progressed since 2001, when a UN panel first called for the creation of an international tax organisation.

This week, countries will be voting at the UN on what may be the biggest shakeup of international tax rules in history (you can follow the latest developments on our live blog). It’s important: a framework convention on tax can deliver binding protocols on key policy areas to curb tax abuse, and also establish a globally inclusive body under UN auspices to set rules in future. On the line is nearly $5 trillion of public money that countries are expected to lose to tax havens over the next 10 years. (You can read more about this in our blog on why the world needs UN leadership on global tax policy.)

The Policy Tracker reports countries’ positions based on public statements and public actions they make. The policy evaluation framework is available here. According to this framework, the majority of countries (60%) have publicly voiced their support in favour of a UN-led tax convention (116 out of 193 UN Members). Only 56 of the world’s nations (so, 23 per cent) are opposing the move; while 22 have not yet publicly expressed a position. The Policy Tracker makes it easy to identify which countries our respective advocacy efforts should be focusing on: by engaging with the governments of those countries who are blocking the move, along with those countries who have not yet expressed a public opinion (see the full country database here).

Since the Tax Justice Policy Tracker basis its assessment of countries’ positions on statements and actions that are public, the positions taken in private negotiations are not reflected. However, the latest information available from these negotiations suggests that the number of opposing voices is shrinking.

Over time, once the vote at the UN has been finalised, the Policy Tracker will continue to track progress with the convention itself. We encourage all interested parties to provide their suggestions and feedback on how to continue the tracking process in a possible new phase of negotiations.

How will you use the tracker?

The Tax Justice Policy Tracker complements the Tax Justice Network’s other tools for reprogramming the tax system, which include the Illicit Financial Flows Vulnerability Tracker, the Financial Secrecy Index, the Corporate Tax Haven Index, and our Data Portal.

We know that there are a multitude of insights and compelling narratives that can be developed using our new Policy Tracker. Moreover, we are encouraged to see how in this short period of time the tracker is starting to be used for advancing evidence-led advocacy strategies. Just as with our new Data Portal, we’d love to hear what you learn from the Policy Tracker, and what you’ve done with it!

You can access the Policy Tracker here.

Related articles

Malta: the EU’s secret tax sieve

The bitter taste of tax dodging: Starbucks’ ‘Swiss swindle’

Disservicing the South: ICC report on Article 12AA and its various flaws

11 February 2026

What Kwame Nkrumah knew about profit shifting

The tax justice stories that defined 2025

The best of times, the worst of times (please give generously!)

Admin Data for Tax Justice: A New Global Initiative Advancing the Use of Administrative Data for Tax Research

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025