Liz Nelson ■ To protect children’s right to education, governments must fight tax abuse

Every year millions of children are denied access to public education. Education is a child’s right, but government revenue budgets, especially in low income countries, are almost always insufficient to ensure all children have the opportunity to access publicly funded primary and secondary school.

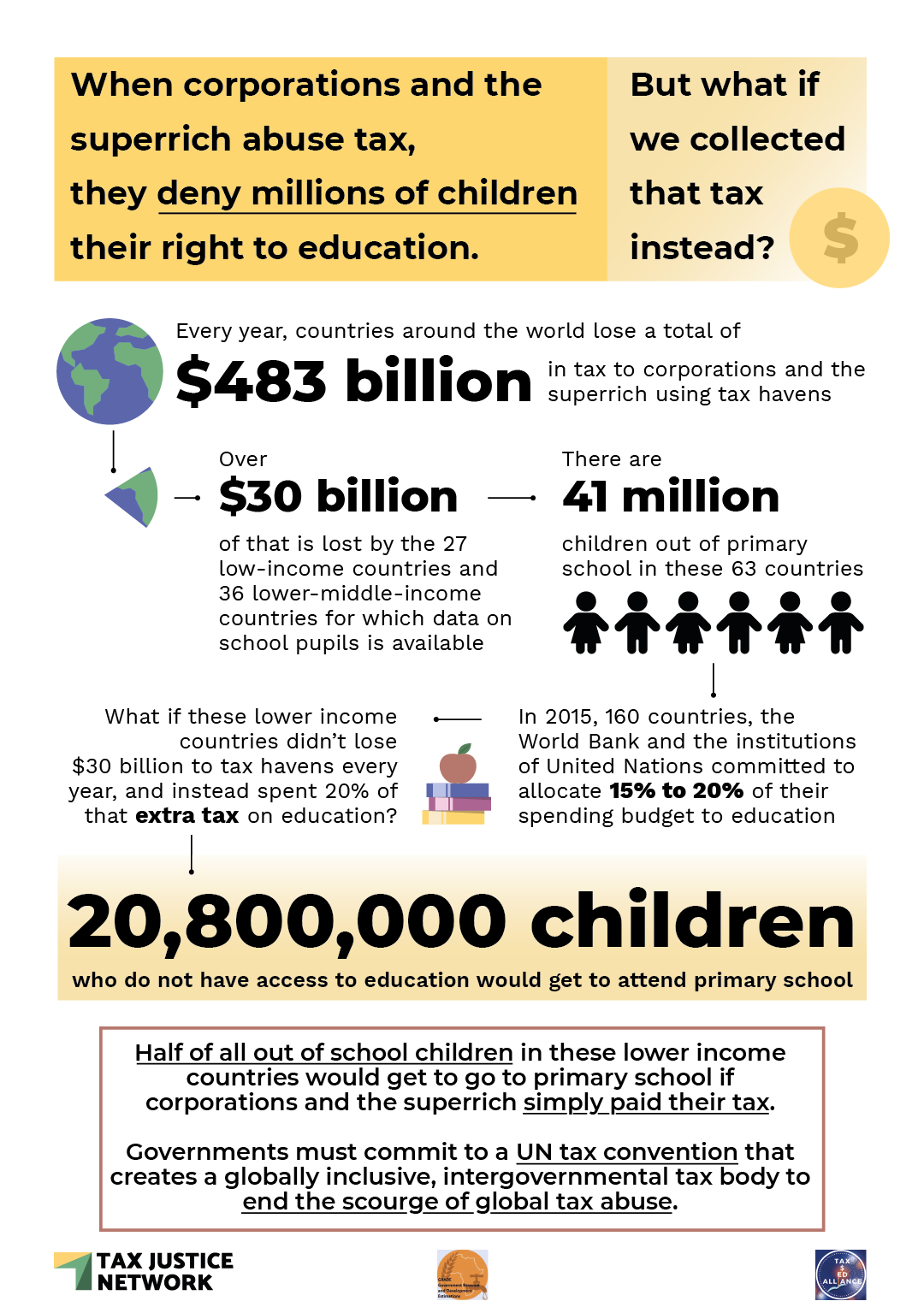

In preparation for the United Nations Transforming Education Summit last week we prepared analysis on the impact of tax abuse on access to public education. The results were shocking. Of the $483 billion lost to tax abuse world wide over $30 billion is lost by the 27 low-income countries and 36 lower-middle-income countries for which data on government expenditure per school pupils is available. In these 63 countries there are 41 million children out of school. If each of these countries were to spend just 20 percent of the tax revenue they lose annually to global tax abuse, 20,800,000 children who don’t have access to education would get to attend primary school.

Our research with Dr. Bernadette O’Hare at the GRADE project used 2021 State of Tax Justice data to measure the impact of global tax abuse by multinational corporations and tax evasion by wealthy individuals on children left out of school. We specifically looked at the impact on education using data on ‘out of primary school’ children and ‘out of secondary school children’. The countries we analysed were: Samoa, Chad, Rwanda, Sierra Leone, Liberia, Malawi, Gambia, Cambodia, Mozambique, Madagascar, Uganda, Congo DRC, Kenya, Myanmar, Togo, Guinea-Bissau, Benin, Tanzania, Guinea, Afghanistan, Nepal, Ethiopia, Mali, Central African Republic, Burundi, Niger, Comoros, Burkina Faso, Georgia, Nicaragua, Vietnam, Sri Lanka, Egypt, Congo, Rep., Bhutan, Syria, Ukraine, India, Morocco, Timor-Leste, Zambia, Moldova, Cameroon, Armenia, Mongolia, El Salvador, Indonesia, Honduras, Vanuatu, Laos, Ghana, Senegal, Pakistan, Eswatini, Guatemala, Mauritania, Cote d’Ivoire, Paraguay, Guyana, Cape Verde, Sao Tome and Principe, Djibouti and Yemen.,

The Incheon Declaration (2015), adopted by 160 states, the World Bank, United Nations institutions and civil society presented a new vision for education and a commitment for governments to use between 15 to 20 percent of spending budgets on education. We cautiously assumed therefore that at most, governments would spend no more than 20 percent of any additional revenue found from curtailing global tax abuse on public education budgets.

At the United Nations Transforming Education Summit – the goal for the TaxEdAlliance, a global initiative that puts the spotlight on transforming education finance of which we are a member, was to urge a radical reframing in the way in which education is financed. Tax justice is central to this reframing.

The vision of Sustainable Development Goal 4 to ensure inclusive and equitable education continues to be thwarted by global tax abuse on a grand scale. Powerful actors whose interests lie in accumulating wealth are denying children throughout the world their right to education. As a consequence countries – economies and societies – that should prosper are out of pocket and without the means to provide inclusive and equitable public education.

It is shameful that those governments and financial institutions who have committed to Sustainable Development Goal 4 fail to make good on their commitments. It is shameful that the obligation to the right for each child to have education is deprioritised. More shameful is those governments and financial institutions who recklessly block progressive tax policy reforms. The time to transform the financing of education is long overdue and calls for a fair, equitable and truly intergovernmental approach must be heard. Such reform demands political leadership. The May 2022 ministerial declaration of the Economic Commission for Africa saw more than a quarter of United Nations member states call for negotiations to begin on a UN tax convention that could deliver comprehensive progress. Yesterday, the UN Secretary General António Guterres announced his readiness to support a UN tax convention.

Policymakers must join this call urgently, and commit to a UN convention on tax that creates a globally inclusive, intergovernmental tax body to end the scourge of tax abuse.

Related articles

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

The tax justice stories that defined 2025

The best of times, the worst of times (please give generously!)

Let’s make Elon Musk the world’s richest man this Christmas!

Admin Data for Tax Justice: A New Global Initiative Advancing the Use of Administrative Data for Tax Research

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025