John Christensen ■ When will the British government impose public registries on its tax havens?

UPDATED

Not so long ago Lee Sheppard, one of the US’s top experts in international tax, gave a pithy and accurate explanation of why powerful countries don’t just close down the tax havens that are undermining their tax and criminal justice and regulatory systems.

We don’t shut [these financial whorehouses] down, because the town fathers are in there with their pants around their ankles.”

This morning the UK government delayed a parliamentary vote scheduled for today that could potentially have required Britain’s three Crown Dependencies (Guernsey, Jersey, Isle of Man) to make their registries of company ownership fully searchable by the public. This follows a Financial Times article entitled Crown Dependencies Set For Transparency Clash with Westminster, which suggested that parliamentarians would probably vote in support of this step.

According to the FT, the Crown Dependencies are threatening a “major constitutional clash” with Britain if it tries to get them to be more transparent about the mucky shell companies being set up there. More specifically:

The chief ministers of the three islands will travel to London to try to head off a cross-party legislative move by MPs to force them to introduce by 2020 public registers about the real owners of companies based there. . . [members of parliament] will push a parliamentary amendment to require public registers containing details of anyone owning more than 25 per cent of a company based in one of the crown dependencies.”

This follows a kerfuffle over the different, but related, British Overseas Territories — including the Cayman Islands, Bermuda, and other major tax havens, on which The Guardian reported last month:

The government has been accused of defying Parliament by delaying plans to require British tax havens such as the British Virgin Islands to bring in public registers that reveal the true identity of owners of companies sheltering assets. Foreign Office ministers have caved in after a rebellion in the British overseas territories . . .”

The tax havens made their usual “we are not a tax haven, we are a highly transparent and co-operative jurisdiction” argument that all tax havens always make. (Well then, why should they fear better transparency?) The only leg they have to stand on is that the UK’s own record in terms of company transparency is appalling. Just look at the Troika Laundromat story for the latest grisly example. But that shouldn’t let the Crown Dependencies or Overseas Territories off the hook.

Why do these havens have these old, anomalous relationships with Britain? There’s a long history here going back many hundreds of years – but at every step, the most fundamental explanation for their endurance has always been the one outlined by Ms. Sheppard.

We’ve explained before, on several occasions, why Britain absolutely does have the power to force these jurisdictions to change their laws. (Here’s one,in the British Politics Review; here’s another.)

But now into this debate has stepped Nikki da Costa, an official at a public relations company who is a former Director of Legislative Affairs at No. 10 (Downing Street, the Prime Minister’s offices,) responding (also here) to the FT’s story. Given her previous position, one would expect her arguments to be the strongest that Britain has. She said:

There are many reasons we don’t legislate for Crown Dependencies without their consent. If you want a good summary read Lord Ahmed’s (sic) ministerial comments from last year relating to Amendment 22 on Overseas Territories.”

(Our emphasis added; we asked her if she is representing tax haven interests – we will update as and when she replies).

She is asserting that Britain does not force its Crown Dependencies to do things they don’t want. The key question here, however, is not whether Britain ‘does not’ force its Crown Dependencies to change their laws, but whether it ‘can’, or ‘cannot.’ And if you read the text she’s referring to, as we have just done, this looks like the age-old British establishment tactic to protect the question of the British tax havens: muddy the waters.

The general attitude in Westminster has always been ‘we like the dirty and questionable money that these tax havens bring in to the City of London, but we want to keep them at arm’s length and pretend that when something nasty turns up, there is nothing we can do.’ So they love to assert that Britain cannot force these places to change their laws. In any case, we went and looked at the comments of Lord Ahmad’s to which she referred. In fact, there is no claim, anywhere, that Britain cannot legislate for its Crown Dependencies. The link does, however, contain this:

Amendment 22 empowers the United Kingdom Government to impose publicly accessible registers on overseas territories but not on Crown dependencies”

In other words, Britain simply forces its Overseas Territories to do what it wants. And it can do the same with the Crown Dependencies. Here is Britain’s own Ministry of Justice, laying it out clearly:

The Islands’ legislatures make their own domestic legislation. Primary legislation passed in Jersey, Guernsey, Alderney and Sark requires Royal Assent from the Privy Council. In the Isle of Man the Lieutenant-Governor has delegated responsibility to grant Royal Assent to any non-reserved legislation relating to domestic matters. Any reserved legislation in the Isle of Man requires Royal Assent from the Privy Council, in the same way as legislation from Jersey, Guernsey, Alderney and Sark.”

That seems clear enough. If the UK government chooses to impose legislation on its Overseas Territories and Crown Dependencies, it can do so, and it can also block laws proposed by their legislatures if it so chooses. It boils down to choice. It is misleading for Nikki da Costa and others to claim that the Crown Dependencies are autonomous.

The current government under Prime Minister Theresa May seems hell-bent on protecting the Crown Dependencies from an amendment intended to introduce transparency to companies registered in these dependencies. This is shocking and irresponsible behaviour, and causes us even greater concern that a post-Brexit Singapore-on-the-Thames development strategy will worsen London’s reputation as the money-laundering capital of the world.

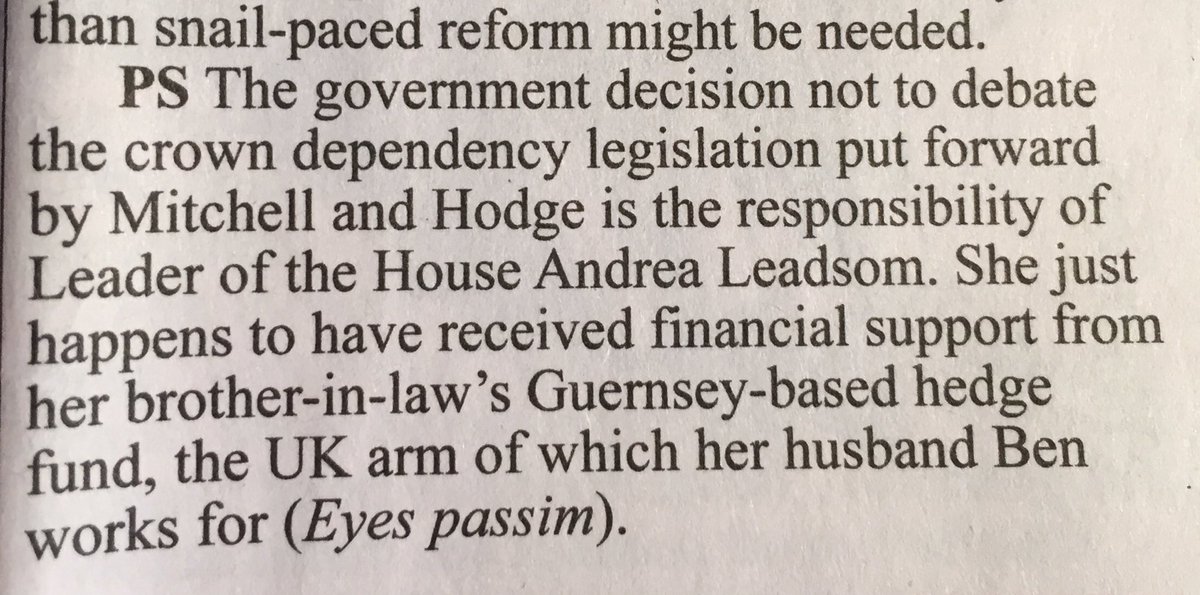

Update: Richard Brooks of Private Eye tweeted: “Small but overlooked point on gov’t decision not to debate move on Crown Dependencies transparency, from @PrivateEyeNews. Loads more in the mag.”

Which, if it was an influence, would be just as Lee Sheppard said.

Related articles

Malta: the EU’s secret tax sieve

The tax justice stories that defined 2025

2025: The year tax justice became part of the world’s problem-solving infrastructure

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations

Tackling Profit Shifting in the Oil and Gas Sector for a Just Transition

Follow the money: Rethinking geographical risk assessment in money laundering

Democracy, Natural Resources, and the use of Tax Havens by Firms in Emerging Markets

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

The Financial Secrecy Index, a cherished tool for policy research across the globe

The documentary “The Spider’s Web: Britain’s Second Empire” is highly recommended viewing: https://spiderswebfilm.com/

The documentary is also available on YouTube.

Your quote from Ministry of Justice explains the process by which laws are created in the CDs. It says nothing about the ability of Government to legislate for CDs.

The CDs legislate for themselves, but it is made official with the Royal Assent of the Privy Councillors, acting as Councillors to the Queen in her capacity as the Duchy of Normandy, being the capacity that, Jersey and Guernsey at least, recognise the Queen.

The delegated powers to Parliament are on behalf of the Queen as the Queen of the UK. They therefore have no right to interfere with the CDs as they do not have the delegated powers of the Duchy of Normandy. Further these powers cannot be delegated due to the protections provided to the Islands by way of Royal Charter from previous monarchs many many, years ago.

You may have noted that the CDs have stated they will be creating public registers in the near future in accordance with the standards set by the EU. This is because the CDs are happy to do so as long as it is the international standard, so as to prevent any business from going elsewhere – who may leave not because of criminal activity but because of general principles of confidentiality.

Once public registers become the norm, and you see international finance centres flourishing, you will realise that such centres are successful because of the pool of knowledge and skills they have in such matters.