Andres Knobel ■ OECD stretches the truth to give the US a better transparency rating than Ghana

It’s baffling but the OECD’s Global Forum has awarded the US a “largely compliant” rating on its transparency in exchanging tax information with the international community despite the US being one of the most secretive countries in terms of company ownership. Troublingly, the US, which ranks in second place on the Tax Justice Network’s Financial Secrecy Index, received a better rating than Ghana, which already has a beneficial ownership register and has signed up for many of the international frameworks that the US refuses to join. Is the Global Forum giving the US favourable treatment? We delve into the details and compare the two countries side by side…

On Monday 16 July, the Global Forum published the second round of a peer review report evaluating the availability of ownership information (now considering beneficial ownership too) in the United States and the situation of exchange of information upon request (“automatic” exchanges will be assessed in the future).

These Global Forum peer review reports are an amazing source of detailed information that we use for Tax Justice Network’s Financial Secrecy Index. However, based on the same facts described by each peer review report, we reach very different conclusions and that’s why we hardly ever agree with the Global Forum’s ratings.

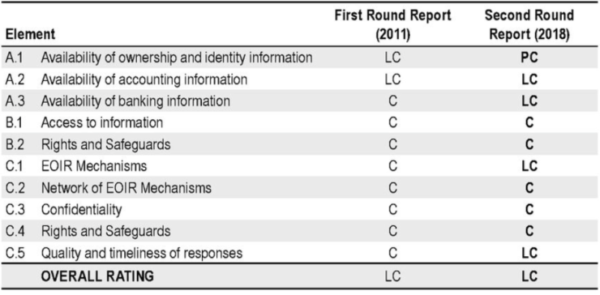

Unsurprisingly, the US, which ranks in as the second worst offender on our Financial Secrecy Index and which “achieved” the most secretive option for legal ownership and beneficial ownership registration of every type of legal vehicle available (as described in our recent paper “State of play of beneficial ownership information”), still managed to keep its 2011 rating of “largely compliant”, according to the Global Forum’s second round of reviews, despite the reviews being more demanding this time!

But the real outrage is when we compare the US’s ranking to another country, say Ghana.

Ghana is rated by the Global Forum as “partially compliant” even though it has pretty outstanding transparency when compared to the rest of the world. It has beneficial ownership registration in place and has joined the Common Reporting Standard for automatic exchange of information. It’s a very little player in practice; just 0.0025% of the market share of offshore financial services according to the Financial Secrecy index.

The US, on the other hand, is undeniably the largest player with 22.30% of the market share of offshore financial services. That’s almost 9000 times larger than Ghana! The US has among the worst cases of secrecy in terms of beneficial ownership transparency and on automatic exchange of information.

US vs Ghana, side by side

Here’s a breakdown of how the US and Ghana compare. The table’s colours are based on traffic light colours: red = bad; green = good.

| The US | Ghana | |

| Financial Secrecy Index ranking (the higher, the worst offender) | 2nd | 95th |

| Player size in practice (market share of offshore financial services). In itself, this is neutral. But the larger the market share, the more responsibility to be transparent. | 22.5% | 0.0025% |

| Ownership Transparency | ||

| Situation of legal and beneficial ownership availability | No legal or beneficial ownership registration for any type of legal vehicle; beneficial ownership is not guaranteed to be available in all cases in the US | Legal and beneficial ownership information of companies has to be registered with a government authority |

| Global Forum’s rating on legal and beneficial ownership availability (section A1 of Global Forum peer reviews) | Partially Compliant

| Partially Compliant

|

| Exchange of Information | ||

| Party to the Multilateral Tax Convention (to exchange information on request or automatically) | No, only party to the Original Convention which allows exchanges with OECD countries only | Yes, it may exchange information with all other parties (except for the US) |

| Implementing the Common Reporting Standard (CRS) for automatic exchange of information? (This isn’t part of the Global Forum rating) | No, only applies FATCA and related agreements (more information is received than shared by the US) | Yes, Ghana signed the Multilateral Competent Authority Agreement and will start automatic exchanges in 2018 |

| Do banks collect all beneficial ownership information required to be exchanged by automatic exchanges? | No, US banks need not collect beneficial ownership information for pre-existing accounts or accounts held by trusts. Either way, the US’s “beneficial ownership” definition doesn’t comply with the standard | Yes, this will be required in order to comply with the common reporting standard (CRS) |

| Factors identified by the Global Forum in relation to “quality and timeliness of responses” (Section C5) | Global Forum quote: “The time taken to provide a response to a request does not ensure effective exchange of information in all cases as was pointed out by a few peers” | Global Forum quote: “Of the five requests processed by Ghana over the period, responses were provided between 180 days and one year in one case, and in the other four cases responses took more than one year.” |

| Global Forum rating in relation to “quality and timeliness of responses” (Section C5) | Largely Compliant | Non-Compliant

|

| Number of elements rated by the Global Forum as “Compliant”, “Largely Compliant”, “Partially Compliant” and “Non-Compliant” | -Compliant: 5 -Largely Compliant: 4 -Partially Compliant: 1 -Non-Compliant: 0 | -Compliant: 8 -Largely Compliant: 0 -Partially Compliant: 1 -Non-Compliant: 1 |

| Overall Rating by the Global Forum | Largely Compliant

| Partially Compliant

|

The devil is in the detail

The Global Forum got a little bit more real in 2018. In 2011, section A1 of the peer review report on availability of ownership information rated the US as “largely compliant” even though it acknowledged that for one of the most common types of entities, the Limited Liability Company or LLC:

“where a single member LLC has no tax nexus with the United States there may be no information available in the United States regarding the owners of that LLC” (page 38).

Section A1 now rates the US as “partially compliant”. However, this rating still seems very generous, not only when compared to the Financial Secrecy Index’s rating of the US as “fully secretive” on legal and beneficial ownership, but also when compared to the Financial Action Task Force’s stinging ranting of the US’s compliance with Anti-Money Laundering Recommendations. The Financial Action Task Force’s Mutual Evaluation, published in December 2016, gave the US the following ratings:

- “Low effectiveness” on Immediate Outcome 5 (IO5) on the prevention of legal persons and trusts from being used for money laundering and access to their beneficial ownership information. Low effectiveness means that the US did not achieve any progress, or achieved negligible progress, on prevention of money laundering here.

- “Non-compliant” on transparency and beneficial ownership of companies and other legal persons (Recommendation 24)

- “Partially compliant” on transparency and beneficial ownership of trusts (Recommendation 25)

This gets worse.

The main difference between the Global Forum and the Financial Action Task Force compared to the Financial Secrecy Index is that the index only considers it acceptable if companies and trusts have to register their legal owners (immediate and direct owners) and their beneficial owners (the individuals ultimately controlling or benefiting from the entity) with a government authority. For the Global Forum and the Financial Action Task Force, if this information is held by the company or trust themselves and authorities may request to see this information, everything is considered to be fine. To put this in perspective, it’s the difference between holding a criminal in a government prison and letting the criminal stay wherever they like, as long as they give their location to authorities, if requested.

But the Global Forum, unlike the Financial Action Task Force, fails to consider the US as non-compliant with ownership transparency, even though new US regulations fail to ensure that all relevant information has to be kept (by anyone).

The Global Forum report on the US summarises:

“not all beneficial owners are required to be identified in line with the standard. (…) Although certain beneficial ownership information in respect of companies, partnerships and trusts is required to be reported to the IRS, supervisory measures to ensure that the beneficial ownership information is adequate, accurate and up to date are not sufficient” (emphasis added) [pages 14-15].

We’ve seen the US fails to have legal and beneficial ownership information available in all cases. Now let’s look at how well they exchange information:

“Since July 2010, the United States has not ratified any signed EOI [Exchange of Information] agreement that requires US ratification. Of these EOI instruments, only the ratification of the 2010 Protocol to the Multilateral Convention (…) directly impacts the US ability to exchange to the standard (…). Nevertheless, as a result the US does not have an EOI relationship in force with 38 out of its 129 EOI partners (…)

The United States response rate has increased since the first round review (…). Although the US took some positive steps, the time taken to provide a response to a request does not ensure effective exchange of information in all cases as was pointed out by a few peers” (pages 18-20).

In conclusion, the US fails to ensure availability of legal and beneficial ownership information, and it failed to ratify the Multilateral Tax Convention (that would allow it to exchange information upon request and automatically with all non-OECD parties to the Convention, i.e. basically with most developing countries). In addition, with those countries with which the US does have an agreement, the time to respond to a request doesn’t ensure effective exchange of information. In light of all this, how did the Global Forum rate the overall compliance of the US? “Largely compliant…”

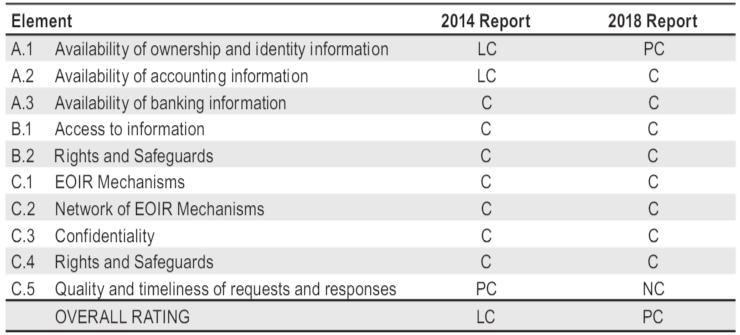

Now compare this to the Global Forum’s rating for Ghana:

This is what really makes the Global Forum’s ratings so outrageous. Ghana:

- ensures companies’ legal and beneficial ownership is registered with a government authority, not merely held in in the hands of the company.

- is already a party to the Multilateral Tax Convention (meaning, it may exchange information upon request or automatically with all other parties, except for the US).

- is implementing the Common Reporting Standard for automatic exchange of information with all other countries (including at the beneficial ownership level).

In spite of all of this, Ghana didn’t manage to achieve a rating of “largely compliant” (as the fully failing US did), but merely “partially compliant”. It only adds insult to injury to point out that the US refuses to join the Common Reporting Standard (CRS) to engage in automatic exchange of information with other countries (which will be analysed by the Global Forum in the future). Moreover, even if the US did decide to exchange as much information as it receives from other countries, US banks don’t even collect the beneficial ownership information that would be needed to be exchanged. In case you were wondering, this is how the Global Forum describes this:

“The United States has introduced rules requiring banks to identify beneficial owners of customers that are entities. These rules ensure that beneficial ownership is available in respect of all account holders except in certain limited cases. In particular, there may be cases where the person identified may not be beneficial owners as defined in the standard; where the account holder is controlled by a trust (…) the beneficial owner will be considered the trustee [instead of every party to the trust as required by the standard!] (…); or beneficial ownership information may not be necessarily available in respect of some pre-existing accounts (…)” [Tax Justice Network-Note] (emphasis added, page 16).

How can Ghana, a country with legal and beneficial ownership registration for companies, achieve the same rating in relation to availability of ownership information as the US, a country without even legal ownership registration let alone beneficial ownership availability? The Global Forum peer review report on Ghana explains:

“While Ghana has reported an annual filing rate with the RGD [Registrar General Department] of 70% in the review period, there is a significant proportion of companies (30%) that have not filed. In addition, there is a high proportion (26%) of companies registered with the Registrar that are not registered with the GRA [Ghana Revenue Authority]” (page 14).

Apparently, a 70 per cent filing rate is on par with non-existent filing requirements to the Global Forum. While Ghana should improve its filing rate, it’s about time the Global Forum starts considering filing ownership information with a government authority as an utmost requirement.

So how can Ghana with “compliant” ratings on 8 out of the 10 indicators get an overall rating of “partially compliant”, while the US with just “compliant” ratings on 5 out of the 10 indicators get a “largely compliant” rating? It appears the cause was Ghana’s “non-compliant” rating for section C5 on quality and timeliness of requests and responses. The Global Forum’s peer review report on Ghana states:

“Over the review period eight requests were sent to Ghana. Four of those requests arrived at the GRA [Ghana Revenue Authority] between March and September 2016 but were only delivered to the EOI [Exchange of Information] unit in January 2017 leading to considerable delays in practice in providing the requested information.

Of the five requests processed by Ghana over the period, responses were provided between 180 days and one year in one case, and in the other four cases responses took more than one year despite the fact that the information was held by the tax authority or another public administration (the Registrar), indicating issues with the organisational processes in terms of non-adherence to the procedures of the EOI Manual” (page 17).

It’s great that the Global Forum peer reviews go into this much detail. But the word bias is written all over the place when it comes to ratings! Whereas the Global Forum is lenient enough to consider the US’s non-existent beneficial ownership register to be partially compliant, the Global Forum takes a strict stance that wholly dismisses Ghana’s information exchanges as non-complaint because they are delayed.

The Global Forum’s recent rating of the US was both a surprise and not a surprise. Comparing the Global Forum’s rating of the US against its own rating of Ghana, it’s hard not to feel as though a different ruler is being used to measure up the US’s efforts to tackle money laundering and tax evasion. The US is responsible for 22% of the market share of the offshore financial services industry, by far the largest share. Shouldn’t we be holding the US to a greater measure of responsibility, not less?

Related articles

Malta: the EU’s secret tax sieve

The tax justice stories that defined 2025

2025: The year tax justice became part of the world’s problem-solving infrastructure

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations

Tackling Profit Shifting in the Oil and Gas Sector for a Just Transition

Follow the money: Rethinking geographical risk assessment in money laundering

Democracy, Natural Resources, and the use of Tax Havens by Firms in Emerging Markets

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

The Financial Secrecy Index, a cherished tool for policy research across the globe

Hopefully the Tax Justice Network can break open the scandal surrounding Bill Browder and the Magnitsky Act, which has a profound tax evasion-haven industry foundational aspect.