Andres Knobel ■ Regulation of Beneficial Ownership in Latin America and the Caribbean

My paper – Andres Knobel – on “Regulation of Beneficial Ownership in Latin America and the Caribbean” which I wrote for the Inter-American Development Bank is now available in Spanish and English here. The paper, published in November 2017, provides an explanation on the concept, obstacles and nuances of the definition of beneficial ownership. It also mentions typical loopholes, the differences in regulation when it comes to legal entities or trusts, and what to do when the ownership chain contains a mix of different types of legal structures.

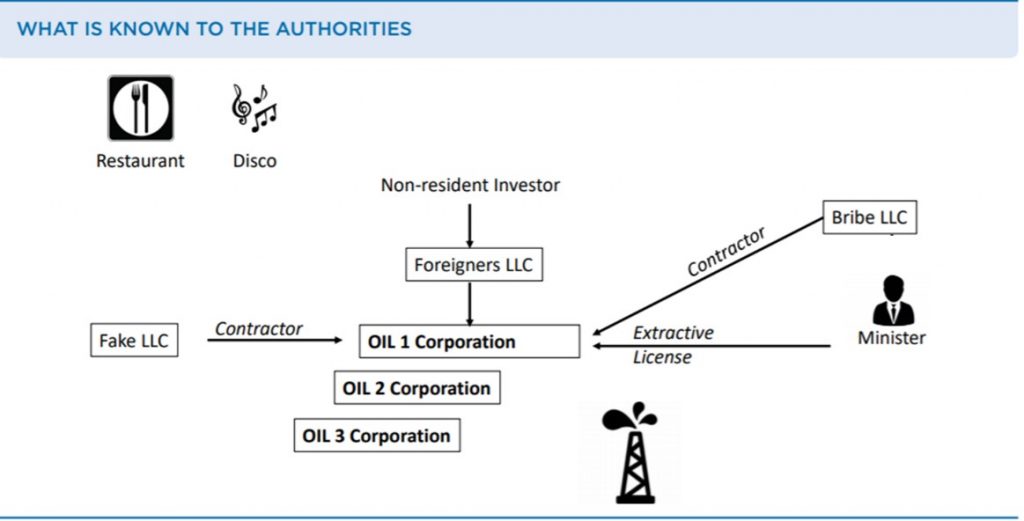

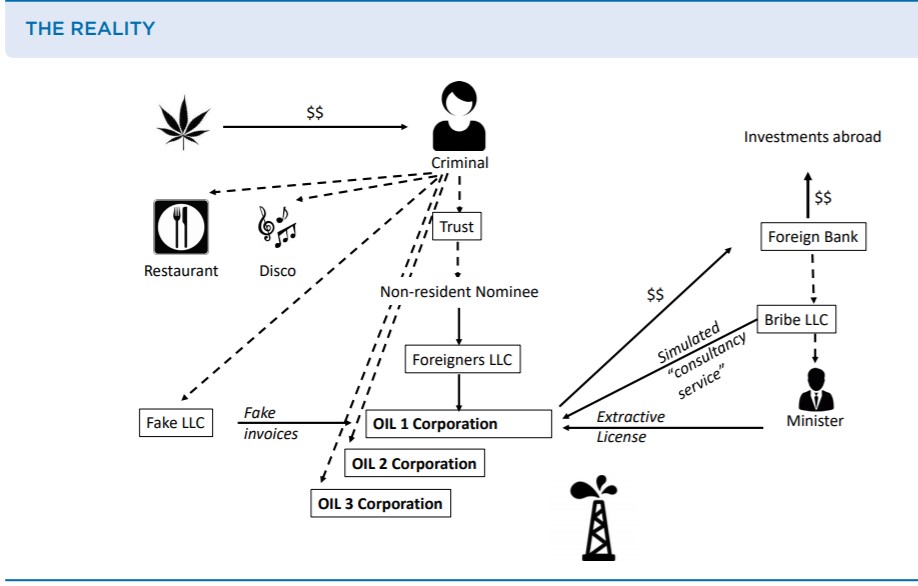

For newcomers, the paper also explains the importance of beneficial ownership for tackling many of the worst type of abuses and crimes. The annex, for instance, shows how beneficial ownership could be key to resolving a scheme involving tax evasion, corruption, money laundering, round-tripping and market abuse:

The second part of the paper assesses beneficial ownership regulation in 26 countries, quoting each country’s definitions of beneficial owners of companies and trusts, and assessing whether those definitions are compliant with international standards (e.g. what threshold they use, do they cover all the parties to a trust, etc).

Most of the Tax Justice Network’s work (e.g. the Financial Secrecy Index) considers beneficial ownership registration with a government authority to be the only acceptable standard. This paper checks availability of beneficial ownership regulation in different countries, and whether they are compliant with the OECD’s Global Forum’s and the Financial Action Task Force (FATF)’s much less demanding standards. According to these organisations, as long as beneficial ownership is available and authorities may ask for it, that’s considered good enough.

Hopefully in the near future, both the OECD and the FATF will join us, and other civil society organisations in considering that the only acceptable standard should be beneficial ownership registration in public registries available in open data format.

Related articles

Malta: the EU’s secret tax sieve

The tax justice stories that defined 2025

2025: The year tax justice became part of the world’s problem-solving infrastructure

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations

Tackling Profit Shifting in the Oil and Gas Sector for a Just Transition

Follow the money: Rethinking geographical risk assessment in money laundering

Democracy, Natural Resources, and the use of Tax Havens by Firms in Emerging Markets

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

The Financial Secrecy Index, a cherished tool for policy research across the globe