Alex Cobham ■ Two days left to end financial secrecy in the UK’s Overseas Territories?

UK parliamentarians have the opportunity to take historic action over the next two days, ending decades of financial secrecy in the UK’s Overseas Territories.

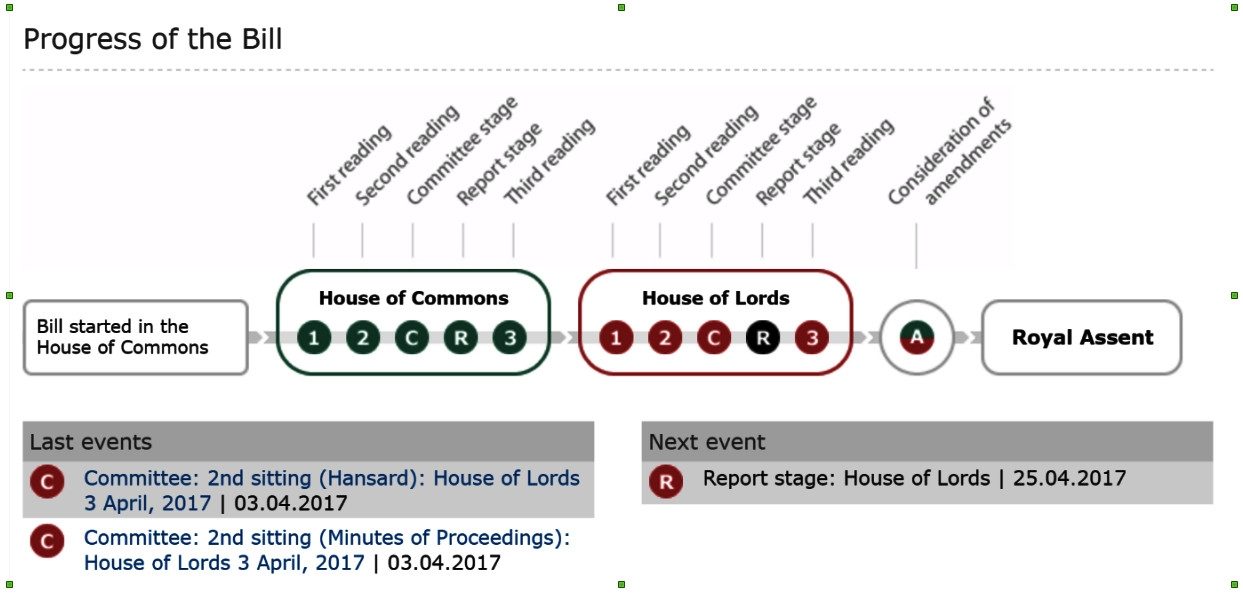

As Parliament closes down before the General Election which will take place on the 8th June, a lot of ongoing business is now at risk. A range of Bills that have been through multiple committee stages could be lost completely, required to start from scratch in the new Parliament. But some will make it through in the intense activity of the ‘wash-up‘:

The wash-up period refers to the last few days of a Parliament before dissolution. Any unfinished business is lost at dissolution and the Government may need the co-operation of the Opposition in passing legislation that is still in progress.

In addition to the year’s Finance Bill, one of the most significant pieces of legislation at risk is the Criminal Finances Bill. Introduced last October, the Bill aims to “significantly improve the government’s ability to:

- tackle money laundering and corruption

- recover the proceeds of crime

- counter terrorist financing

Having made it through the Commons and to report stage in the Lords, a great deal of the scrutiny and debate has already been conducted. Many professionals and civil society organisations, from Christian Aid to Transparency International, have provided significant input. The key remaining question concerns an amendment to extend the standard of fully public registers of the beneficial ownership of companies to the UK’s Overseas Territories – including, importantly for financial secrecy purposes, Bermuda, the British Virgin Islands, and Cayman.

Taken together, the UK’s network of Crown Dependencies and Overseas Territories would top TJN’s Financial Secrecy Index. A core part of the secrecy offered is the ability to create completely anonymous businesses, which appear endlessly around the world in cases of tax evasion, market manipulation, criminal money laundering and other forms of corruption.

Historically, the UK encouraged its dependent territories to pursue opaque financial services as an economic model that could reduce their demands on the UK exchequer, and a way of funnelling ‘cleaned’ funds into the City of London. As such, the UK’s responsibility is clear.

But increasingly the UK has stood internationally for the values of financial transparency. Last year, the UK introduced its own public register of companies’ beneficial ownership. The question facing parliamentarians now is whether to ensure that the Overseas Territories also meet this standard – instead of remaining a stain on the UK’s reputation, multiplying corruption opportunities worldwide.

Today, the Lords will vote on an amendment from Baroness Stern which would require public registers of beneficial ownership from the Overseas Territories. If passed, the Commons would then vote tomorrow on the whole bill. Two days to make history: will the UK parliament step up to the mark?

Related articles

The tax justice stories that defined 2025

2025: The year tax justice became part of the world’s problem-solving infrastructure

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations

Tackling Profit Shifting in the Oil and Gas Sector for a Just Transition

Follow the money: Rethinking geographical risk assessment in money laundering

Democracy, Natural Resources, and the use of Tax Havens by Firms in Emerging Markets

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

The Financial Secrecy Index, a cherished tool for policy research across the globe

When AI runs a company, who is the beneficial owner?

Insights from the United Kingdom’s People with Significant Control register

13 May 2025

Hansards shows Lady Stern withdrew an ammendmenton 3rd April. Is today’s vote on ANOTHER, different ammnedment?