Nick Shaxson ■ US Fortune 500 cos hold $2.4trn offshore, dodging up to $695bn in tax

From Citizens for Tax Justice, a major new report:

From Citizens for Tax Justice, a major new report:

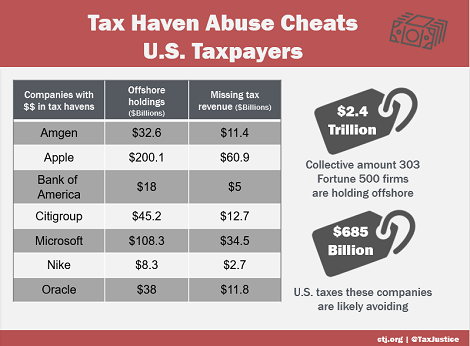

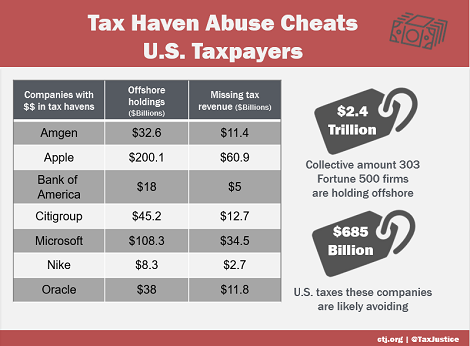

“A diverse array of companies are using offshore tax havens. . . All told, American Fortune 500 corporations are avoiding up to $695 billion in U.S. federal income taxes by holding $2.4 trillion of “permanently reinvested” profits offshore. In their latest annual financial reports, 27 of these corporations reveal that they have paid an income tax rate of 10 percent or less in countries where these profits are officially held, indicating that most of these monies are likely in offshore tax havens.”

And that number is rising, fast.

The press release is here.

The full report is here.

Related articles

UN tax convention hub – updates & resources

Malta: the EU’s secret tax sieve

The Bitter Taste of Tax Dodging: Starbucks’ ‘Swiss Swindle’

Disservicing the South: ICC report on Article 12AA and its various flaws

11 February 2026

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

After Nairobi and ahead of New York: Updates to our UN Tax Convention resources and our database of positions

Taxing windfall profits in the energy sector

14 January 2026

The tax justice stories that defined 2025

The best of times, the worst of times (please give generously!)