Nick Shaxson ■ Which countries have a Land Value Tax?

TJN is a strong supporter of the idea of a Land Value Tax, as part of a comprehensive tax system. It is a kind of wealth tax: a key recommendation in Thomas Piketty’s excellent Capital in the Twenty-First Century, and a long-running recommendation of TJN’s. The LVT, popularised by the 19th Century economist Henry George, building on the work of Adam Smith and David Ricardo, is an effective fair way to raise revenue from rent-seekers.

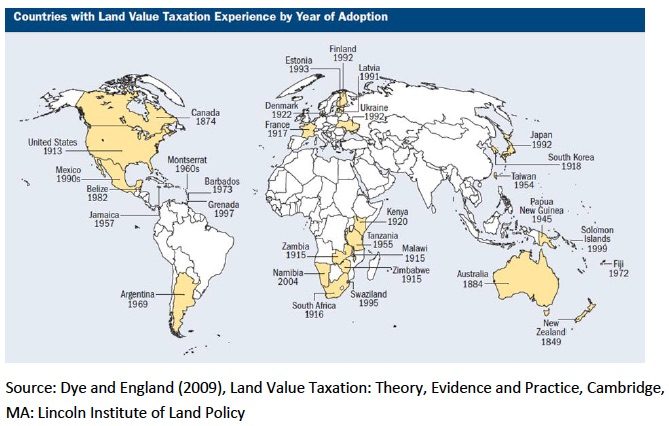

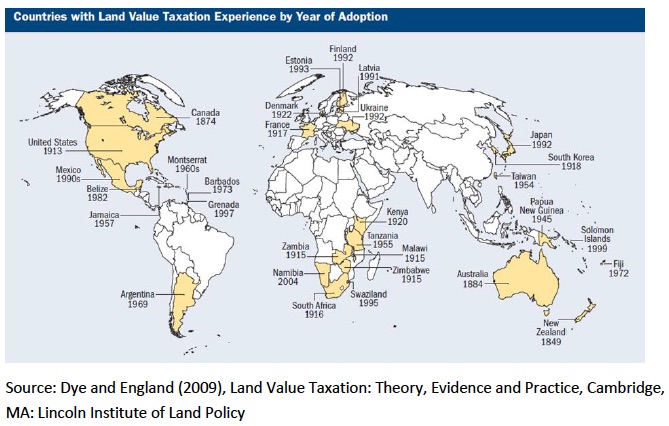

Now a new report for the London Assembly Planning Committee examines the tax. This is of great relevance in a world of falling interest rates (and possibly, as some argue, ‘secular stagnation’) which has seen a huge rise in asset prices – including house prices, in London and elsewhere. The report contains a map of the countries that have or have had experience with LVT:

Read the report here. This is a thoroughly modern, tax justice idea.

Related articles

The elephant in the room of business & human rights

The elephant in the room of business & human rights

UN submission: Tax justice and the financing of children’s right to education

14 July 2025

How the UN Model Tax Treaty shapes the UN Tax Convention behind the scenes

The 2025 update of the UN Model Tax Convention

9 July 2025

One-page policy briefs: ABC policy reforms and human rights in the UN tax convention

Bad Medicine: A Clear Prescription = tax transparency

Tax justice pays dividends – fair corporate taxation grows jobs, shrinks inequality

Reclaiming tax sovereignty to transform global climate finance

Reclaiming tax sovereignty to transform global climate finance

16 June 2025

Actually, “house” prices are not increasing. A housing unit is a form of capital good, and all capital goods depreciate over time. The actual value of a house is best defined as its replacement cost, less any depreciation. Thus, the potential selling price of a house has everything to do with the owner’s ongoing maintenance and periodic replacement of systems (e.g., the roof, heating and air-conditioning, windows, etc.). Ongoing efficiencies in the production of the materials that go into constructing a housing unit have resulted in a reduction in construction costs per square foot (particularly for factory-constructed housing delivered to the site for assembly). One need look no farther than land acquisition costs for an explanation of why a residential property is an impossible acquisition for a growing segment of the population. And, even rental housing is out of reach to many households without significant subsidy provided by government.

yes, that’s a good point. everyone talks about ‘house’ prices, but you’re right, it’s land prices that we’re talking about

Noel Hodson, OXFORD. We built a house in Oxford, UK in 2006. The final building costs totalled £120 per sq ft of usable floor area. Some builders quoted £260 or more per sq ft.. At the peak we borrowed £600,000 for 3 years to do the job, the interest charges at 7.5% were significant – now (2016) interest is less than half. Single land plot costs have since risen from £200,000 to £400,000. Our annual maintenance costs are the industry standard 2.5% of value – about £25,000 per annum – so £250,000 since new. Ten years’ council tax totals about £35,000. Our first 1,200 sq ft home in 1971 cost £16,000 (with a 12.5% interest mortgage) it recently sold for £1,000,000 or 62 times more. Ordinary saloon cars have increased 1971-2016 by 26 times – despite massive automation. The primary reason for UK house price increases is population growth – from 52M to 62M (some reports cite 82M) and solo living. Also, popular TV programs incite people to want more and better living space. UK homes have risen by 7.5% per annum for 600 years. This rate will continue. It is inflation + wealth distribution + population growth. Homes are a long term safe way to save earnings – with frightening short term dips in value.

So if I bought a house 10 years ago and the area i bought in suddenly becomes popular and the value of land in my town increases, are you saying I shoukd now pay higher tax based on the increased value of my house? What if my salary has not increased as much as the land vakue tax calculation has? How do I afford this value tax? I would be forced to sell and buy in another area. Not so fair I think!

In short, yes. But a) your objections describe why an LVT should be just one part of a comprehensive tax system, rather than (as some land value tax advocates suggest) the basis for the entire tax system. b) Let’s not forget that this would redistribute from people living in wealthier to poorer areas, and since the wealthy are more able to bear the tax, this is fair, c) if your land rises in value then you are wealthier, and more able to pay the tax; d) it would mitigate house price rises (which are a far, far greater source of economic risks and insecurity), so instead of the insane boom-bust we’ve seen in places like Ireland and the UK’s southeast, economic growth would generally be more balanced. This would far outweigh the inconvenience to people living in areas whose values rise.

You say in your response “Let’s not forget that this would redistribute from people living in wealthier to poorer areas, and since the wealthy are more able to bear the tax, this is fair”. That’s only fair in your opinion and if you believe in wealth distribution. Taxes are the price we pay for a civilised society because they contribute to Welfare, Public Services etc, excessive taxes just because some people are wealthier is theft!

Robert’s income should balance out because the income from LV would be enough to obviate income tax.