John Christensen ■ HSBC, money-laundering and Swiss regulatory deterrence

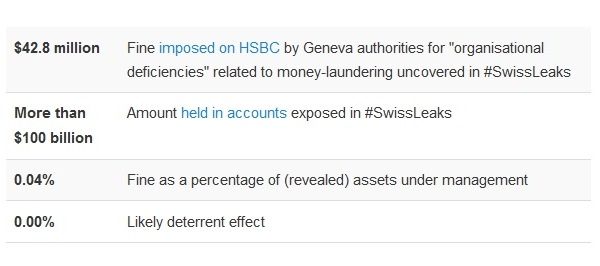

Number-crunching, à la Private Eye: the case of HSBC and its Swiss fine for “organisational deficiencies” in relation to money-laundering.

Number-crunching, à la Private Eye: the case of HSBC and its Swiss fine for “organisational deficiencies” in relation to money-laundering.

- $42.8 million Fine imposed on HSBC by Geneva authorities for “organisational deficiencies” related to money-laundering uncovered in #SwissLeaks

- More than $100 billion Amount held in accounts exposed in #SwissLeaks

- 0.04% Fine as a percentage of (revealed) assets under management

- 0.00% Likely deterrent effect

Not all the assets under management were laundered, of course. Far from it, we must hope. But the “organisational deficiencies” – including reassuring clients that no information would reach their home authorities, or using offshore accounts to circumvent disclosure requirements – represent risks that applied to the whole operation.

To put it another way, the fine is about a fifth of the £135 million in tax that HMRC recovered in the UK alone.

Even the prosecutor imposing the fine was embarrassed, and “launched a stinging attack” on the Swiss law that apparently prevented anything within yodeling distance of being a deterrent.

Cross-posted from Uncounted

Related articles

Malta: the EU’s secret tax sieve

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

The tax justice stories that defined 2025

Let’s make Elon Musk the world’s richest man this Christmas!

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations