TJN Admin ■ Do tax cuts promote growth? Part MCXIV

The world’s economists have been arguing over this question for decades. Which is odd, because the evidence is rather clear on this point. Corporate tax cuts, or overall tax cuts (or hikes) just seem to have a neutral effect on economic growth.

Which is quite unsurprising, given that (as we never tire of reminding people) taxes are not a cost to an economy, but a transfer within it. Why should an internal transfer necessarily change overall growth. It might, but there’s no obvious reason at the outset why it should. But whole swathes of the learned economics profession start out with this ‘fact’, and then create studies to prove it. The evidence-tickling out there is a sight to behold.

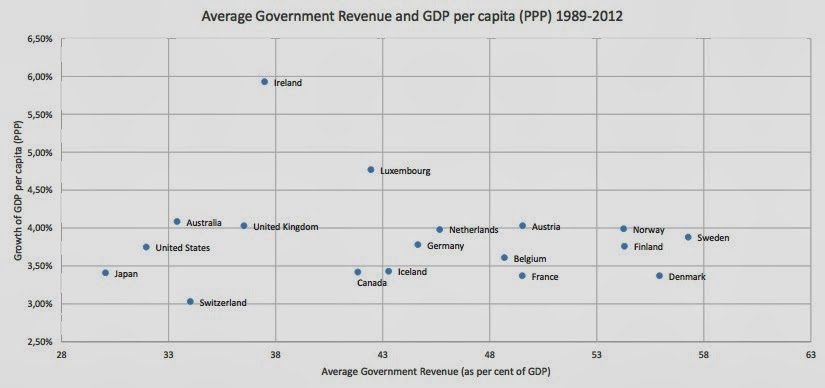

Let’s start with a little graph we just made, which updates earlier work by others. This takes the prosperous western democracies, above a certain income level (so that we’re not comparing apples with oranges), and compares their per capita GDP growth with their absolute levels of tax in GDP. Here it is.

That trend line is, for all intents and purposes, as flat as a pancake. Ireland is an outlier, as is Luxembourg – but these are small tax havens with their own special dynamics so we should probably have excluded them. Anyway, the flatness of this graph is quite striking: despite truly massive differences in tax revenues per capita from below 30 percent to nearly 55 percent, they’ve nearly all grown at roughly the same speed.

This isn’t definitive proof of anything, but it’s a bulwark against the tax-cutters’ arguments. Perhaps an even bigger bulwark – though still far from definitive proof – is that economic growth during the ‘golden age of capitalism’ quarter century after the Second World War, a very high-tax era, was much higher around the world than in the tax-cutting era that followed. For example in the 1950s top marginal tax rates in the U.S. were 90 percent and real per capita GDP increased annually by 2.4%; in the 2000s that tax rate had fallen to 35 percent and real GDP per capita was less than one percent.

But there is plenty more. Not least our two recent blogs on the importance of the corporate income tax, Part 1 and Part 2 which provide a whole slew of insurmountable factors that simply have to be taken into account in any study of the effects of corporate tax-cutting – and which conveniently aren’t considered in any of those studies that purport to show that tax-cutting is the golden elixir of growth.

Now take this latest article from Citizens for Tax Justice in the U.S., veterans of this scene. (We have just quoted them on a rebuttal they did to an appalling campaign in the New York Times claiming — on the basis of a huge and unworldly mess of an economic model — that it’s a great idea to abolish the corporate income tax.) CTJ point to new reports from the nonpartisan U.S. Congressional Research Service (CRS), which “summarizes the evidence on the relationship between tax rates and economic growth” and finds “little relationship with either top marginal rates or average marginal rates on labor income.” It also finds that work effort and savings are “relatively insensitive to tax rates.”

Some of the reports they cite aren’t online, though this one is. CTJ pokes fun at of some of the tax-cutters’ ridiculous and unworldly models and notes:

“While many advocates of tax cuts claim that a high top marginal personal income tax rate hinders investment by the wealthy, the report finds that “periods of lower taxes are not associated with higher rates of economic growth or increases in investment.”

So how much did the Bush tax cuts help? They cite CRS:

“The models with responses most consistent with empirical evidence suggest a revenue feedback effect of about 1% for the 2001-2004 Bush tax cuts,” meaning the effects that the tax cuts had on the economy and on behavior of taxpayers offset just 1 percent of their total cost. And much of this effect may have taken the form of taxpayers changing how many deductions they take, and other tax planning changes, rather than actual economic growth.

The reports debunk (yet again) the laughable Laffer curve (pictured, at top), and also refutes the ill-advised ‘incidence’ argument which is wielded by the shriller tax-cut shills as in their campaign to abolish the corporate income tax. (Or, as one blogger summarises: “CRS teaches the American Enterprise Institute how to do panel regressions”.)

CTJ also makes another important point about bamboozlement:

These studies are often mind-numbingly complicated and it is rare that policymakers or their aides have the time and ability to go through these studies to understand whether or not they actually make sense. Thankfully, the Congressional Research Service has done that job for everyone.

In fact, there’s so much in the short CTJ article worth reading, that we would urge you simply to go there.

Related articles

UN tax convention hub – updates & resources

Taxing Ethiopian women for bleeding

Tax justice and the women who hold broken systems together

Malta: the EU’s secret tax sieve

The bitter taste of tax dodging: Starbucks’ ‘Swiss swindle’

Disservicing the South: ICC report on Article 12AA and its various flaws

11 February 2026

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

After Nairobi and ahead of New York: Updates to our UN Tax Convention resources and our database of positions

Taxing windfall profits in the energy sector

14 January 2026