John Christensen ■ Coming soon: Tax Justice Network Japan

Following extensive discussion among scholars, researchers and activists, Japanese civil society has given the greenlight for preparations to be made for the launch of Tax Justice Network Japan. This new member of the global tax justice movement will bring together existing activist groups such as the Citizens’ Network for Tax Justice in Japan and the NGO Forum for International Solidarity Levies, with the aim of launching TJN-Japan by end-2016.

Following extensive discussion among scholars, researchers and activists, Japanese civil society has given the greenlight for preparations to be made for the launch of Tax Justice Network Japan. This new member of the global tax justice movement will bring together existing activist groups such as the Citizens’ Network for Tax Justice in Japan and the NGO Forum for International Solidarity Levies, with the aim of launching TJN-Japan by end-2016.

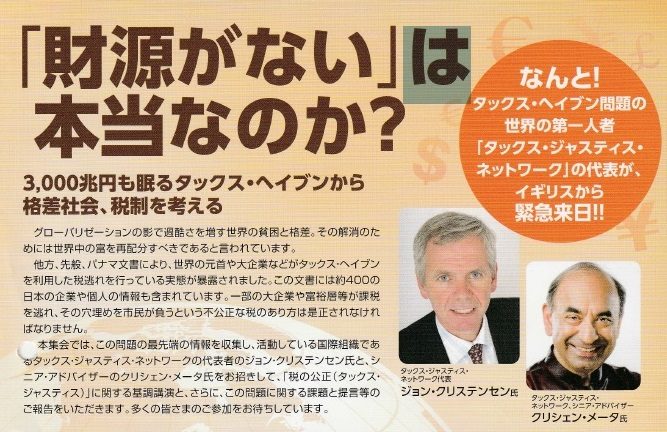

This greenlight comes just days after a TJN mission to Tokyo, comprising John Christensen and Krishen Mehta, took part in a hectic week of meetings with a wide range of parliamentarians, trade unions, NGOs, journalists and other civil society groups with an interest in economic and social justice.

Importantly, being a member of both G7 and G20 Japan is in a position to play a leading role in promoting tax justice policies on the international agenda.

As a leading trading nation Japan is well placed to understand how tax avoidance undermines fair trade, while tax havens harm the quality of development in almost all countries.

Japan also hosts a major offshore finance centre, but has avoided encouraging tax avoidance through a Tax Haven Counter Measure Law (1978) and its secrecy score of 58 places it below the TJN’s secrecy jurisdiction threshold (countries with a financial secrecy score above 60 are categorised as secrecy jurisdictions).

While Japan is deficient in some areas of transparency – for example, the government has not yet agreed to make Country-by-Country Reports publicly available, and company ownership information is also not made available to the public – the 2013 peer review report of the Global Forum on Transpaency and Exchange of Information for Tax Purposes deemed Japan compliant and largely compliant in most respects. This places Japan in a good position to take a leadership role within G7 and G20 in pushing for both improved transparency and information exchange on tax matters.

Japan is also a major contributor to overseas development assistance and has been at the forefront in supporting efforts to strengthen the tax administrations of developing countries. During their meetings with politicians and senior officials the TJN delegation also discussed the need to help tax administrations develop their capacity to audit and investigate tax avoiding multinational companies which can exploit tax havens to shift profits offshore. Technical assistance in this area will help poorer countries reduce their vulnerability to the aggressive tax strategies of many MNCs.

Japanese civil society has been actively engaged on tax justice issues for many years, so the imminent launch of Tax Justice Network Japan represents a major step towards full engagement on research, advocacy and campaign work at the global level.

Related articles

Taxing windfall profits in the energy sector

14 January 2026

The tax justice stories that defined 2025

The best of times, the worst of times (please give generously!)

Let’s make Elon Musk the world’s richest man this Christmas!

Admin Data for Tax Justice: A New Global Initiative Advancing the Use of Administrative Data for Tax Research

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025

Indicator deep dive: ‘patent box regimes’