Nick Shaxson ■ How do top rate income tax cuts affect women?

[vc_row][vc_column][vc_column_text]On International Women’s Day, this is the first of two blogs on the subject of tax justice and gender.

The short answer to the question in our headline is that cuts to the top rate of income tax hit women particularly hard, not just because their disproportionate role in childcare and other family-related areas are hit by ensuing government spending cuts, but also because the top earners who are enjoying the tax-cut bonanza are predominantly men.

For more background on this, see our blog Why Gender Equality Requires More Tax Revenue by Diane Elson, chair of the UK Women’s Budget Group, and our TJN page dedicated to tax justice and gender issues.

So what kind of share of top income earners are men? Well, of course it varies from country to country, and from year to year. But here is some interesting data from the UK, which is surely indicative of a worldwide trend. (Please do let us know of other country research in this area.)[/vc_column_text][vc_raw_js]

JTNDYmxvY2txdW90ZSUyMGNsYXNzJTNEJTIydHdpdHRlci10d2VldCUyMiUyMGRhdGEtbGFuZyUzRCUyMmVuJTIyJTNFJTNDcCUyMGxhbmclM0QlMjJlbiUyMiUyMGRpciUzRCUyMmx0ciUyMiUzRU9uJTIwJTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRnR3aXR0ZXIuY29tJTJGaGFzaHRhZyUyRklXRCUzRnNyYyUzRGhhc2glMjIlM0UlMjNJV0QlM0MlMkZhJTNFJTIwSSUyMGludml0ZSUyMCUzQ2ElMjBocmVmJTNEJTIyaHR0cHMlM0ElMkYlMkZ0d2l0dGVyLmNvbSUyRkdlb3JnZV9Pc2Jvcm5lJTIyJTNFJTQwR2VvcmdlX09zYm9ybmUlM0MlMkZhJTNFJTIwbm90JTIwdG8lMjBjdXQlMjB0YXglMjBmb3IlMjA0NSUyNSUyMHRheHBheWVycyUyMDgzLjUlMjUlMjBvZiUyMHdob20lMjBhcmUlMjBtZW4uJTIwU3BlbmQlMjB0aGUlMjBjb3N0JTIwaW1wcm92aW5nJTIwY2hpbGRjYXJlJTIwcHJvdmlzaW9uLiUzQyUyRnAlM0UlMjZtZGFzaCUzQiUyMEpvJTIwTWF1Z2hhbSUyMFFDJTIwJTI4JTQwSm9seW9uTWF1Z2hhbSUyOSUyMCUzQ2ElMjBocmVmJTNEJTIyaHR0cHMlM0ElMkYlMkZ0d2l0dGVyLmNvbSUyRkpvbHlvbk1hdWdoYW0lMkZzdGF0dXMlMkY3MDcxNzM1NDg1MzY3NTgyNzQlMjIlM0VNYXJjaCUyMDglMkMlMjAyMDE2JTNDJTJGYSUzRSUzQyUyRmJsb2NrcXVvdGUlM0UlMjAlM0NzY3JpcHQlMjBhc3luYyUyMHNyYyUzRCUyMiUyRiUyRnBsYXRmb3JtLnR3aXR0ZXIuY29tJTJGd2lkZ2V0cy5qcyUyMiUyMGNoYXJzZXQlM0QlMjJ1dGYtOCUyMiUzRSUzQyUyRnNjcmlwdCUzRQ==

[/vc_raw_js][vc_column_text]This follows news that, as the Financial Times put it:

“Former Conservative chancellor Lord Lawson on Wednesday night urged George Osborne to cut the top income tax rate to 40p in next month’s Budget, amid signs the Treasury is considering such a move.”

But what is the source of that 83.5% figure?

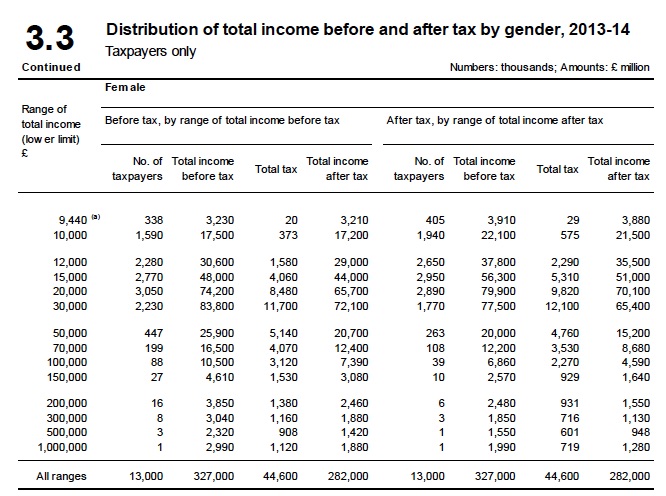

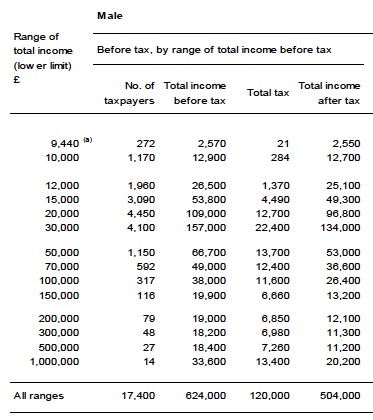

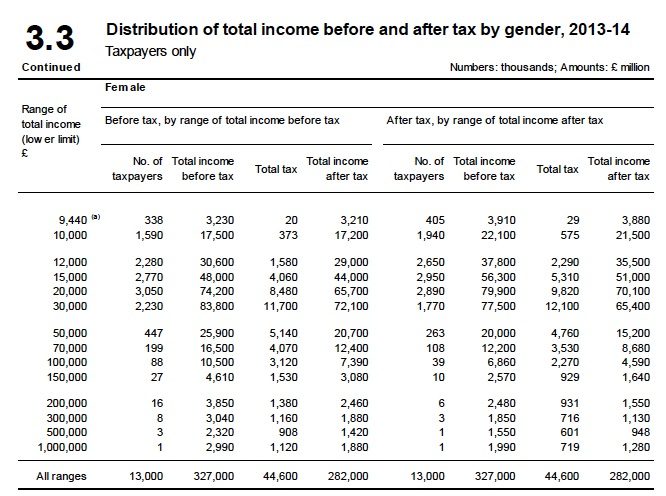

Well, first note that the top rate of UK income tax of 45 percent kicks in above £150,000 of income. Now look at UK Personal Incomes Statistics 2013-14, and in this document the tables are on p36.

First, the statistics for women.

This shows that 55,000 women earned more than £150,000 annually. The next table shows that 284,000 men earned above that level.

So women made up just 16.2 percent of the 339,000 people earning above that level (and, as an aside, the numbers also show us that women earn just 13.4% of the total income above that level).

Or, to put a slightly finer point on Maugham’s tweet, 83.8 percent of the people who would benefit from this tax cut are men.

Of course, households often include both women and men – so benefits to male higher earners will sometimes have knock-on effects that reduce the immediate gender inequality impact. We still lack good data on this point, but it’s clear that if you have any concern with gender inequality, you certainly wouldn’t start by cutting tax for the highest-earning men in the hope of some kind of gender ‘trickle-down’. And of course this is based on latest available data which is from 2013-14, and this tax cut being mulled is for the future. So it’s not an exact forecast, but a pretty good indication.

We should also note that there is a huge ideological game going on here. The big news is that George Osborne, the UK Chancellor (Finance Minister,) has been crowing that since he cut income tax, there has been an £8 billion-ish boost to revenues, year on year. He knows perfectly well that this is purely down to people shifting income from the high-tax year to the low-tax year so as to enjoy the additional rate, rather than any Laffer Curve-type nonsense. Maugham, the Twitterer we cited above, fisks the numbers here.

What neither Maugham nor Osborne have noted, however, is that the official studies that were constructed – perhaps to help bolster the political justification for these tax cuts for the wealthiest section of society, were based on exceedingly dodgy numbers, as we explained in great detail.[/vc_column_text][/vc_column][/vc_row]

Related articles

Stolen Futures: Our new report on tax justice and the Right to Education

Stolen futures: the impacts of tax injustice on the Right to Education

31 October 2024

CERD submission: Racialised impacts of UK’s ‘second empire’

UN submission sets out racist impacts of UK’s ‘second empire’

Infographic: The extreme wealth of the superrich is making our economies insecure

Wiki: How to tax the superrich (with pictures)

Taxing extreme wealth: what countries around the world could gain from progressive wealth taxes

19 August 2024

A Call for Climate and Social Justice: Why Europe Needs a Wealth Tax