Nick Shaxson ■ Tax Haven Netherlands takes over EU presidency. As if Juncker weren’t enough

From Social Europe:

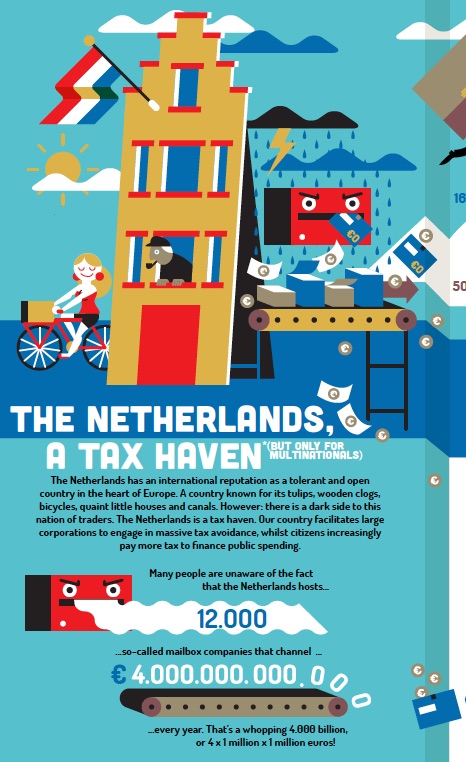

“As of this January 1, the Netherlands holds the Presidency of the European Union. This is a good occasion to put the spotlight on a well-kept Dutch secret: The Netherlands is one of the largest tax havens in Europe, indeed the world.

While minister of finance Jeroen Dijsselbloem – better known as head of the Euro Group – routinely denounces Greece’s “unwillingness” to reform its tax system, the Canadian mining company Gold Eldorado avoids paying taxes in Greece via his own country. While the Netherlands lambasted Cypriot banks in 2013 for laundering (Russian) money, oligarchs were invited in 2013 and 2014 to the Dutch embassy in Ukraine for a seminar by private Dutch law firms on how to avoid taxes via the Netherlands. Recently the European Commission decided that special Dutch tax breaks for Starbucks are illegal under European state aid rules.”

We might add this. Or this. There’s a whole menu of examples, in fact. Read more in the original article.

Still, at least Europe isn’t a monolith, and there’s an interesting separation of roles and powers and responsibilities, so the tax havens can’t take over the whole show.

Oh, wait, hang on a second.

See more at SOMO.

Story hat tip: Wiert Wiertsema

Related articles

🔴Live: UN tax negotiations

The Tax Justice Network’s most read pieces of 2024

Breaking the silos of tax and climate: climate tax policy under the UN Framework Convention on International Tax Cooperation.

Seven principles of good taxation for climate finance

9 December 2024

Joint statement: It’s time for the OECD to walk the talk on human rights

Did we really end offshore tax evasion?

The State of Tax Justice 2024

EU public consultation on the Anti-Avoidance Directive

Indicator deep dive: ‘Royalties’ and ‘Services’

Submission to EU consultation on Anti-Tax Avoidance Directive (ATAD)

6 November 2024