Nick Shaxson ■ Juncker faces Euro tax committee: “disappointing and outrageous”

From Politico:

From Politico:

“European Commission President Jean-Claude Juncker told a special parliamentary committee Thursday that as prime minister of Luxembourg he had no role in the country’s creation of special loopholes for multinational corporations.”

This was a hearing under an ad-hoc panel on the “Luxleaks” revelations of massive corporate tax cheating operations run out of Luxembourg, with the help of cosy “tax rulings” from the Luxembourg authorities. Juncker was Prime Minister of Luxembourg at the time all these schemes were created.

His words are, in the words of Sven Giegold, a European MEP (and one of the founders of the Tax Justice Network, “Disappointing and outrageous.”

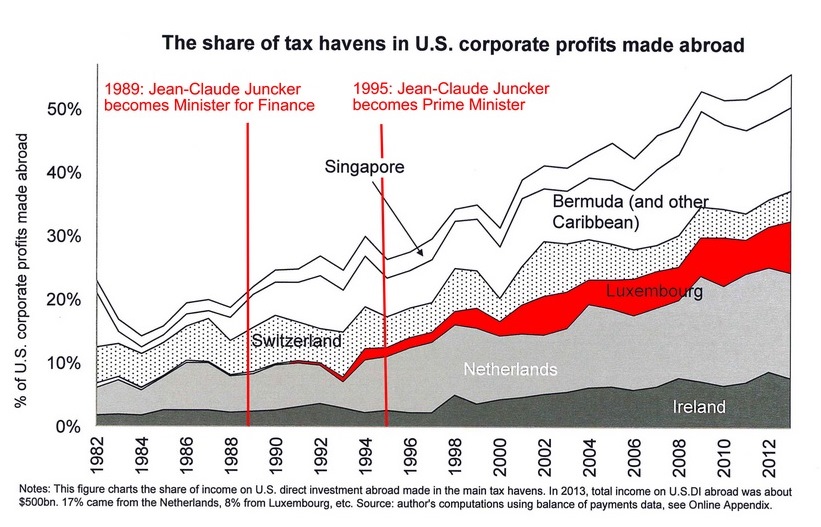

Everybody in the know knows that Juncker was the main architect of and cheerleader for the Luxembourg tax haven, as this graph so clearly suggests.

Juncker’s tax haven history. Source: Gabriel Zucman; tinyurl.com/njy2al2, enhanced by David Walch of Attac-Austria. (NB Bermuda isn’t in the Caribbean, but in the North Atlantic.)

Perhaps Mr. Juncker would like to point to a time during his tenure when he criticised the corporate tax abuses run out of Luxembourg.

Giegold is worth quoting at length here:

“Jean-Claude Juncker’s appearance in the joined ECON-TAXE Committee Meeting was a farce. He staged himself as the infallible advocate of fair tax policy. He denied any involvement and responsibility in the Luxembourg affairs, even though the system was put in place at the time he was the Finance- and Prime Minister. He dismissed any criticism and showed no regret.

Juncker did not answer the question why the Commission withholds documents that are important for the work of the special committee. He handed over the question to Commissioner Pierre Moscovici and did not show any personal support. He treated several parliamentarians without respect.

We demand access to the documents of the code of conduct group on business taxation. Therefore, we have to extend the mandate of the committee in order to be able to analyze thoroughly these documents. If the documents are not made available, we need to establish an inquiry committee which can enforce the inspection of documents.

Today Jean-Claude Juncker clearly failed to gain back trust as guarantor of fair and just tax policy in the European Union.”

Related articles

🔴Live: UN tax negotiations

The Tax Justice Network’s most read pieces of 2024

Breaking the silos of tax and climate: climate tax policy under the UN Framework Convention on International Tax Cooperation.

Seven principles of good taxation for climate finance

9 December 2024

Joint statement: It’s time for the OECD to walk the talk on human rights

Did we really end offshore tax evasion?

The State of Tax Justice 2024

EU public consultation on the Anti-Avoidance Directive

Indicator deep dive: ‘Royalties’ and ‘Services’

Submission to EU consultation on Anti-Tax Avoidance Directive (ATAD)

6 November 2024