Nick Shaxson ■ Tax justice and the coronavirus

Update: the second article in this series is entitled Could the wealth in tax havens help us pay for the Coronavirus response?

The Covid-19 Coronavirus pandemic is, at least on available evidence, striking rich western countries the hardest so far. Lower-income countries will be hit hard too, however: massive capital flight is already underway. And in all societies, as ever, the impacts fall hardest on those who are already marginalised and vulnerable.

But for now, rich countries have an abundance of resources to feed, house and care for all their citizens adequately. The question of how those resources are shared out is a political choice. Tax plays an important role.

Western nations are now in conditions like wartime. (The world is in a kind of war, against an unseen enemy.) Today’s blogger, based in Berlin, isn’t allowed in the streets with more than one companion, without documents to show they’re a family member. In Britain, a standard-bearer for “free” [in reality, rigged] markets, the first nationalisations have begun, and a national lockdown has (belatedly) been ordered. Italian mayors are threatening “to send the police over, with flamethrowers” to people breaking curfew. As workers stay at home to avoid contagion, a shutdown threatens massive job losses: perhaps a fifth of all U.S. workers, on one estimate. A huge global economic crisis looms. And this won’t go away soon.

Governments and societies face colossal economic costs now, as they are confronted by millions of workers losing their jobs and millions of businesses going broke. Old economic orthodoxies are toppling, one by one.

Business as usual is over.

How will societies and economies deal with these costs? First, by accepting that when millions of people stop work, overall economic output must fall. The next question is, who in society will bear the burden, where will they be, and how and when will they bear it? Again, these will be political choices. We can, we must, influence those choices.

Second, governments will massively, suddenly, have to boost public spending: if they don’t, there will be riots. Denmark, for instance, has said it will pay 75 percent of the salaries of employees who would otherwise be fired. Others are following suit with a raft of measures including cash transfers for individuals and support for businesses.

How will states “pay for” this? There are two main ways.

The first, most important, will be through borrowing. There is no inflation on the horizon, interest rates are low and in some cases negative, and financial markets have been eating up government debt without so much as a burp. If there’s a time to borrow, it’s now. And it is already happening. In a move that would have been astonishing just a few weeks ago, Germany has suddenly punched through its long-held (and idiotic) “Black Zero” policies to balance its budgets and not take on new debt. As the Financial Times reports:

The time has come for governments to spend. To protect vulnerable people, broad populations, essential workers, institutions, and the economy. Even the financial sector, where its collapse could pose a threat.

But we are generally a revenue-side organisation, not a spending-side organisation, so we’ll focus on the second way governments can “pay for” the massively expensive new measures coming in, which is tax. Although tax receipts don’t need to match spending, they do still need to be collected, where possible.

Tax systems play another crucial role in that economic question at the heart of this crisis: they help governments choose how the pain of lost output is shared out.

And with all the old ideological orthodoxies are suddenly up in the air, and despite the special interests clamouring for yet more tax breaks, NOW is the time to push hard for tax justice.

In short, tax justice campaigners should be calling for a strong fiscal stimulus which will lead to poor and vulnerable people paying less and rich people and strong, profitable corporations paying more.

Lessons from history

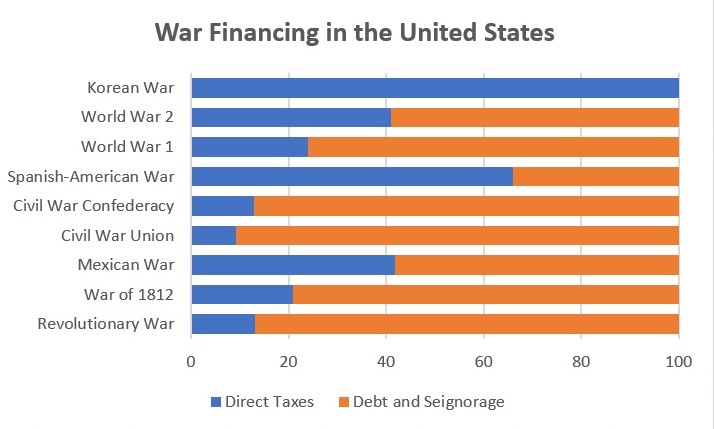

History provides some grounds for optimism as to what comes next. In times of war, governments have tended to make wealthier sections of the population and large businesses carry a larger share of the burden than before. In the First World War, for instance, both Britain and the United States imposed an 80 percent tax rate on excess corporate profits (above an 8% annual return,) and the top income tax rate on the highest earners rose from 15 percent to 77 percent. Something similar happened in the Second War, when top income tax rates rose to 94 percent. In the United Kindgom, the top income tax rate rose to an even more eye-watering 99.25%. Similar tax measures were adopted by other countries at war.

Over time, from one war to the next, taxes have assumed a growing share of the revenue mix, as this graph shows.

Taxes were preferred above borrowing or other measures at times when support for wars was high. Famed economist John Maynard Keynes produced a radical plan for funding the UK’s involvement in WW2 which involved a sharply progressive surtax on high incomes and personal wealth, and he was keen to shift as much of the cost of financing the war effort onto richer people.

It is worth adding that very high rates persisted for at least a couple of decades after the Second World War’s end, accompanied by a raft of other progressive policies and the highest and most broad-based economic growth in world history, before or since. People who have been until recently gloomy about the prospects of an increasingly entrenched, lawless, powerful and tax-free global oligarchy may have grounds for optimism.

Is this time different?

There is a big difference between now and the time of World Wars, however. Back then, employment was running at full tilt, with men heading off to fight and women flooding into the factories. Right now, the opposite is happening: workers are heading home, and millions of businesses face bankruptcy.

So is this the time to be raising taxes? Should we not be cutting taxes instead?

The simple answer is: it is time to be smart about this. Taxes should be cut to help those worst affected — but for those companies that are still making profits, and the wealthiest sections of society, they should now be increased significantly – even massively. Public appetite for this was already in place before the crisis.

But let’s start with all-important measures to support collapsing businesses and workers’ incomes. Women will pay a heavy price, since they will disproportionately be working on the health frontlines, and in the social care sectors, while also caring for children ejected from schools, and the elderly.

The most important measures to help are on the spending side and on other policy measures, such as enforced rent or mortgage delays or freezes or forgiveness. These are beyond the scope of this blog.

On the tax side, there are many ways to support people and struggling businesses. For instance, targeted reductions to value added taxes, focused on basic necessities, would help ordinary people, as would property taxes. Taxes on payrolls, business rates (on real estate) and other taxes which add to the costs of doing business, should be judiciously cut, at least for those businesses facing hardship due to Covid-19. Measures such as “accelerated depreciation” (to allow affected businesses to offset investment costs against tax more quickly) will help shore up investment, though great care is required so they don’t become expensive and pointless loopholes.

But in other areas, taxes should be raised – and raised A LOT.

Tax profitable corporations more

Take corporate income taxes, for instance. These are levied on profits. If companies are struggling, they won’t be making profits, so they won’t pay this tax. So corporate income tax rates can be increased right now, because they will only strike profitable businesses. (There are timing issues: a teetering company could be bankrupted by a crippling tax bill from a previous quarter, but these are details to be managed skilfully.)

Some businesses will do very well out of this catastrophe. Lots of people locked down at home are now turning to Zoom, for instance, to communicate with loved ones. Its share price is now several times what it was in early January.

Likewise, many bricks-and-mortar shops (the ones that hadn’t already been slaughtered by the Amazon steamroller) are now facing temporary or permanent closure – and the American behemoth is ready to hoover up the pieces. Antitrust authorities are nowhere (as we recently remarked.) Let corporate tax pick up some of the slack.

And from a justice perspective, we have to agree with Pope Francis.

Those who do not pay taxes do not only commit a felony but also a crime: if there are not enough hospital beds and artificial respirators, it is also their fault.”

It is not only just and right that the wealthiest people and profitable corporations pay, but if they are still wealthy or still profitable, they also have a greater ability to pay.

So let’s not mess around here. In recent years mainstream governments have been bickering over whether corporate taxes should be at 25 percent, or 20 percent, or 18 percent. All that needs to go out of the window now.

Let’s now start to talk about levying excess corporate income tax rates dramatically high. Let’s start with a 50 percent rate, and start thinking about 75 percent on excess profits, above, say, a five percent hurdle rate. This is way out there on past consensus, but who knows where we’ll be in five years’ time – or in a few months?. (Update, March 27. Top US tax expert Reuven Avi-Yonah and economist Gabriel Zucman echo our call for an excess profits tax.)

This protects the weak, and gets the strong to support the weak.

Barely profitable firms that aren’t making excess profits would pay nothing: it’s those hedge funds profiting from currency collapses, tech firms eating distressed companies’ lunches, or private equity firms buying distressed assets cheaply and financially engineering them for profit – which can and must now pay their share.

Obviously, different countries, and different sectors, face different conditions. But what’s most important now is to start to shift the “Overton Window” – the realm of what is politically possible and what the public is willingly to accept – firmly in the direction of tax justice. Make no mistake: there are powerful forces that want to use the opportunity of this crisis to push exactly in the other direction.

Tax rich people more

Income tax is another flexible mechanism to tax different segments of society at different rates. Under a healthy progressive tax system, the first portion of an individual’s income (say, from 0 to $10,000 per year) isn’t taxed at all; the next portion (say, $10-20,000) is taxed at a low rate; the next portion, let’s say $20-50,000, is taxed at a higher rate, and then above a certain income level, the top rate is applied. In rich countries, that top rate is often of the order of 40-50 percent.

Remember, though, that the top rate has historically been as high as 99.25 percent. Now is a time to raise this rate a long way. It won’t hurt people in the lower tax brackets – if it means more public spending on hospitals, say, it will help them.

How high should they go? Well, there’s research suggesting that the revenue-maximising rate in the United States is somewhere like 75 percent. So let’s start shifting the Overton Window, and push our governments to aim in this direction. And let’s beef this up with wealth taxes, land value taxes, and other progressive taxes. If you’re wealthy, you can afford these.

Tighten up

People will of course shriek at these proposals. High tax rates will discourage investment, they will cry. Clever rich folks will run away with their money to Geneva or Hong Kong or Dubai, where they can get ‘friendlier’ tax rates. Or corporations and rich folk will get busy with their tax advisers, to use offshore trusts and many other subterfuges to escape paying their fair share. It’s like a balloon, they cry: if you squeeze in one place, it will just displace somewhere else, but the volume will remain the same.

Despair! The poor must pay!

Not so. As we and many others have shown many times, high corporate tax rates may affect corporate profit-shuffling, but they do not generally discourage the kinds of investment that healthy economies need. (They do, however, tend to discourage more predatory forms of investment, which is another benefit.)

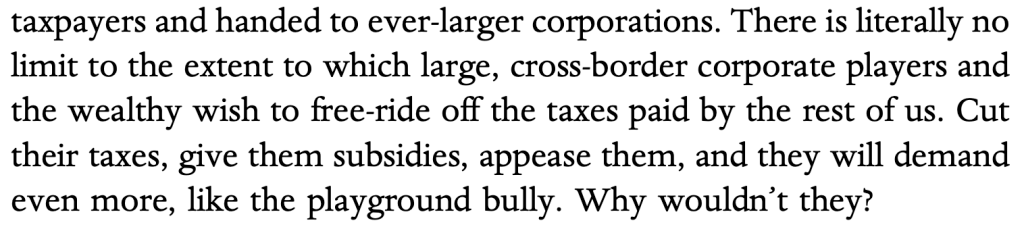

Corporations say they need corporate tax cuts to invest, in the same way that my children say they need ice cream. And do not buy the old argument that corporations and rich people will stop avoiding tax or invest more if only you cut their effective tax rates. As a recent book explains:

More on all this soon.

No, the answer isn’t to kowtow and appease mobile capital and rich people. The time has come to start tightening up. Crack down properly, to stem leakage, to reduce loopholes, increase transparency, and so on. It’s not like a balloon: it’s more like a sponge. When you squeeze, you may get some displacement – but you’ll also wring out a bunch of water too.

So a slighty better slogan is this: tax the poor and fragile and vulnerable less, tax the rich and profitable more, and tighten up to make sure they pay.

We have been working for years on a whole tax justice toolkit, to achieve just this. It includes

- Unitary taxation and formula apportionment.

- Country by country reporting

- Beneficial ownership transparency

- Tackle the enablers of tax injustice.

- Unmask and dethrone the “Competitiveness Agenda” ideology.

- Tackle the finance curse.

And plenty more. The main point is that the time has come to get much more ambitious about all of these.

This blog is about the role of tax systems in the Covid-19 crisis. We will follow it with a series of others: about the role of tax havens, the role of bailouts and subsidies, and the role of a race to the bottom on regulation, tax and other areas. And more. Please watch this space.

Related articles

The tax justice stories that defined 2025

Let’s make Elon Musk the world’s richest man this Christmas!

Taxation as Climate Reparations: Who Should Pay for the Crisis?

Why Climate Justice Needs Tax Sovereignty

Reclaiming tax sovereignty to transform global climate finance

Asset beneficial ownership – Enforcing wealth tax & other positive spillover effects

4 March 2025

Stolen futures: the impacts of tax injustice on the Right to Education

31 October 2024

Infographic: The extreme wealth of the superrich is making our economies insecure

Wiki: How to tax the superrich (with pictures)

Taxing extreme wealth: what countries around the world could gain from progressive wealth taxes

19 August 2024

Unlike after the war wealth levels are at record high, economic boom coming to an end instead of starting, so instead of high taxes on companies and income, tax wealth. If you do it through a one-time levy, like Germany did through Lastenausgleich in 1952, you even save on administrative burden

Firstly I would like to thank you Nick for all your efforts, over the years, kudos, albeit I think the predominate issue is the realities of Monetary systems available to various countries first and foremost. Per se taxation is relevant to such post facto and is conditional considering operational and legal realities E.g. issuer or user with an eye to soft or hard money theories.

On top of that one has to reconcile the legal issues with how monies flows are relative to what Keynes alluded too, understanding of its origins and death.

I can only respectfully submit that for myself I would not ascribe hard money attributes to soft anymore that the opposite.

Respectfully

Thank you so much. This makes so much sense. Sadly, the quote from Pope Francis rings all too true. In an ideal world, where self isn’t on the throne, and people thought in terms of shared community, the correct taxes would be collected and there would be enough in a time of crisis.

Keep doing what you are doing.

Many thanks

Trish Ferrarin

Really a good article. I have learnt a lot.

But, question is if high tax imposed on corporate (which is mostly known to the prospective high tax payer), they may do accounting engineering to show up lower profit.

What might be the Govt. action in such case.

This blog is really very informative and I really appreciate that you shared this content.