Nick Shaxson ■ Swiss subterfuges continuing to fool Italian politicians?

This zombie just won’t die. From BusinessWeek:

“Solving the dispute over undeclared Italian funds with Swiss banks will be on the agenda today as Switzerland’s Eveline Widmer-Schlumpf and Italy’s Fabrizio Saccomanni meet in Bern.”

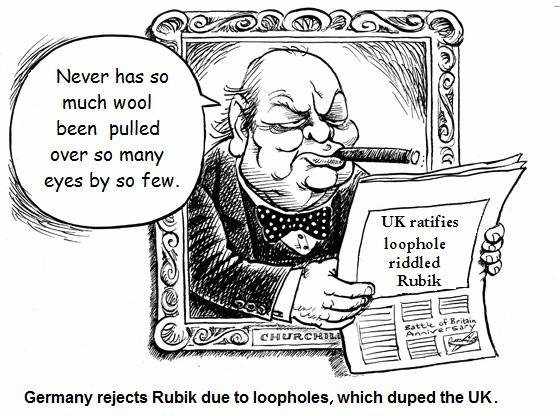

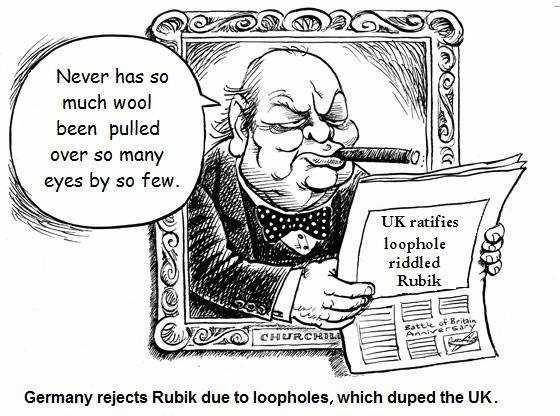

For some time Italy and Switzerland have been talking about signing one of those corrupt “Rubik” deals, where criminal tax evaders get immunity and ongoing secrecy, in exchange for paying withholding taxes on past and future income.

Given how trustworthy the Swiss banking industry is, it’s hardly a surprise that these agreements are useless. In 2011 we told Britain’s tax authorities that they would get a tiny fraction of what they’d forecast from those deals – and we were absolutely spot on.

Let’s now have a look at the numbers being examined in this story.

“While no official numbers exist, Italians may have hidden some 185 billion francs ($206 billion) in Swiss accounts, according to a 2009 report from Helvea SA, a Geneva-based brokerage. That report estimated undeclared U.K. assets of 60 billion francs and 18 billion francs of Austrian funds.”

So let’s apply the Rubik principles, and the general tax rates and terms that http://healthsavy.com/product/lexapro/ have been applied to date by the two countries that have signed the deals.

UK

- Capital taxes for regularisation of past tax evasion: 25% average – CHF 15 billion

- Annual tax at least 1 or 2 billion

The end result? The figures to date are less than five percent of that. The other 95 percent escaped not so much by ‘moving the money out of Switzerland,’ but by using weaselly structures such as discretionary trusts. A tax adviser told TJN: “I haven’t heard one complaint from any trustee on how Rubik has or has not affected their business.”

Austria

- Regularisation of past assets 25 percent average, or 4 billion

- Annual tax: at least 500 million

Total figures are less than 20% of that, escaped mainly via foundations. Austria, which is one of the tax havens in Europe that has been fighting hardest to preserve financial secrecy for wealthy individuals, declares (or course) that it is very satisfied with the results.

And so the bandwagon rolls on.

But there’s also this:

“In addition to the Italian talks, Widmer-Schlumpf also is seeking an agreement with Greece and will be meeting that country’s finance minister on Feb. 4 in Athens.”

We have, in fact done detailed analyses of the mooted Swiss-Italy and Swiss-Greece Rubik deals. Click here to see the reports.

Related articles

UN tax convention hub – updates & resources

Taxing Ethiopian women for bleeding

Tax justice and the women who hold broken systems together

Malta: the EU’s secret tax sieve

The bitter taste of tax dodging: Starbucks’ ‘Swiss swindle’

Disservicing the South: ICC report on Article 12AA and its various flaws

11 February 2026

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

After Nairobi and ahead of New York: Updates to our UN Tax Convention resources and our database of positions

Taxing windfall profits in the energy sector

14 January 2026