Niko Lusiani and Emily DiVito ■ Billionaire market power: How could an individual wealth tax curb corporate consolidation in the US?

The following article is from the “Tax and Monopoly” October 2022 issue of the Tax Justice Focus, an online magazine that explores boundary-pushing ideas in tax justice and revolutionary solutions to the most pressing challenges of our time. Each edition features articles from prominent experts and academics from around the world. The “Tax and monopoly” issue is co-published with the Balanced Economy Project and Roosevelt Institute.

Concentrated control of large corporations has created vast fortunes over the last four decades and fueled the drive towards market domination. Here Niko Lusiani and Emily DiVito consider how the tax system could be used to shift incentives and broaden ownership beyond a handful of latterday robber barons.

Today large incumbent firms dominate industries across the United States – from meat to medicines, from finance to tech, from retail to telecoms. This historic turn away from a dynamic multi-player business sector to a stagnant private sector stunted under the shadow of a few mega-oligopolies has real consequences for people.

Corporate concentration extracts wealth from consumers and communities and directs it to entrenched corporate shareholders and executives. Excess market power raises prices for consumers, lowers wages and worsens jobs for workers, inhibits business dynamism, compromises supply chains, reduces the supply of goods, and exacerbates racial wealth inequality both for individual households and communities as a whole. Perhaps sensing all of this, the US public has more negative sentiment towards big business than at any other point in the last five decades.

While policy thinkers and makers have rightly focused on strengthening antitrust law and competition mechanisms – as well as on building out public options to compete with dominant private firms – tax policy remains overlooked both as a driver of current levels of market concentration, and as a possible tool to remedy this problem – as this special issue of Tax and Monopoly Focus illustrates. Complementing the corporate focus of other contributions, our contribution here explores what effect a wealth tax on individual US billionaires might have on excessive market power.

A wealth tax is, as the name suggests, a tax – thus far proposed as around 1–2% – on the underlying value of the stock of the assets that make up the vast majority of multimillionaire and billionaires’ holdings, including real estate, cash, stocks and bonds, and certain business assets. Seen as fundamentally fair and highly-targeted, the idea of a wealth tax generates broad public support across the political spectrum, and its popularity has helped garner momentum for progress on various ways to tax the ultrawealthy – perhaps best evidenced by how close a 2021 proposal by Chairman of the US Senate Finance Committee for a Billionaire’s Income Tax came to legislative passage. Distinct from a 1–2% tax on the stock of wealth, this ‘mark-to-market’ (M2M) proposal taxes the income that accumulates from wealth by levying an annual tax on the change in the value of a high-net worth individual’s stock, dividends, and other tradable assets – assets that largely go untaxed in the current US system until a realisation event, like a sale, occurs.

Both a wealth tax and a M2M tax are highly-progressive and the uber-wealthy, who escape paying their fair share under the status quo, would exclusively be the subjects of these taxes. Both of these sorts of wealth taxes are largely conceived with the main aim of redistribution and raising revenue to fund broad scale public investments and programs. This revenue-forward rationale has limited discussion about how a wealth tax would shape markets – and in particular the business decisions of those wealthy individuals subject to the tax.

Only America’s top billionaires would be paying these sorts of wealth tax. So, let’s start with some stylised facts on who these individuals are. Focusing for a moment just on the top 10 wealthiest Americans, the list contains familiar names: the titans of the information age – often simultaneously the founders, CEOs and Board Chairs of some of the globe’s most profitable firms topping the stock markets. These include Amazon, Microsoft, Facebook, Berkshire Hathaway, Google, Tesla. These are (almost universally) men who sit at the top of the corporate food chain, and are compensated accordingly. Together, these 10 individuals own over $1 trillion in wealth. Importantly here, their wealth is primarily held in the stock of the companies they control. According to our estimates using the Bloomberg Billionaire Index, over 60% of the wealth of the top 10 American billionaires is held in the equity shares of the companies they control. If we zoom out to the top 50 American billionaires, over 75% of their combined $2.2 trillion in wealth is equity held in corporations that these individuals sit at the top of.

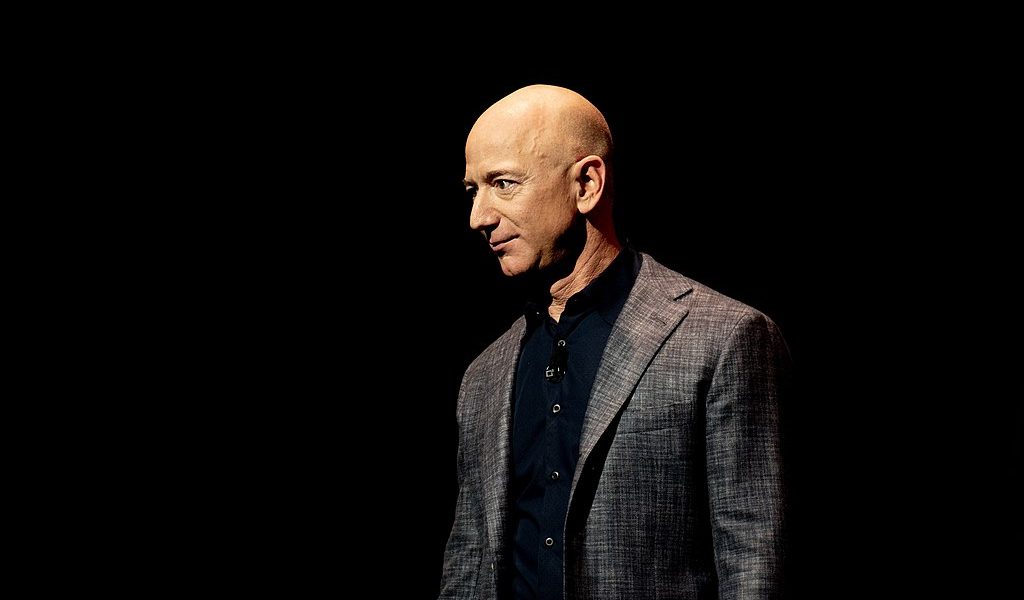

But even that average belies the degree to which most of these people functionally control their businesses, and the wealth that these businesses create. Warren Buffet – Board Chair, CEO and the largest shareholder in Berkshire Hathaway – holds 99% of his wealth in his company’s stock. Mark Zuckerberg – who reigns over Meta – holds 95% of his wealth in company stock. And Jeff Bezos – no longer CEO but still Board Chair at Amazon – holds 83% of his wealth in Amazon equity, and a very powerful 10% controlling interest in the company as a whole. (An individual owning over 5% of shares in a firm is generally considered a ‘blockholder,’ with unique effective power over corporate decisionmaking.) Even Bill Gates – whose wealth is relatively more diversified and holds much less effective control over Microsoft – became one of the top wealthiest people in the US through his shares in the company while he was at its apex.

This is all to say that the central source of wealth for America’s top billionaires is the growth in the value of their corporate equity – which, not coincidentally, is in monopolistic firms facing intense antitrust scrutiny. In the US today, so it seems, control and beneficial ownership of the most dominant firms have once again fused in the form of manager-blockholders who are simultaneously CEO, Board Chair and largest shareholder.

It’s also perhaps not a coincidence that the managerial power of these corporate leaders (and the economic power and wealth that such managerial positions have produced) is correlated with the growth in the market power of the firms they control. While a number of factors contribute to stock appreciation, the most fundamental driver is real and expected earnings: that is, profitability projections. Companies with more market power have more opportunity to increase profitability into the future, and thus are valued higher by financial analysts and stock pickers. It should be little surprise then that the wealthiest billionaires derive their fortunes from their control over precisely the companies able to charge monopoly rents and whose business models rely on building ‘moats’ against competition by killing or swallowing potential challengers.

All else being equal, the larger the ownership stake of an individual Billionaire in their own company, the greater incentive they would have to increase firm value by capturing market share. Personal financial motives then align with the means of controlling the firm to present the opportunity to consolidate market power. That is, the personal financial motivations of America’s top billionaires come together with their means as central corporate decision-makers (as both ‘agent’ and ‘principal’ in many cases with little effective Board accountability) to use their leverage to extract economic rents through capturing market share and dominating competitors. It may just be precisely the ability of billionaires’ companies to capture rents (and thus hikeprofitability, thus share prices, and thus their personal wealth) which drive the decisionmaking of these corporate leaders.

In this context, then what effect, if any, would the introduction of a new tax on the wealth of these individuals have on the broader problem of concentrated market power in the US today? The effective taxation of the firms themselves would not change whatsoever, and all else being equal, the after-tax profits would not either – posing no direct effect on the rents derived from market concentration. It is only the tax liabilities of those individuals in control of the dominant firms that would change. But they would change – and substantially.

First, given how concentrated these billionaires’ wealth is in their companies, both a 2% wealth tax and a mark-to-market annual accrual tax would have a sizable effect on their tax liability, primarily through decreasing the amount of capital gains they would actually see from the appreciation of the stock they own. The higher the effective tax rate, then, the less incentive these individuals would have to make decisions that would ensure the companies they control – and have very concentrated financial stakes in – extract supernormal profits by exerting more and more market power.

This logic connects to recent research on top end income tax, which confirms that high top tax rates in the US previously were, in fact, useful in placing a brake on rent extraction among top earners, as the net benefit for highly-paid executives to continue to seek larger pay was blunted if not eradicated. It wasn’t until top rates dropped that these executives started bargaining more aggressively to hike their pay. Today’s top billionaires’ wealth does not amass from wage income but from the appreciation of their stock, hence their bargaining power over compensation plays out in their ability to manipulate or otherwise affect the stock price by, most especially, capturing excessive market share. A wealth or billionaire income tax then could be seen to decrease the net benefit of this form of rent-seeking, while the absence of said tax leaves the wealthiest with a very strong incentive to seek more returns through their control over their dominant firms.

In fact, those individuals who play simultaneous roles of CEO/Board Chair/ controlling shareholder – in particular in firms with high rents – have many more opportunities to set their own pay than traditional corporate management. This is because they have arguably more control over the levers of stock appreciation – levers which don’t pose a cost to the firm, other shareholders nor workers in the same way labor income does.

Second, a wealth tax may pose liquidity challenges for some of these US billionaires as their wealth is so concentrated in the stock of their own companies. They might be forced to sell some of their stock to come up with the cash to cover their tax liability. That could be thought of as a feature not a bug. Doing so would necessarily decrease their ownership stake and thus their relative control of these companies – thereby diversifying the equity ownership of those firms and making the stakes less concentrated in one individual. More diffuse ownership in dominant firms would not automatically reduce the incentives to capture market power, which is latent in large US businesses no matter the number of shareholders. Wrap-around antitrust rules and competing public options are still very much needed to reduce entrenched market power. That being said, more diffuse ownership would weaken the concentrated decision-making power of these manager-shareholders in key areas such as mergers and acquisitions strategy and executive compensation.

In sum, a wealth tax – given the specific characteristics of the ultra-wealthy in the US – would arguably work to disincentivise the hoarding of market power by decreasing the intensely concentrated personal returns of the individuals controlling the business strategies of some of the country’s most dominant firms. Importantly, in the US context in particular, more assertive antitrust enforcement is needed to break down the hoarding of market power by today’s dominant firms, diminish the economic power of today’s billionaires, and prevent further concentrated wealth accumulation into the future. While the market power effect of taxing the ultrawealthy in the US is necessarily tied up in the specific design choices brought to bear, the time has come to dig deeper into how a wealth tax could dent the personal financial incentives top Billionaires have to capture the rents that emerge from corporate consolidation.

This essay is derived from a forthcoming Roosevelt Institute Issue Brief. Many thanks to Ivan Cazarin for research assistance. Comments encouraged.

As Director of Corporate Power at the Roosevelt Institute, Niko Lusiani leads the think tank’s program to dissect and dismantle the ways in which extractive corporate behavior jeopardises workers, consumers, our natural environment, and our shared economic system.

Emily DiVito is Senior Program Manager for the Corporate Power program at the Roosevelt Institute. She supports the think tank’s work identifying, explaining, and advancing solutions for the problem of unchecked corporate power in today’s economy

Jeff Bezos Image: Daniel Oberhaus, CC BY 4.0 https://creativecommons.org/licenses/by/4.0, via Wikimedia Commons

Related articles

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

The tax justice stories that defined 2025

Let’s make Elon Musk the world’s richest man this Christmas!

Admin Data for Tax Justice: A New Global Initiative Advancing the Use of Administrative Data for Tax Research

2025: The year tax justice became part of the world’s problem-solving infrastructure

Two negotiations, one crisis: COP30 and the UN tax convention must finally speak to each other

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations

Taxation as Climate Reparations: Who Should Pay for the Crisis?