Tax Justice Network ■ Pandemic of tax injustice in Ukraine

The Ukrainian government took the pandemic as an opportunity to further shift the tax burden from the rich to the poor, while Tax Justice Network’s new illicit financial flows tool confirms the country is vulnerable to profits shifting to tax havens and bank deposits outflows.

Guest blog from the Center for Economic Justice, a new TJN affiliate in Ukraine.

The Ukrainian economy has the largest ratio of exports to GDP in Europe, larger even than mega natural resources exporter Russia. The majority of these are commodities such as agricultural produce, steel and iron ore, and most of the exporters are private companies belonging to rich and super-rich Ukrainians. The wealthy not only control the most profitable sectors of the economy but also the mass media and political parties, and hence their influence allows them to enjoy low taxation and lax tax control of their exports. Personal income tax in Ukraine is flat,[1] withholding tax on dividends is low, and agricultural exporters enjoy a substantial reduction on corporate income tax.

To top up these tax privileges (subsidised by a population with the lowest average wage in Europe) the exporters also shift profits to low tax jurisdictions by underpricing sales to offshore intermediaries. Imagine a company, ‘Steel Co’, with subsidiaries in Ukraine, Switzerland and Germany. They make the steel in Ukraine and would like to sell it to manufacturers in Germany. If they do this directly, the entire profits of this operation are located in Ukraine, where they would pay 18% in corporate income tax. However, they can first sell it to the subsidiary in Switzerland for a low price, and then sell it from Switzerland to Germany for a high price. In this way, the majority of the profits can be shifted to offshore financial centers (such as Switzerland), where they are taxed at a much lower income tax.

As our two in-depth studies of transfer pricing demonstrated,[2] commodity exports are significantly underpriced, and as a result both the state budget and the Ukrainian economy are losing desperately needed resources. We estimated that around US $3 billion of profits are shifted offshore every year. Underpaid corporate tax alone costs the national budget about US $600 million.

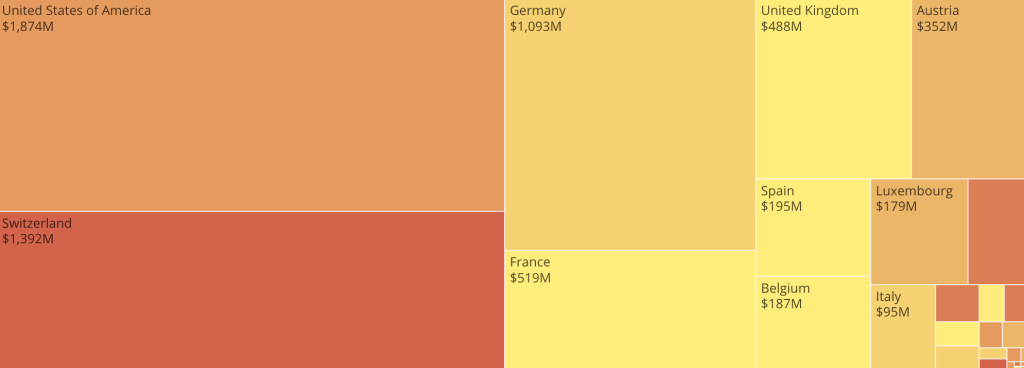

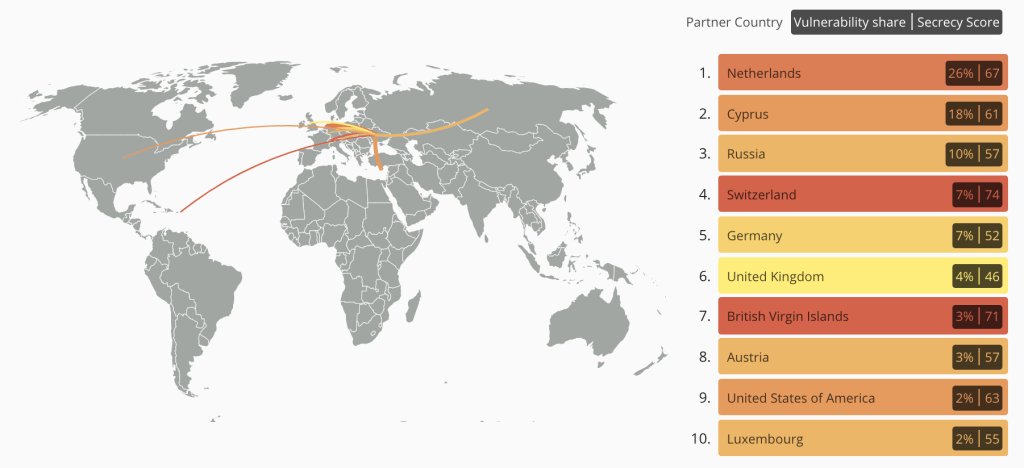

Tax Justice Network’s new Illicit Financial Flows Vulnerability Tracker confirms the exposure of Ukraine’s financial flows to tax avoidance. It shows that the deposits of Ukrainian firms and individuals are located especially in Switzerland (Figure 1). 30% of the overall vulnerability is created by the US and 26% by Switzerland. It also shows that foreign investment into Ukraine takes place predominantly from offshore financial centres (Figure 2). US $8.4 billion of foreign investment comes from the Netherlands, US $6.4 billion from Cyprus, and US $2.1 billion from Switzerland.

Apart from the gross injustice of tax avoidance and official under-taxing of the well-off, reduced resources render the Ukrainian state incapable of handling economic crises like the current pandemic.

Given that the Ukrainian budget is meagre[3] and that tackling the crisis requires budgetary intervention, you might expect the government to step up efforts to close tax loopholes and thereby help society address the economic downturn. But you would be entirely wrong. Contrary to the logic of fairness and efficiency, the “anti-crisis measures” implemented have provided further tax breaks for companies, none for employees[4], and negligible support to affected workers.

The key measures deployed by Ukraine to tackle the economic shock have been:

- Making agricultural corporates temporarily exempt from land tax;

- Temporarily suspending tax checks and fines for corporates;

- Suspending the social tax for the self employed;

- Introducing a “temporary unemployment” scheme: employees can receive the minimum unemployment benefit (about 150 euros per month) from the state and keep their job, if their employer applies for the scheme[5].

These measures place the burden of tackling the crisis firmly on workers, the poor majority of society, while tax avoiders are given further support at the public expense:

(i) the land tax had already been introduced at a special lower rate substituting the corporate tax for agribusiness. This surprising tax break for super-profitable agri-exporters had been criticised for providing them with an unfair and unnecessary advantage, and now even this lowered rate has been scrapped.

(ii) The suspension of tax checks and fines can be enjoyed only by business owners since taxes and social security contributions are automatically deducted from employees’ monthly pay.

(iii) The social security contribution break for the self-employed is surprising on many levels: some business activities remained profitable during the crisis, so why reduce their taxes? And why provide a tax break for the self-employed but not for employees? This measure is in line with the general neoliberal ideology of consecutive right-wing Ukrainian governments.

To conclude, thanks to a lack of sustained pressure on Ukraine’s political elite to reduce inequality, the current crisis has led to a further propagation of tax injustice. By their very nature tax issues are international, and so the struggle for tax justice also has to be international. The international community of activists and progressive politicians needs to step up the coordinated effort to fight for tax and economic justice both in Ukraine and around the world.

[1] Absence of progressive taxation in Ukraine means that high income earners pay the same rate of 18% as the poor, while in the majority of Western European countries the rich pay about 55% tax rate.

[2] https://www.guengl.eu/issues/publications/profit-shifting-in-ukraines-exports-of-agricultural-commodities/ , https://www.guengl.eu/issues/publications/profit-shifting-in-ukraines-iron-ore-exports/

[3] See comparisons in the agri-exports study, ibidem.

[4] There are some for the self employed, but our analysis shows this is done inefficiently and in the logic of radical free market thinking.

Related articles

After Nairobi and ahead of New York: Updates to our UN Tax Convention resources and our database of positions

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Tackling Profit Shifting in the Oil and Gas Sector for a Just Transition

The elephant in the room of business & human rights

Pope Francis, 1936-2025

Urgent call to action: UN Member States must step up with financial contributions to advance the UN Framework Convention on International Tax Cooperation

The Tax Justice Network’s most read pieces of 2024

Indicator deep dive: ‘Royalties’ and ‘Services’

Shell games: A new grant for academic research