Nick Shaxson ■ How financialisation worsens Britain’s regional imbalances: our submission to parliament

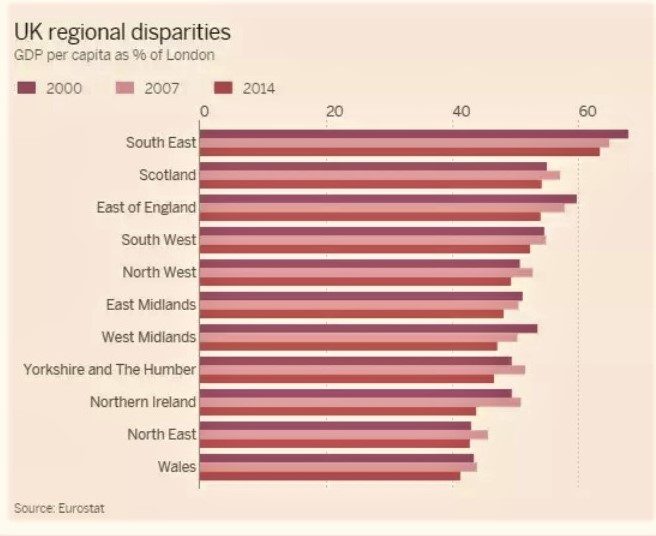

Recently the UK Treasury launched an inquiry into regional imbalances in the UK economy. In short, it was asking about the nature of the economic imbalances in the UK, the problems these imbalances may pose, and what remedies might be available.

The Tax Justice Network sent the Treasury a submission, which you can download here.

The main purpose of the submission is:

to challenge a widespread view that London is necessarily the ‘engine’ of the British economy, creating jobs and wealth and showering taxes and subsidies on other parts of the country, in a grand one-way flow.

The submission then goes on to make the analytical contrast between productive wealth creating activities (such as making useful widgets or services) and wealth extracting ones (such as using tax havens to escape tax, or using monopoly powers to gouge others). It then shows that while the “losers” of the wealth extraction are a wide range of players who are relatively evenly spread across the country, the “winners” are generally focused in a relatively small, highly affluent section of London and the southeast, and the ‘offshore nexus’.

It does this primarily by looking at a single firm, with an underlying activity producing a real benefit, but an immensely complex corporate tower perched atop it, nearly all of whose beneficiaries are in the London/offshore nexus, extracting wealth away from other players elsewhere.

So while London/offshore nexus” certainly does generate jobs and profits in gross terms, in net terms the picture is completely different, with a large part of London’s success coming at the expense of other parts of the economy.

This article is inspired by our long-standing work on the Finance Curse, which has powerful regional implications in other countries too.

Once again, click here for our full submission.

Related articles

UN tax convention hub – updates & resources

Taxing Ethiopian women for bleeding

Tax justice and the women who hold broken systems together

Malta: the EU’s secret tax sieve

The bitter taste of tax dodging: Starbucks’ ‘Swiss swindle’

Disservicing the South: ICC report on Article 12AA and its various flaws

11 February 2026

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

After Nairobi and ahead of New York: Updates to our UN Tax Convention resources and our database of positions

Taxing windfall profits in the energy sector

14 January 2026